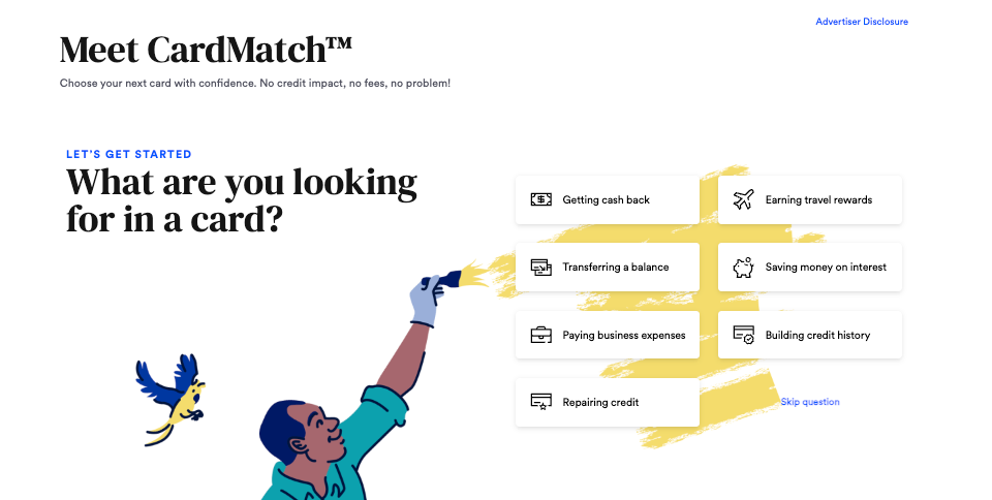

What is CardMatch?

CardMatch is a tool that recommends credit cards that match your preferences and financial qualifications.

All you need to do is provide a few details about your income, employment status, and existing financial obligations. Based on that information, the system returns the credit card offers that are tailored to your situation.

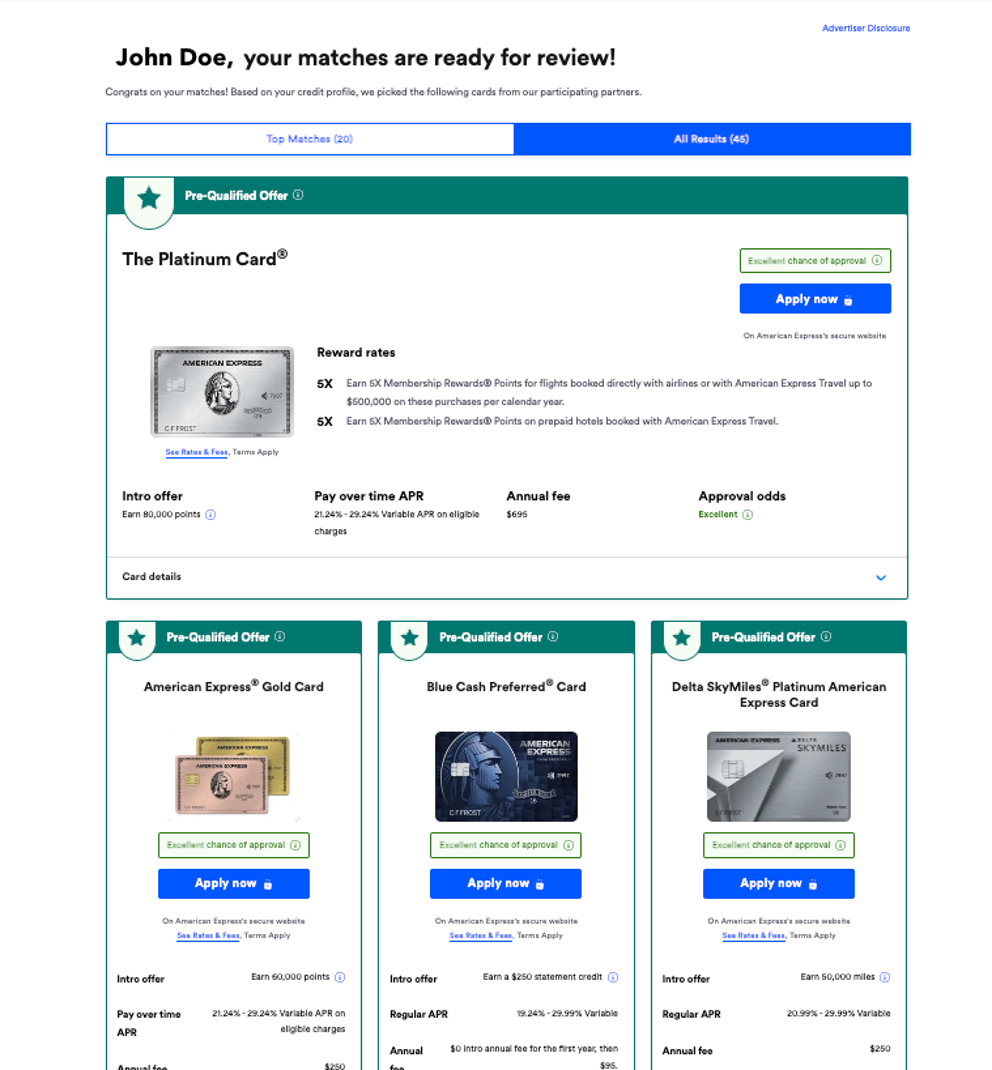

It’s important to note that the tool doesn’t guarantee you’ll be approved for these credit cards; it merely shows you the cards that provide the best odds. You’ll need to complete a separate application to get a final decision.

Get targeted offers with CardMatch

CardMatch locates credit cards targeted to your unique situation. If you’re well-qualified, for example, the system can help you find better offers than you’ll see on the card issuer’s website. It can also reveal limited-time special promotions with better welcome perks.

If you are building or repairing your credit, the tool helps you determine which cards have the best odds of approval. That way, you don’t damage your credit score by applying for cards that aren’t a good fit. Next to each offer, you’ll see a box that tells you whether your chances are excellent, good, fair, or poor.

Current CardMatch offers

The Platinum Card® From American Express

Although you aren’t guaranteed to snag an elevated welcome offer for the Amex Platinum card, select CardMatch users have been able to earn up to 150,000 Membership Rewards points after spending $6,000 on the card within the first three months of account opening.

For our take on this card, check out our Amex Platinum Card review.

American Express® Gold Card

Like the Platinum card, you may be able to earn a higher welcome offer for the American Express® Gold Card through CardMatch. Offers as high as 90,000 Membership Rewards points after spending $4,000 on the card in the first 3 months of account opening have been seen.

For our take on this card, check out our Amex Gold Card review.

Does using CardMatch affect your credit?

Using the CardMatch tool does not affect your credit score. That’s because it uses a soft inquiry to match you with offers. This check provides the tool with a general overview of your creditworthiness, but since it’s not tied to a credit application, it doesn’t hurt your score.

If you decide to apply for one of the offers, however, the bank you choose will run a hard inquiry. These checks can reduce your credit score for a few months, so it’s important to keep applications to a minimum. Not sure what your score is? See how to check your credit score.

How to use CardMatch

Step 1. Go to the CardMatch website

Ready to get started? Click on the banner below or go directly to the CardMatch site.

Next, the CardMatch tool will ask you for some basic information.

-

Employment status. Click the button that best matches your current employment status. In addition to traditional employed and self-employed buttons, there are options for students, retirees, and unemployed people.

-

Annual income. Estimate the total amount of money you bring in per year. Make sure to include all sources, including your salary, side hustles, investment income or retirement pay. If you don’t work but you share a bank account with someone who does, you may be able to include that income.

-

Monthly rent or mortgage payment. Enter how much you spend on housing every month. If you don’t pay anything, enter $0. Credit card companies use this information to calculate your debt-to-income ratio and make sure you’ll be able to make monthly card payments. This information also affects your application odds and your credit limit.

-

Bank account information. Click the button that best describes your current bank accounts; note whether you have a checking account, a savings account, both, or none.

-

First and last name. This helps the tool verify that you are who you say you are.

-

Home address. Type in your current address to assist in identity verification.

-

Last four digits of your Social Security number. CardMatch uses it to conduct a soft credit inquiry so it can provide the most accurate credit card offers.

-

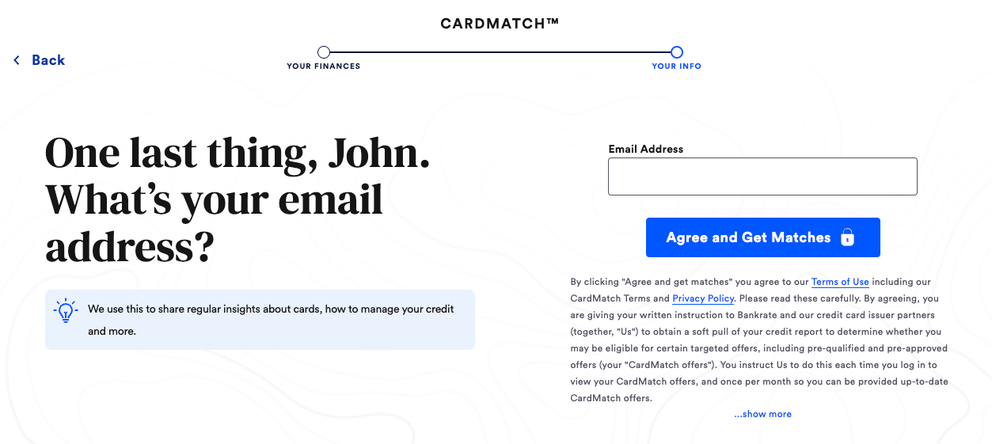

Email address. Enter your primary email address. Make a note of which address you use; CardMatch will send all communications to that inbox.

Make sure to answer each question honestly to get the best credit card offers and increase your chances of approval.

Alternatives to CardMatch

CardMatch is just one way to find the right card for you.

If you want to explore alternatives, try these strategies:

Explore related articles by topic

You’ve viewed 3 of 3 articles

LOAD MORE