How the government shutdown killed the economic recovery

We’ll be seeing lots more data like these, but the White House Council of Economic Advisers is reporting that the government shutdown took a huge bite out of economic growth--and that the impact will linger.

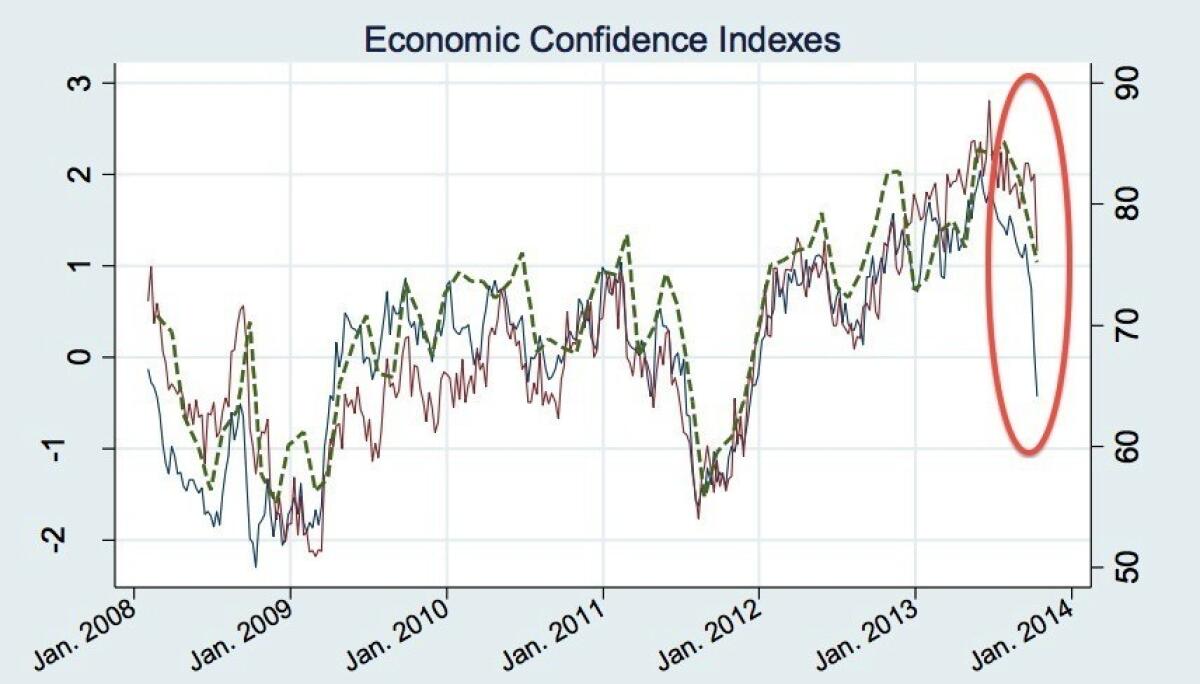

The chart above shows the effect on economic confidence, one of eight daily or weekly economic indicators tracked by the CEA. (The three lines follow three separate surveys, Gallup, Rasmussen and the University of Michigan.) Put briefly, confidence fell off a cliff. That’s likely to bleed into the holiday period. Moreover, the effect was predictable: That big drop the chart shows in mid-2011? That was the last fiscal standoff, which didn’t even result in a government shutdown. The CEA report also covers the other indicators, including unemployment, most of which look just as ugly.

Overall, the CEA report by Harvard economist James Stock and two colleagues calculates, the shutdown pared 0.25% from annual economic growth and cost 120,000 jobs in just its first 12 days. They’re being conservative, since their study covers the shutdown only through Oct. 12. It continued for an additional four days.

They observe that the shutdown not only withdrew government services, but rippled through the private sector.

“For example the travel industry was hurt by the closing of national parks, businesses in oil and gas and other industries were hurt by the cessation of permits for oil and gas drilling, the housing industry was hurt by the cessation of IRS verifications for mortgage applications, and small businesses were hurt by the shutdown of Small Business Administration loan guarantees. In addition, a reduction in consumer confidence and an increase in uncertainty associated not just with the shutdown but also the brinkmanship over the debt limit affected consumer spending, investment and hiring as well.”

We’ll be hearing more of the same as further surveys come in. The economic data over the next quarter or more are likely to be ghastly.