U.S. and China slap big tariffs on each other, escalating trade fight

The tariffs that the United States and China slapped on each other’s exports Friday intensified a trade battle that has a strong risk of roiling financial markets, chilling consumer confidence and seriously harming the global economy.

After President Trump followed through on his threat to apply 25% levies on $34 billion of Chinese products, mostly machinery and industrial parts, Beijing accused the United States of “launching the largest trade war in economic history.” It fired back with dollar-for-dollar tariffs mainly on American farm products and other foods.

There was no indication of new talks between the two sides.

Soybeans topped the list of newly taxed items— and they illustrate how deeply U.S. and Chinese producers and consumers have come to depend on each other.

Some ships from the Pacific Northwest bound for China with tons of soybeans have already been rerouted to Europe or Southeast Asia, analysts here said. Chinese officials, meanwhile, have been pulling out all the stops to encourage domestic farmers to plant more soybeans, so far with mixed results.

“China needs soybeans, and the U.S. needs the Chinese market,” said Jiang Boheng, an analyst with Luzheng Futures Co. in eastern China’s Shandong province. “It’s a lose-lose situation.”

On the whole, the tariffs and retaliatory tariffs amount to penalties totaling $17 billion, a tiny amount given the size of the two economies, which have a combined gross domestic product of roughly $30 trillion.

Nonetheless, the duties will hurt sales and disrupt supply chains for some industries and businesses. More worrisome, the latest actions and the increasingly heated rhetoric from both sides have raised alarms of a drawn-out fight that could take a toll on both economies and spill over to the rest of the world.

Any fallout thus far appears to be muted as American economic growth surged in the second quarter. Job creation hasn’t dimmed. On Friday the government said the nation added a solid 213,000 jobs in June.

China’s economy is expected to expand at a still-rapid pace of about 6.8% this year, even as investments and production have decelerated and the government has clamped down on excessive lending.

The U.S. and China are the two largest economies in the world and have periodically had trade clashes, but Trump and hard-liners in his administration are insisting that Beijing pay for years of what they see as unfairly taking advantage of America’s open markets and know-how.

China’s tariffs are targeting agricultural and food products, including grains, tobacco and whiskey, products largely from states that backed Trump and home to influential GOP lawmakers. The U.S. duties are aimed at hitting China’s supply chain and intermediate parts supporting the country’s high-tech manufacturing.

U.S. businesses and congressional Republicans have increasingly urged Trump to back away from applying broad-based tariffs, calling instead for negotiations and enlisting the help of other trading partners to put pressure on Beijing.

Trump, however, has alienated America’s closest allies such as Canada and the European Union by assessing tariffs on steel and threatening to tax imported cars. The president has made punitive duties, or the threat of them, his instrument of choice to tackle America’s trade deficits and force Beijing to open markets and abandon policies such as requiring foreign firms to form joint ventures and essentially hand over technology secrets to do business in China.

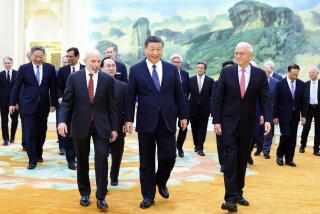

On Thursday, Trump threatened to slap duties on all $500 billion of goods imported from China. Chinese officials have repeatedly vowed that they will stand firm and take comprehensive measures to protect the interests of China and its people. And Chinese President Xi Jinping and others have sought to woo European and other countries to back Beijing’s push against what it sees as Trump’s unilateral protectionism.

“I think the Chinese are digging in for what they see as a protracted battle with the U.S.,” said David Loevinger, an analyst for TCW Emerging Markets Group in Los Angeles and formerly a senior Treasury Department official for China affairs.

Loevinger, who was in China the last two weeks gauging the thinking and mood of businesses and government officials, said it was clear that the trade fight had awakened the Chinese to the country’s “dependency on the U.S. as a supplier, market and banker that leaves them too vulnerable.”

The result, he and others said, is that China has begun to accelerate efforts to build up domestic capabilities and to diversify where China buys its products.

“It would be a mistake for American companies to think they’re the unique providers of goods and services,” said Kenneth Jarrett, president of the American Chamber of Commerce in Shanghai.

Although China has been rebalancing its economy and today is much less dependent on trade, the country still counts on the U.S. and other foreign countries for critical components and technologies.

That was evident in the case of telecommunications giant ZTE, which was paralyzed after the Trump administration initially prohibited American firms from selling parts to ZTE for violating certain U.S. sanctions. Trump later eased the restrictions after ZTE agreed to pay a large fine and overhaul its management with oversight by an American team.

Trump is betting that he has the upper hand in a trade fight with China because the United States buys or imports nearly 4 times as much in products from China as it exports to the Asian country.

But the reality is more complex: Over the last three decades, the two economies have become interconnected, with many American firms dependent on China’s supply chains and large domestic market.

Soybeans provide a prime example. U.S. farmers shipped about $14 billion worth of soybeans to China last year, accounting for more than half of their global exports. American soybeans, in turn, made up about 30% of China’s total soybean consumption.

As valuable as China’s market is for the U.S., American soybeans have helped fill China’s vital need for the grain, used for animal feed and for oil and human consumption. A Chinese saying goes, “Take a day without meat, but not a day without beans.”

But starting Friday, U.S. soybeans entering China face an extra 25% tariff on top of the 3% duty assessed on all imported soybeans. The threat of tariffs already has cost American farmers as soybean prices have fallen and Chinese orders have virtually stopped in recent weeks.

Instead China has been buying more from Brazil and Argentina, among other sources. And on July 1, Beijing dropped the 3% duty for soybean imports from Bangladesh, India, Laos, South Korea and Sri Lanka, to encourage those countries to export more to China.

At the same time, government officials in China’s northeast Heilongjiang province, the heart of China’s soybean production, have doubled subsidies to farmers for replacing corn with soybean, to make up for the anticipated shortfall as American supplies shrink.

Corn has been much more profitable, while soybeans have been a break-even or money-losing crop in recent years. And for some farmers, the government’s push for more soybean planting wasn’t exactly welcomed.

“We couldn’t make money from that. We even couldn’t sell out the previous soybeans,” said He Yongdong, 35, of Kedong County, his voice tinged with resentment. “I’m still keeping the soybeans harvested in 2017. I’ve not got back the money I invested in last May.”

Yet others like Chang Gengguo, who works with Longshu Farmers Cooperative in Wangkui County, sounded like a foot soldier responding to a battle call from government.

He said that even before provincial government officials came to his village to sell them on the new subsidy policy, he had made up his mind to grow more soybeans. And at the end of the sowing season, Chang said, he added 25% to the 400 acres of soybeans he had originally planned to grow. The extra subsidy, he said, was nice but beside the point.

“Even though we couldn’t make money from soybeans, we still want to do that. It’s for the interests of the country,” he said.

But even with increased domestic production, more purchases from other countries and a shift to alternatives like rapeseed, farm industry experts say China still can’t do without more soybeans from the U.S.

On Friday, Chinese agricultural company stocks rose sharply as investors saw potential benefits to domestic farms from import limitations, said Monica Tu, a soybean market specialist at Shanghai JC Intelligence Co. But that may prove short-lived, she said.

“We are concerned about supplies for next year.”

Follow me at @dleelatimes

UPDATES:

1:30 p.m.: This article was updated with additional details.

This article was originally published at 6:25 a.m.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.