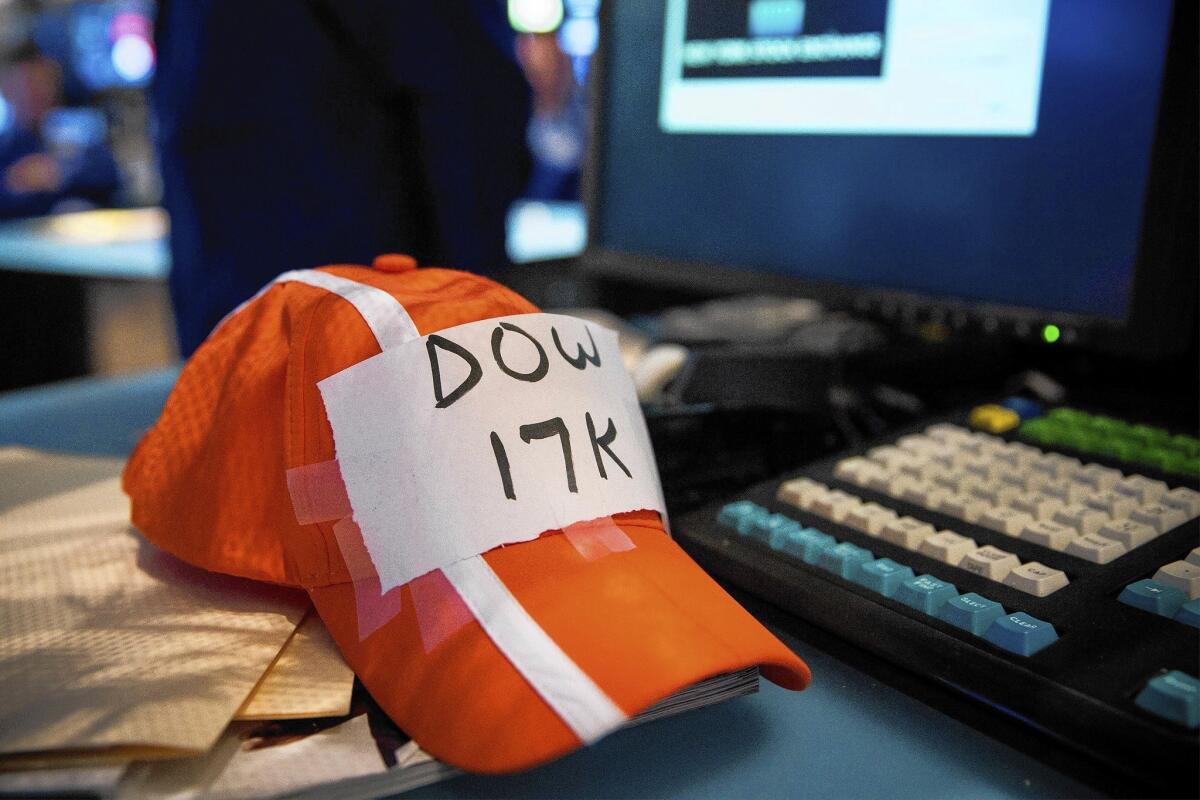

Dow soars above 17,000 for 1st time on jobs news

The stock market has rallied this year on hope that economic growth would finally accelerate beyond its sluggish pace.

That bet seemed to pay off Thursday as the Dow Jones industrial average vaulted over 17,000 for the first time.

Share prices jumped after a better-than-expected jobs report bolstered hopes for an economic surge in the coming months.

“We’re at the cusp of starting to see a sustainably higher growth rate than we’ve seen in the past,” said Bruce Simon, chief investment officer at City National Rochdale.

The Dow jumped 92.02 points, or 0.5%, to 17,068.26. The blue-chip indicator is up 3% this year.

The Standard & Poor’s 500 index, which also hit a new high, has gained 7.4% since Jan. 1.

The unemployment report showed that the economy added 288,000 jobs in June. Employment gains in the previous two months were revised upward and the U.S. jobless rate dropped to 6.1%, the lowest since late 2008.

Stocks also are being driven by the ultra-low interest rates engineered by the Federal Reserve. The central bank has begun to taper its economic stimulus program, but has done so gradually and has stressed that it won’t push rates higher any time soon.

Some experts worried that the strong jobs number could coax the Fed to act sooner, but many others say that’s unlikely.

Investors are hoping for an end to the pattern of frustratingly mixed economic signals that has become the norm over the last several years.

The economy has repeatedly appeared poised to achieve a 3% annual growth rate, hardly blockbuster in historical terms but unattainable since the financial crisis.

Investors were optimistic as the year began, but inclement weather caused an unexpected decline in first-quarter gross domestic product.

However, bulls have clung to the notion that the economy would pick up steam. Some investors worry that share prices are getting ahead of underlying corporate earnings, but bulls say the combination of rising growth, low interest rates and modest inflation could continue boosting the market.

“We think stocks have more room to move higher,” Simon said.

The market clearly has been helped by the lack of plausible alternative investments. Low rates have dulled the appeal of bonds and bank savings accounts.

“There’s no competition for stocks,” said John Bollinger, head of Bollinger Capital Management in Manhattan Beach. “There’s no place else around to invest your money.”

Even though the S&P 500 has nearly tripled since its 2009 trough, the rally is convincing some individual investors to now move back into equities.

“Clients are increasingly willing to say ‘I lost a lot of money in the downturn in ’08 and ‘09, but I’m more and more convinced this is a trend that’s going to sustain itself for a while,’” Simon said. “People are becoming more comfortable with the stock market.”

Not everyone believes the economy is improving.

The recent hiring burst is primarily the result of a snap-back after the winter storms, Bollinger said.

“The fundamentals aren’t terrible, but they’re not great either,” he said.

Still, he doesn’t see anything that could yank stock prices down in the near future as investors become more bullish.

“It’s just not time for [the market] to go down yet,” Bollinger said.