Finding a way out from under big medical bills

Dear Liz: I am so lost. I recently became a widow at 52. My husband didn’t have life insurance. I had to grab a job two weeks after he passed. Five months later, I’m sick with late-stage congestive heart failure and can’t work. I’m barely able to pay my mortgage now with Social Security survivor benefits. I need to sell and rent something cheaper before I lose my home of 18 years. I have to decide between continuing to make the payments and buying medicine and food.

I don’t have health insurance because Medicaid was not expanded in my state and I haven’t been on disability long enough to qualify for Medicare. I owe a lot of money to someone who helped me. I would have been dead without the help, not to mention homeless. My husband left me in a bind.

Answer: I’m so sorry you’re having to deal with all this.

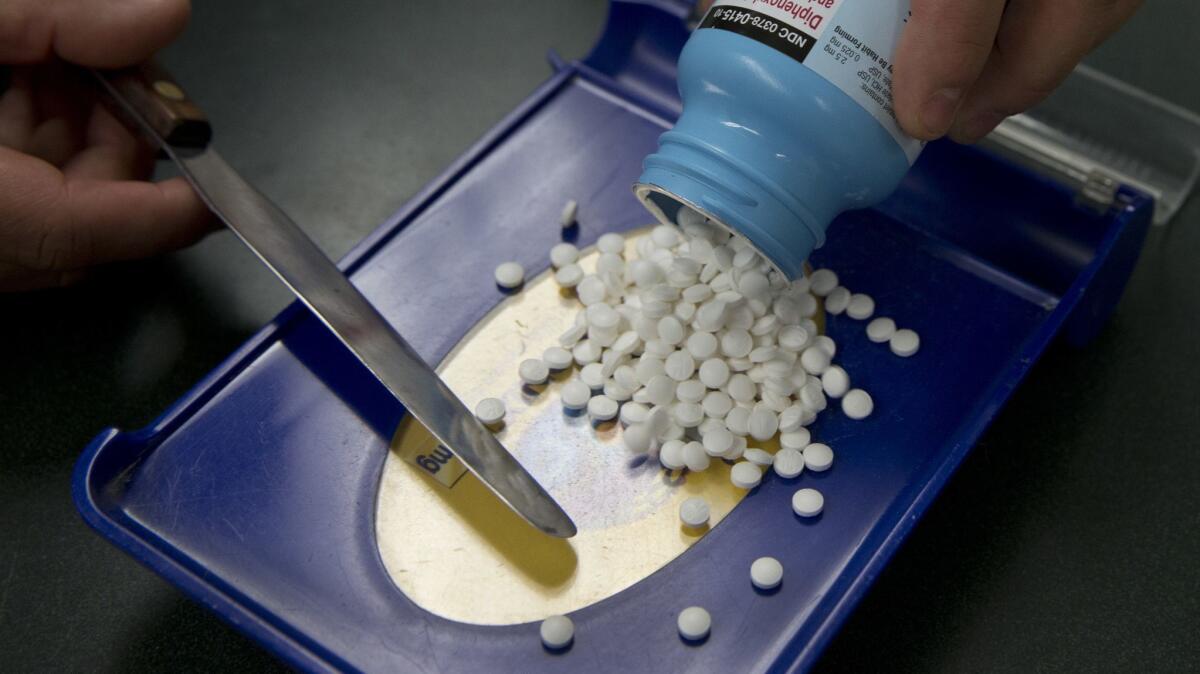

If you’re not already getting help paying for your prescriptions, check out resources such as NeedyMeds.org, the Partnership for Prescription Assistance and the Patient Advocate Foundation’s National Financial Resource Directory. It’s crucial with your diagnosis that you take your medications as prescribed and don’t skip or alter your dosages.

Your medical providers may have charity programs to help pay your healthcare bills, or they might be willing to accept small payments. You may be able to negotiate a discount if you ask to be charged the same rates as your area’s largest insurer.

If you’re on Social Security Disability Insurance, you’ll qualify for Medicare after two years. Without health insurance, though, it may be hard to get the quality care you need to live that long.

You could move to another state that would cover you under Medicaid, but that may not be feasible, given how sick you are. Plus, you may not qualify if you have some equity in your home and you sell it. While your residence is not a countable asset that could prevent you from getting Medicaid, the profits from a sale probably would be.

A housing counselor could help you explore your options, which could include selling, taking on a roommate or getting a mortgage modification. You can get referrals from the U.S. Department of Housing and Urban Development site or by calling (800) 569-4287.

Another option is foreclosure, especially if you don’t have much equity in your home and the foreclosure process is relatively slow in your state. You could use the money that otherwise would go to house payments for living expenses and medicine until you have to move. It’s not ideal, but none of your options are at this point.

Why you should keep credit use low

Dear Liz: You recently said you don’t need debt to have good credit, but I was told that “credit utilization” — the amount of credit you use compared with your credit limits — is important. Paying off the cards each month means zero balances are reported to the credit bureaus and result in no utilization. Also, older credit accounts help scores, and my older accounts dropped off after a period of time, lowering my average age of credit accounts to four years. How can I fix this? Good credit doesn’t stay on forever.

Answer: It’s not true that paying off your cards results in zero credit utilization. The balance that the card issuers report to the credit bureaus is typically the balance on your statement date. You could pay it off in full the very next day, and the statement date balance would still show up on your credit reports and get calculated into your credit scores.

That’s why it’s important to keep your credit utilization down, even if you pay in full (as you should). It’s good to keep charges below about 30% of your credit limit. Below 20% is even better, and below 10% is best.

Accounts typically won’t drop off your credit reports unless they’re closed. Even then, the closed accounts can remain on your credit reports for many years, contributing to the average age of your accounts. The key to having good scores is to keep a few accounts open and in use, not to carry debt.

Liz Weston, certified financial planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com. Distributed by No More Red Inc.

Liz Weston, certified financial planner, is a personal finance columnist for NerdWallet. Questions may be sent to her at 3940 Laurel Canyon, No. 238, Studio City, CA 91604, or by using the “Contact” form at asklizweston.com. Distributed by No More Red Inc.