Column: Incredibly, GOP senators are demanding billions more in tax cuts for the rich

The adage “Give ’em an inch and they’ll take a mile” doesn’t apply anymore in our modern age. Today, it’s better to say, “Give the rich trillions of dollars in tax cuts, and they’ll demand hundreds of billions more.”

That’s the message conveyed by a letter that went out Monday from 21 Republican senators, led by Ted Cruz of Texas, to Treasury Secretary Steven T. Mnuchin. They’re demanding that Mnuchin deliver a new tax cut via executive fiat.

The GOP complains that the capital gains tax isn’t indexed to inflation. As a result, the argument goes, taxpayers including “everyday Americans” are charged taxes on gains that are due purely to inflation, not to the real appreciation of their stocks or bonds.

Indexing capital gains for inflation by administrative fiat is plainly an unlawful overreach of regulatory authority and will be struck down.

— Tax expert Edward Kleinbard of USC

“This treatment punishes taxpayers for the mere existence of inflation and is inherently unfair,” the senators write.

The supposed unfairness could be rectified if Mnuchin were to redefine the concept of “cost basis” — that is, the price at which an asset was purchased — to include inflation. In other words, the $100 you paid for a share of stock in 1990 would be about $200 in today’s money. So, under the GOP senators’ proposal, if you sell it today for $400, you would pay tax only on the inflation-adjusted gain of $200, not the nominal gain of $300.

Some people are never satisfied.

A few things about this. First, to say that capital gains taxes ignore inflation is a lie. The effect of inflation is embedded in the capital gains tax system in several ways: The tax rate is lower than the rate on ordinary wage income — the top rate is 20%, plus a 3.8% surcharge on investment income of taxpayers with income above $250,000, compared with a top tax rate of 37% on ordinary wage and salary income. The capital gains rate itself is tied to the taxpayer’s tax bracket, which is indexed to inflation.

Second, changing the capital gains tax structure by fiat would circumvent the Democratic-controlled House Ways and Means Committee, where all fiscal legislation must originate. “Indexing capital gains for inflation by administrative fiat is plainly an unlawful overreach of regulatory authority and will be struck down” in court, says tax expert Edward Kleinbard of USC, a former chief of staff to the Congressional Joint Committee on Taxation.

Third, the change the Republicans demand would be hellishly complicated. Remember the old days, when conservatives justified the tax cuts of December 2017 by claiming they “simplified” the tax code? Apparently, simplification as a goal goes out the window when there’s real money at stake.

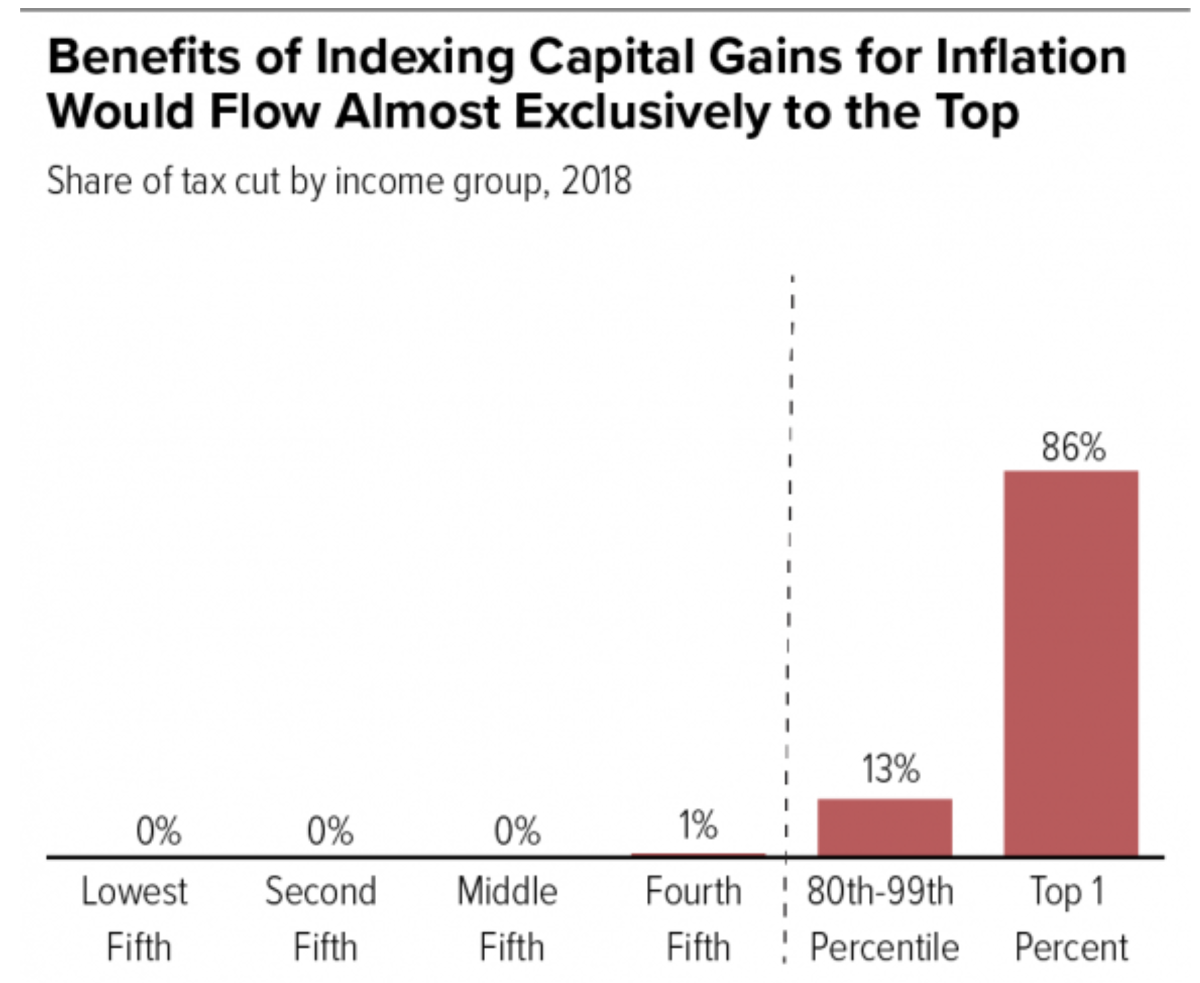

Lastly, even more than the 2017 tax cut, this one would be almost exclusively a rich person’s gimme. The top 1% would collect more than 86% of the benefits, according to a 2018 analysis by the Wharton School; the bottom 90% would get 2.5% of the benefits. The change would cost the Treasury $100 billion to $200 billion over 10 years, according to expert estimates.

Before we get into the niceties of the Republicans’ argument for another tax cut, here’s a bit of context.

Our emerging political debate over taxing the rich seems to be getting bogged down in details — how high a tax rate, should we tax income or wealth, etc., etc.

The idea of indexing capital gains to inflation has been floating around for decades, pushed mostly by the right-wing anti-tax lobby. It tends to bubble to the surface when there’s a Republican in the White House or the prospect of one. It was bruited about, for example, in 1992, during the George H.W. Bush administration, and again in 2012, when there were hopes that Mitt Romney would win election over Barack Obama.

Because Congress, especially a Democratic Congress, was perceived to be a roadblock, the idea of indexing capital gains typically was tied to the idea of making the change without congressional authorization. A sizable library could be filled with law journal articles arguing pro and con, but one of the more straightforward debunkings of the notion came from George H.W. Bush’s attorney general.

“The question was: Can we, simply through administrative action, index capital gains,” the attorney general recalled of the discussions in his office in 1992. “And not only did I not think we could, I did not think that a reasonable argument could be made to support that position.”

That attorney general was William Barr, who is again the attorney general today.

It should come as no surprise that the idea of indexing capital gains should be experiencing a recrudescence today, in the Trump era. A group of 14 anti-tax groups describing themselves as “a broad cross-section of conservative, free-market, pro-business and pro-family organizations” got the ball rolling in January with a letter to Trump, calling on him to “deliver a booster shot to economic growth and the stock market ... without having to go to Congress.” Monday’s letter from Cruz and his colleagues just builds on the anti-tax gang’s groundwork.

A few years ago, the joke going around was that a cocaine habit was God’s way of saying you have too much money.

It also should come as no surprise why the wealthy and their henchpersons in Congress focus on cutting the capital gains tax. As we’ve reported before, the capital gains break is the quintessential handout to the rich. On average, taxpayers reporting income of $10 million or more claim more than half of their income as capital gains or dividends subject to the low rate; only 17.5% of their income was reported as wages or salary. For a middle-class taxpayer reporting income in the $75,000-to-$100,000 range, only 2% qualified as capital gains and qualified dividends.

The GOP senators wring their hands over the inequities in the capital gains tax, apparently on the principle that if they don’t stand up for the 1%, who will? Their argument is that if you buy a share of stock for, say, $100 and sell it 20 years later for $200, at least part of your $100 gain is due to inflation — in real inflation-adjusted terms, you may have made only $70, but you’re paying tax on the full $100. That’s not “equitable,” they say.

But they don’t acknowledge that the capital gains tax already is heavily biased toward the wealthy. “Today, we systematically undertax capital gains,” Kleinbard told me. The preferential rate on capital gains has been justified in part to compensate for the effect of inflation. Moreover, investors can eliminate the capital gains tax entirely simply by holding an asset to their death; the assets their heirs inherit are automatically revalued at the price at the original owner’s death, so the embedded capital gain is reset at zero.

As Kleinbard observes, that makes the capital gains tax our only entirely voluntary tax. “To pile on top of that an inflation adjustment,” he says, “is an insult to the American tax system.”

Quarterly GDP report shows that the sugar high of tax cuts wasn’t sustainable.

The Republicans gloss over the impact their proposal would have on tax simplicity. “It would be ungodly complicated,” says Bruce Bartlett, a White House advisor to Ronald Reagan and George H.W. Bush. “Think about selling assets bought at different times that would be indexed differently.... Also there is no consensus on which inflation index to use. As you know, there are many of them. And all such indexes have their critics.”

The senators make their pitch on the grounds of economic growth, but their argument is laughably thin. The 2017 tax cuts have brought the economy “historic levels of growth,” they write. “Thanks to the current administration’s policies, business investment went from a disappointing minus-0.6% in 2016 to plus-7% in 2018.

Well, not so much. The latest report on economic growth in the second quarter of 2019 demonstrates that the sugar rush of the tax cuts already has faded away. It’s unclear where Cruz et al get their figures on business investment, but the government’s Bureau of Economic Analysis pegs the growth rate of gross private domestic investment at minus-1.3% in 2016 and plus-5.1% in 2018. The latter figure is well below the growth rate in 2011, 2012, 2013, and 2014, by the way. And in the second quarter it fell by an annualized rate of 5.5%.

So much for the “significant economic benefits” that the senators say that yet another tax cut, aimed even more squarely at the rich, would bring to America. Ted Cruz and his colleagues are thinking of the benefits it would bring to the wealthiest Americans, not “America.”