Applebaum’s way may keep Measure QS away

Every introduction is nearly the same during every meeting, nearly every other week.

Former Burbank Unified board president Larry Applebaum states during the public-comment section of board meetings that he’s a 58-year resident of the school district that educates his daughter, Lauren, a Burbank High junior.

Applebaum served as a Burbank Unified board member for 12 years until 2017 and has helped the district in other capacities.

A strong Burbank Unified advocate, Applebaum is on the opposite side held by many friends and former colleagues.

The man perhaps most responsible for passage of Measure S, a 2013 bond sometimes referred to as “Larry’s Bond” that raised $110 million for upgrades to district facilities, is opposing the district’s latest funding effort.

Applebaum is urging residents to vote “no” on Measure QS, saying it’s fatally flawed. The measure is a 10-cents-per-square-foot annual parcel tax expected to cost average city residents about $170 per year and raise roughly $9 million annually.

He even authored the main argument against Measure QS, co-sponsored by former board members Audrey Hanson and William Abbey, in the voter guide.

“My former colleagues are not too happy with me,” Applebaum said on Oct. 17, the day before he spoke at the latest district meeting. “But, there are a lot of people in the community who are happy with me because at least I’m standing up and speaking about what I believe needs to be said.”

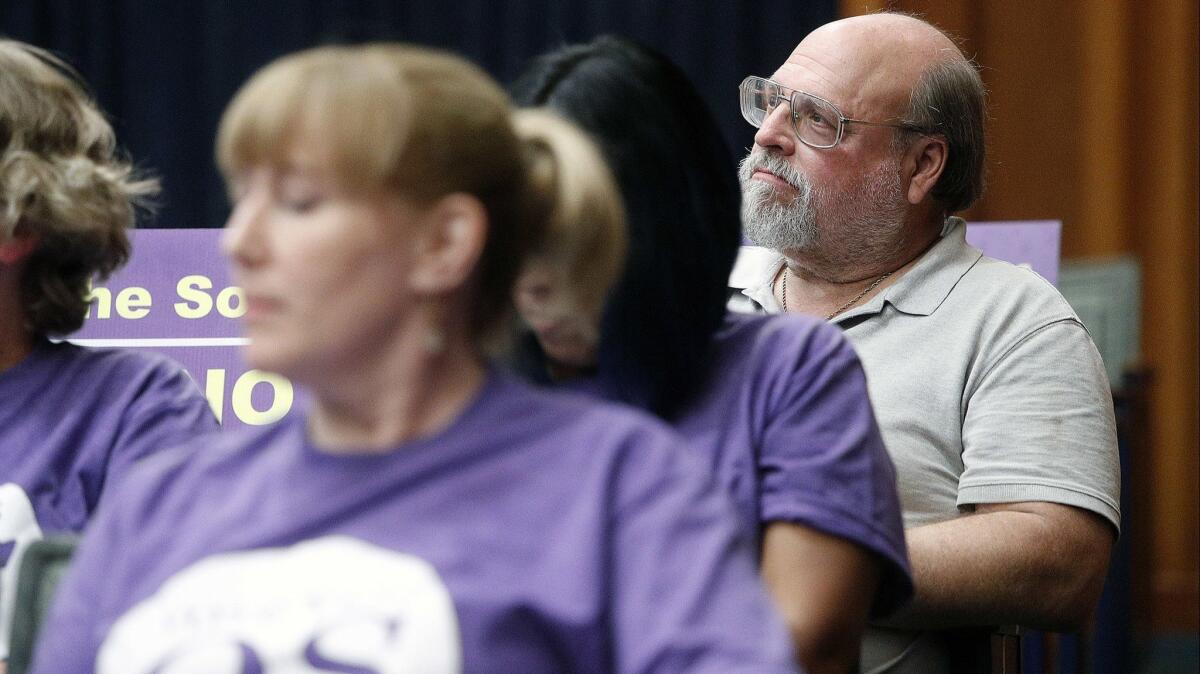

Applebaum has, at times, stood alone against a purple sea of Measure QS supporters.

He doesn’t like that the parcel tax has ties to salaries and doesn’t address the district’s pension problem, while the measure has no sunset clause and would require a voter repeal to end it.

Applebaum said he also thinks key benefactors may reduce their giving levels to Burbank Unified. He cited the new 456,000-square-foot IKEA store as an example. Applebaum said he expects the store will scale back its usual grants and donations totaling around $60,000 a year to the district because the company will have to pay a $46,000 annual tax.

“I’m not against the parcel tax. I’m against how they’re using it and how they’re saying they’re going to use it,” he said. “Once they use it for salary, all the things that they’re saying and the goal sheets, salary will overwhelm all of that and there won’t be any of that.”

The parcel tax is supposed to address several needs, such as buying new band uniforms and helping lower classroom sizes, along with giving teachers and staff a one-time 3% salary raise, in addition to a 2% hike that was recently approved.

“This measure is being marketed in a way that is not honest because it’s going for salaries and 3% is already guaranteed,” he said. “It doesn’t take somebody with a brilliant mind to extrapolate that next year when the [unions] go to the bargaining table, they’re going to see $5.7 million of additional revenue and they’re going to want to bargain.”

Applebaum contends that a 3% salary hike translates into roughly $3.3 million of the annual $9-million Measure QS pot.

“When I left in 2017, every percent of a salary increase equaled about a $1.1-million increase, so that’s where I’m getting that number from,” he said. “So this year, it will be 3%. If the district gives another 2% the following year, then 2% again and 2% again, then in five years, guess what? There’s no money left.”

Burbank Supt. Matt Hill countered that claim.

“That’s just his assumption,” Hill said. “There’s nothing in the parcel tax language or contract agreement that would say that.”

Applebaum said that parcel-tax money should have been directed toward fixing the pension problem, which he contends is the real issue.

Currently, 88% of the district’s operating cost is tied to employee compensation, with pension costs expected to be around $16.5 million for the 2018-19 school year. Five years earlier, the district paid a little over $7 million.

While he’s fond of Hill, Applebaum said he thinks the former Los Angeles Unified administrator is avoiding making tough decisions.

“He’s in year four,” Applebaum said of Hill. “He’s never had to cut as a superintendent. I had to cut several years as a board member. It’s not fun, but you do what you have to do.”

Applebaum said the school district should relax its student-teacher ratio as a way to help offset spending, noting his daughter went from a second grade class with a 20-to-1 ratio to 28-to-1 the following year and “she’s doing just fine” now in 11th grade.

He pointed to the district cutting $2 million in 2000 during the dot-com bubble, which was done, in part, by slashing discretionary positions.

“They did what they had to do,” Applebaum said. “And guess what? When good times came back, class sizes were lowered again, and some people were hired back. We can do that again.”