Online lenders drawing more scrutiny by regulators

Online lenders, led by San Francisco’s Lending Club, have grown explosively over the last few years, lending billions to consumers who can quickly get large sums by simply filling out a few online forms.

Now state and federal officials look to be taking steps toward more tightly regulating the industry.

The Consumer Financial Protection Bureau this week called for borrowers to alert the federal agency of any complaints they have about the firms, a move seen in the industry as a potential prelude to further action by the consumer watchdog.

“It’s likely a signal that the bureau has decided to send to companies: Watch out, our eyes are on you,” said Scott Pearson, a partner in the Los Angeles office of law firm Ballard Spahr who represents marketplace lenders. “It’s a sign that the regulators are paying attention to what marketplace lenders are doing.”

The CFPB’s call for complaints comes the same week that California officials are moving forward with a broad inquiry into the online lending business.

Both the state Department of Business Oversight and the CFPB have turned their attention to so-called marketplace or peer-to-peer lenders — online firms that offer loans to consumers and small businesses, then sell those loans to investors.

There are now dozens of such lenders, which use online applications and speedy underwriting systems to issue loans, often for tens of thousands of dollars at widely varying interest rates. Marketplace loan originations have grown from about $1 billion in 2010 to $12 billion in 2014, according to a Morgan Stanley estimate.

That growth has attracted the attention of consumer advocates, who are concerned about how lenders protect customer data and whether they comply with state and federal lending laws. Now regulators are taking notice too.

At the federal level, the CFPB has not said what, if any, action it might take in the marketplace lending business. In Monday’s announcement, bureau Director Richard Cordray said only that marketplace lenders need to comply with existing rules.

“When consumers shop for a loan online we want them to be informed and to understand what they are signing up for,” Cordray said in a statement. “All lenders, from online start-ups to large banks, must follow consumer financial protection laws.”

Pearson said the additional scrutiny could mirror what the CFPB has done in other industries.

The bureau has recently gone after auto lenders, alleging that they charge higher interest rates to minority borrowers, and debt-collection firms for using illegal tactics. It has also enacted new rules requiring mortgage lenders to provide more information to borrowers.

“To the extent there’s any kind of discrimination going on, that’s something the bureau would be very interested in. And to the extent there’s anything they believe is unfair, deceptive or abusive,” Pearson said.

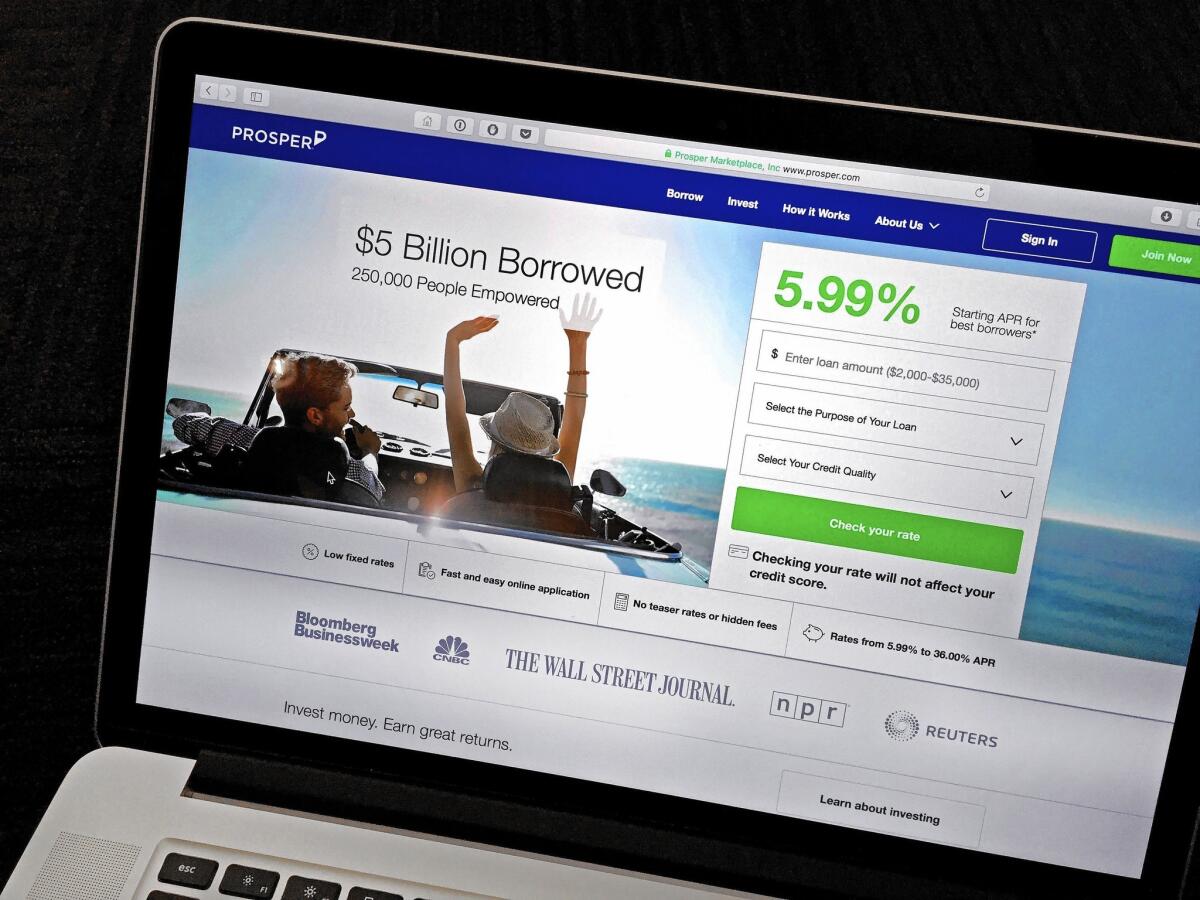

State regulators are looking at the industry too. In December, the California Department of Business Oversight asked 14 marketplace lenders, including Lending Club and Prosper, to submit detailed information about their businesses, part of an inquiry that could lead to changes in state regulation.

Companies have until Wednesday to submit information. Department spokesman Tom Dresslar said he believes all 14 companies will meet the deadline.

When the inquiry was first disclosed, Dresslar said it had been in the works for months. But the announcement followed the revelation that San Bernardino shooter Syed Rizwan Farook had borrowed $28,500 from Prosper in the weeks before the Dec. 2 rampage.

There has been no evidence to suggest that the loan was out of the ordinary.

The department asked lenders to provide information about their business in California, including the number and dollar amount of loans issued over the last six years and details about their loan sales.

“We could decide they’re not adequately regulated or that they’re not adequately complying with California lending law,” Dresslar said. “We could decide everything’s hunky-dory. Our minds are wide open.”

Some of the issues the state is likely to weigh include whether lenders are following securities law when selling loans to investors and the extent to which lenders are subject to California lending law.

Al Goldstein, chief executive of Chicago online lender Avant, another of the firms involved in the California inquiry, said the increased interest from regulators isn’t surprising.

“Our expectations were that we were going to be heavily scrutinized,” he said. “We always expected regulators to get interested. It’s the nature of the business.”

Goldstein said regulatory scrutiny could expose some bad practices but shouldn’t be a problem for Avant and other companies following the rules.

“When regulators come and talk to us, they’ll have no surprises,” he said.

Although regulators have yet to take any concrete steps, one of the industry’s leaders has recently made changes to its business, possibly anticipating regulatory action.

Lending Club said late last month that it would change the way it works with the bank that issues loans on Lending Club’s behalf.

By having Salt Lake City’s WebBank issue its loans, Lending Club has said it can charge interest rates nationwide based on lending laws in the bank’s home state of Utah rather than on the law in a borrower’s home state.

But in an unrelated case last year, a federal appeals court ruled that if a bank no longer has an interest in a loan, that protection might not apply.

In a statement last month, Lending Club said WebBank will now keep an ownership stake in all loans, a move aimed at making sure that the company won’t have to abide by state-by-state rules.

“We believe this new structure will strengthen the foundation of our program to provide borrowers the ability to access affordable credit on a nationwide basis,” Lending Club Chief Executive Renaud Laplanche said in a statement.

Even so, Dresslar said whether Lending Club and others are required to follow state lending laws is something that the Department of Business Oversight is looking into as part of its inquiry.

“That fact that an online lender has a relationship with a bank that purportedly relieves them of the responsibility to report loan activity in California — we consider that an open question,” he said.

Twitter: @jrkoren

MORE FROM BUSINESS

Back to blimps? Lockheed Martin will show off its Hybrid Airship

Obama administration proposes new effort to combat high drug prices

Column: Donald Trump tried to get me fired after I wrote about Trump University