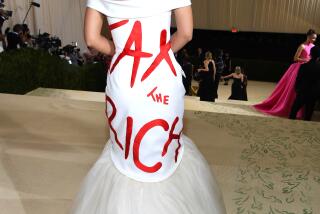

Op-Ed: California should pass a small tax on big wealth

California’s tax system is upside down at the top: Millionaires pay higher rates than billionaires. California’s wealthiest residents — who have partaken in a $4-trillion increase in billionaire wealth in the last year — contribute next to nothing to state coffers. Meanwhile, many less fortunate Californians are suffering.

The ordinary rich — say, a well-compensated doctor — pay a lot in California income tax; they do their share to help support the state. Indeed, many working-class individuals, such as nurses, teachers or firefighters, pay tax on a much larger share of their economic gains than do the wealthiest Californians.

So how do mega-millionaires and billionaires escape the state’s Franchise Tax Board?

The answer is that our tax system does not reach large fortunes unless property is sold or money is paid out in salaries or in stock dividends. Playing Wall Street games, the very rich in the state can avoid taxation and still fund their lavish lifestyles.

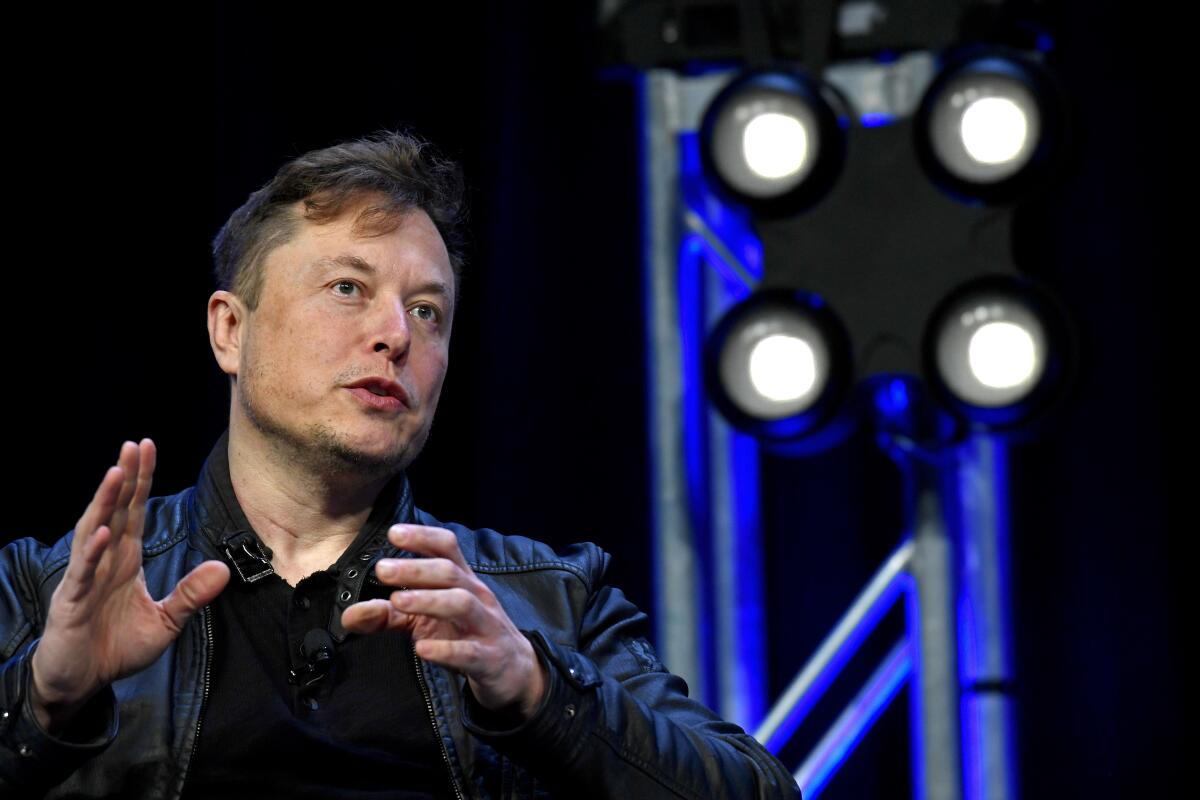

Consider Elon Musk. He built a fortune in California currently valued at about $180 billion, the largest ever seen in the state. We don’t know exactly how much state income tax he has paid, but because he hasn’t sold his Tesla stock or taken a substantial salary or dividends, we can surmise that he has paid very little. Musk now claims to have moved to Texas, so he will probably never pay income tax to California on the billions he accumulated while benefiting from the services and protections provided by the state.

The state Legislature is now considering a pair of bills — Assembly Constitutional Amendment 8 and Assembly Bill 310 — that would levy a 1% tax on extreme wealth: anything above $50 million, with an additional 0.5% tax on fortunes worth more than $1 billion. With Georgetown University law professor Brian Galle, we helped draft these bills to deter tax avoidance and to restore fairness to California’s tax system.

Under these two measures, a household worth $51 million, for example, would pay a tax of $10,000 a year (1% of $1 million). That would be a small burden for such a household but a big boon to California because about one-quarter of all American billionaires reside in the state. As we lay out in a white paper on the legislation, the reforms would raise about $22 billion a year, and more as wealth increases in the state.

California may be able to weather the pandemic without budget cuts, helped by President Biden’s COVID-19 relief package. But soon enough, the state will again face deficits and a host of unmet needs. Sacramento must invest in climate change resilience, such as power line and power grid upgrades to help prevent catastrophic wildfires. The state’s school systems are facing teacher shortages. Housing and mental health facilities are needed to help those living on our streets.

Most fundamentally, it is time to make the tax system fairer.

We estimate that about 15,000 families would be subject to the new wealth tax — the richest 0.07% of the state. According to Forbes magazine, there are about 170 California billionaires, and their total wealth is now around $1 trillion. It was only $700 billion two years ago, before COVID-19, and $300 billion 10 years ago. During the pandemic, while 7.8 million unemployment claims were filed in the state, the state’s richest people gained $300 billion. About half of the $22 billion the new tax would raise would be paid by these billionaires.

Those opposed to a new wealth tax claim that the very rich would flee California in droves, a la Musk, who has made no secret of his objections to the state’s regulations. Much the same warnings were sounded in 2012 and 2016 when California raised income taxes on millionaires. And yet our research shows that the state has gained millionaires and billionaires, along with added revenue from those earlier taxes on the rich.

Other researchers who have studied the question of whether millionaires leave states when taxes are raised have generally found that such movement is uncommon and that when the rich do relocate, taxes aren’t the main reason.

Think about it: For many of the ultra-wealthy, paying a 1% or even 1.5% tax on their fortunes would amount to less than the usual fluctuations of their net worth because of weekly swings in the stock market. And those who made a lot of noise about departing because of the tax would probably have left anyway, seeking a lower-tax state when they finally sell off some of their holdings.

Don’t buy the scare stories about taxing extreme wealth. We need such a tax so that California’s economy benefits all its residents, not just the rich, and to make sure that the wealthiest in the state pay their fair share.

David Gamage is a professor of law at Indiana University Bloomington, Emmanuel Saez is a professor of economics at UC Berkeley, and Darien Shanske is a professor of law at UC Davis.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.