5 things to watch when Apple reports its second-quarter earnings

When it comes to Apple’s earnings, you can always bank on absolutely never hearing about the things you most want to hear about.

Apple TV? IWatch? Cheaper iPhone? IRadio? Forget any mention of future goodies.

PHOTOS: The top smartphones of 2013

What’s left is to sort through a lot of numbers, reading them for signs that support and refute your position that Apple is either vastly undervalued or doomed to become tech’s next dinosaur.

Either way, here are five things to watch when Apple releases its earnings report Tuesday after the stock markets close:

1. Margins: The reason that Apple is Apple is not just that it sells boatloads of stuff, but that it sells boatloads of stuff at premium prices. That gives it a larger profit margin on each gadget it sells than rivals like Samsung. And that in turn stuffs its pockets with cash.

So when observers moan about things like market share, Apple can reply that it doesn’t matter because it dominates the most profitable segments of markets for things like smartphones.

But...

Investors have been worried that Apple’s margins, specifically its gross margins, are shrinking. Apple’s gross margin has slipped from a peak of 47.4% last year to 38.6% in the most recent quarter. That’s still fantabulous by the standards of mere mortal companies, but, of course, it’s headed in the wrong direction as far as investors are concerned.

They worry that lower-margin products like the iPad Mini combined with pricing pressure from rivals like Samsung are eating into Apple’s fat margins. And if Apple has to release a cheap phone to compete in emerging markets, those margins could further shrink.

Apple previously projected that gross margins for the quarter ending in March would be 37.5% to 38.5%. If Apple falls short or wildly exceeds that range, then either bulls or bears will be galvanized.

Colin Gillis of BCG Partners is optimistic that gross margin is one area that Apple could deliver a positive surprise to investors.

“That could be a positive upside there,” Gillis said.

2. Production: Apple unleashed a record number of new or upgraded products last year. But that created some havoc with the supply chain, with the company mentioning that sales in the quarter ending in December were often less than they might have been because they simply couldn’t build and deliver the products customers wanted.

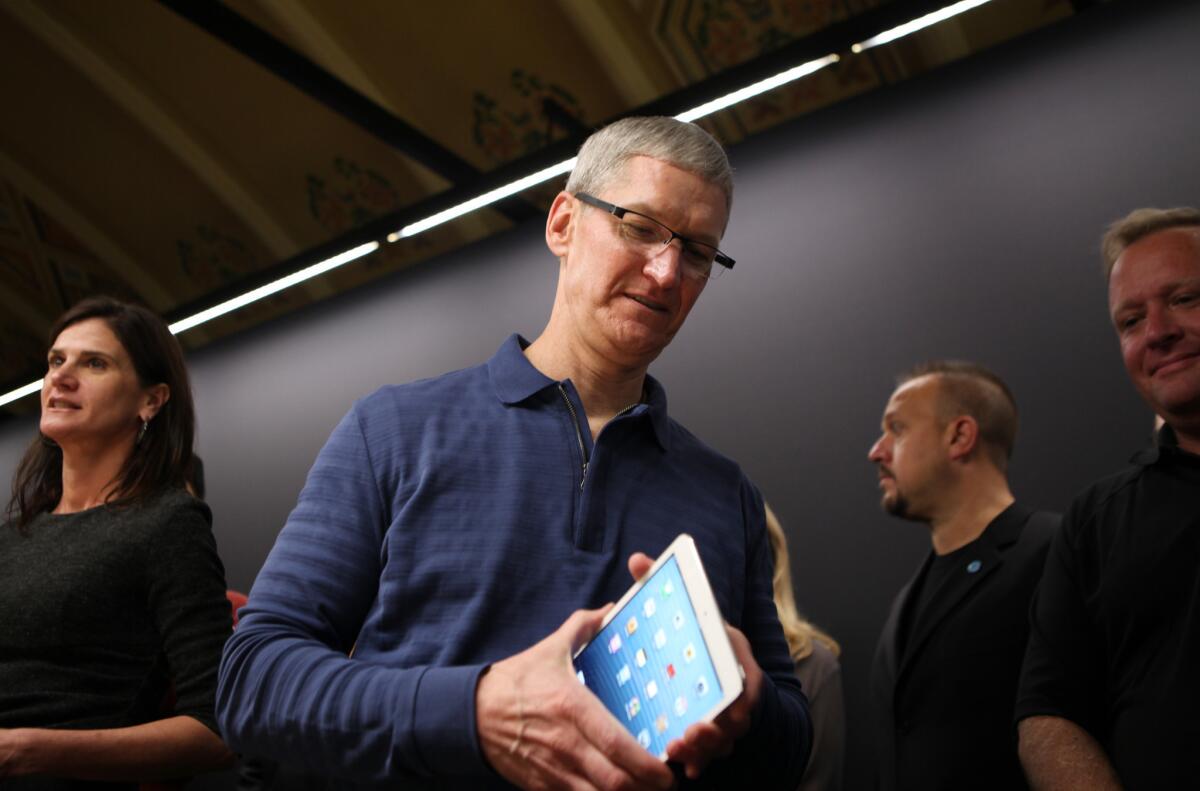

It’s one of the more unlikely problems for Apple to have, considering that current CEO Tim Cook was previously the man who was credited with building the company’s powerhouse supply chain. Still, the company seemed to make some progress getting back in balance by the end of the last quarter.

Let’s see if they’ve completely fixed everything. Otherwise, new rumored products like an iPhone 5S could face similar delays in delivery like the iPhone 5 did last year.

3. Dividends and buybacks: Not too much to say here. Almost everyone expects the company to increase the dividend and stock buyback program it launched last year. The real questions remaining: By how much? And will they announce during earnings Tuesday, or wait? Either way, shareholders who have watched $300 billion in market cap go POOF! are very much eager to get their hands on a dividend consolation prize, and to see Apple buy back shares to make the stock less volatile.

4. Emerging markets: For all the Apple gloom, the company is still leading the U.S. market. Its real issue is overseas, where Samsung is winning the race. Last quarter, Apple broke out results from China because the market has grown so important. The company won’t discuss the cheaper phone that many believe is on its way and is vital to competing in these developing markets. But observers will be looking for signs that Apple is making greater progress in competing in these markets.

5. Guidance: This will probably be the biggest numbers folks will dissect. Analysts’ consensus at the moment is that Apple will report $39.52 billion in revenue and $9.22 earnings per share for its third quarter ending in June. But there’s growing sentiment among analysts that Apple will offer guidance lower than that. Whether it does, and by how much, could have a big effect on the stock for weeks to come.

ALSO:

Facebook Home off to slow start on Google Play

Apple records and keeps users’ Siri queries for up to 2 years

Review: HTC One is a powerful, attractive smartphone [Video]