Newsom’s budget proposes $3 million for Alzheimer’s research, brain task force

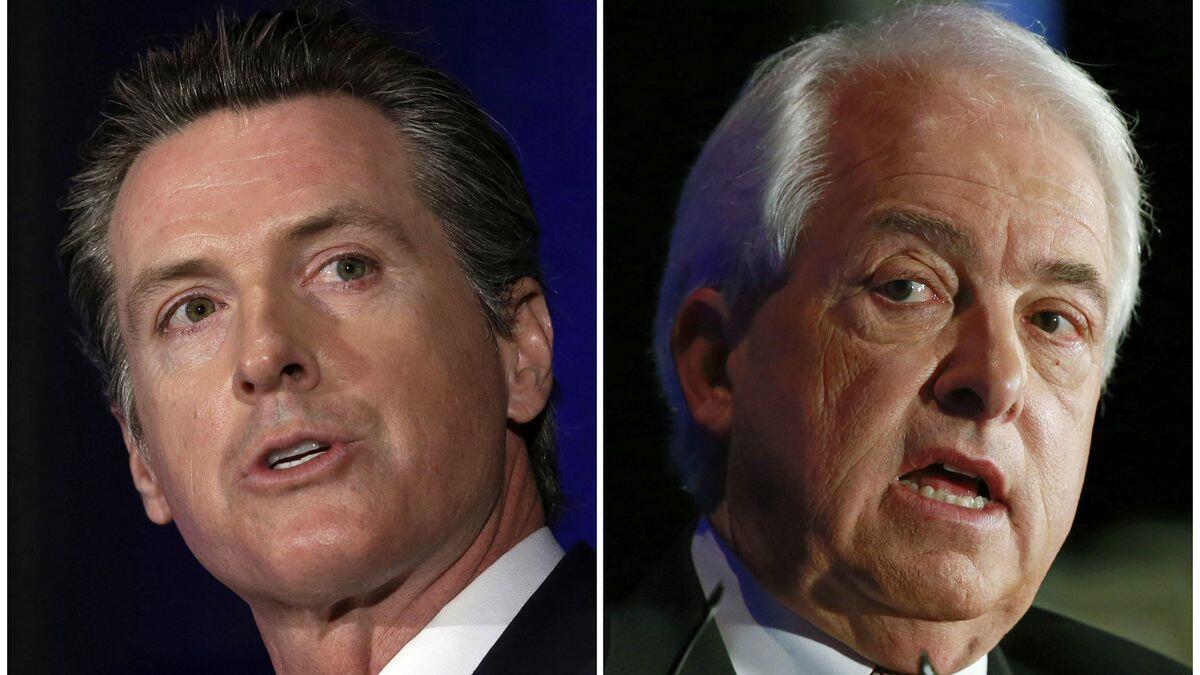

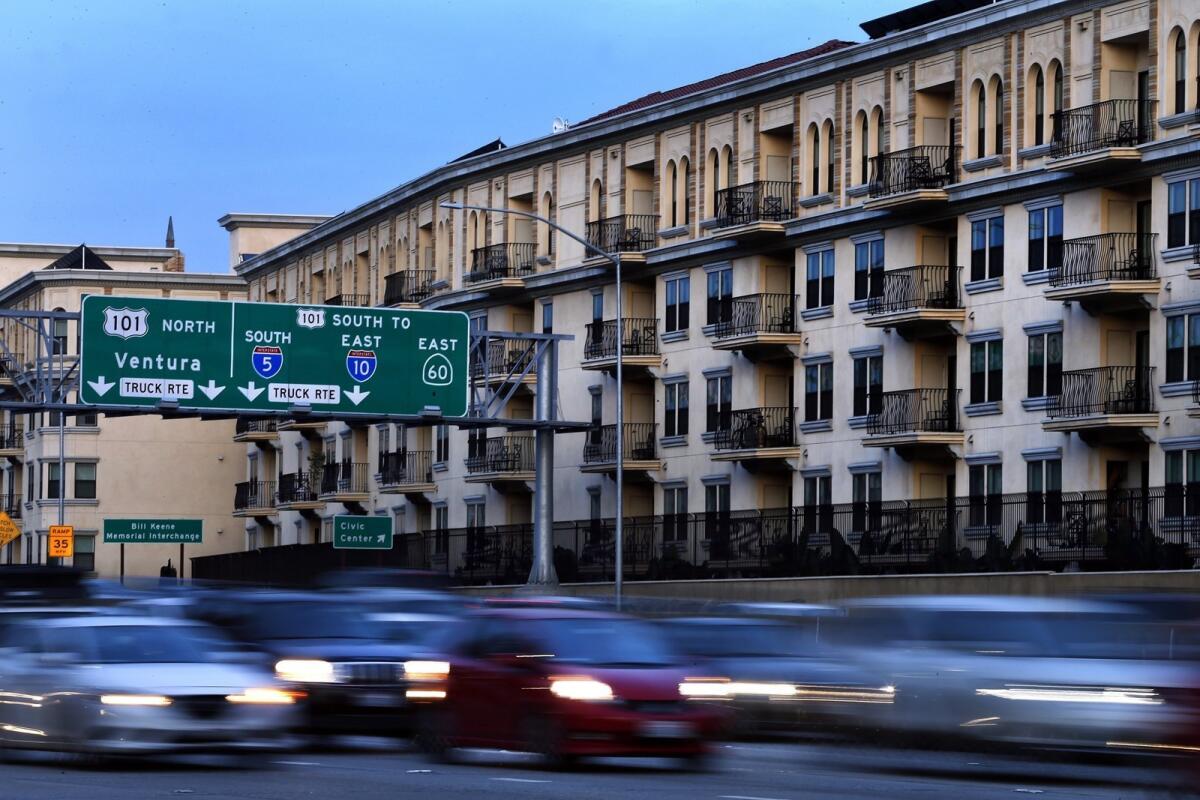

Gov. Gavin Newsom will call for the creation of a brain health task force and dedicate $3 million annually from the state’s general fund to Alzheimer’s disease research in the budget proposal he will release Thursday, a source close to the administration said.

The money for Alzheimer’s research would target the new grants at understanding why the disease is more prevalent in women and people of color. Former California first lady and Alzheimer’s activist Maria Shriver pushed for the funding to be included in the state budget.

Shriver said in a statement Wednesday that the funding would make California the first state to make “understanding our brains a priority.”

The state’s former first lady, whose late father Sargent Shriver was diagnosed with Alzheimer’s, founded the Women’s Alzheimers Movement, an advocacy group raising awareness about women’s increased risk for developing the disease. In 2011, she wrote a comprehensive assessment on the disease, to which Newsom — then mayor of San Francisco — contributed a portion called “What one city is doing.”

“This is personal to me, just like it is to millions of California families,” Shriver said. “Alzheimer’s is one of the largest medical, social and economic crises in our state, and of our time. I am so proud that, once again, California is leading the way. Wiping out Alzheimer’s is going to require bold thinking, and there is no doubt in my mind that California is home to bold thinkers who can make this happen.”

Gov. Gavin Newsom orders ‘reinvention’ of troubled California DMV

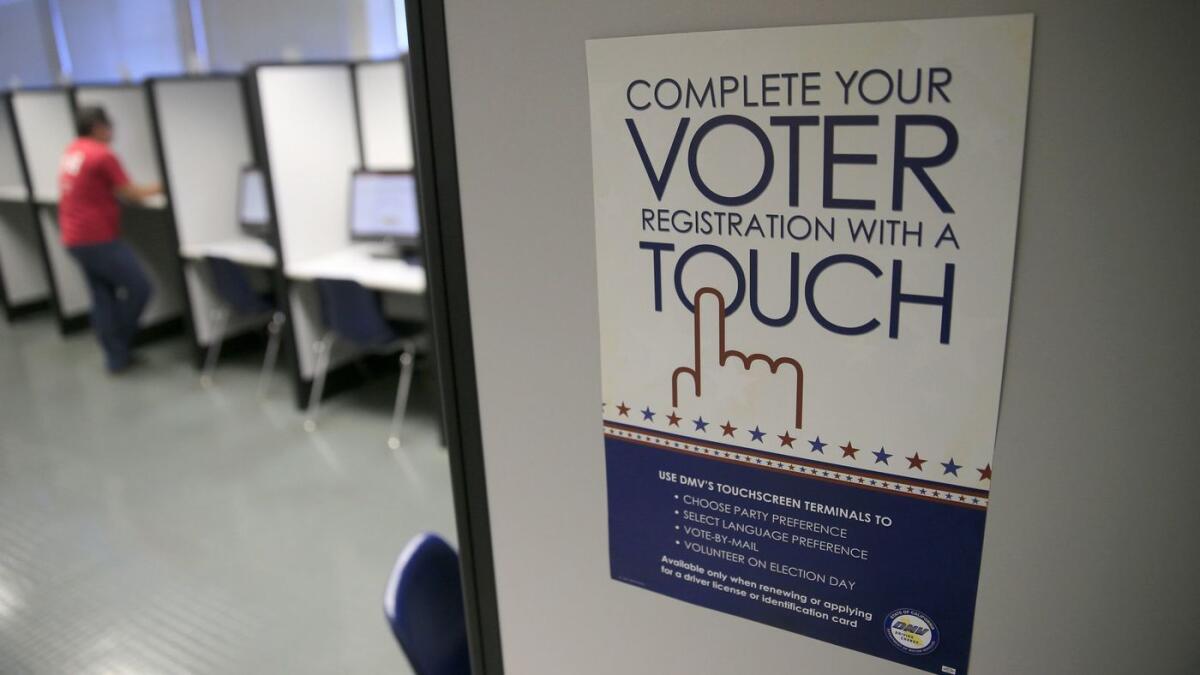

Gov. Gavin Newsom on Wednesday ordered an overhaul of the California Department of Motor Vehicles, which has been plagued by hours-long wait times at field offices, computer crashes and voter registration errors involving tens of thousands of customers.

Just a few days after taking office, Newsom appointed a top advisor to a new “DMV Reinvention Strike Team” to revamp the beleaguered agency over the next six months.

“By any metric, California DMV has been chronically mismanaged and failed in its fundamental mission to the state customers it serves and the state workers it employs,” Newsom said in a statement, adding “It’s time for a reinvention.”

The governor appointed state Government Operations Agency Secretary Marybel Batjer to lead the strike team with a goal of modernizing the agency and enacting changes that improve customer satisfaction, employee performance and transparency. Newsom also ordered an accelerated review of initial findings of an ongoing audit ordered last year by Gov. Jerry Brown.

The action was welcomed by lawmakers who have been critical of the DMV, including Assemblyman Vince Fong (R-Bakersfield).

“The egregious management failures of the DMV have been self-evident, which is why I have been calling for new leadership and a comprehensive independent audit of this troubled state agency over and over again as the problems grew significantly worse,” Fong said.

Last summer, Californians seeking new driver licenses complained of wait times of four to six hours at DMV offices, which the agency blamed partly on snafus caused by a rush of people trying to get Real IDs, a new identification card design required for airline passengers starting in late 2020.

Delays were also blamed on computer crashes at DMV offices as the agency struggled to update its aging automation systems.

The DMV also admitted that there were an estimated 23,000 errors as people either were unknowingly registered to vote or mistakes were made in their registration status as part of the state’s new “motor voter” program. The agency registered to vote as many as 1,500 people with legal U.S. residency but no citizenship.

Last month, DMV Director Jean Shiomoto retired from the agency. Legislators were angered earlier this week when the DMV said it needed an additional $40 million to prevent the return of long lines at its field offices.

In addition, the agency has been under fire for issuing driver licenses in the last year that do not comply with the federal Real ID standards requiring two forms of identification by applicants.

California police unions are preparing to battle new transparency law in the courtroom

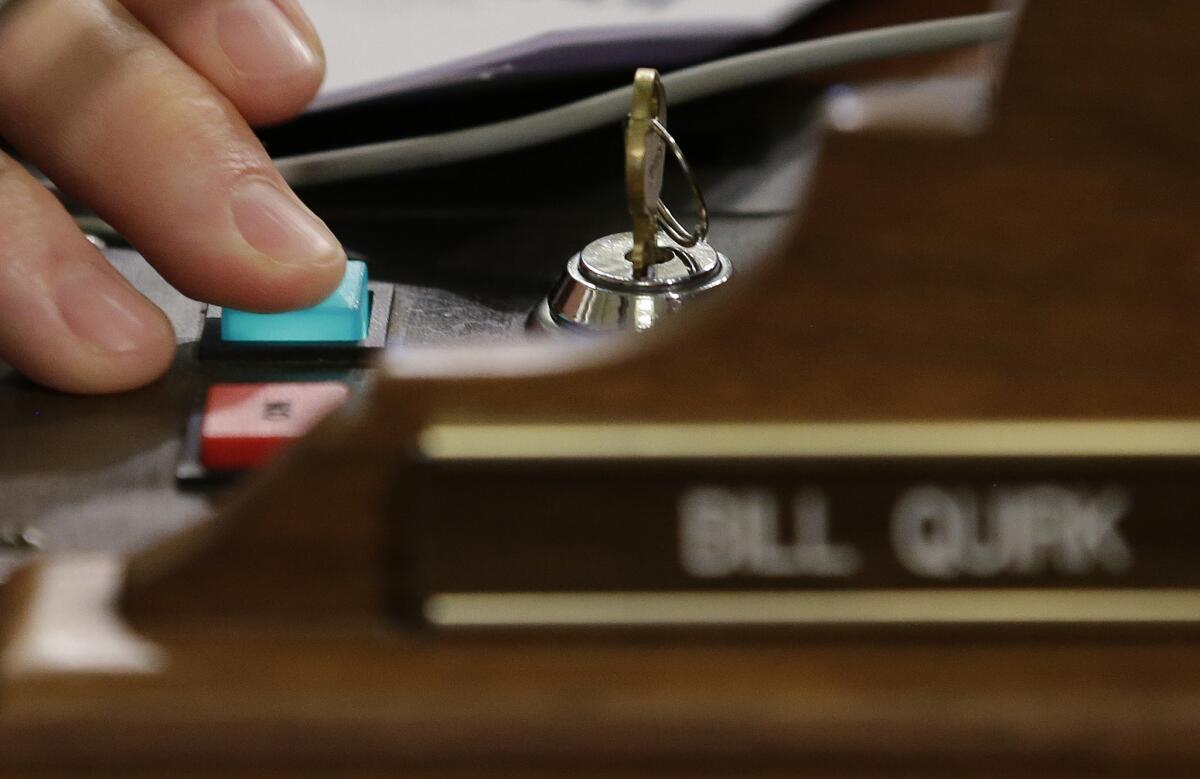

Just as a landmark police transparency law is going into effect, some California police agencies are shredding internal affairs documents and law enforcement unions are rushing to block the information from being released.

The new law, which begins to unwind California’s strictest-in-the-nation protections over the secrecy of law enforcement records, opens to the public internal investigations of officer shootings and other major uses of force, along with confirmed cases of sexual assault and lying while on duty. But the lawsuits and records destruction, which began even before the law took effect Jan. 1, could tie up the release of information for months or years, and in some instances, prevent it from ever being disclosed.

“The fact that police unions are challenging this law is on some level not surprising,” said Peter Bibring, director of police practices at the American Civil Liberties Union of Southern California, one of the principal supporters of the new law. “They have a long history of fighting tooth and nail against transparency.”

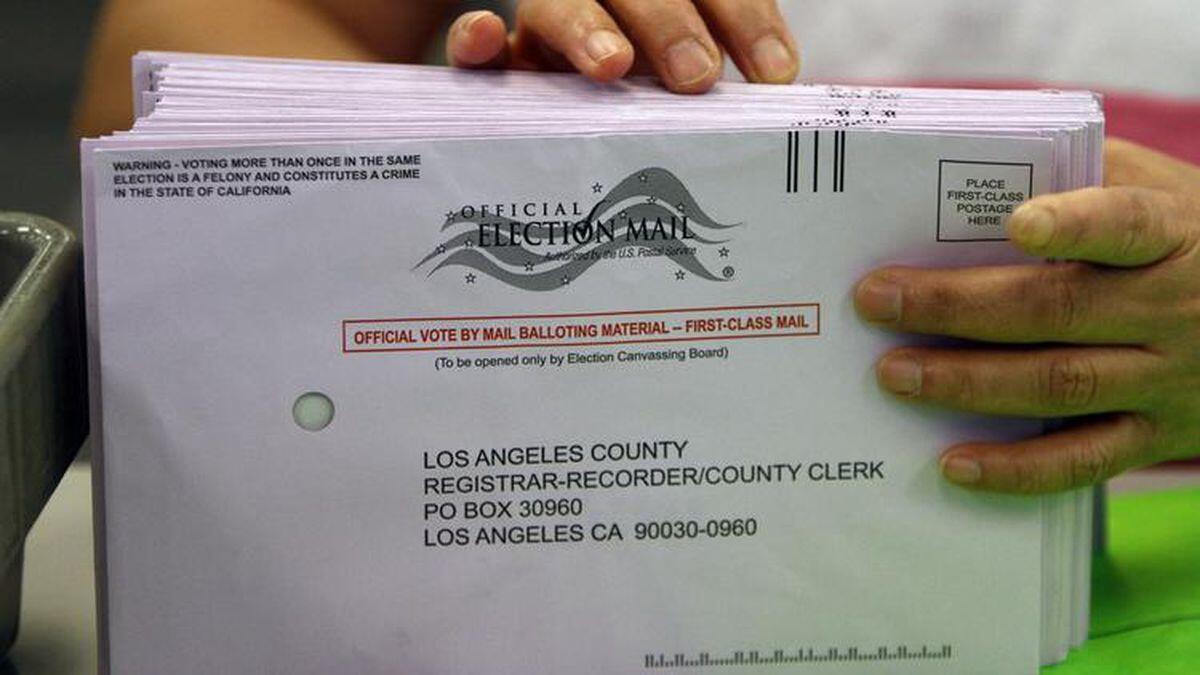

Secretary of State Alex Padilla begins second term with challenge to ensure ‘every Californian is counted’

Secretary of State Alex Padilla was sworn in for a second term on Monday, saying he would continue the battle to protect the right to vote at a time when voter suppression efforts, online disinformation campaigns and interference from foreign adversaries have polarized the public and threatened to undermine trust in U.S. elections.

“I am doubling down on our fight here in Sacramento and in Washington, D.C., to defend our democracy,” he said. “Working on the front lines with so many of you, I know that our collective resolve has never been stronger.”

But the loudest applause came when Padilla promised to fight back against the Trump administration’s changes to the U.S. census, saying he will “ensure every Californian gets counted.”

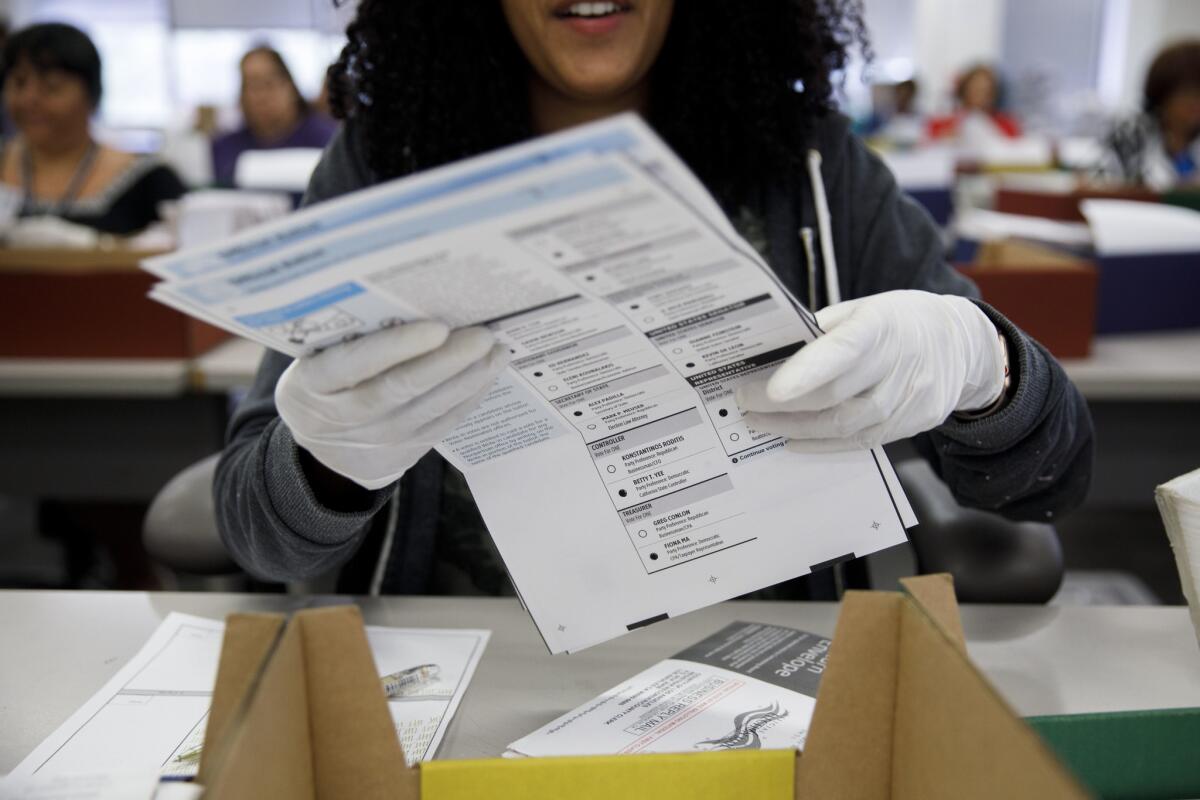

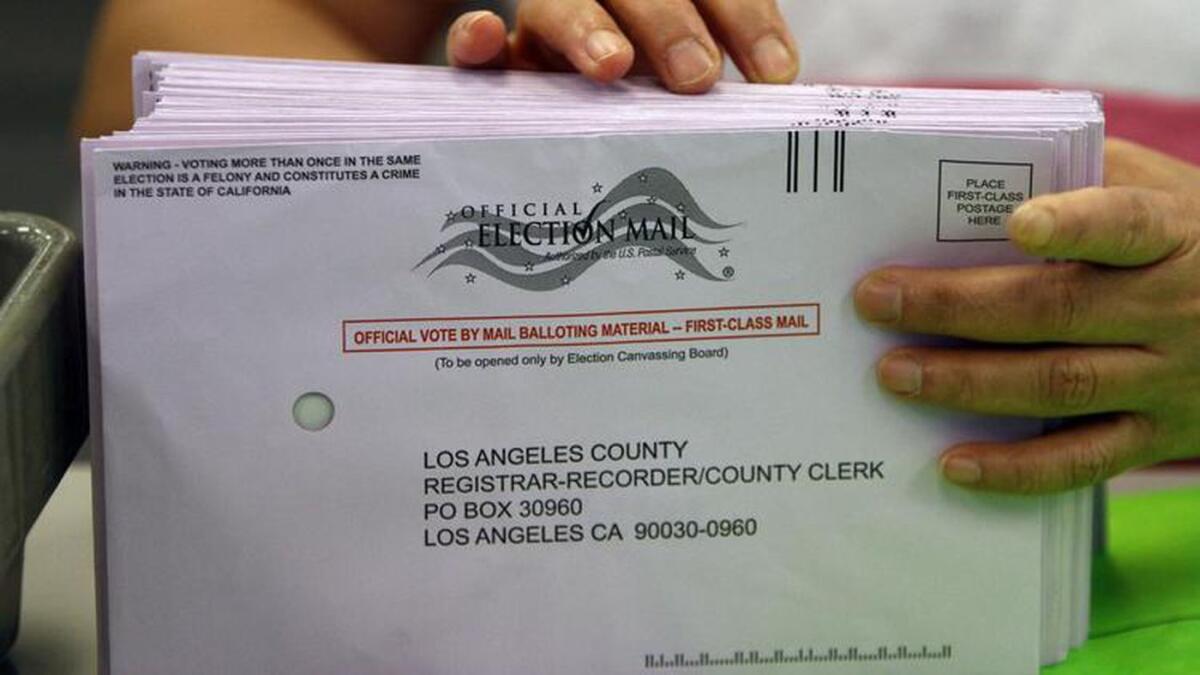

Padilla, a former state senator and Los Angeles City Council member from the San Fernando Valley, led the cause for a new “motor voter” registration law in 2015, and a new system for online business registrations. But the programs have had experienced problems: More than 23,000 Californians were registered to vote incorrectly by the state DMV, the agency reported last year.

On Monday, Padilla said he would continue to push back against false claims of voter fraud in California and pointed to the state’s voter turnout as proof that his office was involving more people in the democratic process, a promise he made when he was first sworn in four years ago.

More than 12.7 million voters cast ballots in the Nov. 6 midterm election, representing roughly 65% of the state’s registered voters, the highest number of any midterm election since 1982, according to state certified results.

“I made that promise based on a shared belief that we are a stronger democracy and a better California when we hear all voices from all corners of California, and when those voices are not just heard but counted,” Padilla said.

Ricardo Lara, California’s first statewide officeholder to come out as gay, sworn in as insurance commissioner

Ricardo Lara took the oath of office as California insurance commissioner on Monday, pledging action to boost healthcare coverage and combat climate change.

Lara, a Democrat from Bell Gardens, is the first elected statewide officeholder in California who has come out as gay. He began his speech in downtown Sacramento by thanking LGBTQ leaders who came before him and celebrated the occasion.

“Today, because of you, we’ve shattered the pink ceiling,” Lara said.

In his inaugural speech, Lara announced the creation of an executive position in his office to address climate change.

“There is no other industry that has the necessary expertise to ensure that California is prepared to mitigate and reduce risk to our communities and our environment,” Lara said. “Our planet can’t wait. I’m ready, and I hope you are too.”

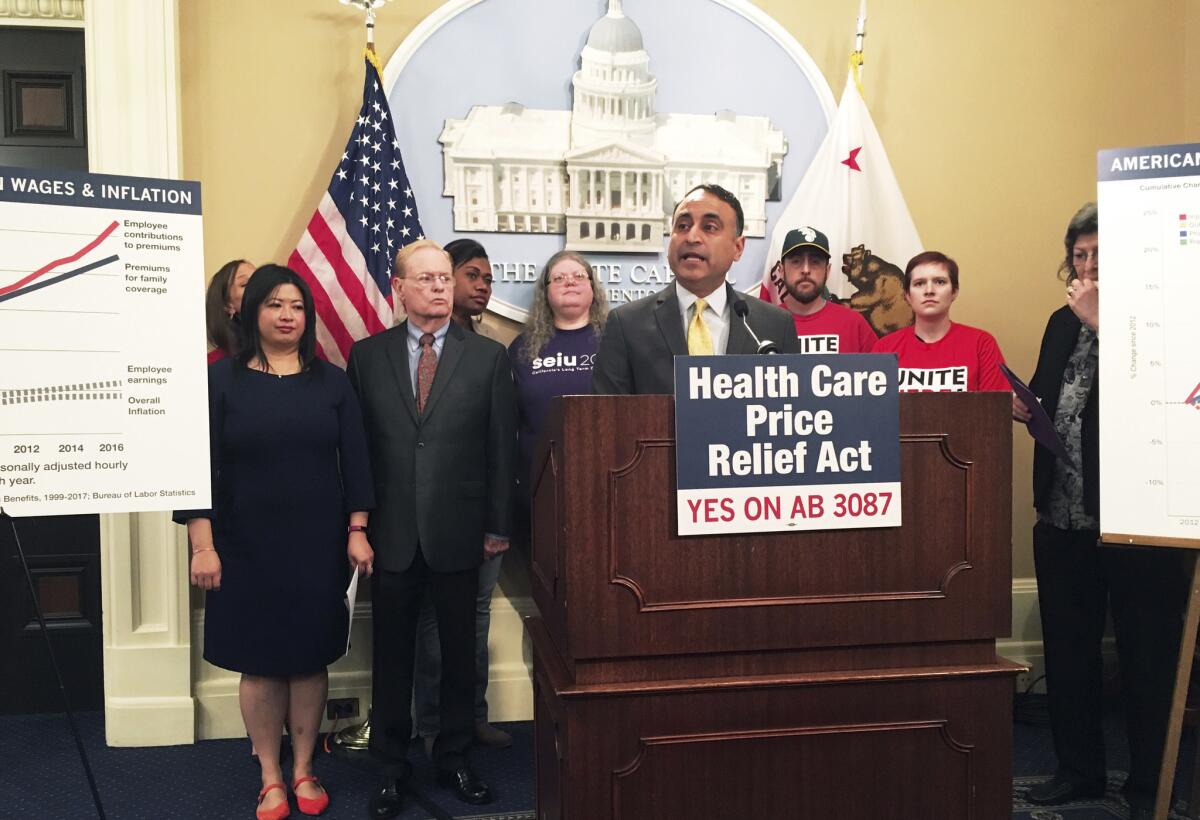

Lara served as a state legislator and in 2017 introduced a bill to create a single-payer healthcare system in the state. He promised to work with new Gov. Gavin Newsom to expand coverage across California.

Lara was sworn in by retired U.S. District Judge Vaughn Walker, who declared unconstitutional California’s Proposition 8 gay marriage ban. State Sen. President Pro Tem Toni Atkins (D-San Diego) was on hand for the ceremony along with multiple other state lawmakers.

New California Lt. Gov. Eleni Kounalakis says she will help expand access to universities in the state

More Californians should be given access to public universities, Eleni Kounalakis said as she took the oath of office Monday to become the state’s first woman elected lieutenant governor.

Kounalakis was given the oath of office by Gov. Gavin Newsom, her predecessor in the job, who pledged they would work together.

As lieutenant governor, Kounalakis serves on the University of California Board of Regents and the California State University Board of Trustees, she noted in a speech at her swearing-in ceremony at the main Sacramento Library.

In that role, she said, she will be “committed to expanding access to affordable public higher education here in our state. It’s wise, its smart and it is the best way to address our rapidly changing digital economy.”

Kounalakis is former president of a development company founded by her father, Angelo Tsakopoulos, and served during the Obama administration as the U.S. ambassador to Hungary.

In November, she won her first run for statewide office. Also attending the ceremony were House Speaker Nancy Pelosi and former Michigan Gov. Jennifer Granholm.

California meets Dutch Newsom, who steals the show at his father’s inauguration

In the California political world, all eyes were on Gov. Gavin Newsom on Monday until his 2-year-old son stole the show.

Dutch, the youngest of four children in the Newsom brood, climbed onstage in the middle of his father’s inaugural address in a tent outside the Capitol on Monday. The unplanned moment saw the 51-year-old governor’s big day interrupted by the toddler, bringing levity to the ceremony.

Newsom was recounting Gov. Jerry Brown’s last inaugural speech and reference to the Sermon on the Mount, a biblical story about two men who built separate homes on sand and rock, when Dutch approached his father, a pacifier in his mouth and blanket in hand.

“Now more than ever we Californians know how much a house matters and children matter,” Newsom said, improvising as he scooped the boy into his arms.

The governor kissed Dutch on the cheek and held him for several minutes as he continued with the speech.

“This is exactly how it was scripted,” Newsom joked.

Newsom eventually put his child down and Dutch walked to the edge of the stage before retreating behind the podium to hide from his mother, First Lady Jennifer Siebel Newsom. The crowd roared.

Siebel Newsom was able to briefly divert her son only for him to return to the stage minutes later. She grabbed him again and this time, the crying toddler did not reemerge.

“When fires strikes, when kids cry and the earth shakes, we’ll be there for each other,” Newsom said.

Los Angeles Mayor Eric Garcetti, who said the moment humanized Newsom, threw cold water on any theories that Dutch’s cameo was planned.

“No, I know it was not,” Garcetti said with a laugh after Newsom’s speech concluded. “I could see that look of absolute abject terror [on Newsom’s face]. We’ve all been there. Kids always think it’s about themselves and they’ve proved it.”

California Assembly Speaker Anthony Rendon (D-Lakewood) agreed.

“I worked in early childhood education for 20 years and there’s no way you can ever get a child to do anything when you want them to do it,” Rendon said.

Fiona Ma takes oath as California’s new treasurer

Fiona Ma took the oath of office in Sacramento on Monday as the state’s 34th treasurer, promising to boost California’s economy.

Ma previously served on the San Francisco Board of Supervisors, in the state Assembly and on the California Board of Equalization.

“I want to thank everyone for entrusting me with this important job. I understand my role here as your state treasurer is to build that financial wall around California so that we will remain the fifth-largest economy,” Ma said in brief remarks. “That is my promise to you.”

California Supreme Court Chief Justice Tani G. Cantil-Sakauye administered the oath to Ma.

Following the ceremony, Ma held an ice cream social for guests. On Wednesday, she will host a public event in San Francisco to celebrate her swearing-in.

Watch live: Gavin Newsom is sworn in as California’s 40th governor

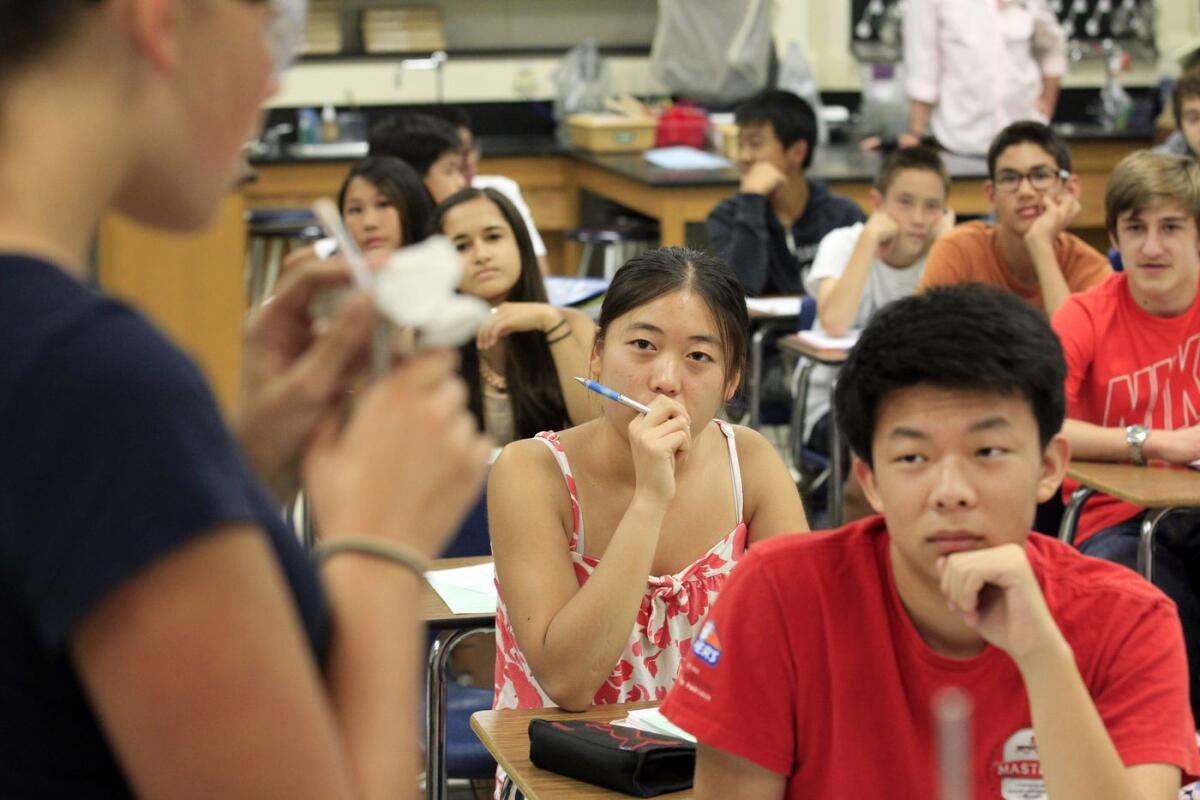

Expectations are high for newly sworn-in state schools chief Tony Thurmond

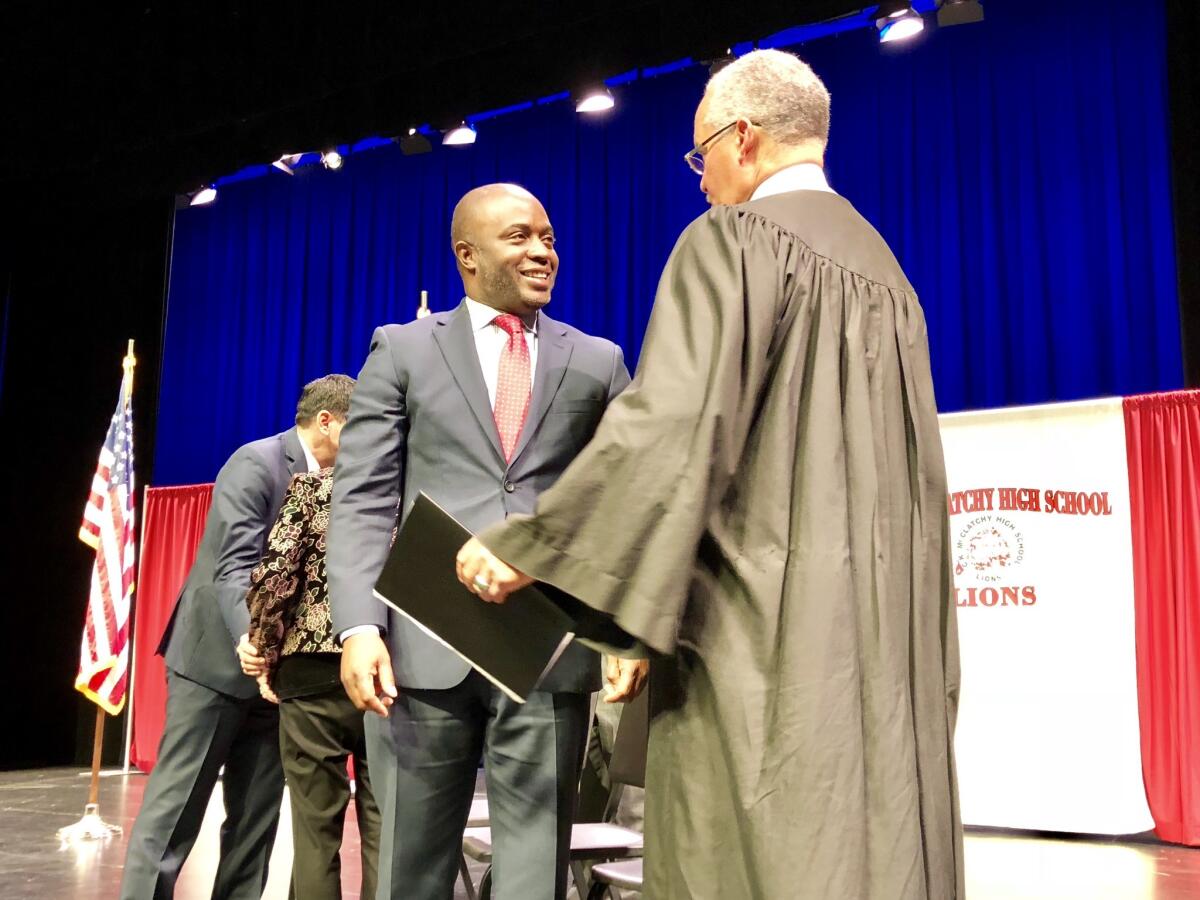

Tony Thurmond took the oath of office as California’s state superintendent of public schools on Monday, promising a labor-friendly agenda before the teachers, students and Democratic officials who filled an auditorium at McClatchy High School in Sacramento to watch him being sworn in.

“We can’t close the achievement gap without a great teacher at the head of every class,” Thurmond said Monday to applause. “We have to make sure we provide quality compensation and support to our teachers and our classified staff and all the educators who support our kids.”

Thurmond, a Bay Area Democrat who served in the state Assembly, won a hotly contested and expensive race with the help of labor leaders against charter school executive Marshall Tuck. The race took several days to sort out after Tuck held an initial lead in early returns on election night before falling behind thereafter.

Thurmond was sworn in Monday by retired Alameda County Superior Court Judge Gordon Baranco. He was joined on stage by labor rights leader Dolores Huerta and Assembly Speaker Anthony Rendon (D-Paramount).

Thurmond’s former colleagues in the state Assembly took turns praising him and promising to be an ally in improving schools. Many said they expected Thurmond would be a strong leader focused on improving student outcomes.

“We know we are going to work hard to give you the money you need and the budget you need to fully fund education and our schools so we can put our money where our mouth is and make sure our children have everything they need,” Assemblywoman Connie Leyva (D-Chino Hills) said.

As state superintendent, Thurmond will oversee the education of 6.2 million students at 10,000 schools. Thurmond was a member of the West Contra Costa County School Board and a Richmond city councilman before he was elected to the state Assembly.

“Tony is the right man at the right time to fight the federal, Donald Trump, Betsy DeVos anti-child, anti-education, anti-civil and -human rights agenda,” U.S. Rep. Barbara Lee (D-Calif.) said. “Tony is going to do that for us.”

State Controller Betty Yee takes oath of office with call for more affordable housing and healthcare

California Controller Betty Yee took the oath of office Monday for a second term, saying she still has work to do addressing problems that include a lack of affordability in housing, healthcare and higher education.

A San Francisco native, Yee is the chief financial officer of California — the fifth-largest economy in the world — having first won election to the post in 2014 before winning reelection in November.

“No region is spared from the widening inequality and increased poverty that plague our state, fueled by the lack of affordable, stable housing, the cost of healthcare and transportation, limited educational opportunities, student loan debt, displacement caused by disasters and more,” she said.

Yee was administered the oath of office by California Supreme Court Chief Justice Tani G. Cantil-Sakauye at the Crocker Art Museum in Sacramento before an overflow crowd that included state Senate leader Toni Atkins (D-San Diego), state Atty. Gen. Xavier Becerra and San Francisco Mayor London Breed.

“As a public official it is about governance that delivers results and stays accountable while upholding the underlying value of dignity for all,” Yee said.

California Atty. Gen. Xavier Becerra begins new term promising to fight Trump policies

California Atty. Gen. Xavier Becerra on Monday took the oath of office for a new term, saying he would continue his role as a leading challenger to Trump administration actions that he believes are counter to the state’s interests.

Becerra, a former 12-term congressman, has become a national opposition figure to Trump, having sued the federal government 45 times since he was appointed as the state’s first Latino attorney general in 2017.

“We’ve been a little busy stopping the dysfunction and insanity in Washington, D.C., from infecting California,” Becerra told an audience during a swearing-in ceremony at the California Museum in Sacramento.

“Whether it’s the criminals on our streets or the conman in the boardrooms or highest office of the land,” Becerra said, “the California Department of Justice, well, we’ve got your back.”

Becerra won his first statewide election as the state’s top cop in November, two years after he filled the post vacated when predecessor Kamala Harris was elected to the U.S. Senate.

He has peppered the Trump administration with lawsuits challenging federal policies on healthcare, the U.S. census, the environment and immigration.

“Our state builds dreams, not walls,” he said in a direct criticism of Trump’s proposal to build a wall at the U.S.-Mexico border.

Just last week, Becerra led a coalition of 17 Democratic attorneys general in announcing an appeal of a federal judge in Texas that ruled the Affordable Care Act unconstitutional.

“The ACA has been the law for nearly a decade and is the backbone of our healthcare system,” Becerra said last week. “This case impacts nearly every American — workers covered by employers, families, women, children, young adults and seniors — so we will lead the ACA’s defense as long and far as it takes.”

California Democratic Party Vice Chairman Daraka Larimore-Hall announces bid to lead group

Daraka Larimore-Hall, a top official at the California Democratic Party, said Monday he’s running to replace former chairman Eric Bauman, who resigned abruptly in November after being confronted with allegations of sexual misconduct.

Larimore-Hall, a longtime state party activist and former chairman of the Democratic Party of Santa Barbara County, was one of the party leaders who urged Bauman to resign following the allegations.

In an email to supporters announcing his bid, he urged “both structural and cultural change at every level of our Party.” He also repeated his call for a “top-to-bottom investigation” of the allegations, the party and its culture.

In a Times investigation, 10 party activists and staff members said Bauman made crude sexual comments and engaged in unwanted touching and physical intimidation in professional settings.

“In order to be where we need to be for 2020, we have to confront the culture of abuse and fear that allowed someone to behave in such a vile way for so long,” Larimore-Hall said in an interview. “We can’t brush it aside or think that our activists or our candidates or our donors are going to forget about this overnight.”

Larimore-Hall said his first priority would be to fully investigate the allegations and restore rank-and-file confidence in the party’s leadership.

The second would be to refocus the party on political priorities as the 2020 presidential election nears. The Bauman episode, Larimore-Hall said, threatens to derail the Democrats’ plans to help defeat President Trump and keep the seven congressional seats gained in the midterm elections.

“It’s definitely a crisis,” Larimore-Hall said. “But the component parts — the energy, the enthusiasm, the volunteers, the infrastructure — it’s still there. We just need to direct it toward something.”

Larimore-Hall was elected vice chairman of the state party in February following Bauman’s razor-thin victory over Bay Area activist Kimberly Ellis.

Ellis has announced another bid for the chairmanship and former state Senate leader Kevin de León is also mulling a run. The vote will take place at the party’s May convention in San Francisco.

Newsom will vow to ‘seize this moment,’ and swipe at Trump in Monday inaugural address

Building on the theme of California exceptionalism that defined his campaign, Gov.-elect Gavin Newsom will depict the state as a guardian of progressive values and a counterweight to President Trump in his inaugural address Monday, according to excerpts of his prepared remarks.

“What we do today is even more consequential, because of what’s happening in our country,” read the excerpts obtained by The Times. “People’s lives, freedom, security, the water we drink, the air we breathe — they all hang in the balance. The country is watching us. The world is waiting on us. The future depends on us. And we will seize this moment.”

The speech casts California’s political stakes in a decidedly national scope, promising an agenda that will unify and be an example to the rest of the country. It contrasts the governing goals of Newsom, a Democrat, with that of Trump, the incoming governor’s perennial foil.

“We will offer an alternative to the corruption and incompetence in the White House,” the excerpts say. “Our government will be progressive, principled, and always on the side of the people.”

Newsom campaigned on an ambitious and wide-ranging platform, promising sweeping solutions on housing, healthcare, education and other issues that rank among Californians’ top concerns. In the weeks after his election, he struck a more muted tone, taking pains to emphasize his fiscal caution and need for patience in achieving those goals.

The inaugural excerpts indicate a return to lofty pledges. While Newsom will vow to “prepare for uncertain times ahead” by building budgetary reserves and paying down debt, the prepared remarks quickly turn to a vow to be “bold.”

Newsom has already floated several proposals for his first budget that carry significant price tags, including a nearly $2-billion plan to boost early childhood development for low-income families and a dramatic expansion of paid family leave from six weeks to six months.

When asked for a preview of his inauguration speech during a news conference Sunday evening, Newsom predicted pundits would criticize his address as “short on specifics.”

“Well, of course, I’m at an inaugural,” Newsom said. “But I’ll be very detailed in the budget, a few days later. And then we will architect, in much more nuance and detail, in state of the state. I really see this as three opportunities … to communicate over the next few weeks our agenda, our vision for the state.”

Times staff writer Taryn Luna contributed to this report.

Newsom-hosted benefit concert raises nearly $5 million for wildfire victims

On the eve of the gubernatorial inauguration, California’s political class rubbed elbows in Sacramento for a benefit concert hosted by Gov.-elect Gavin Newsom and headlined by the rapper Pitbull.

Newsom told the crowd gathered at the Golden 1 Center on Sunday evening that the fundraiser brought in nearly $5 million for the California Wildfire Foundation, a 501(c)(3) that supports the families of fallen firefighters and communities affected by wildfires.

“You know, a lot of folks feel anxious about not just politics, but government,” Newsom said on stage before introducing the rapper and activist Common. “But those firefighters, they are the antidote to the fear and cynicism; they are the manifestation of why government matters and why you should care.”

Top sponsors, including Salesforce, Kaiser Permanente and other interest groups, paid up to $1 million each to support the cause and curry favor with the new administration. Nathan Click, a spokesman for Newsom, said organizers sold more than 7,000 tickets.

Several state lawmakers attended the concert alongside Capitol staff, lobbyists and business types, who mingled on the floor of the arena and offstage in private VIP areas.

The rock band X Ambassadors and a duo called the Cold Weather Sons from the town of Paradise, which was destroyed by fire in November, were among several performers who entertained the crowd during the four-hour event.

The “California Rises” concert is the final in a series of festivities held Sunday to celebrate the inauguration of California’s 40th governor. Earlier in the day, Newsom attended a private brunch at Sacramento’s Crocker Art Museum and his inaugural committee hosted a free party for families at the California State Railroad Museum at the Old Sacramento Waterfront.

Newsom’s inauguration is set to begin at 11 a.m. Monday on the steps of the Capitol.

Inauguration fever hits Sacramento as Gov.-elect Gavin Newsom prepares to take office

Incoming Gov. Gavin Newsom doesn’t officially take the oath of office until Monday, but the parties celebrating his inauguration were in full swing all day Sunday.

Newsom and his family were mobbed by well-wishers at the California State Railroad Museum at the Old Sacramento Waterfront in the afternoon, where his inaugural committee hosted a free party for families.

“He just has charisma. He’s able to really connect with people,” said Rosielyn Pulmano, an attorney from Elk Grove who came to see Newsom with her husband, two sons and her niece. “I think he cares about working Californians and a lot of their issues.”

Newsom arrived with his wife, documentary filmmaker Jennifer Siebel Newsom, and their four young children, and the governor-elect spent a good deal of his time wading through crowds, taking selfies with supporters and signing autographs as music boomed in the background.

As the family toured the inside of the museum’s locomotives and the bevy of exhibits, Newsom’s two-year-old son, Dutch, was wide-eyed, impressed by all the train cars and seemingly a little overwhelmed by the crowd.

Newsom said that for his son, all that was missing from the museum was Thomas the Train, popular fictional locomotive in children’s books and cartoons .

“If there’s one thing I can contribute to Sacramento maybe it’s getting a Thomas the Train exhibit for the two years olds,” Newsom joked when talking with reporters afterward.

Newsom said he wanted to include such an event in his inaugural festivities to highlight families and children, whose wellbeing will be among the top priorities of his administration.

“You’ll see that not only as a preamble to the inaugural and the budget that we’ll be submitting next week, but I think it’ll be a big part of the administration,” Newsom said.

The museum event followed a private, high-dollar brunch at Sacramento’s Crocker Art Museum. A steady rain failed to dissuade as many as 200 guests who sipped wine and dined on chicken and salmon while waiting for a photo with California’s new first couple.

Seen at the event were representatives of some of the state’s most powerful political interests, among them organized labor, healthcare companies and tribal gaming interests. A few other high-profile guests attended, too, including Larry Baer, CEO of the San Francisco Giants, and Erika Jayne, a singer and cast member of the reality TV show “The Real Housewives of Beverly Hills.”

“I’m excited to see someone like Gavin — young, vibrant — taking over the state and leading us into the future,” Jayne said after attending the brunch with her husband, attorney Tom Girardi. “He’s got a lot of great plans.”

Attendees said the event, which was closed to reporters and held under a tent in the museum’s outdoor atrium, did not include prepared remarks by Newsom. Among those seen leaving the event were representatives of AT&T, the California Medical Assn., Uber, Kaiser Permanente and the State Building and Construction Trades Council.

A fundraising invitation obtained by The Times offered bundled tickets to all of the inauguration events, including those on Sunday and the Monday ceremony, ranging in price from $25,000 to $200,000. The money will be collected by a committee specifically organized to pay for Newsom’s inaugural weekend.

Sunday’s festivities are scheduled to end with a benefit concert headlined by Pitbull at the Golden 1 Center, home of the NBA’s Sacramento Kings, to raise money for the victims of California’s recent deadly wildfires.

As Newsom inaugural events begin, he unveils more state budget promises on education and paid family leave

California’s incoming governor, who must send his first state budget plan to the Legislature this week, has already signaled a significant new focus on programs to help families and children from infancy to college.

Gov.-elect Gavin Newsom campaigned on a platform that included a number of child-focused efforts specifically aimed at helping lower-income families. The price tag for the initial efforts is expected to approach $2 billion — a cost paid out of an unrestricted tax revenue windfall that could be one of the largest in state history.

Newsom may also seek help for families through new subsidies paid by California employers. The governor-elect is expected to propose a dramatic expansion of paid parental leave — from six weeks to six months — according to an internal document provided by a source close to the Newsom transition team, first reported on Sunday by the New York Times.

The document doesn’t offer a full explanation for how the program will be funded, saying instead that the budget will set “a goal of ensuring that all newborns and newly adopted babies can be cared for by a parent or a close family member for the first six months.” Employers across the state are currently assessed a payroll tax that helps offer a subsidy to parents who temporarily leave their job to care for a newborn.

Newsom’s plan, according to the document, would pay for some of the new costs by shrinking the mandated cash reserve of the state fund that administers the program, allowing more of the money to be paid in benefits. The increase in paid leave would not all happen at once but instead be phased in over a multi-year period.

A task force to help implement the expanded care plan is also envisioned, according to the document. It would determine whether two parents could split the six months of paid leave and whether an extended family member could be enlisted to help care for the child of a single parent over the six-month period.

The incoming administration’s focus on young children will also include $1.8 billion in new spending on early childhood education programs, with a particular focus on training childcare workers and pushing for more California schools to offer full-day kindergarten. Those costs, according to an overview memo obtained by the Los Angeles Times, are considered to be a one-time expense while leaving the long-term costs of the effort to be determined later.

More community college students would get free tuition under a third initiative expected in the new governor’s budget plan. Newsom will propose spending $40 million to offer a second year of tuition-free college to California students, according to an outline provided by a transition official, first reported by Politico. Students are already eligible for a single year of paid tuition under a plan agreed to by Gov. Jerry Brown and lawmakers in 2017.

The incoming governor embraced the idea of free community college during the 2018 campaign as part of a broader focus on additional investments in higher education.

“Education is an economic development strategy,” Newsom said at a higher education forum last spring. “We need to significantly increase the investment from the general fund of this state on higher education. There’s no greater higher return on investment.”

Whether the proposal would be targeted to students based on a family’s financial need is unclear. Many low-income students are already eligible for fee waivers at community colleges. The new governor must submit his full state budget plan to lawmakers no later than Thursday.

Gavin Newsom and his family decide Sacramento is the place to be

Gov.-elect Gavin Newsom and his family will give up the Marin County life and move to the Victorian-style governor’s mansion in Sacramento after he takes the oath of office Monday.

Newsom and his wife, documentary filmmaker Jennifer Siebel Newsom, had debated whether or when to relocate to the state capital since his election in November.

The couple have four young children and expressed reservations about moving in the middle of a school year.

“To best serve the people of California while also maximizing family time together, the Newsoms have therefore decided to move to Sacramento,” said Newsom’s spokesman, Nathan Click. “On Monday, they will move into the Governor’s Mansion – along with their four children, their two family dogs, and their family bunny rabbit — and reside there for the immediate future.’’

The Newsoms currently live in Marin County.

Gov. Jerry Brown and his wife, Ann Gust Brown, moved into the grand house in 2015 after it underwent $4.1 million in renovations to update electrical and plumbing systems, as well as to remove lead-based paint and install a fire sprinkler system and other security features.

The mansion was built in 1877 and has been home to 14 governors, but before Brown it had not housed a California governor for nearly half a century.

The state bought the mansion from a wealthy Sacramento hardware merchant, Albert Gallatin, in 1903 for $32,500. It was one of the few California homes at that time to have indoor plumbing.

Newsom announces top labor, business liaisons as he prepares to take office

Gov.-elect Gavin Newsom on Friday named two advisors on issues related to the California economy, each recognized for their expertise on business and labor.

The incoming governor will appoint Julie Su as secretary of the California Labor and Workforce Development Agency and Lenny Mendonca as chief economic and business advisor and director of the Governor’s Office of Business and Economic Development.

Su, 49, has served as state labor commissioner under Gov. Jerry Brown since 2011 and has led an office tasked with the enforcement of California’s labor laws. She won a MacArthur Foundation “genius grant” in 2001 and previously worked as a civil rights attorney representing low-wage workers. In her new position, Su will be tasked with coordinating the work of several workforce departments in state government, including those that administer unemployment benefits and oversee the relationship between agriculture workers and employers.

Mendonca, 57, has been a longtime advocate for rethinking government operations as co-chairman of the nonprofit organization California Forward. Previously, he was partner at McKinsey & Co., a global management consulting firm. While he will be a key advisor to Newsom on the state’s economy, Mendonca will also lead the office often referred to as “Go-Biz,” designated as a high-level way to encourage job growth and economic development.

“In his new role, Mendonca will help ensure that California is rolling out the welcome mat to current and future California businesses and growing a sustainable economy for every Californian,” said a statement from the Newsom transition team.

Newsom will take the oath of office as governor Monday. He has previously selected key advisors on the state budget, legislative affairs and the executive branch’s wide array of agencies and departments.

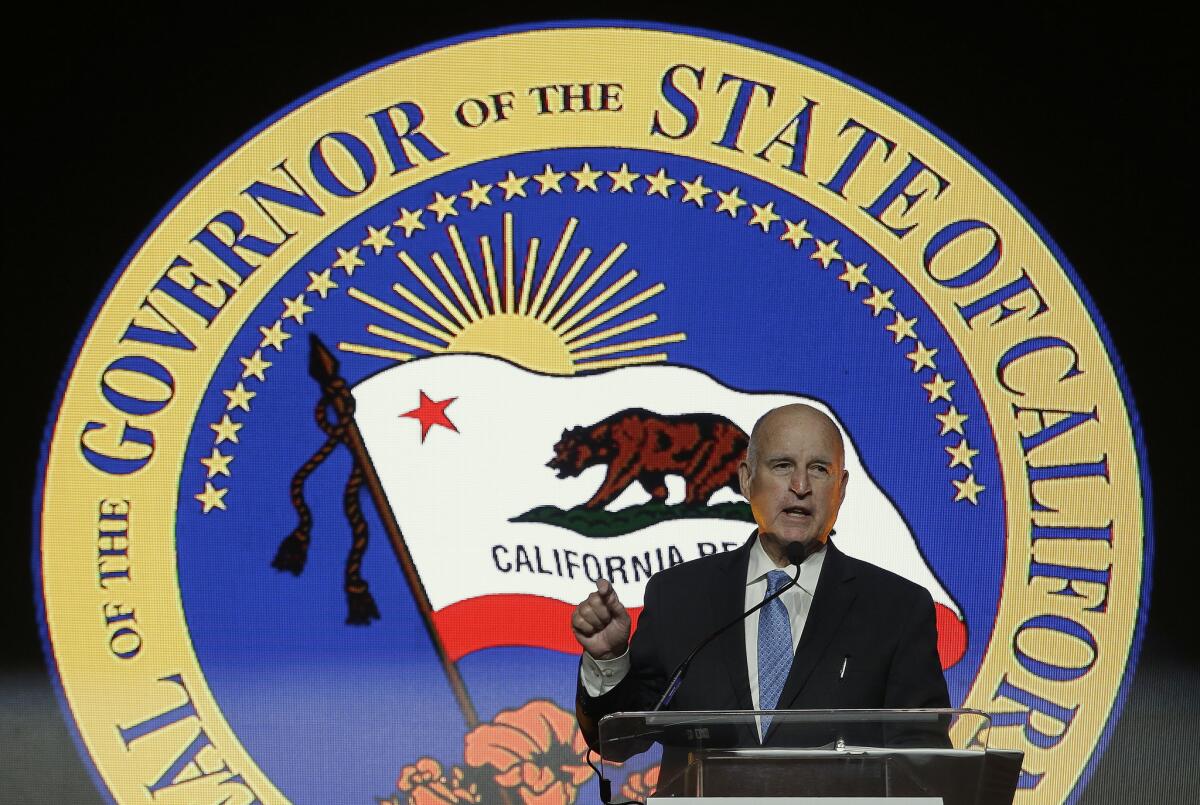

Joshua Groban, aide to Gov. Jerry Brown, sworn in to California Supreme Court

California Supreme Court Justice Joshua Groban, a lawyer and longtime aide to Gov. Jerry Brown, was sworn into the state’s highest court Thursday in Sacramento.

The ceremony marked Brown’s fourth appointment to the state Supreme Court and gave the seven-member bench a Democratic majority.

“We live in a highly chaotic, ever-changing and ever-confusing world,” Groban said in prepared remarks at the Stanley Mosk Library and Courts Building. “But I’m happy to report that I’m joining an institution whose fundamental purpose, at core, is to provide stability and consistency amidst this chaotic place we live. I look forward to doing that with a sense of reflection, respect, fidelity to the law and compassion.”

None of Brown’s appointees, Groban included, have judicial experience. Groban served as legal counsel to Brown’s 2010 gubernatorial campaign and joined the administration as a senior advisor to the governor, overseeing the appointments of some 600 judges over the last eight years. Prior to working with Brown, Groban, 45, practiced law for more than a decade.

In perhaps his final public appearance before his successor, Gov.-elect Gavin Newsom, takes office next week, Brown pushed back on notions that he stacked the court.

“I don’t want this to be known as a ‘Brown court,’” the governor said before administering the judicial oath of office. “First of all, the so-called ‘Brown appointments’ do not agree with themselves and nor should they. They are individuals. They will differ. It’s not anybody’s court.”

The governor called the court a “high calling” and said Groban possesses the values for the job.

“Probably, next to my wife, I’ve talked to no person as much as I’ve talked to Josh Groban,” Brown said.

“I think you’ve talked to him more,” California’s First Lady Anne Gust Brown interjected.

“I can’t tell you what the hell he’s going to do,” Brown later quipped. “I warned him, don’t screw up, at least not at first.”

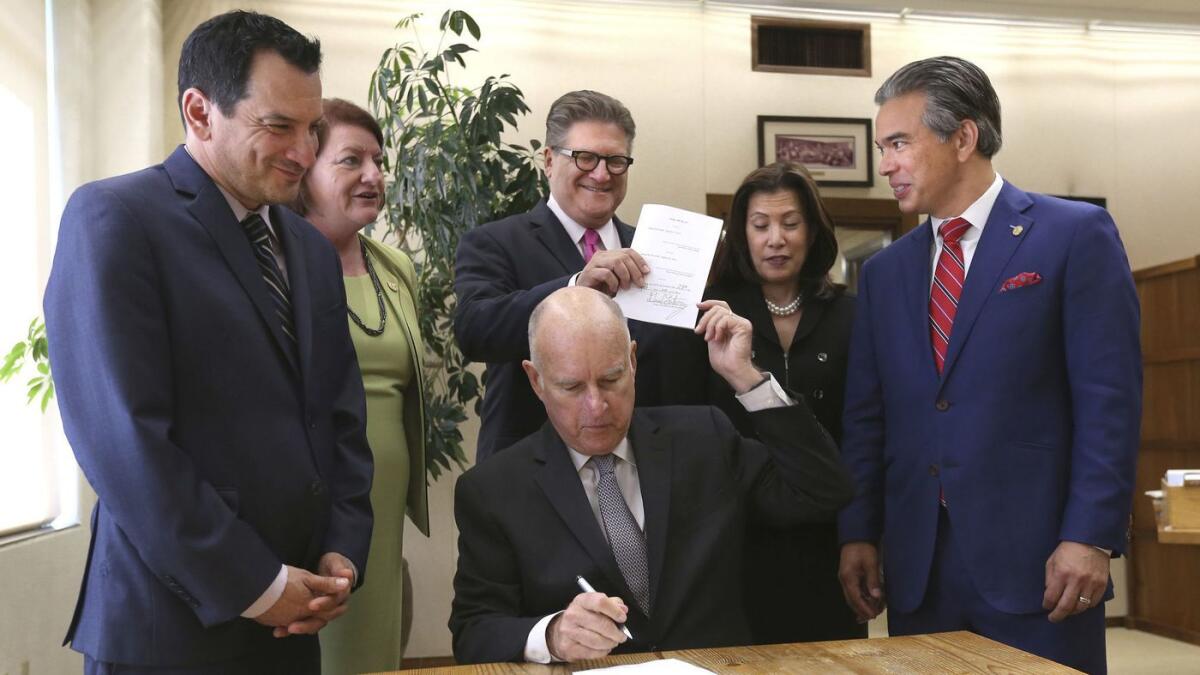

California campaign watchdog agency seeks law barring use of campaign funds to fight harassment claims

Elected officials accused of harassment or discrimination would be barred from using political contributions to cover their legal defense costs under legislation proposed by California’s campaign watchdog agency.

The state Fair Political Practices Commission has agreed to pursue a law change to clear up confusion after an attorney for one former state lawmaker argued political funds could be used in such legal defenses.

Commission Chairwoman Alice Germond said putting a prohibition into the law would “provide some much needed clarity.”

“As chair, I would like to show the public their lawmakers are held to a standard that is above reproach,” Germond said in a statement. “People don’t give money to campaigns for lawmakers to use it to defend their own bad behavior, so lawmakers shouldn’t be able to use it in that manner.”

The issue came up a year ago when an attorney for former Sen. Tony Mendoza (D-Artesia) sought a formal opinion from the FPPC after the Senate launched an investigation that later concluded Mendoza likely engaged in a pattern of harassment against female aides.

Mendoza resigned in February under threat of expulsion by the Senate.

In a Jan. 10, 2018, letter, Cassandra Ferrannini, an attorney for Mendoza, wrote to the FPPC that she believed Mendoza “should be allowed to establish a legal defense fund able to defray his legal expenses” in defending himself against the allegations.

“The use of campaign funds for attorney’s fees under these circumstances would fall squarely within the scope of legislative matters, since it involves the alleged conduct of a legislator with regard to legislative staff that he supervised,” Ferrannini wrote.

The commission staff originally issued an advice letter that said Mendoza may use campaign and legal defense funds to defend himself from claims of sexual harassment that arose directly out of his activities or status as a candidate or elected officer.

But the panel later rescinded the letter after some members questioned using campaign funds to fight sexual harassment claims. That left uncertainty about what was allowed, which Germond said could be cleared up by a new law. The FPPC is still looking for a legislator to carry the bill, a spokesman said.

California’s landmark police transparency law takes effect after court denies police union effort to block it

A new state law allowing the public disclosure of internal police shooting investigations has gone into effect after the California Supreme Court on Wednesday denied a bid by a police union to block it.

The law opens to the public for the first time internal investigations of officer shootings and other major uses of force, along with confirmed cases of sexual assault and lying while on duty.

The San Bernardino County Sheriff’s Employees’ Benefit Assn. challenged the law last month, asking state Supreme Court justices to decide that the law only apply to incidents that occur in 2019 or later. The court rejected that request Wednesday, allowing members of the public to seek all applicable records held by police departments. Union president Grant Ward said in a statement that his organization was disappointed with the decision and is now seeking other legal options.

“We feel this is a statewide issue and should be considered accordingly,” Ward said.

Last month, the city of Inglewood authorized the destruction of more than 100 police shooting investigations and other records in advance of Jan. 1, when the disclosure law was scheduled to take effect. California law requires police departments to keep such records for five years, and Inglewood City Council voted to destroy records older than that. Mayor James T. Butts has said the decision had nothing to do with the new law.

In Los Angeles, Police Chief Michel Moore has said that complying with the new disclosure rules could take hundreds of thousands of hours of work.

State Sen. Nancy Skinner (D-Berkeley), the author of the transparency law, has said she has no immediate plans to propose changes to it.

Few complaints of racial profiling are sustained by police agencies in California, state panel finds

Law enforcement agencies in California sustain few citizen complaints of racial or identity profiling, according to a report Wednesday by a state panel set up to help reduce bias in policing.

The state’s Racial and Identity Profiling Advisory Board recommended in its annual report that law enforcement agencies improve training and adopt clear guidelines for tracking and reporting data on who is stopped by officers.

The panel said that 453 law enforcement agencies in the state received 9,459 civilian complaints in 2017, including 865 complaints alleging racial or identity profiling.

Of the racial and identity complaints that reached a disposition that year, 1.5% were sustained, 14.6% resulted in officers being exonerated and 83.9% of complaints were not sustained or were determined to be unfounded, the report said.

A clearer picture of the issue is expected from a 2015 law that requires police agencies to report demographic data on all detentions and searches. The first reports by the eight largest agencies, including the Los Angeles Police Department and the Los Angeles County Sheriff’s Department, are due to be submitted in April.

California Atty. Gen. Xavier Becerra, whose office oversees the board, said tracking of all detentions and searches will be helpful to understand the scope of the issue.

“The Board’s recommendations will help make our law enforcement agencies more transparent and promote critical steps to enhance, and in some cases, repair the public trust,” Becerra said in a statement Wednesday.

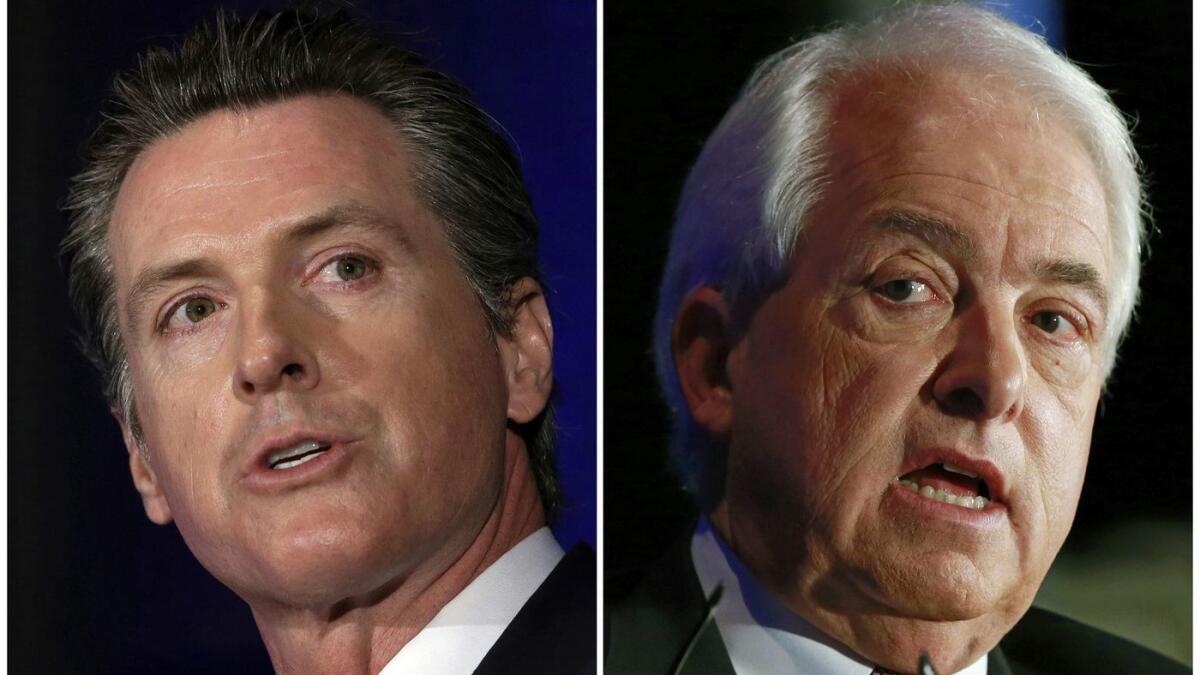

California housing crisis podcast: What Minneapolis’ decision to end single-family zoning might mean for California

There’s a national movement brewing to roll back zoning rules in cities that only allow one house on a plot of land. The epicenter of that movement is Minneapolis, which passed a plan last month to eliminate single-family zoning citywide and let landowners build duplexes and triplexes on residential property.

On this episode of “Gimme Shelter: The California Housing Crisis Podcast,” we talk about the reasons why Minneapolis leaders took this action, including their desire to combat a history of racial exclusion and spur more housing density to fight climate change. We also debate how Minneapolis’ decision might affect housing politics in California.

Our guest is Minneapolis City Council President Lisa Bender, who helped shepherd the new zoning rules to passage and a former San Francisco city planner.

The episode also crowns 2018’s Avocado of the Year — the most ridiculous story exemplifying California’s housing woes — and includes our predictions for the most under-the-radar important themes in housing politics in 2019.

“Gimme Shelter,” a biweekly podcast that looks at why it’s so expensive to live in California and what the state can do about it, features Liam Dillon, who covers housing affordability issues for the Los Angeles Times’ Sacramento bureau, and Matt Levin, data and housing reporter for CALmatters.

You can subscribe to “Gimme Shelter” on iTunes, Stitcher, Soundcloud, Google Play and Overcast.

How young immigrant ‘Dreamers’ made flipping control of the House a personal quest

Gabriela Cruz, who was brought to the U.S. illegally when she was 1, couldn’t vote, but in the final hours before the Nov. 6 election, she was making one last run to get people to the polls.

The sun was setting in Modesto when she found Ronald Silva, 41, smoking a cigarette on a tattered old couch behind a group home. He politely tried to wave her off until she reminded him he had a right that she as an immigrant without citizenship didn’t have.

“It could really make a change for us,” said Cruz, 29.

Gov.-elect Gavin Newsom will propose almost $2 billion for early childhood programs

Seeking to frame his new administration as one with a firm focus on closing the gap between children from affluent and poor families, Gov.-elect Gavin Newsom will propose spending some $1.8 billion on an array of programs designed to boost California’s enrollment in early education and child-care programs.

Newsom’s plan, which he hinted at in a Fresno event last month, will be a key element in the state budget proposal he will submit to the Legislature shortly after taking office Monday, a source close to the governor-elect’s transition team said.

The spending would boost programs designed to ensure children enter kindergarten prepared to learn, closing what some researchers have called the “readiness gap” that exists based on a family’s income. It would also phase in an expansion of prekindergarten and offer money to help school districts that don’t have facilities for full-day kindergarten.

“The fact that he’s making significant investments with his opening budget is really exciting,” Ted Lempert, president of the Bay Area-based nonprofit Children Now, said Tuesday. “What’s exciting is the comprehensiveness of it, because it’s saying we’re going to focus on prenatal through age 5.”

A broad overview document reviewed by The Times on Tuesday shows that most of the outlay under the plan — $1.5 billion — would be a one-time expense in the budget year that begins July 1. Those dollars would be a single infusion of cash, an approach favored by Gov. Jerry Brown in recent years.

Most of the money would be spent on efforts to expand child-care services and kindergarten classes. By law, a governor must submit a full budget to the Legislature no later than Jan. 10. Lawmakers will spend the winter and spring reviewing the proposal and must send a final budget plan to Newsom by June 15.

Though legislative Democrats have pushed for additional early childhood funding in recent years — a key demand of the Legislative Women’s Caucus — those actions have typically come late in the budget-writing season in Sacramento.

“Quite frankly, to start out with a January proposal that includes that investment in California’s children reflects a new day,” state Sen. Holly J. Mitchell (D-Los Angeles) said.

The governor-elect will propose a $750-million boost to kindergarten funding, aimed at expanding facilities to allow full-day programs. A number of school districts offer only partial-day programs, leaving many low-income families to skip enrolling their children because kindergarten classes end in the middle of the workday. Because the money would not count toward meeting California’s three-decades-old education spending guarantee under Proposition 98, which sets a minimum annual funding level for K-12 schools and community colleges, it will not reduce planned spending on other education services.

Close behind in total cost is a budget proposal by Newsom to help train child-care workers and expand local facilities already subsidized by the state, as well as those serving parents who attend state colleges and universities. Together, those efforts could cost $747 million, according to the budget overview document.

An expansion of prekindergarten programs would be phased in over three years at a cost of $125 million in the first year. The multiyear rollout would, according to the budget overview, “ensure the system can plan for the increase in capacity.”

Lempert said the Newsom proposal is notable for trying to avoid the kinds of battles that in recent years pitted prekindergarten and expanded child care against each other for additional taxpayer dollars.

“The reality is we need to expand both simultaneously,” he said.

Another $200 million of the proposal would be earmarked for programs that provide home visits to expectant parents from limited-income families and programs that provide healthcare screenings for young children. Some of the money would come from the state’s Medi-Cal program, and other money from federal matching dollars. Funding for the home visits program was provided in the budget Brown signed last summer; the Newsom effort would build on that.

Emphasizing a policy area with broad appeal in his first state budget could reflect Newsom’s political sensibility about the challenges ahead. Democratic lawmakers and interest groups will be especially eager to see how Newsom addresses the demand for an overhaul of healthcare coverage in California — especially after a 2017 effort to create a single-payer, universal system fizzled. The path forward on healthcare is complex and costly, making early childhood education a more achievable goal in the governor-elect’s early tenure.

Newsom is likely to face considerable demands for other additional spending. In November, the Legislature’s independent analysts projected that continued strength in tax revenues could produce a cash reserve of some $29 billion over the next 18 months. Almost $15 billion of that could be in unrestricted reserves, the kind that can be spent on any number of government programs.

Kim Belshé, executive director of the child advocacy organization First 5 LA and a former state health and human services secretary, said the initial Newsom budget proposal suggests the next governor will focus on a comprehensive approach to improving outcomes for children from low-income families.

“School-ready kids deserve quality early learning, strong and well-supported families, and access to early screening services,” Belshé said. Newsom “understands the ‘whole child,’ multifaceted needs of our kids and is clearly ready to lead.”

Mitchell, the chair of the Senate budget committee, said she’s eager to see the details of the governor-elect’s proposal to determine whether it might signal the beginning of an even broader expansion of early education efforts. Similar efforts have been hindered by a lack of money and ongoing debate over which services to help children 5 and younger need state funding the most. Universal preschool, in particular, has been debated for more than a decade. California voters rejected a ballot measure to fund a full prekindergarten system in 2006.

“It’s clear there’s a new movement afoot trying to engage on investment for universal preschool,” Mitchell said. “How we invest, and how we prioritize that investment, is going to be a great conversation for the coming months.”

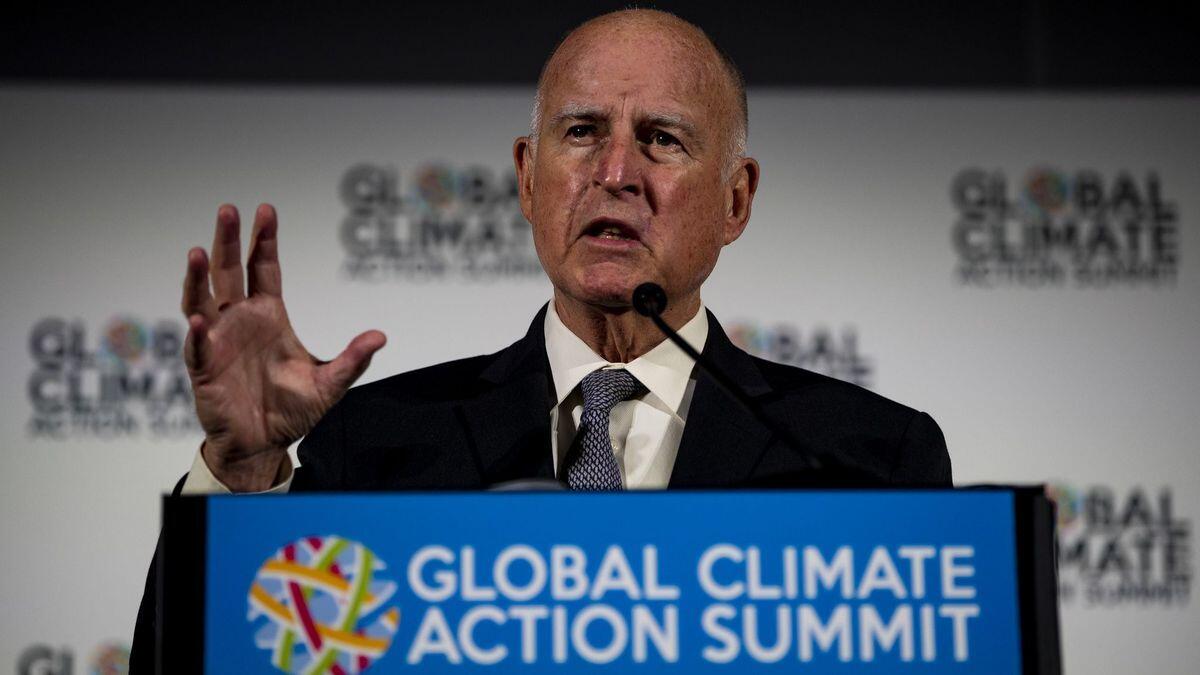

California Politics Podcast: A final conversation with Gov. Jerry Brown

No Californian has served longer as governor, signed more laws, granted clemency to more felons or waged more high-profile campaigns than Gov. Jerry Brown.

Brown will leave behind a unique legacy when he packs his last belongings for the trip from the governor’s mansion in Sacramento to his Northern California ranch. His final two terms in office could be his most consequential.

The governor reviewed some of the more notable moments from the past eight years in a far-reaching interview with The Times on Dec. 22. This week’s podcast episode includes extended portions of that conversation.

After turning back efforts to ban tackling in youth football, the sport’s enthusiasts try something new

California youth football supporters who defended their sport against a proposal this year that would have barred tackling have taken a new approach: going on the offensive.

Under a bill supported by a coalition of youth football groups, California, beginning in 2021, would limit children to two 60-minute practices of full contact, while barring tackling in the sport’s offseason.

The proposal introduced this month by Assemblyman Jim Cooper (D-Elk Grove) models the limitations on restrictions already in place for high school football in California, which caps full-contact practices to 90 minutes twice a week.

The restrictions come amid growing concern from medical professionals who say repetitive collisions from hitting and blocking can cause long-term brain damage.

“We want to improve the safety standards for youth tackle football across the state,” said Joe Rafter, president of Southern Marin Youth Football in the San Francisco Bay Area, who is working with Cooper’s office on the bill. “It’s the right thing to do.”

But Rafter said their efforts would also block any new attempts by lawmakers to bar youth tackle football. A bill to set a minimum age of 12 to play organized tackle football died in April, but the authors of the legislation, AB 2108, promised to try again in 2019.

Assembly members Kevin McCarty (D-Sacramento) and Lorena Gonzalez (D-San Diego) cited research showing youths who began playing tackle football before age 12 developed cognitive, behavioral and mood problems earlier than those who began full-contact sports later.

McCarty’s office said he plans to introduce another bill banning tackling in youth football.

“I played organized football as a child and I love the sport to this day,” McCarty said after the bill was pulled from the Arts, Entertainment, Sports, Tourism and Internet Media Committee in April when it became apparent it did not have the votes to pass. “But love for football doesn’t mean that we should ignore science.”

Cooper said he wants to ensure that kids can still play tackle football, but in a safer environment. Banning tackling outright goes too far, he said.

“Americans love football and kids love playing football,” Cooper said. “However, we must ensure our children are safe while participating in contact sports.”

Gavin Newsom announces lineup for concert to benefit California wildfire victims

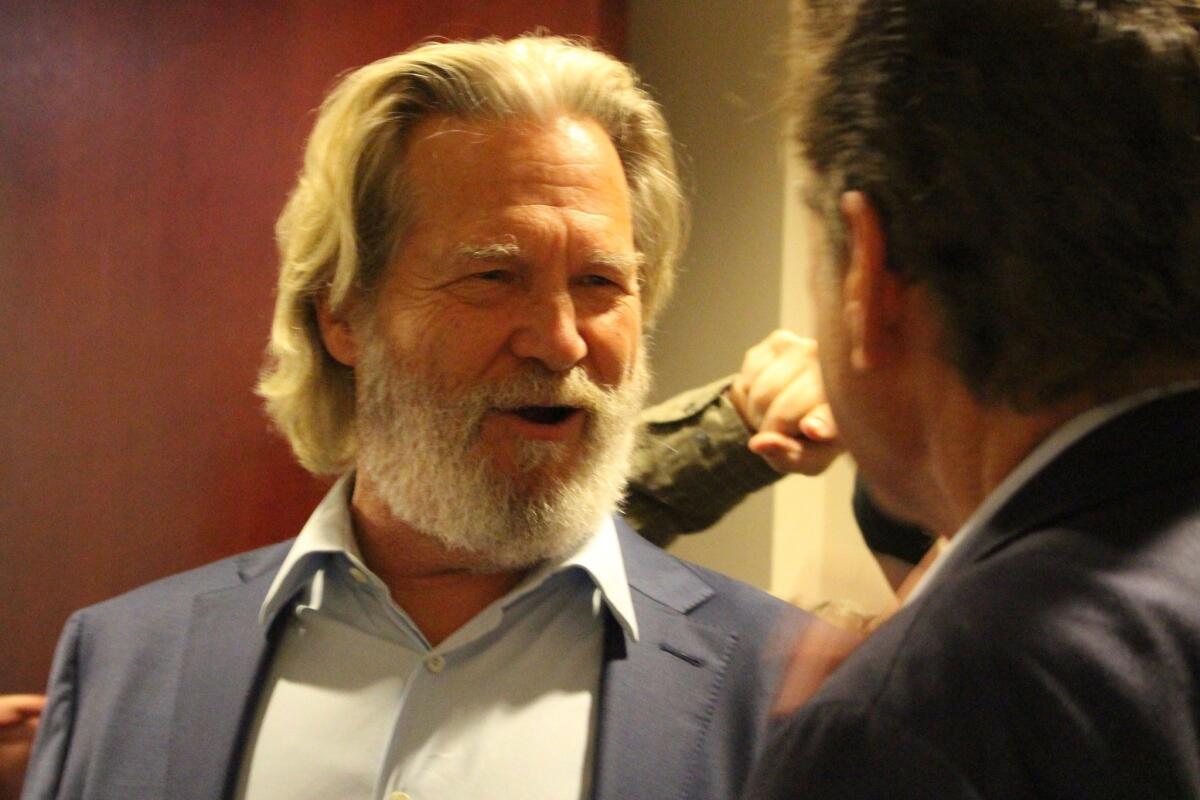

A sagging economy could doom a 2020 ballot measure to raise commercial property taxes, Gov. Jerry Brown says

An effort to remove commercial property in California from the tax limits imposed by the landmark Proposition 13 could be felled by an economic slowdown, Gov. Jerry Brown said.

In a Saturday interview with The Times at his Northern California ranch, Brown said liberal activist groups that have successfully placed the proposal on the November 2020 statewide ballot shouldn’t read too much into early poll numbers showing support for the plan.

“That isn’t as easy as you think,” Brown said. “Because you’re going to be in a downturn of the business cycle. And you’re talking many kinds of business. And the cost of doing business in California is already high.”

The ballot measure would allow counties to more frequently assess the market value of commercial property in California than allowed under Proposition 13, a 1978 ballot initiative that amended the state constitution to place strict limits on assessing property values and taxation for both homeowners and businesses. An analysis of the new measure, which qualified in October for the 2020 ballot, estimates it could bring in some $10.5 billion a year in new tax revenue.

“The business community will fight it,” Brown said. “And the minimum wage, the family leave, the environmental rules … business[es] have left California, that’s going to be the big argument. And I think that’s something you really have to think a lot about.”

The governor, who leaves office early next month due to term limits, declined to either endorse or oppose the ballot measure. He said California’s economic health in two years’ time could be a key factor in how voters weigh the proposal.

“We’ll be in a recession by then,” Brown said. “So it’s anybody’s guess.”

Inglewood to destroy more than 100 police shooting records that could otherwise become public under new California law

The city of Inglewood has authorized the shredding of more than 100 police shooting and other internal investigation records weeks before a new state law could allow the public to access them for the first time.

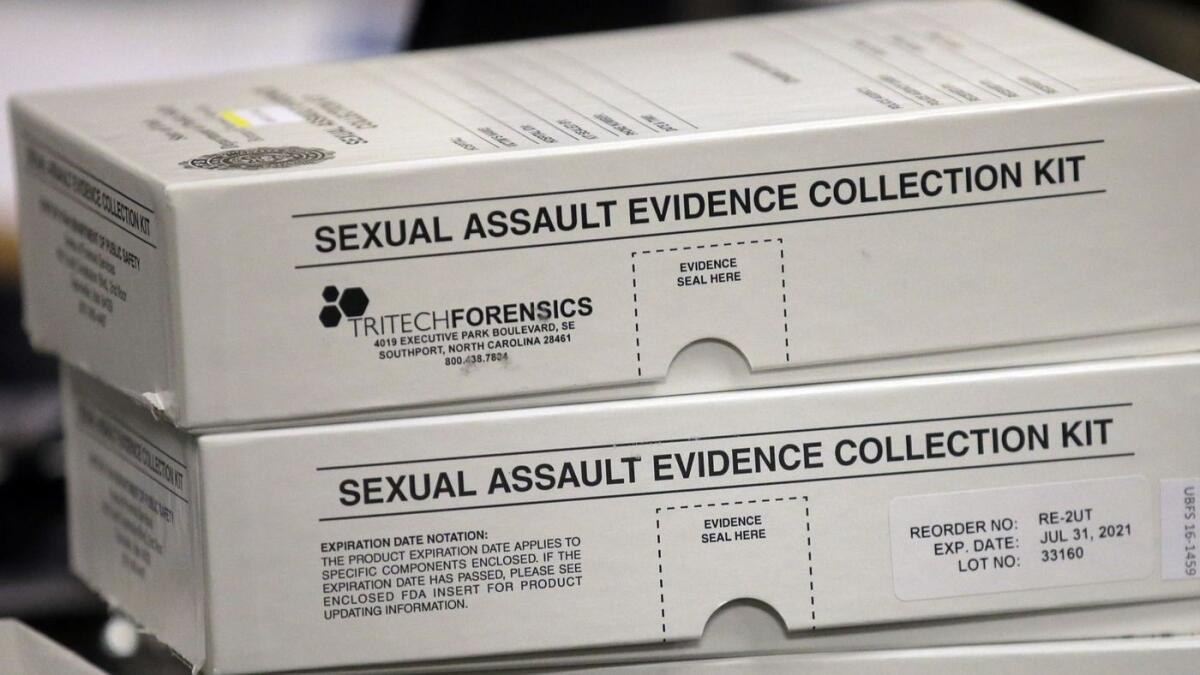

The decision, made at a City Council meeting earlier this month, has troubled civil liberties advocates who were behind the state legislation, Senate Bill 1421, which takes effect Jan. 1. The law opens to the public internal investigations of officer shootings and other major uses of force, along with confirmed cases of sexual assault and lying while on duty.

“The legislature passed SB 1421 because communities demanded an end to the secrecy cloaking police misconduct and use of force,” Marcus Benigno, a spokesman for the American Civil Liberties Union of Southern California, said in a statement. “Inglewood PD’s decision to purge records undermines police accountability and transparency against the will of Californians.”

California law says police departments must retain records of officer shootings and internal misconduct investigations for five years. The city of Inglewood, however, had kept records longer than that, including case files of police shootings dating to 1991. State Sen. Nancy Skinner (D-Berkeley), the author of SB 1421, intended for her bill to allow public access to all qualifying records held by a department, no matter the date of the incident.

Inglewood City Council approved the destruction of records that have been in the police department’s possession — more than 100 cases — longer than required by law. The city staff report and council resolution describing the action makes no mention of the new police transparency law. Instead it says the affected records are “obsolete, occupy valuable space, and are of no further use to the police department.” It added the traditional method of destroying such records is to shred them.

It is unclear whether the records have since been destroyed.

A spokesman for the Inglewood Police Department along with Inglewood’s city manager, attorney, clerk, four council members and Mayor James T. Butts, a former Santa Monica police chief, did not respond to requests for comment. Inglewood’s City Hall is closed the last two weeks of December.

The Inglewood Police Department has a reputation for secrecy and using excessive force. In 2008, the department’s officers fatally shot four men in as many months, three of whom turned out to be unarmed. The U.S. Department of Justice launched a civil rights probe and found significant flaws in the way the department oversaw use-of-force cases and investigated complaints against officers.

Civil rights advocates still question why Inglewood police opened fire on a couple found sleeping in a car in 2016, killing them both.

California police have a long history of shredding records to avoid scrutiny of their actions. In the 1970s, the LAPD famously destroyed more than four tons of personnel records after defense attorneys began requesting them as part of criminal cases against their clients. The move resulted in the dismissal of more than a hundred criminal complaints.

In response, the Legislature demanded that records be preserved but then took other measures, supported by police unions, to ensure the public had very little access to them, making California the most secretive state in the nation when it comes to police misconduct.

Skinner’s legislation begins to unwind those laws, which have been on the books since 1978.

No video or audio of the Dec. 11 council action is available on the city’s website and neither are meeting minutes or any record of the decision. A city spokeswoman, Courtney Torres, confirmed that the council had voted in favor of the police records purge, and said all the relevant reasons for the decision were included in the city staff report.

The Jan. 1 implementation for SB 1421 has prompted other police officials to act. A police union in San Bernardino is asking the state Supreme Court to determine that Skinner’s bill only applies to incidents that occur in 2019 or later. Los Angeles Police Department Chief Michel Moore sent a letter to Skinner earlier this month warning that complying with the law in regard to older records in the department’s possession could take hundreds of thousands of work hours.

Federal officials question California DMV’s process for issuing Real IDs

The U.S. Department of Homeland Security has notified the California Department of Motor Vehicles that its process for providing residents with federally recognized identification cards is not adequate.

DMV spokesman Armando Botello said Friday that 2.3 million residents who received Real IDs under the current process will have to submit additional documentation when their cards are renewed in five years but will be able to use them in the meantime.

The DMV is developing a way for residents to submit more documentation online or via email to comply with the stricter federal requirement, he said.

But some state legislators are upset about delays in notifying them of the problem and say Homeland Security could eventually require additional documentation provided by current holders.

“The DMV has known for a month that millions of Real IDs they’ve been dolling out are potentially invalid,” Assemblyman Jim Patterson (R-Fresno) said. “The DMV’s only hope is that the Department of Homeland Security takes pity on California and gives the DMV more time to fix this mess.”

Real IDs are a new kind of driver license and identification card that federal law will require legal residents to present when boarding domestic flights or visiting military bases and other federal facilities starting Oct. 1, 2020.

The DMV has only been requiring one form of documentation, including a current lease or utility bill, to verify the residence of a card applicant.

But the federal government said in a Nov. 21 letter to the agency that two such documents are needed.

On Friday, DMV Director Jean Shiomoto released a letter defending the current process but said her agency will start requiring a second document to prove residency in April.

“In order to minimize confusion among our customers, the CADMV will work to inform individuals who have been issued a Real ID under the current process that their card will be accepted for official federal purposes, even if their renewal occurs after the October 1, 2020, final enforcement date for Real ID,” Shiomoto wrote to the federal agency.

Legislative officials worry there is still a possibility that those issued Real IDs in the past might be required to present a second document to have their cards designated as compliant.

The more complex process for obtaining Real IDs has led to hours-long waits for customers at DMV field offices this year, although wait times have been reduced recently by an increase in staffing.

Shiomoto last month announced that she is retiring amid problems with the “motor voter” registration system and after the governor ordered an audit of her agency in response to the long wait times.

On Friday, Assembly Republican Leader Marie Waldron of Escondido blasted the DMV for waiting a month to tell legislators of the problem.

“This is unacceptable and flies in the face of security for our citizens, which is what Real ID was created for in the first place,” she said in a statement.

Gov.-elect Gavin Newsom taps Keely Bosler to be his finance director

Gov.-elect Gavin Newsom on Friday appointed Keely Martin Bosler as director of the California Department of Finance, continuing the role she has served under Gov. Jerry Brown since August.

Bosler will become Newsom’s chief fiscal advisor, and will play a pivotal role in shaping Newsom’s spending plan for the state that will lay the foundation for his top policy priorities. Newsom must roll out his first budget plan within days of taking office on Jan. 7.

“California’s brighter future depends on a strong, stable fiscal foundation,” Newsom said in a statement released Friday afternoon. “Keely is an accomplished public servant of sound fiscal judgment. She understands that state budgets are more than numbers on a page – they are value statements affecting the fate and future of millions of families reaching for the California Dream. We are fortunate to have her on our team.”

Prior to being appointed finance director, Bosler served as Brown’s cabinet secretary for two years and, before that, as the chief deputy director for budget in the Finance Department for three years.

Earlier this year, Brown picked Bosler to lead an audit of the Department of Motor Vehicles, which had come under fire for long wait times at DMV field offices and numerous computer problems, including errors in the new “motor voter” program that registered Californians to vote.

“As we have discussed, long wait times at the Department of Motor Vehicles do not reflect the high standards of service that Californians expect from their state government,” Bosler wrote in a letter in September to DMV Director Jean Shiomoto.

The audit is still ongoing, but Shiomoto has since announced she will retire at the end of the year.

California’s legislative analyst, after decades of nonpartisan research for lawmakers, calls it a career

Only five people have led the independent research office of the California Legislature since its creation in 1941. And each of them has had a pretty simple mantra to live by in reviewing public policy proposals and government programs: Call it like you see it.

“The job of any analyst, to me, is you maintain that nonpartisanship,” Legislative Analyst Mac Taylor said.

Taylor, 65, will retire from the post at the end of December after a four-decade career with the research team that began, as he likes to tell it, just after the passage of the landmark property tax rollback, Proposition 13, in 1978. He became the leader of the office, with the title of legislative analyst, in October 2008.

Two months later, state government found itself in arguably the worst fiscal crisis in its history — a projected shortfall that ultimately grew to $42 billion by the following winter.

“There were forces beyond our control,” Taylor said of that time. “But don’t underestimate the policy changes that were made afterward.”

Those changes, most notably a boost in taxes paid by high-income earners and a robust state budget cash reserve fund, have helped lead to successive years of fully funded government services. The state is projected to have some $24 billion in reserves by the end of the current fiscal year.

Taylor announced his intention earlier to step down this year. Leaders from both houses of the Legislature select the analyst, who leads a staff of almost five dozen researchers. The office provides in-depth reports on pending legislation, as well as on broader policy topics like education and healthcare, and produces an independent analysis for every proposed ballot measure.

A succession of lawmakers and governors alike have praised or panned the work of the Legislative Analyst’s Office based on their own political worldview. Taylor said his staff is mindful that they work for legislators, but try to ignore the rhetoric that follows the release of a major report.

“People are going to do what they’re going to do with our information,” he said. “They don’t always like it, but they appreciate that we give them our best advice.”

Taylor oversaw a transformation in the way the Legislative Analyst’s Office distributes its information, embracing the release of research reports through social media instead of relying on traditional printed copies and journalist roundtable events. But he said the work of the researchers has remained largely unchanged through the decades.

“Having an independent take on things, I think, is good for the Legislature,” he said.

No replacement for Taylor has been announced, which means a short transition for his eventual successor before Gov.-elect Gavin Newsom sends his first budget proposal to lawmakers in early January. Taylor, who lives in the Sacramento suburbs, said he will honor the tradition of his predecessors in stepping away from public policy debates in order to give the new analyst space to lead the team as he or she sees fit. He said he hopes to travel in the coming years and spend time with his children who have moved to the East Coast.

“Forty years in state government,” Taylor said in why he was stepping aside now. “Isn’t that enough?”

Gov. Jerry Brown sues to save California sentencing laws

Outgoing Gov. Jerry Brown sued Thursday to protect one of his signature actions in office, a voter-approved measure that allows most prison inmates to seek earlier release and participate in rehabilitation programs.

His administration filed a lawsuit challenging a pending 2020 initiative that seeks to toughen criminal penalties as part of an effort to roll back reforms adopted by voters within the last decade.

Brown’s lawsuit in Sacramento County Superior Court contends the measure lacked enough valid signatures to overturn a previously approved constitutional amendment.

County officials and California Secretary of State Alex Padilla certified the signatures in July but said they were submitted too late to qualify for last month’s election. The lawsuit names Padilla and the ballot measure’s official proponent, Nina Salarno Besselman, president of the advocacy group Crime Victims United.

Padilla said the measure exceeded the required roughly 366,000 valid signatures, equal to 5% of votes cast for governor in 2014. Brown’s lawsuit says he used the wrong threshold. It says changing the state Constitution requires 8%, or more than 585,400 signatures.

That makes the pending initiative more than 150,000 signatures short, the lawsuit says.

“He’s wrong,” said Jeff Flint, a spokesman for the campaign backing the measure. He predicted a judge will be reluctant to reject a measure that already has qualified for the ballot.

“The secretary of state told us how many signatures are required, and that’s how many we collected,” Flint said.

Padilla’s office did not immediately respond to requests for comment.

The measure would reverse reforms adopted by voters through Proposition 47 in 2014 and Proposition 57 in 2016.

Proposition 57 allows most inmates to seek earlier paroles, and Proposition 47 reduced some drug and property crimes from felonies to misdemeanors. The combination has helped keep California’s inmate population below a population cap set by federal judges.

Corrections department spokeswoman Vicky Waters said the measure gives corrections and parole officials broad discretion “to protect our communities and fashion a rational system of rehabilitation and punishment. This new initiative unlawfully seeks to supplant the department’s constitutional authority to implement these critical reforms to our criminal justice system.”

The pending initiative would shorten the list of crimes that qualify for earlier parole and change some theft crimes from misdemeanors back to felonies. It would also increase the number of crimes for which DNA is collected, a list that was limited when some crimes went from felonies to misdemeanors.

Those supporting the tougher penalties say easing criminal penalties has increased the number of dangerous criminals on the streets, but those backing the changes say they have helped reduce mass incarceration and rehabilitate convicted criminals.

California Supreme Court orders records unsealed in pardon of ex-state Sen. Roderick Wright

The California Supreme Court has granted a request to unseal court records involving Gov. Jerry Brown’s decision last month to pardon former state Sen. Roderick Wright for felony convictions involving lying about living in his legislative district, officials said Thursday.

The court order was in response to a request by the nonpartisan First Amendment Coalition, which argued that the public has a right to know what information went into the governor’s decision to grant clemency to Wright.

“This is an important victory for public access to court files involving the exercise of executive clemency,” said coalition spokesman Glen A. Smith. “We are gratified the court has recognized that these decisions should be subject to the same public access rules that apply to other judicial records under California law.”

The court gave Brown’s office until Jan. 2 to redact confidential material before giving the court documents that can be released to the public. The court files submitted by the governor’s office include letters of support for a pardon and an internal review of Wright’s case.

The court denied a motion to unseal the records of all clemency cases but left open consideration of requests on other individual cases.

Brown’s office is “currently evaluating the court’s decision,” said spokesman Brian Ferguson. The governor argued against unsealing records in a recent court filing that said confidentiality is consistent with historical practice and is supported by state law.

In pardoning Wright on Nov. 22, the governor wrote: “He has shown that since his release from custody, he has lived an honest and upright life, exhibited good moral character, and conducted himself as a law abiding citizen.”

California political watchdog agency fines BART, urges prosecution over using public funds for campaign

California’s state political watchdog agency on Thursday imposed a $7,500 fine against the Bay Area Rapid Transit District and called for a possible criminal or civil prosecution over allegations the district used public resources to campaign for a 2016 bond measure.

The state Fair Political Practices Commission levied an administrative fine against BART for its failure to disclose spending on YouTube videos, social media posts and text messages to promote Measure RR, which authorized $3.5 billion in general obligation bonds.

Though the panel lacks authority to seek criminal charges over the misuse of public funds, it also urged county district attorneys in the BART service area and the state attorney general to pursue possible criminal or civil charges over the spending of taxpayer dollars for campaign purposes, Commission Chairwoman Alice Germond said.

“It is the concept of misusing public funds that I think we all here are very disturbed about, and we want to send a warning and not create a precedent that is a minor, little slap on the wrist,” Germond said, adding that the referral to criminal prosecutors “would further send a message that this is wrong.”

Commissioner Brian Hatch also called for the state Legislature to consider granting the FPPC power to go after public agencies that spend taxpayer money on campaigns.

Sen. Steve Glazer (D-Orinda) called on the agency to increase the fine to the maximum level of $33,375. The proposed $7,500 fine “represents a slap on the wrist for a very serious violation of the law and the public’s trust,” Glazer said in a letter to the panel.

In supporting the fine recommended by the staff, Germond said BART has agreed to pay the penalty.

“Somebody did something wrong and they have admitted it,” she said.

A staff report said there were factors in favor of a fine below the maximum.

“Although the Commission considers BART’s violations to be serious, the absence of any evidence of an intention to conceal, deceive, or mislead; the voluntary filing of the delinquent campaign statement; and the absence of a prior record are mitigating,” the report said.

Activist Kimberly Ellis announces bid for chair of the California Democratic Party amid leadership turmoil

Bay Area progressive activist Kimberly Ellis is making another run at leading the state’s Democratic Party, she announced Thursday.

Ellis burst onto the state political scene in 2017 when she narrowly lost the chairmanship to then-Los Angeles Democratic Party Chairman Eric Bauman.

Last month, Bauman was forced to resign after he was accused of misconduct, throwing the party into turmoil over its leadership. In an investigation by The Times, 10 party staffers and political activists alleged that Bauman made inappropriate sexual comments in professional settings and engaged in unwanted touching.

“Right now, who we are as a Party has come starkly into question,” Ellis wrote in an email to supporters. “We - elected leaders, the labor community, delegates and activists, have to find an answer, and find it quickly.”

“After deep consideration and long conversations with delegates, elected officials, labor leaders, social justice advocates and Party activists who urged me to consider taking up the mantle, I’ve decided to answer the call and run for Chair of the California Democratic Party.”

Citing what she called a “collapse” in state party leadership, Ellis said she’s hoping to help “reform the tone, tenor and culture of the California Democratic Party and rebuild the trust that has been broken.”