U.S. businesses beg Trump team for relief from tariffs as trade war with China rolls on

The Trump administration is moving forward this week with plans to impose tariffs on a wider array of Chinese imports even as it explores the possibility of a negotiated resolution of its deepening trade conflict with China.

On Monday, the U.S. trade representative’s office began an extraordinary six days of public hearings on President Trump’s plans to tax an additional $200 billion worth of Chinese products. The latest tariff proposals, along with earlier levies on $50 billion worth of imports from China, would mean that by next month roughly half of everything U.S. businesses import from China would confront special taxes.

Trump says the tariffs are a response to unfair Chinese trade practices, including forcing American companies to surrender their trade secrets to obtain access to the Chinese market and cybertheft of U.S. technology. Members of both political parties and many industry groups agree that China is guilty of such violations. But as the economic impact of the confrontation with China mounts, opponents are becoming more vocal in their opposition to Trump’s chosen remedy of imposing tariffs.

The planned escalation “dramatically expands the harm to American consumers, workers, businesses, and the economy,” the U.S. Chamber of Commerce said in its prepared testimony.

At the hearings held by the U.S. trade representative’s office, sporting goods manufacturers, candle makers, footwear companies, semiconductor producers and others will plead to be excluded from the next tariffs. More than 1,300 comments have been filed in response to the president’s proposed action, most opposing the plan.

A paintbrush maker in Newark, N.J., said the tariffs could make the hog bristles it buys from China too expensive, forcing it to cancel more than two dozen government contracts.

“If this tariff is enacted, the impact on my small company and its 20 employees will be devastating,” wrote Arthur Edelsen, president of Spectrum Paint Applicator Corp. “I would be put out of business immediately without question.”

On Wednesday, U.S. and Chinese officials are scheduled to meet for the first time in two months to discuss potential solutions to the commercial standoff. The U.S. delegation is led by David Malpass, undersecretary of the treasury for international affairs, while China’s team is headed by Wang Shouwen, vice minister of commerce.

There is little expectation that the meetings will produce a breakthrough. Neither official has full authority to make a deal, and earlier rounds of talks led by more senior officials made little progress.

And Trump told the Reuters news service Monday that he did not “anticipate much” from the discussions.

In March, Malpass was forced to backpedal after telling a conference of bankers in Buenos Aires that he had “discontinued” an official economic dialogue with Beijing. After the Treasury Department publicly contradicted him, he said he “misspoke.”

Although some Chinese officials have expressed concern about their slowing economy and many Republicans in Congress are worried the trade war could cost them votes in November, neither country appears prepared to back down.

So far, the United States has imposed tariffs on $34 billion worth of Chinese products; levies on a further $16 billion worth of products are scheduled to take effect Thursday. China has retaliated with tariffs on an equivalent amount of U.S. goods.

“In both countries, the leadership’s political imperative of talking and acting tough on trade seems to supersede any short-term domestic economic costs from tit-for-tat tariffs,” said Eswar Prasad, former head of the International Monetary Fund’s China division. “The internal political dynamics in each country could make it difficult to contain or find an exit path from escalating trade hostilities.”

Ambiguity over the president’s goals also is clouding prospects for a negotiated solution. During an early round of talks in May, U.S. officials presented the Chinese with an eight-point wish list that included a dramatic reduction in the deficit that the United States runs in trade with China, a halt to subsidies for new technology industries, immediate elimination of various tariffs and other trade barriers and agreement not to retaliate against future U.S. measures.

“The long, vague list that, in effect, asks China to boil the ocean is not actionable,” said Jeff Moon, who was a U.S. trade negotiator in the Obama administration. “A failure to remedy that problem and develop a manageable set of issues would set us up for an indefinite trade conflict with no offramp.”

The administration also remains split between hard-liners such as Peter Navarro, a top White House advisor who wants to force U.S. companies to end their dependence upon Chinese factories, and officials such as Treasury Secretary Steven T. Mnuchin who favor traditional trade policies.

“We still do not know what Trump ultimately wants in a deal,” said Claire Reade, a former U.S. trade negotiator who is now with the law firm Arnold & Porter.

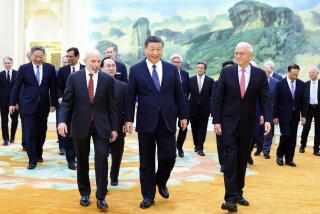

Genuine bargaining may await the personal involvement of Trump and Chinese President Xi Jinping. The two leaders are scheduled to meet twice in November, at an Asian summit in Papua New Guinea and at the Group of 20 meeting in Buenos Aires.

“The chances of a deal soon are still quite small,” said Scott Kennedy, director of the project on Chinese business and the economy at the Center for Strategic and International Studies.

Meanwhile, disruptions from tariffs continue to spread. Purolite, which produces a resin that municipalities use to purify their water supplies, is in the cross hairs for the 25% tariffs that take effect Thursday.

The Bala Cynwyd, Pa., company imports about $50 million worth of chemicals from its wholly owned Chinese subsidiary near Hangzhou and — amid a worldwide shortage of the resin — says that it cannot find an alternative supply.

“This is a health hazard. If they can’t get this product, it can cause another Flint, Mich.,” Purolite Chief Executive Steve Brodie said, a reference to the city that has suffered with tainted water for several years.

Lynch writes for the Washington Post.