Downey congresswoman backs Antonio Villaraigosa for governor

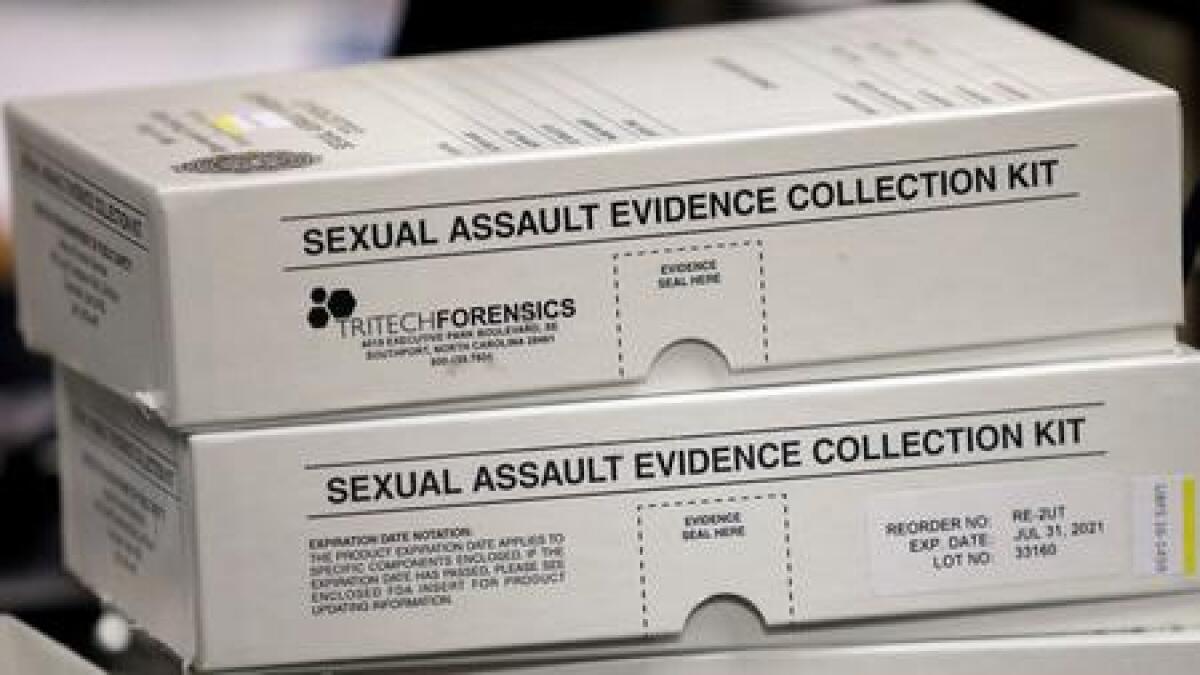

California farmworkers will have to undergo sexual assault prevention training

Gov. Jerry Brown on Monday signed legislation to ensure farm labor contractors train employees on how to prevent and report sexual assault, a response to a 2013 PBS Frontline investigation that found sexual violence against women was a pervasive problem in California fields.

Senate Bill 295 by Sen. Bill Monning (D-Carmel) makes sexual harassment training mandatory at all businesses that supervise farm employees or provide them with lodging, transportation or other services.

The training has to be conducted or interpreted in a language that employees can understand, the law stipulates, and farm labor contractors will have to provide proof of all of their materials and resources to the Farm Labor Commission as part of the license renewal process.

Under the new law, the state labor commission also will be able to charge a $100 civil fine for any violation of the new requirements.

The PBS Frontline investigative documenatory, “Rape in the Fields, The Hidden Story of Rape on the Job in America” found more than half a million women work in U.S. fields. Most do not have legal residency in the country, and sexual harassment and violence often go unreported. A 2012 Human Rights Watch survey found 80% of 150 women in California’s Central Valley had experienced some form of the abuse.

Los Angeles voters can cast ballots in Assembly race on Tuesday

The political dominoes from U.S. Sen. Barbara Boxer’s retirement are almost done falling.

Her decision two years ago to forgo reelection led to a reshuffling that eventually left vacant a state Assembly seat in Los Angeles.

There are 13 candidates running in the special election, and the primary is Tuesday.

California Politics Podcast: Lawmakers say their focus on housing has just begun

For months, lawmakers in Sacramento said that their effort to pass a package of bills aimed at California’s housing woes was only the beginning.

They repeated that pledge on Friday, even after acknowledging the heavy political lift it took just to pass the simple steps signed into law by Gov. Jerry Brown.

On this week’s podcast episode, we discuss the political and practical impact of the new housing laws, as well as what might be in store for 2018.

We also discuss Brown’s decision to move California’s presidential primary from June to March, and whether it has any hope of making the state relevant in the race for the White House.

Other topics on this week’s podcast include a push for a property tax proposal on next year’s statewide ballot, and a new poll showing a number of likely voters think Sen. Dianne Feinstein should step down when her current term ends.

I’m joined by Times staff writer Liam Dillon and Marisa Lagos of KQED.

Gov. Brown signs major housing legislation

At a signing ceremony in San Francisco on Friday morning, Gov. Jerry Brown signed 15 bills aimed at addressing the state’s mounting housing problems.

“It is a big challenge,” Brown said. “We have risen to it this year.”

The bills could add nearly $1 billion in new funding for low-income housing developments in the near term as well as lessen regulations that slow growth.

Watch live: Gov. Jerry Brown signs bills to tackle California’s housing crisis

Gov. Jerry Brown and state lawmakers are gathered in San Francisco for the signing into law of a package of proposals designed to tackle some of the most pressing parts of California’s housing crisis.

Businesses in California will be required to tell customers exactly how much their automatic renewal will cost

California will require online businesses that offer free trials to tell customers exactly how much an automatic renewal will cost under a law signed by Gov. Jerry Brown on Thursday.

The law’s author, Sen. Bob Hertzberg (D-Van Nuys), thinks the bill, known as SB 313, will make it easier for customers to cancel service.

“Consumers need to know what they are signing up for and that they can just as easily cancel any service or subscription online as when they started it online,” Hertzberg said in a statement.

Streaming services like Hulu and Spotify and the file-sharing site Dropbox have elicited lawsuits and consumer complaints about their automatic service renewals, according to Hertzberg’s statement.

The law goes into effect in July.

Antonio Villaraigosa wants to bring back an urban renewal program to fund low-income housing

California candidate for governor Antonio Villaraigosa wants the state to bring back an urban renewal program to fund low-income housing.

“Solving our state’s growing housing crisis will take a sustained commitment and creative thinking,” Villaraigosa wrote in an op-ed in the San Francisco Chronicle. “But when it comes to giving local governments the tools they need, we don’t need to reinvent the wheel.”

Gov. Jerry Brown and lawmakers eliminated a state redevelopment program in 2011 as a cost-cutting move aimed at saving nearly $2 billion during the state’s budget crisis. The program allowed cities to target run-down neighborhoods for investment and use a share of property tax dollars generated by development to fund improvements, including financing low-income housing. But doing so required the state to spend more to support public schools, and Brown derided the agencies as being rife with abuses of taxpayer dollars.

Villaraigosa, a former mayor of Los Angeles, said a revived program would allow for greater state assistance to address housing problems.

Lawmakers passed a large package of housing legislation earlier this month, including a new real estate transaction fee and a bond measure for the November 2018 ballot. But even with that new spending, state subsidies will remain billions of dollars’ short of what’s needed to finance housing for its neediest residents, according to state and third-party estimates.

Will California Republicans in the House support a tax proposal that would hit their districts hard?

One-third of Californian taxpayers could be forced to pay thousands more in federal taxes from the repeal of one deduction under a GOP proposal released Wednesday, setting up another political dilemma for California Republicans facing tough reelection battles next year as Democrats work to win back the House of Representatives.

The potential repeal of the state and local tax (SALT) deduction, which allows taxpayers to write off those taxes on their federal returns, would hit especially hard in wealthier areas, some of which are on the exact turf Democrats are trying to win over in Southern California.

Details of the overall tax reform plan have yet to be worked out, but so far, vulnerable California Republicans are not joining GOP colleagues in other states who have said they won’t accept the repeal of the deduction, and some of them seem willing to negotiate.

Here’s why California’s early primary in 2020 is destined to pick the next president. (Nah, not really)

Today we answer questions.

Woo-hoo! Now that Gov. Jerry Brown has signed the bill, it looks like California is moving up its 2020 presidential primary. Finally!

Uh.

No more watching from the sidelines as small-fry states like Iowa and New Hampshire throw their weight around.

Um.

I’m already fluffing pillows and prepping the guestroom for all the 2020 hopefuls who’ll be camped out.

Er.

What? You don’t seem too excited.

Look, it would be great if California voted in a truly meaningful presidential primary. It’s been about 50 years since that happened. But it’s about as likely in 2020 as President Trump dumping Vice President Pence and running for reelection on a unity ticket with Hillary Clinton.

How can that be?

Lots of reasons, both political and practical.

Do tell.

Poll: Californians like Obamacare more than ever but are divided on single-payer healthcare

As the latest attempt to repeal the Affordable Care Act fizzles, the law has reached its highest popularity in California in four years, according to a new poll released Wednesday by the Public Policy Institute of California.

Nearly 60% of the Californians hold a generally favorable view of the healthcare law, and just over a third of Californians see it unfavorably — the highest approval rating since PPIC began tracking the law’s popularity in 2013.

But while Democrats and independents back the law, known as Obamacare, with strong majorities, three-quarters of Republicans have negative views of it.

Only 18% of Californians believe congressional Republicans should try again to repeal and replace the Affordable Care Act, and 58% of adults want to see bipartisan efforts to improve the law.

Underscoring the GOP’s challenge in dramatically reducing government’s role in healthcare, two-thirds of the state’s adults believe it is the federal government’s responsibility to ensure that all Americans have health coverage.

But Californians are divided on whether to substantially increase government involvement through a single-payer system, such as the “Medicare for All” proposal recently introduced by Sen. Bernie Sanders (I-Vermont).

A national single-payer insurance program such as “Medicare for All” gets support from 35% of Californians, according to the poll. Support is higher among Democrats — 44% — and independents — 34% — than among Republicans. Only 6% of Republicans back such a system.

But the current system, a patchwork of government and private insurance options, isn’t particularly adored by Californians.

Just under 30% of adults support continuing with a mix of private and public insurance options, while 36% of Democrats, 21% of Republicans and 31% of independents see that mixed system as the best way to provide health coverage.

Half of California’s likely voters think Sen. Dianne Feinstein should retire, poll finds

As Democratic Sen. Dianne Feinstein contemplates a 2018 bid for reelection, a new poll has found that 50% of California’s likely voters think she shouldn’t run again.

Just 43% of likely voters support Feinstein running for a sixth term, according to a Public Policy Institute of California poll released Wednesday. The results are similar among all California adults, not just likely voters, with 46% saying she should not run for another term and 41% saying she should run.

Feinstein, 84, has come under increased pressure from members of California’s left, many of whom were infuriated when earlier this month she called for “patience” with President Trump and refused to back demands for his impeachment.

Still, the poll found that Feinstein remains popular. More than half of likely voters — 54% — approve of the job she’s doing, compared with 38% who disapprove.

That’s on par with Gov. Jerry Brown’s approval rating, and it bests the marks for California’s other Democratic senator, Kamala Harris. When likely voters were asked about Harris, the former state attorney general elected to the Senate in November, 47% approved of the job she was doing in Washington and 30% disapproved. Almost a quarter of voters didn’t offer an opinion about Harris.

The contrasting results on Feinstein are difficult to decipher but at the very least indicate voters remain restless.

“Partly, this is a holdover from last year’s election in which you saw many Democrats wanting a more liberal alternative at the presidential level and you saw many independents wanting an outsider,” said Mark Baldassare, president of Public Policy Institute of California. “As people are looking to next year, there’s a desire for something new.”

Speculation continues that Feinstein may face a Democratic challenger. Among those who have been mentioned is state Senate leader Kevin de León (D-Los Angeles), who is weighing his next political move after he terms out of office in 2018. De León lashed out at Feinstein after her comments about Trump in early September.

In her last election, Feinstein trounced her Republican opponent, Elizabeth Emken, by a 25-percentage-point margin in 2012. She won by almost an identical margin in 2006 when challenged by former Republican state Sen. Richard Mountjoy.

However, California has since switched to a top-two primary system. The two candidates who receive the most voters in the June primary election will advance to the 2018 general election, regardless of their party.

Two Democrats faced off in the finale of California’s 2016 U.S. Senate election, with Harris besting then-Rep. Loretta Sanchez.

Want to see ‘Hamilton’ in L.A.? Rep. Cardenas is raffling tickets as a fundraiser

Rep. Tony Cardenas (D-Los Angeles) is raffling off a set of tickets to “Hamilton” in Los Angeles as a campaign fundraiser.

According to the small print in an email the campaign sent to supporters, one winner will be randomly selected among donors by 11:59 p.m. PST on Oct. 3. The tickets are for the Oct. 19 showing of the hit musical and have an approximate retail value of $824. Entries for the raffle can also be made without donating to the campaign.

Cardenas is friends with the father of Lin-Manuel Miranda, the Tony- and Pulitzer-winning creator of “Hamilton.” When the show opened in Los Angeles in mid-August, Miranda spoke to nearly 1,000 students in Cardenas’ largely Latino San Fernando Valley district.

The congressman isn’t the only one with the idea. Gubernatorial candidate John Chiang is raffling tickets to the Nov. 1 show to those who follow him on Instagram — if they fill out a form on his campaign website.

Barbara Boxer says if Sen. Dianne Feinstein runs for another term, she should expect a tough race

It’s one of the hottest political parlor games in California right now: Will she run again?

Everyone is waiting for Sen. Dianne Feinstein to announce if she’ll seek a sixth term.

And even though they served as colleagues in Washington for more than two decades, former Sen. Barbara Boxer said she has no inside intel on what Feinstein will do in 2018.

“I believe she is running until I see any other indication,” Boxer said Wednesday at a Sacramento Press Club lunch. “Every single race is hard.... Anyone who runs against her will give her a tough race.”

Feinstein, 84, has made clear she is taking her time, even as ambitious politicians eye the seat she has held since 1992. One long-shot Democrat already is raising money for the race, and Feinstein recently drew criticism from California Senate President Pro Tem Kevin de León, who has not ruled out a primary challenge against her.

Boxer said Wednesday her own priority for next year’s midterm election is flipping several Republican-held House seats in Southern California.

“There’s no such thing as an off election year,” she said. “It’s an on year.”

Much of this work will be done through the political action committee Boxer founded, PAC for a Change. The organization also supports electing more Democrats to the Senate and standing up to President Trump’s policies, she said.

Since leaving the Senate in January, Boxer has also given speeches and promoted her book, “The Art of Tough.” She doesn’t like to consider herself a retiree.

Boxer also skirted a question about her pick for governor in a race that already is crowded with several Democrats. All of the candidates, she joked, are “like my sons and daughters.”

California’s top elections officer now says his agency’s website wasn’t the one ‘scanned’ by Russian hackers

Five days after saying he had been told Russian hackers scanned the state’s main elections website for weaknesses in 2016, California Secretary of State Alex Padilla said Wednesday that it turns out it didn’t actually happen that way.

Padilla said that his office was given incorrect information by the U.S. Department of Homeland Security and that the Russian operation was instead focused on “scanning” the network of the state Department of Technology.

“Our notification from DHS last Friday was not only a year late, it also turned out to be bad information,” Padilla said in a statement.

Bryce Brown, a spokesman for the state’s information technology agency, said officials had long known about “suspect activity that occurred on our network last summer” but didn’t know anything else until the notification from federal officials.

“Although we did not have knowledge of the source until now, we have confirmed our security systems worked as planned and the activity was blocked as it happened in 2016,” he said.

The Department of Homeland Security did not respond to a request for comment.

On Tuesday, the Associated Press reported that federal officials also reversed course in a notification they had made to Wisconsin elections officials about Russian activity. In June, federal officials told Congress that 21 states’ elections systems were targeted by Russian activity.

Padilla insisted last week that the “scanning” incident found no vulnerabilities or access to any California voter information, and he criticized DHS officials for the delay in sharing information about 2016 activities. On Wednesday, he said hopes that federal officials will continue to work with the states in preventing cyberattacks.

“I remain committed to a partnership with DHS and other intelligence agencies; however, elections officials and the American public expect and deserve timely and accurate information,” Padilla said.

California moves its presidential primary to March in push for electoral relevance

Backing an effort for California to claim a bigger share of the attention from presidential candidates, Gov. Jerry Brown has signed a bill moving the state’s primary elections to early March.

Brown’s decision, announced without fanfare on Wednesday, means the state will hold its presidential primary on March 3, 2020. It’s a reversal from a decision he made in 2011 to push the state’s primary elections back until June, after years of trying — and failing — to entice major candidates to bring their campaigns to California instead of smaller, more rural states.

Democrats who embraced the push for an early primary said they were motivated in part by the election of President Trump, whose successful bid for the Republican Party nomination was well on its way to reality by the time California voters cast ballots on June 7, 2016.

“We have a greater responsibility and a greater role to promote a different sort of agenda at the national level,” said state Sen. Ricardo Lara (D-Bell Gardens), the author of the bill. “We need to have a greater influence at the national level.”

The new law also moves California’s congressional and legislative primaries to March, a change which some have suggested could make it difficult for challengers to raise money and quickly put together a credible campaign for challenging established incumbents.

Under current projections, California’s primary would come fifth in the presidential nominating process in 2020 — following caucuses in Iowa and Nevada and primaries in New Hampshire and South Carolina. Lara said he realizes that the Democratic National Committee may not like the state moving its election up to the early slot, but that he hopes party officials will work with California officials over the next few years to accommodate the change.

“California’s role has clearly changed,” he said.

California first tried the March primary in 1996. But by election day, 27 states had already held their own presidential primary or caucus, passing over California – one of the most expensive places to buy political advertising time in the nation.

The state’s most successful early presidential primary was in February 2008, when 57.7% of registered voters turned out in a race won by Democrat Hillary Clinton and Republican John McCain. That was the highest voter turnout for a California presidential primary since 1980. But even then, enough states had already voted that the relative impact of the early election was small.

Last year, 47.7% of registered voters cast ballots in the state’s June presidential primary.

Several Democratic lawmakers praised Brown’s decision to allow another try at the early primary.

“Candidates will not be able to ignore the largest, most diverse state in the nation as they seek our country’s highest office,” said Secretary of State Alex Padilla.

The bill does not change the scheduled 2018 statewide primary, which will be held in June.

Brown has one other closely watched bill on his desk with the potential for national political impact: A proposal to deny access to the California ballot for any presidential candidate who won’t release personal tax returns to the public – a not-so-subtle jab at Trump’s refusal to do so in 2016. The governor has until Oct. 15 to act on that, and other, bills passed by the Legislature before it adjourned earlier this month.

UPDATES:

2:54 p.m.: This article was updated with additional information on California’s past attempts to move up its primary, as well as details about the 2016 campaign and comment from Secretary Padilla.

This article was originally published at 1:48 p.m.

ALSO:

California’s Democratic leaders have a plan for thwarting Trump in 2020

Skelton: Brown should junk the presidential election bills on his desk

Hollywood tour buses could get more rules slapped on them under the law Gov. Jerry Brown just signed

Gov. Jerry Brown on Wednesday signed legislation aimed at reining in the proliferation of tour buses offering to take fans to the homes and gathering spots of celebrities in Hollywood and other trendy neighborhoods.

The measure allows cities and counties to adopt rules that restrict the routes or streets used by the tour buses, and prohibit the use of loudspeakers on open-topped buses and vans.

Assemblyman Adrin Nazarian (D-Sherman Oaks) introduced the proposal in response to a report by NBC Los Angeles that found some tour buses were operating unsafely without proper permits. He also cited complaints about topless buses on narrow streets of the Hollywood Hills, Malibu and Bel-Air.

Latino state lawmakers back Antonio Villaraigosa for California governor

The Legislature’s California Latino Caucus on Wednesday endorsed former Los Angeles Mayor Antonio Villaraigosa for governor.

While expected, the nod from the politically influential caucus is a boon for Villaraigosa, a former Democratic Assembly speaker and the only major Latino candidate running for governor. Villaraigosa has lagged behind Lt. Gov. Gavin Newson in early polls and fundraising.

“As Assembly speaker and Los Angeles mayor, Antonio Villaraigosa worked to strengthen our economy, expand our healthcare, improve our schools and invest in strategic infrastructure projects that create middle-class jobs,” Sen. Ben Hueso (D-San Diego), chair of the caucus, said in a statement Wednesday morning.

An intriguing aspect of the endorsement is that one of the most prominent members of the California Latino Caucus is Senate leader Kevin de León (D-Los Angeles). In Sacramento, speculation abounds over whether De León may run for governor, and the Villaraigosa endorsement could indicate De León has other plans for his political future.

Villaraigosa joins a slate of other Latino statewide candidates endorsed by the caucus: Sen. Ed Hernandez (D-Azusa) for lieutenant governor; current appointee Xavier Becerra for attorney general; incumbent Alex Padilla for secretary of state; Sen. Ricardo Lara (D-Bell Gardens) for insurance commissioner; and Assemblyman Tony Thurmond (D-Richmond) for superintendent of public instruction.

California is trying to educate people about marijuana before recreational sales start

Months before California allows the sale of marijuana for recreational use, the state has launched an education campaign about the drug, including highlighting the potential harms of cannabis for minors and pregnant women.

The state is scheduled to issue licenses starting Jan. 2 for growing and selling marijuana for recreational use, expanding a program that currently allows cannabis use for medical purposes.

In response, the California Department of Public Health has created a website to educate Californians about the drug and its impacts, including how to purchase and safely store cannabis.

“We are committed to providing Californians with science-based information to ensure safe and informed choices,” said State Public Health Officer Dr. Karen Smith.

The website, “Let’s Talk Cannabis,” notes it is illegal for people under 21 to buy marijuana for non-medical use and warns that “using cannabis regularly in your teens and early 20s may lead to physical changes in your brain.”

The site also warns that marijuana edibles may have higher concentrations of tetrahydrocannabinol, or THC. “If you eat too much, too fast you are at higher risk for poisoning,” the website warns.

The state urges parents and guardians to talk to their teenagers about legal and health issues surrounding marijuana use.

The state officials also say consuming cannabis is not recommended for women who are pregnant or breastfeeding, or who plan to become pregnant soon, noting that it “can affect the health of your baby.”

The website got good marks from legalization activist Ellen Komp, deputy director of California’s chapter of National Organization for the Reform of Marijuana Laws.

The website is “fairly accurate,” she said, but added, “The risks with pregnancy are somewhat overstated, telling women they should not use cannabis for nausea or even if they are thinking of getting pregnant.”

Some 43% of Californians have used marijuana for recreational purposes and 54% said they have not, according to a USC Dornsife/Los Angeles Times poll last November.

Among those who have not used it, just 2% said they are much more likely to use it if Proposition 64 passed, which it did, while 5% said they are somewhat more likely to use it, and 89% said they are no more likely to smoke pot if it was legalized.

Other advice from the state’s site: driving under the influence of cannabis is illegal and increases the chance of a car accident, and cannabis should be stored in a locked area to avoid poisoning children and pets.

Updated at 11:30 am to include data from poll on marijuana use.

Combustion engines could go the way of the horse and buggy in California, top air regulator says

Imagine a future where only zero-emission vehicles could be registered in California or driven on the state’s freeways.

Those are two tactics that could be used to help the world’s sixth largest economy phase out combustion engines, suggested California Air Resources Board Chair Mary Nichols in a recent interview with Bloomberg.

The state already has far-reaching policies for fighting climate change, but Nichols said Gov. Jerry Brown wants to make sure California is keeping pace with goals set by other countries.

Britain and France plan to ban vehicles powered by gasoline or diesel fuel by 2040, and China recently announced it would set its own deadline.

“I’ve gotten messages from the governor asking, ‘Why haven’t we done something already?’” Nichols said in the Bloomberg interview. “The governor has certainly indicated an interest in why China can do this and not California.”

The discussion is not a new one for California leaders. Brown signed legislation last year requiring the state to reduce greenhouse gas emissions to 40% below 1990 levels by 2030, but an even more ambitious target was included in a 2005 executive order from Gov. Arnold Schwarzenegger.

To hit the goal of slashing emissions to 80% below 1990 levels by 2050, California would need nearly every new vehicle sold between 2040 and 2050 to produce zero emissions, according to an analysis from the Air Resources Board.

So far, California has struggled to meet more modest goals of getting more electric cars on the road, and emissions from transportation have recently increased.

“Given the existential challenge we face, the administration is looking at many, many possible measures – including additional action on electric vehicles – to help rapidly decarbonize the economy and protect the health of our citizens,” Dave Clegern, a spokesman for the Air Resources Board, said in a statement.

Police body camera footage depicting rape victims won’t be released in California under new law

Gov. Jerry Brown signed a measure Tuesday that would prohibit the public release of police body camera footage or other videos that depict victims of rape, incest, sexual assault, domestic violence or child abuse.

The new law will not change existing policy. Generally, police departments across California don’t release body camera footage outside of a courtroom. This measure, Assembly Bill 459 from Assemblyman Ed Chau (D-Arcadia) enshrines extra protection for such footage into state law.

Lawmakers have struggled to pass more wide-ranging police body camera policies. A bill that would have allowed much more footage to be released did not advance this year.

After meeting with Trump, California Democrats say they want a seat at the tax reform table

Ahead of Republicans’ plans to unveil a more detailed overview of their tax reform plan Wednesday, President Trump sat down with a bipartisan group of members that included California Democratic Reps. Linda Sanchez and Mike Thompson.

Sanchez, of Whittier, who serves on the House committee that has authority over tax legislation, said members didn’t learn much about the details of the plan Tuesday.

“There were kind of generalities but no specificity, which is why we’re interested to see what they put out tomorrow, because clearly it’s not something that’s had Democratic input,” Sanchez said.

According to a White House transcript of part of the meeting, Trump said the plan is focused on making the tax code “simple and fair,” increasing the deduction most families can take, lowering the business tax rate and bringing wealth stored overseas back to the United States.

Thompson, of St. Helena, said the president listened to what Democrats had to say, but he didn’t get the impression that the policy plan would change before it becomes public Wednesday.

“I don’t think it was that kind of meeting. We all agreed we wanted a fair, easy-to-work-with tax code that generates more jobs,” said Thompson, who is also on the committee. “He said repeatedly he wants to be successful.”

Republicans are set to unveil a “consensus document” Wednesday they say will be a much more detailed overview than previous tax policy papers they’ve released. But it is not expected to be an actual plan or bill.

Republicans will huddle with Vice President Mike Pence for half of Wednesday to discuss tax reform. Democrats are holding their own tax reform forum too.

It’s been 30 years since Congress has passed a major tax overhaul, and Republican leaders have set an ambitious timeline for passing a tax-reform measure, indicating they want to get it to Trump’s desk by the end of the year.

Sanchez said she tried to stress in the meeting that Democrats should play a role in writing the final bill. There wasn’t discussion about the group sitting down with Trump again, she said.

“The president was very pleased that it was a bipartisan effort, which sort of confused me because that was the first meeting where there were members of the Democratic side of the Ways and Means Committee there,” Sanchez said. “I don’t know if they’ve been telling him that the process is bipartisan or if he knew it wasn’t bipartisan but didn’t care, but I thought that was kind of odd.”

Tom Steyer won’t rule out challenging Sen. Dianne Feinstein, but warns against reading too much into that

Billionaire environmentalist Tom Steyer did a little political two-step Tuesday when a reporter pressed him on whether he might challenge Democratic Sen. Dianne Feinstein if she runs for reelection.

Capital Public Radio’s Ben Adler tweeted that he asked Steyer if he would rule out running against Feinstein, and that Steyer would not nix the idea. Steyer was visiting a Sacramento high school to encourage students to register to vote.

Steyer quickly added that he hates answering speculative questions such as the one posed to him because there’s always a chance it might “bite you in the rear end.”

“I’d rather come out with what I do want to do as opposed to eliminating all the things I don’t want to do,” he told Adler.

Steyer, a Democrat who has openly contemplated a run for governor, said he is still weighing his political prospects and has not decided if he will run for office in 2018.

Feinstein has been facing increased pressure from progressive activists who believe she’s out of touch with her constituents. That intensified earlier this month when Feinstein refused to back the impeachment of President Trump, instead calling for “patience” during his presidency, which prompted a rebuke from state Senate leader Kevin De León.

Feinstein has been coy so far about whether she’ll retire or run again in 2018, but she does have a hefty $3.5 million in campaign funds socked away.

Judge rewrites summary of proposed gas tax repeal initiative, saying it was ‘fundamentally flawed’

A judge on Monday rewrote the title and summary for a proposed initiative that would repeal recent gas tax increases in California. He rejected a title and summary written by the state attorney general’s office as “fundamentally flawed.”

Sacramento Superior Court Judge Timothy M. Frawley criticized the attorney general’s office for not mentioning in the title that the ballot measure would repeal newly approved taxes or fees.

“This is not a situation where reasonable minds may differ,” Frawley wrote in his ruling. “The Attorney General’s title and summary ... must be changed to avoid misleading the voters and creating prejudice against the measure.”

The initiative proposed by Assemblyman Travis Allen (R-Huntington Beach) would repeal a bill approved in April by the Legislature and governor that would raise the gas tax by 12 cents per gallon and increase vehicle fees in order to generate $5.2 billion for road repairs and to improve mass transit.

The title and summary will be placed on petitions to be circulated by those trying to qualify the measure for the November 2018 ballot. The title and summary are also placed on the ballot if enough signatures are collected.

The original title written by Atty. Gen. Xavier Becerra’s office was: “Eliminates recently enacted road repair and transportation funding by repealing revenues dedicated for those purposes.”

Allen’s attorneys argued the voter could read that to mean that the Legislature identified existing funds for transportation and the initiative would take those funds away.

The judge’s title says: “Repeals recently enacted gas and diesel taxes and vehicle registration fees. Eliminates road repair and transportation programs funded by these taxes and fees.”

The judge also made it clear in the summary that an Independent Office of Audits and Investigations that would be eliminated by the initiative is “newly established.”

Representatives of the attorney general’s office were not immediately available to comment on whether the ruling would be appealed.

Democrats to try to force vote on Dream Act with rarely successful procedural move

House Democrats are trying to force a vote on Rep. Lucille Roybal-Allard’s version of the Dream Act, they announced in a news conference Monday.

The House and Senate have less than six months to address the legal status of people brought into the country illegally as children before the program protecting them from deportation ends in March.

In the weeks since President Trump announced he was ending the Deferred Action for Childhood Arrivals program, Democrats have pushed for a quick vote on Roybal-Allard’s bill, which is backed by every House Democrat and four Republicans. There are also a handful of other Republican-sponsored bills that could be considered.

To force a vote, Democrats would need a majority of the House — 218 members — to sign what’s called a discharge petition to pull the bill from the House Judiciary Committee and bring it to the House floor.

Roybal-Allard, a Democrat from Downey, said she believes there is enough support to pass the bill if Democrats can get it to the House floor. Democratic leaders said they expect all House Democrats will sign the petition.

“The American people overwhelmingly oppose deporting our ‘Dreamers,’” Roybal-Allard said. “But the Republican leadership is ignoring the wishes of a majority of the American people.”

Democrats hold only 194 seats, and would have to convince 24 Republicans to buck their party leaders and sign the petition.

House leaders control which bills come to the floor for a vote and when. Although discharge petitions have been used in the past to shame congressional leadership into letting a bill move forward, the procedural move is rarely successful.

This month, Republican Rep. Mike Coffman of Colorado filed a discharge petition for the Bridge Act, a Republican- sponsored bill to address the legal status of people brought to the country illegally as children. Five members of Congress had signed on as of Monday.

FOR THE RECORD

Sept 26, 12:38 p.m.: An earlier version of this post identified the member of Congress who filed a discharge petition for the Bridge Act as Rep. Mike Thompson. It was Rep. Mike Coffman.

California lawmakers grant some megaprojects relief from environmental law, but not others

When professional sports team owners, Facebook and big developers have asked California lawmakers for some relief from the state’s main environmental law over growth, the answer usually has been yes.

The law, the California Environmental Quality Act, requires developers to disclose and reduce a project’s effects on the environment — a process that often can get tied up in lengthy litigation.

This year, legislators passed a measure aiming to shorten any potential environmental lawsuit against Facebook’s expansion of its headquarters, two skyscrapers planned in Hollywood and other megaprojects to less than nine months. Doing so has led many to question why only big projects get such relief.

The fate of California’s biggest campaign donor disclosure bill may hinge on some small details

You wouldn’t expect to see the leader of California’s campaign watchdog agency rooting for Gov. Jerry Brown to veto sweeping new disclosure rules for political donors. And yet, that’s where things stand in a seven-year debate over helping voters follow the money.

“I think we can do better than this bill,” said Jodi Remke, chair of the California Fair Political Practices Commission.

Remke and her staff have raised a red flag about the fine print tucked inside Assembly Bill 249, the “California Disclose Act,” that rewrites rules for campaign contributions that are “earmarked.”

Bay Area Rep. Eric Swalwell backs Gavin Newsom for governor

Oceanside lifeguard receives California’s highest public safety honor

An Oceanside Fire Department officer who risked his life to save a boater received the state’s highest award for public safety officers on Monday.

Gov. Jerry Brown and Atty. Gen. Xavier Becerra presented David Wilson with the Public Safety Medal of Valor at a ceremony at the state Capitol.

In July 2016, Wilson rescued a man whose boat crashed into a jetty in Oceanside Harbor. The victim was barely conscious and jammed between two rocks. With only a short window between each set of waves, Wilson dove underneath the water and swam into the boulders to free the victim’s legs.

“You earned it,” Brown said at the ceremony. “You were assaulted by the waves and the rocks, and you went ahead anyways. That’s why you are the only one getting a medal of honor.”

A review board made up of law enforcement officers reviewed 21 nominations for the Medal of Valor.

The award is given out once a year. There can be more than one recipient, but this year Brown chose one.

California joins 11 states to oppose one of the ways Ohio cancels a voter’s registration

California’s attorney general joined a group of other states on Monday to ask the Supreme Court to abolish a controversial policy in Ohio that cancels a voter’s registration for not frequently casting a ballot.

A federal appeals court earlier this year found the Ohio practice to be illegal. Though California doesn’t use a similar process, state Atty. Gen. Xavier Becerra signed on to a court filing with 11 other states and the District of Columbia to urge the justices to uphold the lower court’s ruling.

“Removing eligible voters from registration lists serves to silence and suppress citizens,” Becerra said in a written statement. “All too often, state policies like the one we’re opposing in Ohio make it harder for our most vulnerable citizens to vote.”

The case centers on Ohio’s practice of sending a registration notice to those who don’t cast any ballot in a two-year period. If a voter doesn’t respond or vote over the following four years, his or her registration is canceled.

In California, elections officials generally remove voters from their lists only if there’s proof the person has died or if it’s clear through other research methods that he or she has moved. Otherwise, those who don’t cast ballots over a period of time are moved to an “inactive list” of voters.

“Aggressive purging of voter rolls jeopardizes the fundamental rights of American citizens,” California Secretary of State Alex Padilla said in a written statement. “States should not have free rein to kick voters off the rolls merely because they sit out elections.”

Ohio elections officials maintain that the system has been in use for a number of years, and that it’s been used to keep the lists of voters accurate. Critics who filed the original lawsuit argued that the purging of names has been used selectively in a way that penalizes only certain voters for not casting a ballot.

Put Californians before Republicans on healthcare vote, Dianne Feinstein tells GOP House members

Sen. Dianne Feinstein made a direct appeal to her 14 California congressional Republican colleagues on Monday, asking them to stop the latest GOP healthcare bill if it gets to the House.

The Senate hasn’t scheduled a vote on the plan, and it’s not clear it would pass if a vote was held. But if it did, California House members could determine whether it goes to President Trump’s desk or not.

If it gets through Congress, the Senate bill is expected to have an outsized effect on California, slashing more than $100 billion in federal funding for the state over the next decade and tens of billions more in the years that follow.

“If this bill makes it to the House, you have an opportunity to stop it. I implore you to do so. This is about putting people over politics, Californians ahead of party,” Feinstein wrote in a letter to House Majority Leader Kevin McCarthy of Bakersfield.

Senate leaders want to take up the bill this week because a Senate rule that allows Republicans to pass the bill with a simple majority expires Sept. 30. Democratic senators, including Feinstein and Kamala Harris, oppose the bill.

“While I will do all I can to defeat this bill, I ask that if it passes you put politics aside and vote in the best interest of those you represent and help defeat this dangerous bill,” Feinstein said in her letter. “It is no secret that the bill was drafted to take federal funds from California and other states that expanded Medicaid (in order to cover low-income working adults) and give it to states that put politics ahead of their people and failed to expand Medicaid.”

Many of the state’s conservative-leaning districts benefited the most from Obamacare’s expansion of Medi-Cal to include more low-income adults, a group of people that would likely lose coverage if the bill passes and the federal government no longer contributes as much to pay for their healthcare.

California’s House Republicans all voted in favor of a GOP plan to repeal the Affordable Care Act in May. Several politically vulnerable Republicans said they did so because they believed the Senate would return a bill to the House that would address their concerns with the House bill.

Seven California Republicans face particularly tough reelection campaigns in 2018, in part because their districts backed Hillary Clinton for president in 2018, and many of their opponents have already started using the May vote against them.

7.5 million Californians could lose coverage under latest Obamacare repeal effort, state health insurance exchange says

Californians who get their health coverage on the individual market could face dire consequences under the current Republican effort to dismantle the Affordable Care Act, warned a new analysis released Monday by Covered California, the state’s health insurance exchange.

Under the latest plan, which is being led by Sens. Lindsey Graham (R-S.C.) and Bill Cassidy (R-La.), 7.5 million Californians could lose their health insurance by 2027, the analysis said. It also said the repeal could trigger a collapse of the state’s individual insurance market.

“The Graham-Cassidy plan takes resources away from California and from the majority of states, which means that far fewer Americans would have insurance or the existing protections from insurers,” said Peter V. Lee, executive director of Covered California, in a statement.

“The effect on California would be devastating, and lead not only to there being more uninsured people than there were before the Affordable Care Act, but would also cause huge negative impacts on the health care delivery system, the economy and on those with employer-based coverage,” Lee said.

The report comes on the heels of another grim analysis by Gov. Jerry Brown’s administration, which estimated that the Senate proposal would strip California of nearly $139 billion in federal funds from 2020 to 2027.

The Covered California report looked at two different scenarios for how state officials could respond to such a slash in federal dollars. If the state chose to prioritize protecting Medi-Cal, which provides coverage for low-income Californians, the analysis projects the collapse of the individual insurance market by 2021.

If officials chose to direct attention to the individual market by stepping in to cover subsidies now paid for by the federal government, that could lead to large reductions in the Medi-Cal program.

In both scenarios, the result would be up to 7.5 million fewer Californians with health insurance, according to the report.

“Proponents claim Graham-Cassidy gives states flexibility and choice, but in reality it puts states into a lose-lose situation,” Lee said. “Under this plan, California and states across the nation would be forced to either turn their backs on their most needy residents, or let the individual market be destroyed. Either way, millions lose coverage.”

Keep an eye out for these 10 California bills that could become law

In a flurry of floor debates, committee meetings and deal-making to wrap up the first year of the Legislature’s session, lawmakers sent hundreds of bills to the governor’s desk.

While high-profile legislation to make California a “sanctuary state” and address the state’s housing crisis may have stood out, other bills that can have an effect on daily life could also become law.

Here are 10 bills awaiting Gov. Jerry Brown’s signature:

- Landlords won’t be able to threaten to deport immigrant tenants

- Students could attend their first year at community college for free

- Knowingly exposing a sexual partner to HIV would no longer be considered a felony

- People who smoke pot while driving or riding in a car could be punished by fine

- Parks and beaches would be tobacco- and marijuana-free

- Taxpayers could pay $270 million if the Los Angeles 2028 Olympic bid goes over budget

- There may be a gender-neutral option for state driver’s licenses

- New parents at small businesses could get 12 weeks of leave to care for a new child

- California teachers could get paid pregnancy leave

- Public schools with low-income students might provide free menstrual products

Democrats make it clear the Golden State Warriors are welcome in the state Capitol

The Golden State Warriors may not be swinging by the White House to mark their 2017 NBA championship, but they’ll still be feted in the state Capitol.

Democratic legislators took to Twitter over the weekend to make clear the Warriors would be welcomed in Sacramento, after President Trump tweeted on Saturday that a White House invitation was “withdrawn” due to star point guard Stephen Curry’s disinclination to visit the president.

State Sen. Nancy Skinner (D-Berkeley), whose district includes Oakland, the team’s hometown, said the Warriors were invited to the state Capitol well before the Twitter fracas, as is customary whenever California teams win a national championship.

But she said it was important to reiterate that invitation in light of Trump’s comment.

“Look at the amount of tweets that guy sends out. No way do we respond to every tweet,” Skinner said. “But when it’s to disinvite the three-time NBA champions, that deserves a response.”

No date for a Warriors visit has been set as of yet.

Skinner lauded the team’s handling of Trump’s tweet, pointing to a statement in which the Warriors said they’d find ways to “celebrate equality, diversity and inclusion” on their trip to Washington.

“While of course as Californians, we’re incredibly proud that it’s a California team that won the NBA championship, there’s

even that much more pride that it’s a team that lives and expresses those values that we try to put into practice every day,” she said.

Senate President Pro Tem Kevin de León (D-Los Angeles) also chimed in with an invitation.

Attorney running against Sen. Dianne Feinstein is hosting Hollywood fundraiser

Pat Harris may be a long-shot candidate for U.S. Senate, but he’s not fundraising like one.

On Monday Harris, a Democrat challenging Sen. Dianne Feinstein, is set to tread territory familiar to many prominent statewide candidates looking for cash: the Hollywood fundraiser.

The event is to be held at the Catalina Jazz Club on Sunset Boulevard and is being billed as a CD release party for Carol Welman, a jazz musician and Harris’ wife. Tickets range from $150 for a single ticket to $2,700 for a VIP dinner for two. (An email to Welman’s subscriber list earlier this week advertised tickets for as little as $30).

Harris announced that he was running last month on a platform that includes support for single-payer healthcare and a pledge that he will only take campaign donations from individuals.

Facing pressure from progressive activists, Feinstein has been coy so far about whether she’ll retire or run again in 2018. Either way, she’s stockpiled $3.5 million in her campaign war chest. As of June 30, Harris had raised no money except for $104,685 he loaned his own campaign.

Three other candidates have also filed to run against Feinstein: Democrats Steve Stokes and David Hildebrand, and independent Jerry Carroll.

Rep. Keith Ellison headlines dinner for Orange County Democrats, who declare ‘orange is the new blue’

The focus was on 2018 as Orange County Democrats gathered Saturday night in Costa Mesa to bask in their high hopes here.

Headliner and deputy chairman of the Democratic National Committee, Rep. Keith Ellison of Minnesota, urged unity as dozens of Democrats navigate crowded primaries throughout the state.

The theme of the annual awards dinner was “Orange is the New Blue,” a twist on the title of a popular Netflix show and the latest indication of Democrats’ rosy outlook as they try to flip the county’s four GOP-held House seats next year.

Ellison told the crowd it was “not the proper role” of the DNC to choose among the many primary contenders. “But you will sort it out running spirited campaigns, you will sort it out over ideas, and when it is over we need you to hold hands and support the Democrat.”

Ellison pushed for a return to grass-roots organizing and outreach to voters of all stripes — and not just during election years.

“We cannot come a month before the election, tell them ... ‘Come vote for us,’” Ellison said. “We’ve got to be in their lives in a physical, palpable way. Then we do have to have the right words, we do have to stand up for them.”

In an interview, Ellison also stressed the need to pass legislation for young people brought to the country illegally who were allowed to stay and work under the Obama Administration’s Deferred Action for Childhood Arrivals program.

Ellison said Democrats are open to negotiating certain immigration enforcement provisions in order pass a replacement for DACA, which President Trump announced he will end in March. But he said Democrats won’t acquiesce to Trump’s demand for a border wall or allow additional capacity for immigration detentions.

“There are certain things that are simply not on the table — the wall or more detention beds, we’re just not doing that,” he said.

California Politics Podcast: Here’s the impact from the state lawsuit against Trump’s border wall plans

Last week’s California lawsuit against the proposed new border wall with Mexico was a dramatic challenge to President Trump. But politically it was very much in line with the narrative that’s been crafted all year long.

On this week’s episode of the California Politics Podcast, we take a closer look at how the new lawsuit may be the biggest moment so far for state Atty. Gen. Xavier Becerra.

We then turn to two other items in the news in which significant challenges have appeared: a rebuke of Gov. Jerry Brown’s controversial plan to build a pair of Northern California water tunnels, and some closely watched bills that quietly fizzled in the final hours of the California Legislature’s 2017 session.

I’m joined by Times staff writer Melanie Mason and Marisa Lagos of KQED News.

California Republican won’t say if he supports Graham-Cassidy healthcare bill

Orange County Rep. Ed Royce was noncommittal about his stance on the controversial Graham-Cassidy healthcare bill designed to roll back provisions of the Affordable Care Act.

“I have not looked at the details in it,” Royce said as he arrived at an event at his Yorba Linda campaign office. “We’ll see if something passes out of the Senate.”

California’s congressional Republicans have stayed mum on the bill so far. An expected vote on the measure in the Senate next week could be stymied by Sen. John McCain’s announcement Friday that he would not support the bill.

Asked about President Trump’s announcement that he was ending the Deferred Action for Childhood Arrivals program, which allowed young people who came to the country illegally as children to stay and work, Royce said he would try to “work out a solution in tandem with border security.”

Royce addressed several dozen volunteers at his campaign headquarters Saturday afternoon.

About 40 volunteers showed up to knock on doors and make phone calls for his reelection campaign. He already has drawn more than half a dozen challengers as Democrats attempt to reclaim the House. The Royce campaign office has been up and running for a couple of months.

It’s rare for a congressional incumbent to begin campaigning so early in an off-year, but Royce is one of nine California Republicans deemed potentially vulnerable in 2018.

Earlier in the day, several dozen protesters showed up to picket outside and protest Royce’s vote to repeal Obamacare earlier this year.

One of the protesters returned hours later, when Royce showed up at the office. She also asked about his position on the Graham-Cassidy bill.

“We’re going to see what legislation comes out,” Royce told her.

Russians tried to find weaknesses in California’s election website last year, say state officials

California’s chief elections officer said U.S. government officials believe Russian hackers tried to find weaknesses in the state’s election website during the 2016 campaign, but that there’s no evidence their effort was successful.

Secretary of State Alex Padilla said the Department of Homeland Security only told him on Friday of last year’s attempt. He described the attack as a “scanning” of the state’s website in hopes of finding weaknesses in its computer network.

“Our office actively monitors scanning activity as part of our routine cybersecurity protocols,” Padilla said in a statement. “We have no information or evidence that our systems have been breached in any way or that any voter information was compromised.”

Those involved were “Russian cyber actors” according to Padilla’s description of information he received from federal officials. In June, a top federal official told the Senate Intelligence Committee that systems in 21 states were believed to have been scoured by cyberattackers.

The election website, www.sos.ca.gov, contains public information about voting procedures as well as data on past election results and current issues. More sensitive data, including the electronic files of some 17 million registered voters, are not included on the website.

A leaked National Security Agency document earlier this year outlined a Russian effort to hack into devices made by a Florida-based voting software company. One California county, Humboldt, used the company’s software, but did not find any evidence of tampering.

Padilla, a frequent critic of President Trump’s special panel investigating the potential of voter fraud, said federal officials should have notified him much earlier of the attempted breach.

“The practice of withholding critical information from elections officials is a detriment to the security of our elections and our democracy,” he said.

Antonio Villaraigosa jabs at Gavin Newsom over his apparent embrace of single-payer healthcare bill

Supporters of a measure to establish single-payer healthcare in California were thrilled by Lt. Gov. Gavin Newsom’s embrace of their bill on Friday, but a rival gubernatorial campaign was less impressed with his position.

A spokesman for former Los Angeles Mayor Antonio Villaraigosa accused the lieutenant governor of flip-flopping because after Newsom was asked if he explicitly endorsed the legislation — Senate Bill 562 — he responded that he endorsed “getting this debate going again.”

“This is an outrageous parsing of words when millions of people are at risk of losing their healthcare,” Villaraigosa spokesman Luis Vizcaino said in a statement.

“It is a yes or no question, lieutenant governor. Are you for SB 562 or not? The nurses and California voters deserve the truth,” Vizcaino added.

The question of backing SB 562 is thorny since it was shelved earlier this year after Assembly Speaker Anthony Rendon (D-Paramount) called it “woefully incomplete.” Backers have said they’d be willing to make changes to the measure, but the contours of those proposed changes have not been made public.

Vizcaino said Villaraigosa “has always supported universal healthcare and the concept of single payer,” but agreed with Speaker Rendon that the bill couldn’t be sent to the governor without a funding plan.

Speaking to reporters, Newsom said he saw a single-payer system in which the government covers healthcare costs as the best way to achieve universal coverage and said he would be “actively engaged in designing and developing it” if SB 562 does not pass next year.

RoseAnn DeMoro, executive director of the California Nurses Assn./National Nurses United, said she saw Newsom’s remarks as a clear endorsement of their measure and a stance she said was not surprising.

“We always knew Gavin would support our bill,” DeMoro said.

She lambasted Villaraigosa — who does not support SB 562 — for criticizing Newsom, whom her group endorsed nearly two years ago.

“I want Villaraigosa to explain to the Latino community why he doesn’t think they should have ... comprehensive healthcare,” she said. “Villaraigosa’s being disingenuous. He knows better. He’s just politically posturing trying to find a wedge issue and he knows better.”

UPDATE

4:32 p.m.: This post was updated with an additional statement from Villaraigosa’s spokesperson on the former L.A. mayor’s support for universal healthcare.

In San Francisco, Bernie Sanders plays two roles: Obamacare defender and single-payer advocate

Sen. Bernie Sanders headed west to drum up support for his recently unveiled “Medicare for All” proposal Friday, but first trained his sights on the Obamacare repeal bill currently gripping Congress.

Sanders (I-Vt.), whose speech was the cornerstone of a California Nurses Assn. gathering in San Francisco, blasted the Republican plan led by Sens. Bill Cassidy of Louisiana and Lindsey Graham of South Carolina as “horrific legislation.”

“How cruel, how immoral it is, to say to those millions of Americans, we are going to take away that health insurance that keeps you alive,” Sanders said.

Sen. John McCain announced on Friday he could not support the measure, dealing the GOP plan a blow. Sanders thanked McCain for his stance, prompting the liberal crowd to cheer the Arizona Republican.

Some Democrats had worried that Sanders’ push for his single-payer plan could distract from efforts to oppose the repeal bill. But the senator was explicit in his appeal to the approximately 2,000 supporters in attendance to focus their energy on defeating the repeal measure.

“Our job is to continue to make sure the Republicans do not get the 50 votes they need ... I beg of you, please, do everything you can to stop the bill,” he said.

Still, the crux of Sanders’ speech focused on his single-payer bill, which he sold as an improvement over the status quo.

“The Affordable Care Act, as we all know, made significant improvements to our healthcare system,” Sanders said, citing the expansion of the number of Americans with health insurance and the ban on insurance companies’ ability to deny coverage to people with preexisting conditions.

“But we must be honest and acknowledge that with all the gains of the Affordable Care Act, it does not go far enough,” he added.

The bill expands the Medicare program to cover the healthcare costs of all Americans with no out-of-pocket payments for patients. The measure does not include a plan to finance such a system, but Sanders has released a report laying out various ways to cover the costs, including a progressive income tax.

During his pitch, Sanders said the implications extended beyond health policy.

“It is a struggle about what this great nation stands for,” Sanders said. “It is a struggle about whether or not every working person in this country has healthcare as a right or whether we allow insurance companies and drug companies to continue to rip us off.”

Graham-Cassidy Obamacare repeal plan ‘devastating,’ could cost California almost $139 billion, state officials warn

Healthcare advisors to Gov. Jerry Brown believe the latest effort on Capitol Hill to repeal the Affordable Care Act would blow a monstrous hole in the state budget, slashing federal health funds by $138.8-billion over a seven-year period.

The estimate, released Friday by the state Department of Healthcare Services, comes on the heels of increased focus on the Republican bill championed by Louisiana Sen. Bill Cassidy and South Carolina Sen. Lindsey Graham.

It is the third time since President Trump took office that GOP lawmakers in Washington have proposed changes to federal health subsidies that would downsize California’s share of federal funds. No firm estimates have been made of the number of state residents who might lose health coverage under the Cassidy-Graham proposal, though earlier efforts from congressional Republicans were estimated to put millions of Californians at risk.

“Simply stated, this proposal is the most devastating of the three federal health care proposals that we have evaluated this year,” wrote Jennifer Kent, director of the Department of Healthcare Services in a memo to Diana Dooley, the governor’s secretary of health and human services.

The report estimates a loss of $4.4 billion to the state budget in 2020 through reduced dollars for Medi-Cal, the state’s version of the federal Medicaid program. By 2026, state officials estimate the annual reduction in health dollars would grow to $22.5 billion.

That moment in time is key, say state officials, because the Senate GOP plan calls for no additional dollars under a new “block grant” healthcare funding plan beyond 2026.

“The Graham-Cassidy proposal represents a significant shift of costs from the federal government to states,” wrote Kent.

The expansion of Medicaid dollars under the Affordable Care Act has had a dramatic impact on reducing the number of uninsured people in the state. Estimates are that almost one of every three Californians is now enrolled in the Medi-Cal program.

With a $183.2-billion state budget, California would have no easy options for replacing even a portion of the missing dollars. The state is projected to have an $8.5-billion “rainy-day fund” by next summer, which would cover only a portion of the lost federal dollars and even then, only for a single year.

“Given our state’s significant population of low-income individuals,” Kent wrote, “this proposal abandons our traditional state/federal partnership and shifts billions in additional costs to California.”

Gas tax foes win victory as they try to get a repeal on November 2018 ballot

In a rare court rebuke of the state Attorney General’s Office, a judge said Friday that the title and summary written for a proposed initiative is misleading — and that he’d do a rewrite himself to make it clear the measure would repeal recently approved increases to gas taxes and vehicle fees.

Sacramento Superior Court Judge Timothy M. Frawley said he would draft a new title and summary to be placed on petitions for the initiative after attorneys for the state and proponents of the ballot measure could not agree on compromise language.

“In this circumstance, I honestly believe that the circulated title and summary that has been prepared is misleading,” Frawley told attorneys during a court hearing Friday. He hopes to release the new title and summary by Monday.

The initiative proposed by Assemblyman Travis Allen (R-Huntington Beach) would repeal a bill approved in April by the Legislature and governor that would raise the gas tax by 12 cents per gallon and increase vehicle fees to generate $5.2 billion annually to fix the state’s roads and bridges and improve mass transit.

Allen and his attorneys said the state attorney general sought to confuse voters with a title that does not use the words “taxes” or “fees.”

The title was proposed to say: “Eliminates recently enacted road repair and transportation funding by repealing revenues dedicated for those purposes.”

Allen, who is running for governor in 2018, said the court decision showed the attorney general was trying to sway voters against the initiative.

“Justice is being served for the voters of California,” Allen said after the court hearing. “I think that he [the judge] has properly seen that the attorney general has tried to intentionally mislead the voters of California because he has tried to prejudice their vote and tried to keep increased taxes for Californians.”

A coalition of business, labor and government officials called Fix Our Roads, which supports the gas tax legislation, had representatives in the courtroom who later criticized Allen for seeking political gain at the expense of California motorists.

“This is more about Travis Allen’s gubernatorial race than anything else,” said coalition spokeswoman Kathy Fairbanks. “He’s condemning voters to driving on potholed roads and being stuck in traffic.”

Allen said the initiative and his campaign for governor are both aimed at giving voters power to fight higher taxes.

“Finally ordinary Californians are understanding that they actually can hold Sacramento accountable,” Allen said. “This is why I’m running to be the next governor of California, because for too long Sacramento has been run by out-of-touch elitists that are coming from Sacramento and the Bay Area of San Francisco.”

A second initiative to repeal the gas tax has been proposed by a different group of Republican activists.

Allen said he supports the second initiative but noted it has to collect many more signatures because it seeks to change the state constitution. “It has a long way to go,” Allen said.

If the judge issues a new title and summary Monday, Allen said the petitions will hit the streets immediately and he is confident they will get the 365,880 signatures to qualify the measure for the November 2018 ballot.

‘We will have universal healthcare in the state of California,’ Gavin Newsom promises single-payer advocates

Lt. Gov. Gavin Newsom has made his most explicit endorsement yet of a controversial single-payer healthcare proposal that has roiled Democratic politics in California.

Newsom appeared Friday before the California Nurses Assn., the most ardent backers of SB 562, a stalled bill to establish a system in which the state would cover all residents’ healthcare costs.

“There’s no reason to wait around on universal healthcare and single-payer in California,” Newsom said. “It’s time to move 562. It’s time to get it out of committee.” The line prompted cheers and a standing ovation from the audience of about 1,500 members of the nurses’ union.

He capped off his remarks with a promise: “If we can’t get it done next year, you have my firm and absolute commitment as your next governor that I will lead the effort to get it done. We will have universal healthcare in the state of California.”

Enthusiastic nurses in the room heard an unequivocal backing of their effort to push forward with the bill.

“When he says he’s going to get this done, he means, seriously, that he will pass SB 562 and make sure that there is healthcare for all Californians,” said Catherine Kennedy, a neonatal nurse from Roseville.

But speaking to reporters after his address, Newsom was less clear in embracing the specifics of the proposal.

“I 100% support moving this process along, getting this debate going again and addressing the concerns, the open-ended issues that the nurses themselves have acknowledged as it relates to the need of going through the legislative process and to fill in the blanks on the financing plan, among other issues,” he said.

President Obama appears in an Assembly race mailer in California — but read it closely

The race to replace Jimmy Gomez, who was elected to Congress earlier this year, has so far been waged by mail and door-knocking in northeast Los Angeles.

Most of the mailers feature local leaders and endorsements from groups including Planned Parenthood and the Sierra Club.

But one mailer that arrived in my mailbox Thursday has a much more familiar face — former President Barack Obama. While it might seem like one to the casual voter sorting through junk mail, this isn’t an endorsement.

“Want to know what kind of job Gabriel Sandoval will do in the Assembly? Listen to the people he’s worked with in the past,” the mailer reads, above Obama’s official White House portrait.

In small type, it notes that Sandoval “served as a Senior Civil Rights Attorney and Senior Advisor” for a White House initiative within the Department of Education.

It features a glowing quote over an image of a July 12, 2013, letter from the president to Sandoval written on White House letterhead.

Healthcare a hot issue in race for California governor

With the hyperpartisan politics surrounding healthcare stirred up by efforts to repeal Obamacare and calls for a single-payer system, both Lt. Gov. Gavin Newsom and former Los Angeles Antonio Villaraigosa are claiming the mantle of healthcare visionary.

On the campaign trail the two Democratic candidates for governor are touting their signature healthcare accomplishments from earlier in their political careers as their bona fides.

For Newsom, it’s about Healthy San Francisco, the nation’s first municipal universal healthcare program, approved while he was mayor; and for Villaraigosa, it’s Healthy Families, which provided healthcare coverage to the children of California’s working poor, legislation he authored as a California assemblyman.

But do they deserve all the credit? It sure doesn’t look that way.

Healthy San Francisco is one of the many topics Newsom is expected to highlight when he speaks to the California Nurses Assn. convention in the Bay Area on Friday morning.

On Thursday night, Newsom took a shot at the latest Republican effort in Washington to roll back the Affordable Care Act – a bill written by Sens. Lindsey Graham (R-S.C.) and Bill Cassidy (R-La.)

“The numbers on this make my skin crawl. Under Graham-Cassidy, an individual with metastatic cancer could see their premiums increase by $142,650. Diabetes? $5,600. Want to tackle the opioid crisis? Gets a lot tougher if an individual suffering from drug dependence sees their premiums go up by $20,450,” Newsom said in an email sent out by his campaign. “This is not a game. Lives are at stake.”

Rep. Duncan Hunter calls for preemptive strike against North Korea

Rep. Duncan Hunter said that the United States needs to launch a preemptive strike against North Korea in order to prevent the rogue nation from harming the U.S. first.

“You could assume, right now, that we have a nuclear missile aimed at the United States, and here in San Diego. Why would they not aim here, at Hawaii, Guam, our major naval bases?” Hunter, an Alpine Republican, said Thursday during an appearance on San Diego television station KUSI.

“The question is, do you wait for one of those? Or two? Do you preemptively strike them? And that’s what the president has to wrestle with. I would preemptively strike them. You could call it declaring war, call it whatever you want,” Hunter continued.

Hunter, a member of a House Armed Services Committee and the subcommittee with jurisdiction over the United States’ nuclear arsenal, did not say whether the military should strike North Korea with conventional or nuclear weapons.

Will Bernie Sanders’ push for ‘Medicare for All’ help or hinder the California effort for single-payer?

When Vermont Sen. Bernie Sanders visited Beverly Hills last May, he made a full-throated appeal for California to “lead the country” and pass a pending state proposal to establish single-payer healthcare.

On Friday, he’ll return to California for a San Francisco speech trumpeting his own higher-stakes plan — a bill to drastically overhaul the nation’s healthcare system by covering everyone through Medicare.

The push for single-payer, in which the government pays for residents’ medical care, has already rattled California’s political landscape. Now, the Sanders measure brings an additional jolt, elevating the issue to a national debate that has implications for the future direction of the Democratic Party and early jockeying in the 2020 presidential race.

One of Jeff Denham’s Democratic challengers drops out

Republican Rep. Jeff Denham of Turlock still has at least nine challengers..

What will Kevin de León do when his term in the California Senate expires next year?

As he gaveled down what may be his last full year as leader of the California Senate on Saturday, Kevin de León had still not said what he planned to do next.

Will he run for governor or U.S. Senate? Does he want to be mayor of Los Angeles some day? De León told reporters they will have to wait to find out.

His advisors, supporters and political observers have their own ideas what De León could do next.

‘Who the hell is Dana Rohrabacher?’ Seth Meyers asks on ‘Late Night’ as he slams the congressman

“Late Night” host Seth Meyers focused on Orange County Rep. Dana Rohrabacher on Wednesday in a segment looking at the Republican congressman’s relationship with Russia, titled “Who the Hell is Dana Rohrabacher?”

The seven-minute segment highlights Rohrabacher’s recent trip to meet with Wikileaks founder Julian Assange, who claims he has evidence Russia wasn’t involved in hacking Democratic emails during the election, then hits on some of Rohrabacher’s other more eccentric moments — his patriotic songwriting, medical marijuana use and musing about whether global warming was caused by dinosaur flatulence.

Rohrabacher’s friendliness toward Russia has drawn increased attention in recent months, especially as his name has popped up on the periphery of the House and Senate investigations into Russian attempts to interfere with the 2016 election.

Rohrabacher is one of nine Republicans whom Democrats have identified as vulnerable in California, and Rohrabacher’s 2018 opponents have tried to use the congressman’s relationship with Russia against him.

One of his challengers, biotech firm chief executive and Democrat Hans Keirstead, made a statement early Thursday on the segment.

“I, like many people in Orange County, wish we could laugh at some late-night TV and then turn it off and move on, but unfortunately Dana Rohrabacher is our representative in Congress,” Keirstead said. “For too long he has put his own career and ideology before the people of Southern California, and it’s time we had someone representing us whose No. 1 priority is the quality of life for the people in our community.”

Rohrabacher did not immediately respond to a request for comment.

Skelton: The presidential election bills on Gov. Brown’s desk may be satisfying politics, but they’re risky ideas

Two presidential election bills are on Gov. Jerry Brown’s desk, sent to him by the Democratic Legislature. Both should be tossed in the trash.

No doubt I’m in the minority on this. These bills do offer some fun, even if they’re flawed.

One has strong pluses that are outweighed by unacceptable minuses.