Mobile payments start-up Square files to go public

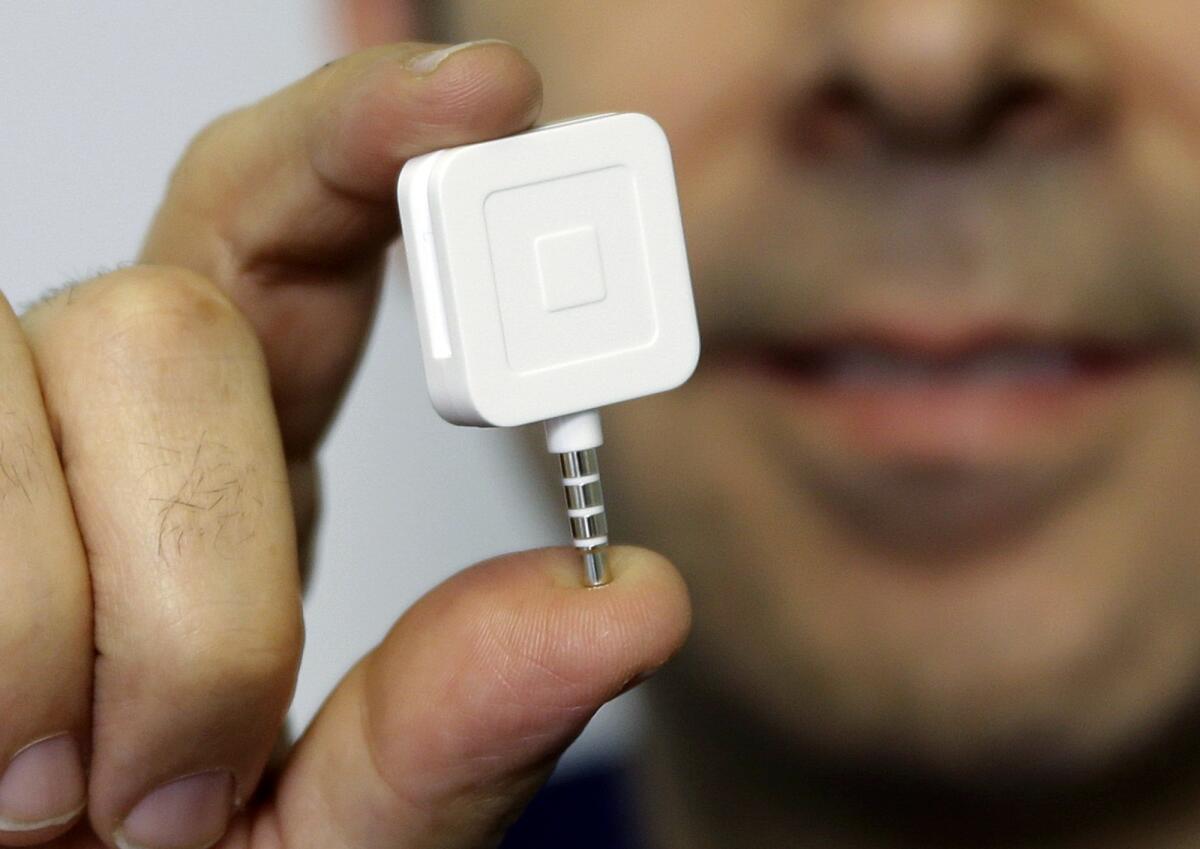

A businessman displays his Square credit card reader.

San Francisco mobile payments start-up Square filed to go public Wednesday, meaning it could soon test whether investors will back a highly-valued, money-losing tech company whose chief executive also runs social media company Twitter.

Square is one of more than 100 tech companies that in recent years have been valued at more than $1 billion in private financing despite not producing a profit or very much of one.

In a Securities and Exchange Commission filing, Square said losses jumped to $154 million last year on $850 million in revenue from about $105 million on $552 million in revenue during 2013. Its most recent private financing valued the company at $6 billion.

A turbulent stock market and a seemingly endless supply of venture capital dollars have led to a slowdown in initial public offerings this year.

The shaky market has stirred fear, though, among venture capitalists that companies such as Square won’t be as highly valued on Wall Street, as investors seek to rein in the difference between share prices and earnings. However, a successful IPO would result in big victories for Khosla Ventures, Sequoia Capital and other venture capital firms with substantial stakes in Square.

It would also mean Twitter and Square Chief Executive Jack Dorsey would be running two public companies amid critical periods. Twitter laid off 8% of its workforce this week, aiming to tighten the focus of its engineering team.

Meanwhile, 6-year-old Square has been ramping up sales efforts, expanding outside the United States and developing new services. Square generates 95% of its revenue from retailers, restaurants and other shops that pay the company a fee to process payments.

Dorsey and software engineer Jim McKelvey co-founded the company after the latter, who is an artist, wanted to accept credit cards when selling an ornamental glass faucet. McKelvey found the process of signing up to swipe credit cards cumbersome. Square’s innovation was a small, square card scanner that plugs into an iPhone’s audio port. It connects to a payments app, and a suite of other financial and marketing services that Square hopes to upsell to businesses.

Dorsey described those options in Wednesday’s SEC filing.

“We’ve made getting capital as easy as tapping a button,” he wrote. “We replaced pen and paper accounting with real-time insights into sales patterns and customer trends. Everything works together seamlessly to help our sellers make smart decisions for their businesses.”

In the first six months of this year, $16 billion worth of purchases were made through Square systems, excluding Starbucks stores. Square had struck a special agreement with Starbucks that is winding down. Excluding that deal, Square generated $199 million in revenue from January through June, recording a loss of $19 million (compared to $44 million in the first six months of 2014).

Square is seeking to list on the New York Stock Exchange under the ticker “SQ.”

Twitter: @peard33