Tips for emergency healthcare overseas

While on a two-week vacation in France, Scott Power’s wife, Nicole, contracted swine flu and had to be hospitalized in Paris.

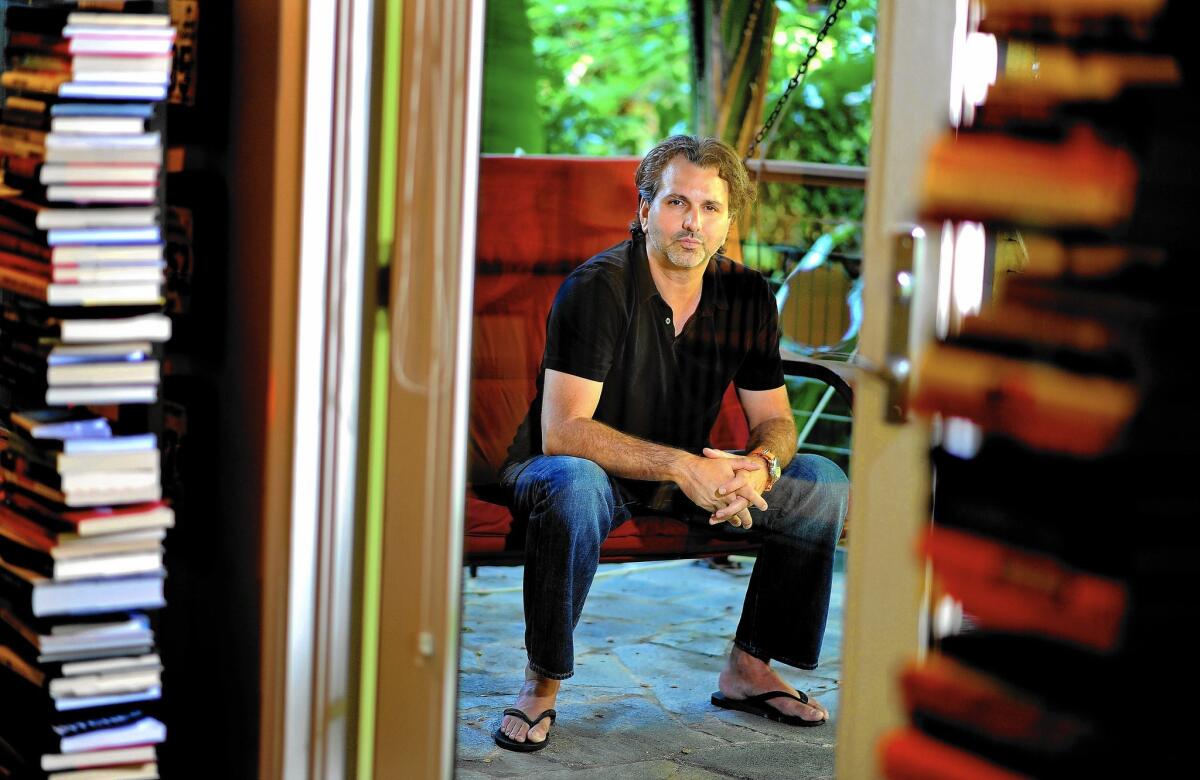

“She becomes deathly ill. It was one of the scariest moments in our relationship,” recalled Power, a 45-year-old Los Angeles entrepreneur.

In a country where he didn’t speak the language, Power was initially at a loss about what he needed to do to help his wife. “Do I call 911?”

Like Power, most people aren’t sure what to do or what insurance covers when a medical crisis occurs overseas.

A recent survey conducted by InsureMyTrip, an online company that compares travel insurance products, found that more than 1 in 4 Americans are unclear whether their health insurance covers any doctor or hospital visits outside the country.

When we’re planning a vacation overseas, the last thing we want to consider is that the trip might be ruined by illness or a medical emergency. But it happens.

Experts offer a range of tips and resources for dealing with an overseas medical emergency.

Insurance coverage. Most health plans cover urgent and emergency care worldwide. The coverage is generally the same as when you go outside your plan’s network of doctors and hospitals at home.

Out of the country, “the member would have the same responsibility for coinsurance, deductibles and other plan requirements that would apply in the U.S.,” says Anjie Coplin, spokesperson for health insurer Aetna.

Expect to pay cash upfront and submit bills for reimbursement when you return home. So remember to keep all your receipts.

Medicare coverage. Neither Medicare nor Medicare Advantage plans cover medical services outside the U.S. — except for under special circumstances in Canada.

But some Medigap plans — extra private insurance to pay healthcare costs not covered by Medicare — may offer some coverage for medical emergencies outside the country.

These policies typically pay 80% of the billed charges once you’ve met your deductible for the year ($250) — as long as the emergency care is first needed within two months of your trip getting underway. There’s a foreign travel emergency lifetime limit of $50,000.

Medicare Advantage plans, which are administered by private insurers, sometimes also offer worldwide coverage.

“I would always encourage people to look at what they have, because a lot of insurance companies have deals with other plans that offer this coverage,” says David Lipschutz, managing attorney with the Center for Medicare Advocacy Inc., a Connecticut-based education and advocacy organization.

Call your insurer. “If you are admitted to a hospital, call your insurance company or have someone do this for you. Your insurance company may be able to help you deal with the situation,” Coplin says.

Check to see whether your insurer contracts with a travel services vendor that connects you to doctors, hospitals, pharmacies and other healthcare services abroad.

Also, ask for copies of your medical records for the care you receive. These may help your insurance company process your claims when you return home.

Consider travel medical insurance. If your insurer doesn’t offer travel services as part of your plan, consider a separate plan. These are short-term policies that cover the cost of care your regular medical plan won’t when you’re away from home.

Prices vary, but on average, you can pick up a policy for roughly $13 a day, says Nate Purpura, spokesperson for online insurance broker EHealth.

The most comprehensive policies cover the cost of having to cancel or cut your trip short because of illness; emergency medical evacuation for you and your family; emergency medical coverage; and baggage protection.

They also give you 24/7 emergency assistance and access to someone who speaks the local language and can help you navigate the situation wherever you’re traveling.

“A good travel insurance company will do the negotiating for you” both with overseas doctors and with your insurance company at home, Purpura says. It will also pay for the cost of your care right away, limiting your out-of-pocket expenses.

Experts suggest looking for a plan that offers comprehensive coverage to ensure you have maximum protection, including care for preexisting health conditions. And, as with any insurance, the devil is in the details. Pay close attention to make sure you understand exactly what is and is not covered.

Look to embassies and nonprofits. You can contact the local U.S. embassy for help in case of a medical emergency. Consular officers can connect you with local medical care.

The nonprofit International Assn. for Medical Assistance to Travellers (https://www.iamat.org) gives you access to a global network of English-speaking doctors and mental health professionals around the world at reasonable rates.

Scott Power did get his medical insurer to fully cover the cost of wife Nicole’s 10-day hospital stay.

It took more than a year and a half to settle the bill — which was a fraction of what it would have been in the U.S., he says. “In my humble opinion they should have looked at the bill and said, ‘Oh my God, what a bargain,’ and paid right away.”

Twitter: @lisazamosky

Zamosky is the author of “Healthcare, Insurance, and You: The Savvy Consumer’s Guide.”