Laws and Funding Thwart Search for Illegal Workers

Every year, the Social Security Administration collects information from companies that could make it easier to crack down on illegal immigration.

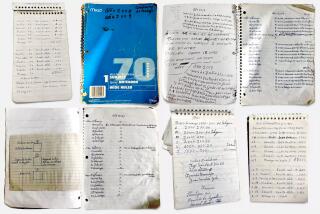

A New Jersey labor broker and a security guard firm in California are among thousands of businesses that have filed Social Security tax payments for a large number of workers that do not match any known taxpayer. That, the Social Security agency says, is a sign that the workers are most likely illegal. In 2001, payments for 96% of the New Jersey company’s workers did not correspond to any taxpayer on file.

Yet the authorities who enforce immigration law have no access to the names of the companies or the workers.

That is just one of many ways that legal barriers, funding priorities and other problems make it hard for immigration officials to go to the one place they know undocumented workers will be: the work site.

With the Senate debating an overhaul of immigration laws, the nation is about to see how much muscle Congress is willing to put into the effort to stop illegal hiring.

Proposals to increase federal oversight of employers and the workplace have long faced opposition from business groups, which say they fear taking on new costs and struggling with flawed government databases.

The House has passed legislation that would require companies to check the legal status of all employees with Homeland Security Department databases. It also would allow enforcement officials to see Social Security wage data and increase civil and criminal penalties for employing undocumented immigrants.

The Senate too is debating compulsory worker checks, along with proposals to boost the number of work-site investigators and raise penalties for hiring undocumented workers.

“Nothing gets enforced. Employer sanctions don’t get enforced,” Sen. Dianne Feinstein (D-Calif.) said during a recent Senate Judiciary Committee hearing. And the fact that existing laws against illegal hiring are not fully enforced, Feinstein said, “in itself is a magnet” attracting more illegal immigrants.

The number of federal workers who focus on finding illegal immigrants on the job has dropped in recent years, from 240 in 1999 to 90 in 2003.

And less than 1% of the money devoted to immigration enforcement is directed to crackdowns at the workplace, with the overwhelming majority spent at the nation’s borders. Last year, 127 employers were convicted for hiring undocumented workers -- a small fraction of the thousands of businesses thought to be using illegal labor.

The one Homeland Security program for checking worker eligibility is voluntary, is subscribed to by a small number of the country’s employers and is off-limits to the agency conducting workplace enforcement.

Knowingly hiring undocumented immigrants became illegal in the U.S. in 1986. Congress required companies to have workers fill out an I-9 form -- stating that the workers were U.S. citizens, permanent residents or authorized to work -- and to check identification.

But it allowed workers to offer any of 29 documents, including report cards for those younger than 18, as proof of their identity and work eligibility. It did nothing to help employers sift forged papers from genuine ones, a task that has become more difficult as forgeries have become more sophisticated. The Government Accountability Office has said that employers can easily hire illegal workers by filling out the I-9 and accepting false documents, knowingly or not.

The Senate and House immigration proposals include limits on the range of acceptable forms of identification and move to make them tamper-proof by equipping them with biometric or machine-readable features.

Last week, President Bush acknowledged the difficulties employers had in checking identification when he talked about an onion grower he recently met: “I don’t think he’s in a position to be able to determine whether or not what looks like a valid Social Security card or whatever they show is valid or not,” Bush said.

One tool employers such as the onion grower could use is Basic Pilot, run by a branch of the Homeland Security Department. It is a voluntary worker-verification program established in 1996 that many in Congress would like to make mandatory for all companies.

Under Basic Pilot, employers enter employee information into a website within three days of making a new hire. The system then matches the information with data at the Social Security Administration and the Department of Homeland Security, using Social Security numbers to confirm or deny the employee’s eligibility to work. Employees who do not get confirmation must be fired.

About 5,500 of the country’s 8 million employers were registered to use Basic Pilot in March.

Legislation before the Senate would require all companies to phase in the program within five years, whereas the House legislation would require firms to screen all new hires within two years of the law’s implementation, with verification of previous hires to be completed in six years.

Some employers have reported that Basic Pilot helped them verify work status, but the program is seen as deeply flawed. Not all its computers are linked; in 2004, 15% of queries to the Homeland Security Department had to be entered manually. The program can detect document fraud, but it is blind to identity theft. Borrowing a legal worker’s name and Social Security number allows an undocumented worker to sail through the checks.

And to the frustration of immigration enforcement agents, the authorities who manage Basic Pilot do not share information. They say employers might avoid signing up if they knew workplace enforcement officials were watching.

“It’s not set up to be an investigative tool,” said Bill Strassberger, a spokesman for U.S. Citizenship and Immigration Services. “It’s set up to be a tool for employers. It’s an aid to employers as they attempt to verify the employment eligibility of their workers.”

Along with the drop in staff numbers has come a decline in employer sanctions. The number of notices of intent to fine issued to companies that knowingly hired an illegal worker or improperly filled out an I-9 form plummeted from 417 in 1999 to three in 2004.

Dean Boyd, a spokesman for the Immigration and Customs Enforcement agency, said the drop in such notices was due in part to the realization that they did little to inhibit some firms who “saw them as the cost of doing business.”

Instead, the agency is looking for ways to apply criminal charges against rogue employers. Boyd said that arrests of undocumented workers and their employers had risen since 2003, and that the immigration agency was planning to beef up its workplace enforcement efforts. Employers are often charged with money laundering or human smuggling, because a criminal case brings greater penalties.

Officials note that the administration’s 2007 budget request allocates $47 million for work-site enforcement and calls for hiring 171 special agents and 35 support staff members.

“We’re building workplace enforcement back up and looking to make this a priority,” Boyd said.

Some lawmakers want to give enforcement officials access to Social Security data that could indicate which companies probably have a heavy concentration of illegal workers. The Social Security Administration tracks incidents of when tax payments do not correspond to any known taxpayer. But the law bars it from sharing the information.

Still, it is unclear whether Congress will approve the law change, as some lawmakers have worried that the change could weaken taxpayer privacy protections.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.