GoPro hopes IPO will fuel expanded media strategy

[This post was updated at 2:25 to reflect additional information filed by GoPro.]

GoPro updated its IPO filing Wednesday, revealing that it plans to sell 17.8-million shares of its stock between $21 and $24 per share. That would make the San Mateo-based maker of action cameras worth about $2.77 billion, assuming an average price of $22.50 per share.

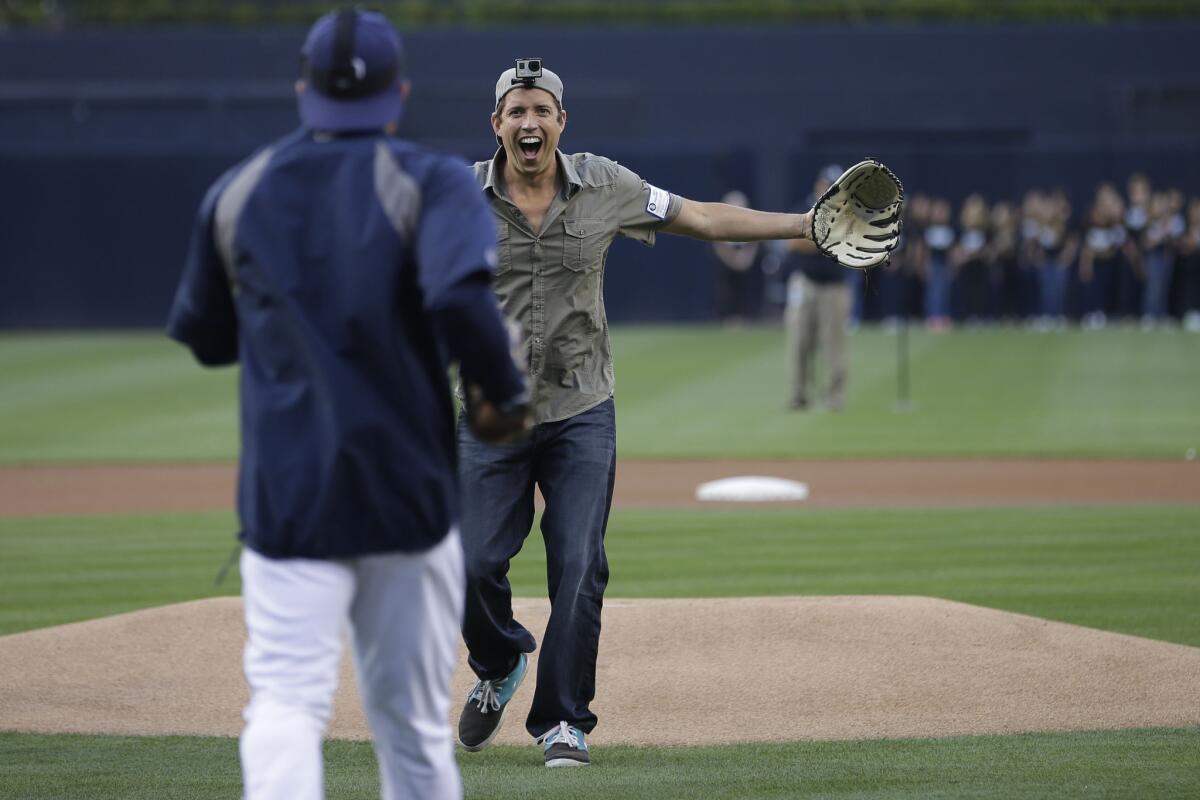

GoPro was founded in 2004 by Nick Woodman, the company’s chief executive and an avid surfer. The company specializes in small cameras that are extremely popular among both professional and amateur athletes.

The company would raise $491.3 million, though half of that is going to insiders who are selling stock. After the bankers and lawyers are paid, the company will pocket about $183.1 million, of which it plans to use $111 million to pay off a loan.

Much of what’s left (admittedly, not a huge sum) will go toward funding its ambition of becoming a full-fledged media company.

“To date, we have generated substantially all of our revenue from the sale of our cameras and accessories and we believe that the growing adoption of our capture devices and the engaging content they enable, position GoPro to become an exciting new media company,” the company says in its prospectus.

That camera business has quietly become a blockbuster. But it’s not all smooth sailing for GoPro.

The company has profits of $61 million on $986 million of revenue in 2013. That was up from $32 million in profits on $526 million of revenue in 2012.

However, during the first three months of 2014, the company posted revenue of $235.7 million. That’s down from $255.1 million a year earlier.

GoPro says it plans to address that revenue issue, in part, by launching a more aggressive media strategy. Those efforts will now be led by Tony Bates, a former high-ranking Microsoft executive and CEO of Skype.

Bates was rumored at one time to be a successor to former Microsoft CEO Steve Ballmer. After being passed over, he left the company earlier this year.

Last week, GoPro announced it had hired Bates to be its president, reporting to Woodman, and to oversee its media strategy. The company also added Dolby Laboratories Inc. Chairman Peter Gotcher to its board.

“I’m fired up to have two seasoned technology veterans like Tony and Peter join our team,” Woodman said in the press release. “As president of GoPro, Tony will focus on our core business as well as scaling GoPro’s fast-growing media operations.”

The videos made by the company’s customers already have massive reach thanks to the huge volumes posted on social media services:

“In 2013, our customers uploaded to YouTube approximately 2.8 years worth of video featuring ‘GoPro’ in the title. Also on YouTube, in the first quarter of 2014, there was an average of 6,000 daily uploads and more than 1.0 billion views representing over 50.0 million watched hours of videos with ‘GoPro’ in the title, filename, tags or description,” the company says in the filing.

What does the GoPro media strategy look like? There are some hints in the IPO filing where, among other things, it points to its partnerships announced earlier this year with Microsoft and Virgin America:

“GoPro programming has developed a dedicated and growing audience. We believe GoPro is well-positioned to become the first media company whose content is captured exclusively using its own hardware. We will continue to expand our distribution of GoPro programming and the reach of the GoPro Network to new platforms such as Xbox Live,” the IPO filing says.

To assist with that, the company is developing a new content management system to make it easier to organize, edit and share its videos. That system is being developed using technology acquired last year when GoPro bought General Things Inc., a Web development firm.

At some point, GoPro says, it may try to charge for some aspects of this new CMS.

In addition, GoPro says it is investing to “scale GoPro as a media entity and develop new revenue opportunities” by developing its own original programming while also finding and distributing the best videos created by its customers.

These efforts will likely take awhile to bear fruit. GoPro says while it expects to get some advertising revenue and third-party sponsorships from places like the Xbox, Virgin and its YouTube channel, it does not expect this money to be “material” in 2014, according to the filing.

Meanwhile, as has been expected, Woodman will become Silicon Valley’s newest billionaire, at least on paper.

Woodman owns an astonishing 49% of the company. Those shares would be worth $1.28 billion at $22.5 per share. Woodman disclosed that he plans to sell 3.56 million shares in the IPO, which will let him personally raise $80.1 million.

[UPDATED: 2:25 p.m.] In additional filings made Wednesday afternoon, GoPro announced a program to let its customers and partners share in the windfall from its IPO.

In a press release, Woodman explained: “At GoPro, we realize that it’s the people who love our products and what we do who are the real heroes here, and it just made sense for us to level the playing field and include them in our IPO.”

Using an investor Website run by Loyal 3, members of the public can buy between $100 and $10,000 worth of pre-IPO stock. The price has not been settled, but GoPro has initially set an initial range of $21 to $24.

The Loyal 3 site now includes a short video by Woodman. And it links to a video of the company’s roadshow.

The company has set aside 1.5% of the stock it plans to offer in the IPO for its customers and fans to participate.

Some day, this will all be road. Until then, follow me on Twitter: @obrien.