A glimpse at some of what’s in California’s new $202-billion state budget

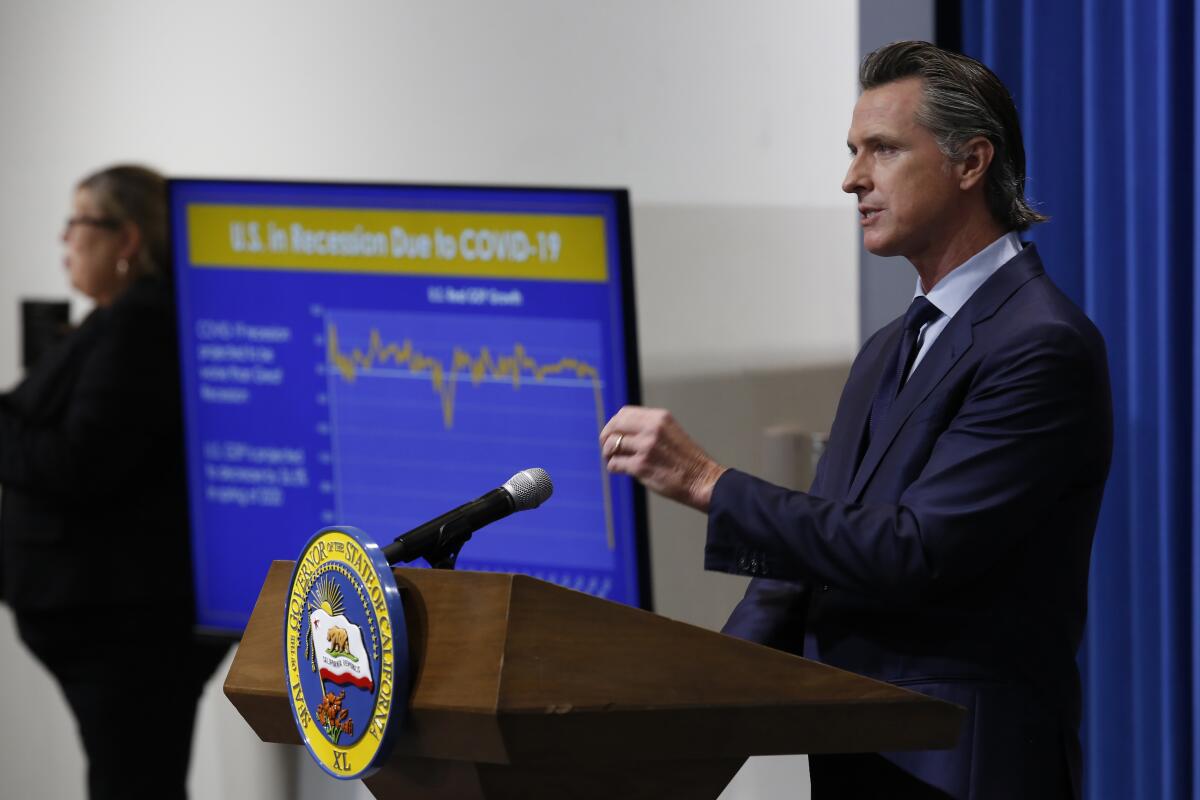

Gov. Gavin Newsom on Monday signed into law the key provisions of a new state budget, a spending plan that seeks to erase a historic deficit while preserving service levels for schools, healthcare and social services.

The $202.1-billion budget, a blueprint for the fiscal year that begins on Wednesday, is unlikely to be the final effort to address the economic impacts of the state’s COVID-19 pandemic. A handful of budget-related items remain pending in the California Legislature, and lawmakers may revisit funding levels once a more clear picture of tax receipts develops after July 15.

“In the face of a global pandemic that has also caused a recession across the world and here in California, our state has passed a budget that is balanced, responsible and protects public safety and health, education, and services to Californians facing the greatest hardships,” Newsom said in a statement.

Legislators persuaded Newsom to largely replace the cuts he proposed last month to some of the state’s core programs with an assortment of other budget-balancing solutions: delayed payment plans, borrowing from various internal funds and more optimistic tax revenue estimates. The final agreement also relies heavily on cash reserves, withdrawing almost half the money in California’s $16-billion “rainy day” fund.

While some budget choices were supported by lawmakers from both major political parties, the enacted plan largely reflects the priorities of majority Democrats.

Schools hold their own, but just barely

When measured by total local and state tax dollars, the new budget essentially holds school spending flat at an average of about $12,000 per student. But those numbers can be deceiving because K-12 schools and community colleges won’t be receiving all of the money in a timely fashion.

The budget authorizes up to $12.5 billion in school funds — some of it owed now, most in the new fiscal year — to be paid late through a system of “deferrals” last used during the Great Recession. School districts will be mostly on their own to replace the missing dollars, either by tapping district reserve funds or taking out loans. The state agrees to pay back the borrowed money down the road.

One other budget provision could help schools find cash: The state will temporarily pick up some of the employer’s contribution to pension payments covering teachers and other employees.

Outside of required spending, the state will allocate $5.5 billion in one-time funds to mitigate the impacts of changes brought on by the coronavirus crisis. Most of the money will be divvied up based on a school district’s concentration of low-income and English-learning students, while another portion is focused on the effects on special education students.

Schools will also receive some new flexibility in requirements for instructional minutes, given the pandemic’s impact on teaching plans for the new academic year.

These cuts get erased with Washington’s help

A key component of the final deal between Newsom and Democratic lawmakers was how much new coronavirus relief California might receive this year from President Trump and Congress and what to do until it arrives.

The spending plan includes a list of more than $11 billion in spending cuts that will be reversed if at least $14 billion in new federal dollars arrive this fall. Education programs dominate the list, and the budget envisions federal dollars would allow some of the payment deferrals to be avoided. Cuts to housing programs, court operations and child support administration would also be erased. And steep pay cuts to state workers would be offset.

If less than $14 billion arrives from Washington, the budget requires those dollars to be doled out proportionally among the various programs slated for reinstatement.

Sweeping COVID-19 relief efforts

California’s new budget has a variety of ways to assist Californians and government services hit hard by the costs of the unprecedented public health crisis.

Counties and cities will receive $1.8 billion of the state’s share of existing federal coronavirus relief, much of it divvied up based on population.

The state’s infectious disease operations will be boosted, while recipients of various programs normally requiring in-person interviews to determine eligibility — those who receive in-home care and services for aged and blind, for example — will be able to renew participation by phone or videoconference.

Food bank services will receive additional state support. So too will people with developmental disabilities as well as their families. A new program will offer housing and mental health services to college students who left school after the onset of the coronavirus in the spring.

State tax dollars will continue to back child-care vouchers for essential workers. Up to $15 million will be set aside as emergency financial aid for students at state colleges and universities who were denied federal help because of their immigration status. And general fund dollars will be used to mitigate other coronavirus shortfalls, such as lost entrance fees and fuel taxes that usually help fund California parks.

A single time limit for welfare programs

In 2012, Gov. Jerry Brown signed into law a limit of 48 months for Californians to receive aid from the state’s welfare assistance program, CalWorks. Subsequent changes created a pair of 24-month maximum time limits on other work requirements.

The new budget sets the stage for erasing all of that and going back to what existed before Brown’s push: a single lifetime limit of 60 months for access to CalWorks services — consistent with federal rules and possibly offering new help to some who ran out of time in recent years.

“The pandemic has bought into very clear relief the reality faced by lower-income people,” said Frank Mecca, executive director of the County Welfare Directors Assn. of California. “Their lives aren’t linear.”

Local officials, Mecca said, have spent so much energy trying to manage the different “clocks” of eligibility that it’s left less time for helping clients get back on their feet.

The budget protects overall CalWorks funding by using a portion of a special cash reserve for health and welfare services, a backup pool of funds that didn’t exist in previous recessions.

Elsewhere, the budget adds four more years of additional CalFresh benefits for those who live in communities without reliable access to safe drinking water. And it offers new access to the state’s earned income tax credit for some Californians without legal immigration status if they have a child younger than 6.

Health services largely protected from cuts

Medi-Cal, the state’s version of the federal Medicaid program, serves about 1 in every 3 Californians — a stark reminder of the divide between rich and poor. While almost two-thirds of the funding comes from the federal government, Newsom targeted a wide array of healthcare services for cuts under the budget he proposed last month.

Democratic legislators rejected many of those cuts, maintaining access to dental and vision services, occupational and physical therapy, and a diabetes prevention program. They also refused to cut payments to doctors who treat Medi-Cal patients, an effort funded by new tobacco taxes that voters approved in 2016.

Some programs will be expanded. Medi-Cal pregnancy coverage will extend for up to 12 months after childbirth for women diagnosed with a maternal mental health condition. As part of a federal program, California will ensure Medi-Cal eligibility for people younger than 21, or a former foster care youth under 26, while incarcerated.

Additional services will be offered to treat opioid use disorders. And the state Department of Health Care Services will have almost $200 million in tax revenues from the sale of legalized marijuana for education, prevention and treatment of youth substance use disorders.

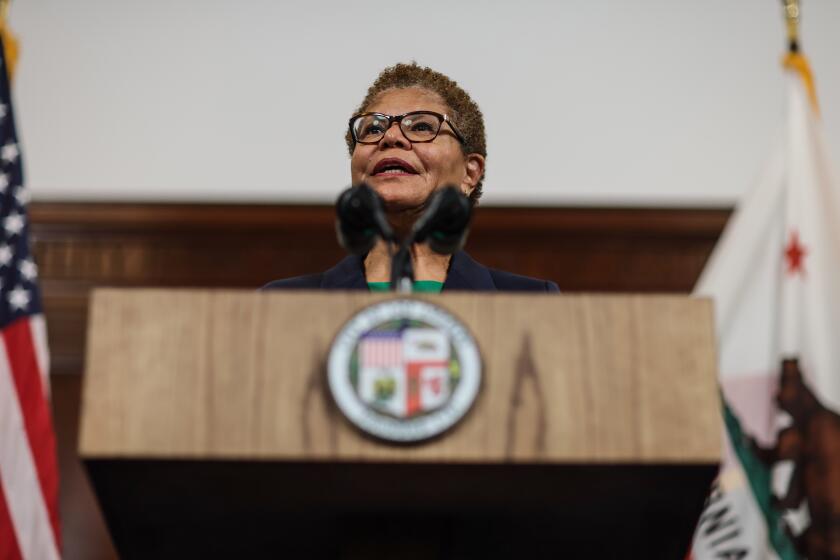

Buying hotels to house the homeless

Coronavirus prevention efforts brought a new idea into vogue for addressing the state’s homelessness crisis: purchasing empty hotels and running them for those in need of shelter.

The budget spends $550 million from this spring’s federal coronavirus relief aid to buy and refurbish motels, hotels and hostels for homeless Californians. Local officials are already involved in this effort under the state-local partnership known as Project Roomkey, though the local effort in Los Angeles has struggled and Newsom’s push met with early resistance in other communities.

Counties will receive an additional $50 million to help operate those facilities over the coming 12 months. In many cases, these renovations will be exempt from provisions of the California Environmental Quality Act in hopes of speedy completion.

More state funding for homelessness efforts is also in the budget: $300 million will be spent on the homeless relief program that began last year. Counties and cities will receive funding through the program.

And the budget boosts housing assistance, spending $300 million for housing counseling and mortgage relief programs and $31 million for tenant legal aid. The money comes from the state’s share of a 2012 national legal settlement after the mortgage crisis of the last recession — money the state tried to use to balance the budget in the past and was forced last year by the courts to spend specifically on housing help.

Fewer business tax breaks

California’s projected budget deficit will be erased for the coming year mostly by surplus cash and longer payment plans, with only about $4.4 billion in new tax revenue. Most of that money will come from two changes directed largely at businesses.

Deductions for net operating loss, where deductions total more than taxable revenues, will be canceled for three years retroactive to Jan. 1 on net incomes of more than $1 million.

New limits will also be placed for three years on business incentive tax credits, capped at offsetting no more than $5 million in tax liability for the same three-year period.

Notable efforts to spend ‘budget dust’

Budget watchers often dismiss small spending items in the annual spending plan as “budget dust,” costing so little relative to the overall dollar amounts as to not merit significant debate.

Perhaps, but the fine print offers a peek at how state government really operates.

A review by the Assembly Budget Committee cites more than $1.3 million in litigation costs for some of the environmental lawsuits the state has filed against the Trump administration, citing efforts to defend provisions of the Endangered Species Act and recent federal biological opinions affecting water use in California.

Cleanup costs continue to mount for California’s Mendocino Complex blaze, which burned some 410,000 acres in 2018. The budget sets aside $2.2 million for debris removal in rural Lake County. That’s on top of $3.2 million that’s already been spent. It’s possible, but not certain, that the federal government will ultimately reimburse some of the costs.

The budget allocates $700,000 for the creation of a “working group” to help guide the state’s new Fair Pay to Play Act, the law that allows college athletes to receive endorsement deals.

Carrying out California’s new law imposing a moratorium on bobcat hunting will boost the budget of the state Department of Fish and Wildlife by more than $2.7 million. Implementing California’s smoking ban on state beaches and parks will cost $2 million in the coming year.

But those costs pale in comparison to the cost for picking up trash strewn alongside California’s highways: The budget boosts Caltrans’ litter abatement program by $31.8 million. That’s expected to grow to an increase of $43.4 million a year by the summer of 2024.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.