Big investor T. Rowe Price challenges Snapchat founders’ power

Investment giant T. Rowe Price is disappointed that Snapchat’s co-founders want to retain disproportionate control over their company when it goes public.

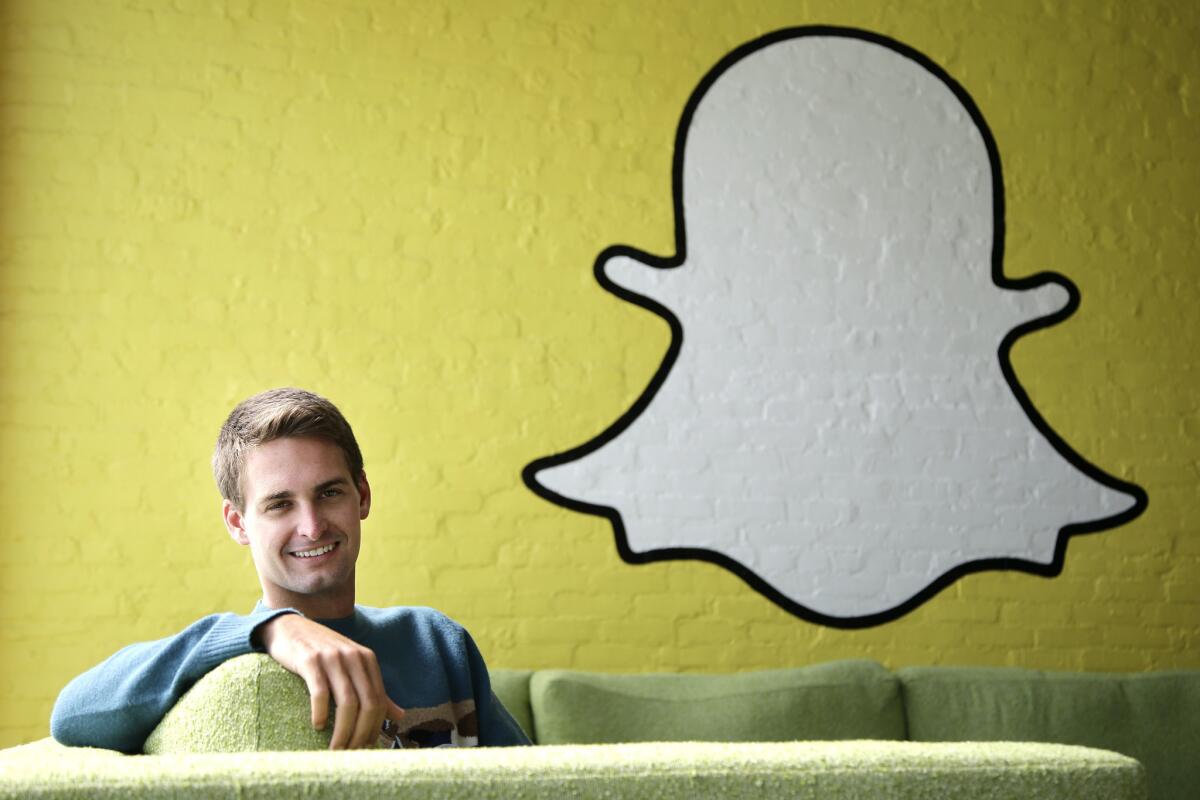

Evan Spiegel and Bobby Murphy, who started working on the chat app together at Stanford University, reportedly are seeking 70% of the voting power of Snap Inc. following an initial public offering this year. They technically would own a much smaller percentage of the company, but they would gain greater control by denying votes to some other owners.

T. Rowe Price, which co-manages at least $7 million worth of Snap Inc. shares, according to regulatory filings, expressed concern with the plan.

“We want our clients to have the vote they deserve,” Chief Executive Bill Stromberg told the Australian Financial Review in an article posted Thursday. “So we are quietly and persistently advocating for change.”

The displeasure appears unlikely to sway Snap to change its plan, and T. Rowe Price acknowledged in a later statement that it doesn’t expect to back away from the Los Angeles company.

“We take our obligation to represent our investors’ interests very seriously,” T. Rowe Price stated. “We believe our investment in Snap continues to be in our investors’ best interests. We have a very good relationship with Snap and its management team, and we look forward to continuing our partnership in the future.”

Snap declined to comment.

Founders having outsized control is a growing trend among public companies, especially in technology and media industries. Having two classes of stocks — one with limited votes — enables company leaders to distance themselves from the views and guidance of shareholders, who may have a different idea of how to govern and grow a company. Entrepreneurs say it frees them to make large, long-term and risky bets on innovative ideas.

But corporate governance experts have said giving outside shareholders little say in a company makes it difficult for them to hold executives and board members accountable.

T. Rowe Price has taken a vocal stand against the dual-class setup. Last year, the firm said it would send a message by voting against the nomination of key board members at companies who adopt a structure in which controlling shareholders have extra power.

Twitter: @peard33