Charney investment deal doesn’t guarantee return to American Apparel

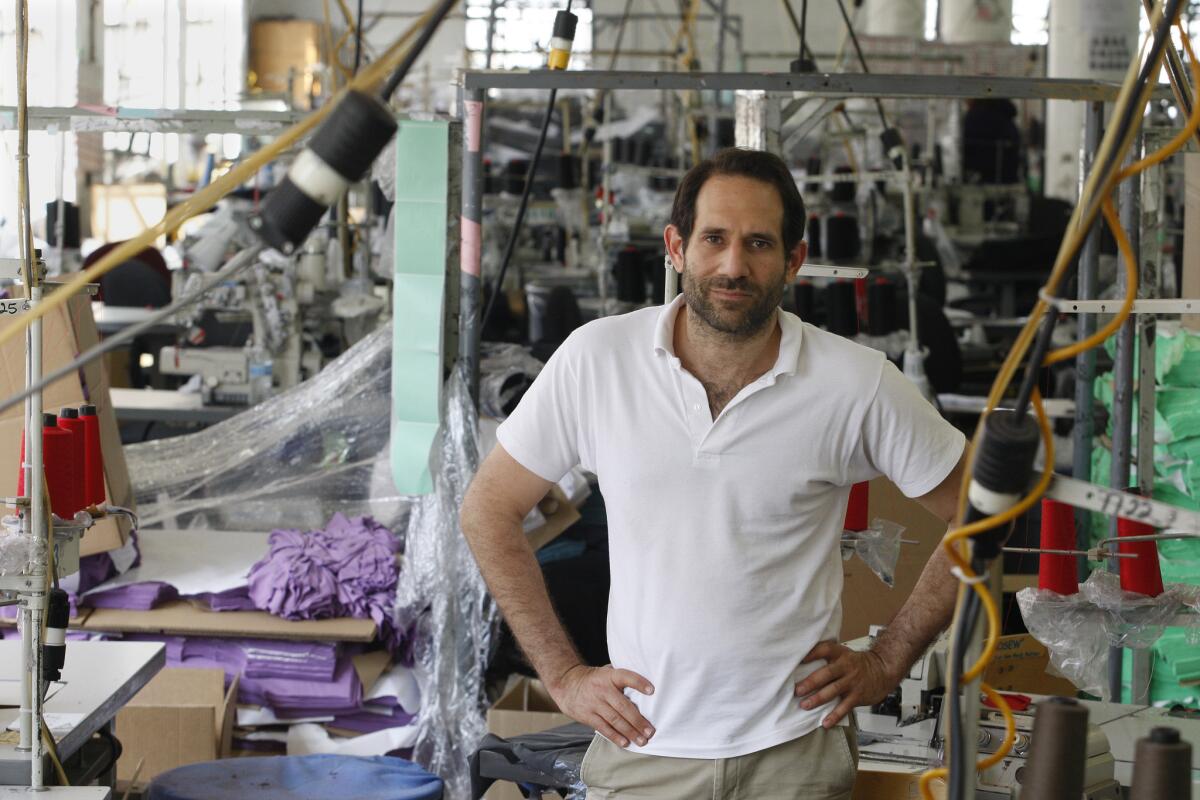

Ousted American Apparel Chief Executive Dov Charney has regained control of a large chunk of the company’s stock, but that strategy has tethered him to the strategic vision of the investment firm that allowed him to buy those shares.

Charney entered into a cooperative buying arrangement with New York investment firm Standard General last week. That deal allowed Charney to up his stake to 43%, from 27%, boosting his comeback bid for the retailer that he founded.

But that deal also gave Standard General control over Charney’s shares, and both sides agreed to vote their shares “only as agreed between them,” according to filings with the Securities and Exchange Commission on Friday.

The deal with Standard General throws a dramatic new twist into Charney’s vigorous efforts to regain control after American Apparel’s board voted him out two weeks ago. The board fired him as chairman and suspended him as chief executive “pending an investigation into alleged misconduct.”

Standard General said Wednesday that Charney has agreed not to serve on the Los Angeles retailer’s board or assume any leadership role until an investigation into his behavior is finished, according to a letter from Standard General to investors that was obtained by the Wall Street Journal.

“He will serve no role if he is deemed unfit” following the investigation, the letter said. Standard General said its deal with Charney should not be considered “an endorsement of him.”

Standard General has been in talks with American Apparel’s board about ushering in new leadership to the struggling company, according to the New York Times. The investment firm plans to work on installing new directors who have experience in the retail industry and with turning around struggling companies.

After Charney borrowed nearly $20 million last week from Standard General to buy 27.4 million shares in American Apparel, analysts speculated that he had a good shot of retaking control of the company.

His purcahse came before American Apparel implemented a poison pill plan that is intended to prevent an unwanted takeover. Charney on Tuesday indicated that he would seek written consent from other shareholders in order to install new directors and put himself back at the head of the company.

It remains to be seen whether Standard General’s involvement will have any immediate impact on America Apparel. The retailer warned that firing Charney could throw it into bankruptcy by triggering defaults on nearly $40 million in loans. One lender, Lion Capital, has called for repayment on its nearly $10-million loan.

The company has retained an investment firm to find capital, and analysts have speculated that the company needs a cash infusion.

Charney has indicated he will use everything at his disposal to win back the company he founded.

The dueling sides have engaged in a series of moves and counter-moves over the last two weeks. American Apparel is currently investigating allegations against Charney, including the alleged misuse of company funds and apartments and whether he improperly allowed a subordinate to publish naked photos of a former employee who was suing Charney. His contract blocks his termination as CEO for 30 days.

His lawyer, Patricia Glaser, has denied the allegations and last week filed an arbitration petition alleging wrongful termination, breach of contract and retaliation.

Follow @ShanLi for news about business and the California economy