What’s for sale at this outdoor market? Cold, hard cash

The men stand in a maelstrom of money. There’s lots of it: inch-thick wads of crisp Benjamins, 100-euro bills and Turkish liras. Brick-sized blocks of Libyan dinars bulge from suitcases or are spirited away in wheelbarrows.

Here in the cobblestoned pathway of the Musheer market, a few steps away from the Art Deco building of Tripoli’s central bank, cash is not only king, it’s the lifeblood of a black market. It is nurtured by Libya’s dangerous mix of petrodollars, mafia-esque militias, and a war economy that has devoured the country’s top institutions.

For the record:

9:25 a.m. July 11, 2019An earlier version of this article described Tim Eaton as a Libya expert at the International Crisis Group. He works for Chatham House.

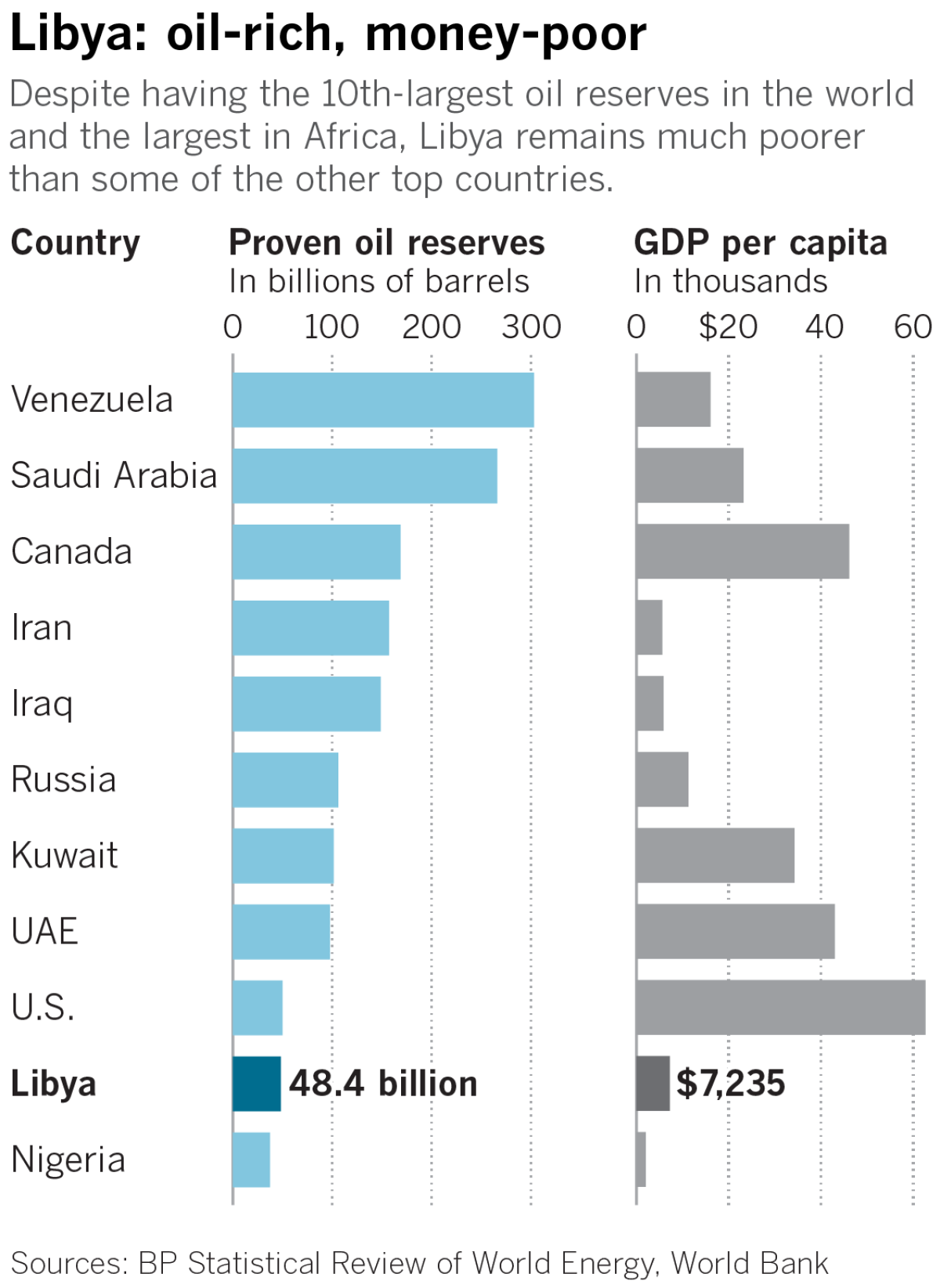

Though Libya has the raw materials of prosperity — it has Africa’s largest proven oil reserves, the world’s 10th largest — almost a third of its more than 6 million people live below the poverty line.

Meanwhile, the country has devolved into a free-for-all of militias fighting for and funded by the country’s awesome natural resources.

Moammar Kadafi, the “Brother Leader” who ruled the country for more than four decades, once wielded those riches, using networks of patronage to keep the country in his grip.

But since the North Atlantic Treaty Organization-backed revolution that ousted him and led to his death in 2011, and the civil war that began in 2014, the country has split between warring factions, aligned with either the Government of National Accord or aspiring autocrat Gen. Khalifa Haftar’s Libyan National Army. Both sides feed off the country’s petrodollars, even as they hijack public institutions and businesses to do so.

“In Libya, we don’t have a tribal conflict, or a sectarian fight or anything about ideologies,” said Husni Bey, a prominent Libyan businessman and head of the HB Group, one of Libya’s largest companies. There is, he said, only “plunder.”

One place this plays out on a daily basis is the Musheer market, an open-air currency exchange in the shadow of Tripoli’s ornate Ottoman clock tower, one of the landmarks of the Libyan capital.

Come 9 a.m., hundreds, sometimes thousands of unlicensed currency traders come to this marketplace with no stalls. Business is done in the walkway itself, with chaotic helgas, or circles of traders, announcing offers and counteroffers for various amounts of money. And what happens here in Musheer affects currency prices everywhere in Libya.

“I’ve got 50,” says one customer. He means $50,000. Few seem impressed; top traders, who occupy any helga’s center, regularly handle what is called a “bako” — a million dollars.

The strategy for making profits here is simple: It’s a matter of exploiting both the scarcity of money as well as the difference between the official exchange rate, where a dollar buys 1.4 Libyan dinars, and the black market rate.

Before late 2018, the rate was highly volatile and could reach up to 10 dinars per dollar. It pushed banks to offer letters of credit to authorized merchants, granting them dollars at the official exchange rate so they could import essential foreign goods.

But the measure was ripe for abuse. It turned Tripoli, where the central bank and top financial institutions were located, into a Gotham-esque crime metropolis.

Militias kidnapped or used extortion to force businessmen and bank employees to give them letters of credit they used to get dollars at the official exchange rate, only to then sell them on the black market. Instead of importing containers of vital goods, they would fill them with sand to give the illusion they were full.

They cut through long lines at ATMs to make sure what cash was inside the banks went to them first, leaving none for legitimate customers.

A 2016 U.N. report accused Haitham Tajouri, head of the Tripoli Revolutionaries Brigades faction and presumably a fashionista who enjoys sporting Versace clothing on the battlefield, of threatening central bank employees to get $20 million worth of letters of credit.

The black marketeers reaped gargantuan profits, flaunting their riches with cars and lavish parties.

They also brought the jealousy of other brigades outside Tripoli. In September, a militia from the town of Tarhunah some 40 miles southeast of Tripoli, launched an assault on the capital it said was aimed at stopping Tripoli militia leaders’ feeding frenzy.

It was one of many instances in which the militias and their constant fighting sabotaged the rise of a post-Kadafi state, with more than half of the country’s cash supply stuck in the black market, according to a 2017 report from Mercy Corps.

In the wake of that offensive, the government imposed a 183% fee on private currency transactions, devaluing the dinar to $3.90 to reduce the gap between the official and black market rate. It also opened up letters of credit to anyone.

But there was a catch.

State transactions remained at the official exchange rate, as did an annual foreign currency allowance per family member capped at $500 issued via special credit cards. (It has since been raised to $1,000.)

The measures stabilized the currency and presumably reduced the factions’ stranglehold over the money supply. Yet there is still a small gap between the rates, and the liquidity crisis persists; getting cash from an ATM is a game of chance to find a bank with bills and bearable queues watched over by gun-toting militiamen.

Meanwhile, the annual allowance credit cards became another scam. Cardholders could only withdraw the foreign currency outside Libya, then take it back to sell on the black market. But since most families can’t afford to leave, critics of the measure say, heads of families instead come to Musheer and sell their cards to factions or businessmen for a lesser amount to get dollars faster.

Multiple people interviewed said that militias have become an integral part of the system, with fighters on the central government’s payroll and embedded in institutions. Haftar would agree: In April, he mobilized his Libyan National Army forces to attack the capital, accusing the government of being “hopelessly infested by militias.”

Haftar’s rival government in the east has its own central bank branch, but because of the civil war in 2014, it has been disconnected from the main branch in Tripoli.

To fund his offensives and the state in the east, Haftar has relied on billions of Libyan dinars printed in Russia and unofficial bonds to fund his offensives, accumulating more than $25 billion in debt.

Since it is not recognized by the government and has no access to hard currency deposits from the central bank, the Libyan National Army must finance its offensives at the black market rate even as the Government of National Accord, which controls money flows into the country, benefits from the official exchange rate, Bey said.

The Libyan National Army also established a military authority for investment and public works, commandeering agricultural projects and steel exports in areas under their control, said Tim Eaton, a Libya expert at Chatham House, a London-based think tank focused on international affairs, in an interview last week.

Another industry bears a grimmer cargo: Both sides work with factions operating vast human smuggling rings that prey on migrants and bring in hundreds of millions of dollars.

Deadly land, deadly sea: Libya migrants face brutal choice »

Throughout the chaos, oil has continued to flow. Earlier this month, oil officials said production had reached 1.3 million barrels per day.

The National Oil Corp. remains the sole entity authorized to sell the country’s oil, despite Haftar holding much of the infrastructure in Libya’s oil-rich east, while the Government of National Accord controls distribution networks.

All sides, said one executive who spoke on condition of anonymity because he was not authorized to speak to the news media, understand that damaging the oil facilities in the fighting would mean no money for any of them.

And there’s a lot of money to be had. Over at Musheer market, once an exchange price is agreed upon, traders hire one of the wheelbarrow boys to pack the cash in trash or opaque plastic bags before pushing them through the souk.

They move quickly past the shadow of Tripoli’s nearby central bank building. No one pays much attention; it’s rude — and dangerous — to stare in a place like Musheer, where the only item as readily available as cash is guns.

They walk off into the warrens of the souk, and disappear.

ALSO:

Midnight in Tripoli brings kebab stands and picnics, but the enemy is at the gates

Libya’s two wars: One on the battlefield and one on Facebook

How the military piggybacked on populist uprisings in Algeria and Sudan

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.