Pinterest sets IPO price range below its 2017 valuation

Pinterest Inc. is seeking to raise as much as $1.28 billion in a U.S. initial public offering that could value the company below the amount it reached in its last private valuation.

The San Francisco company, which enables its users to make online photo bulletin boards, is offering 75 million shares for $15 to $17 apiece, according to a filing Monday. Based on the total number of Class A and Class B shares outstanding after the offering, if it priced at the top of the range, that would give Pinterest a market valuation of about $9 billion, according to data compiled by Bloomberg. Its fully diluted value could be higher.

In its last private funding round in 2017, the company raised $150 million for a total valuation of about $12.3 billion. Pinterest begins its IPO road show in New York on Monday and will travel to cities including Boston, San Francisco and Chicago to market the shares, according to a term sheet reviewed by Bloomberg. It aims to price the stock after the market closes April 17.

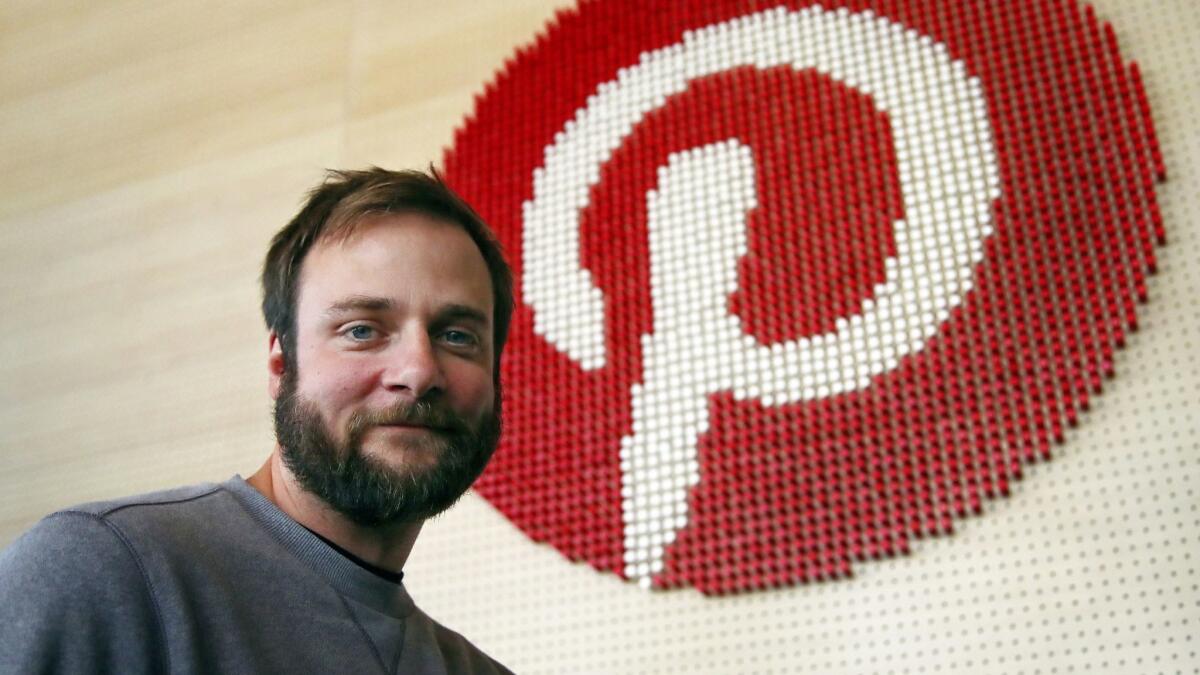

Pinterest co-founder Evan Sharp had to learn how to lead »

Pinterest accelerated its offering to capitalize on the hot U.S. market for IPOs, which expects to see a flurry of U.S. tech companies go public this year. In March, No. 2 U.S. ride-hailing giant Lyft Inc. priced its shares at $72 in the largest offering from a tech start-up since Snap Inc. went public two years ago. Lyft was the biggest U.S. listing after the partial government shutdown dampened first-quarter listings’ momentum. After Lyft shares dipped below their IPO price, they touched above it again, then slid Monday to close at $70.23.

Pinterest earlier revealed about $756 million in revenue from online advertisements in 2018, a 60% growth rate that accelerated from the year prior. Its net loss shrank to $63 million in 2018 from $130 million in 2017. Pinterest says 265 million people use its digital scrapbook at least once a month.

The share sale will be led by banks including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Allen & Co. Pinterest applied to list on the New York Stock Exchange under the ticker PINS.