Key points of the GOP’s proposed tax plan

House Republicans released a sweeping tax overhaul that would limit or end many deductions used to minimize how much Americans owe — particularly in high-cost areas like California. The rollout launches a legislative process that will test GOP unity in the coming weeks as the party struggles to deliver one of President’s

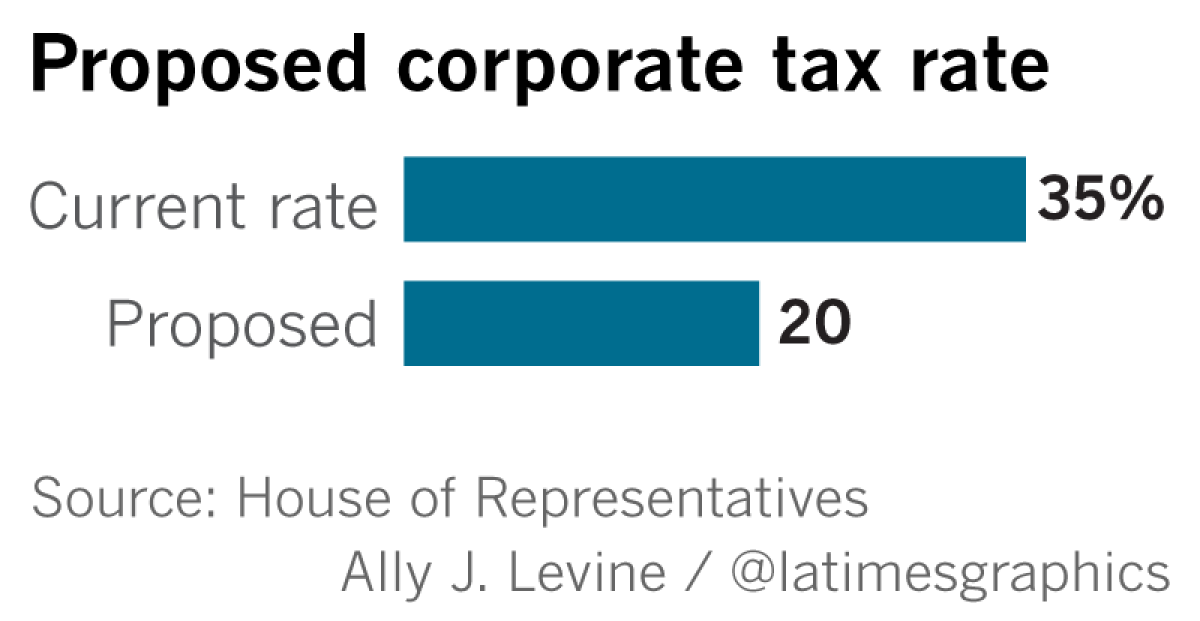

Corporate tax rate

In addition to dropping the corporate rate to its lowest level since 1939, the bill lowers to 25% the top rate paid by so-called pass-through businesses, whose owners file taxes as individuals. Currently, such businesses are taxed at the same rate as individuals, topping at 39.6%. The change may help some small businesses, but also is a boon to law firms, partnerships and real estate companies, including many of Trump’s.

State and local taxes

Eliminates deductions for state and local income and sales taxes and caps property tax deductions at $10,000. Californians would be disproportionately hurt by the change because it has the highest state income tax rate in the nation.

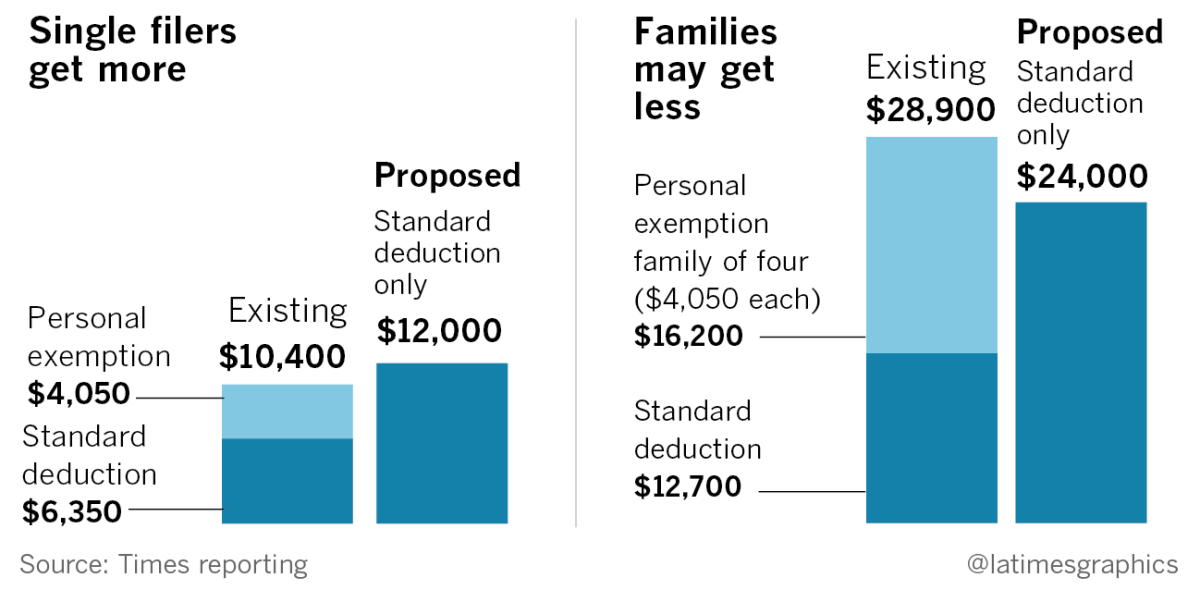

Standard deduction

The plan increases the standard deduction for taxpayers who don’t itemize from $6,350 to $12,000 for individuals, and from $12,700 to $24,000 for couples. But it also eliminates the $4,050 per-person personal exemptions that currently help many taxpayers further lower their bills.

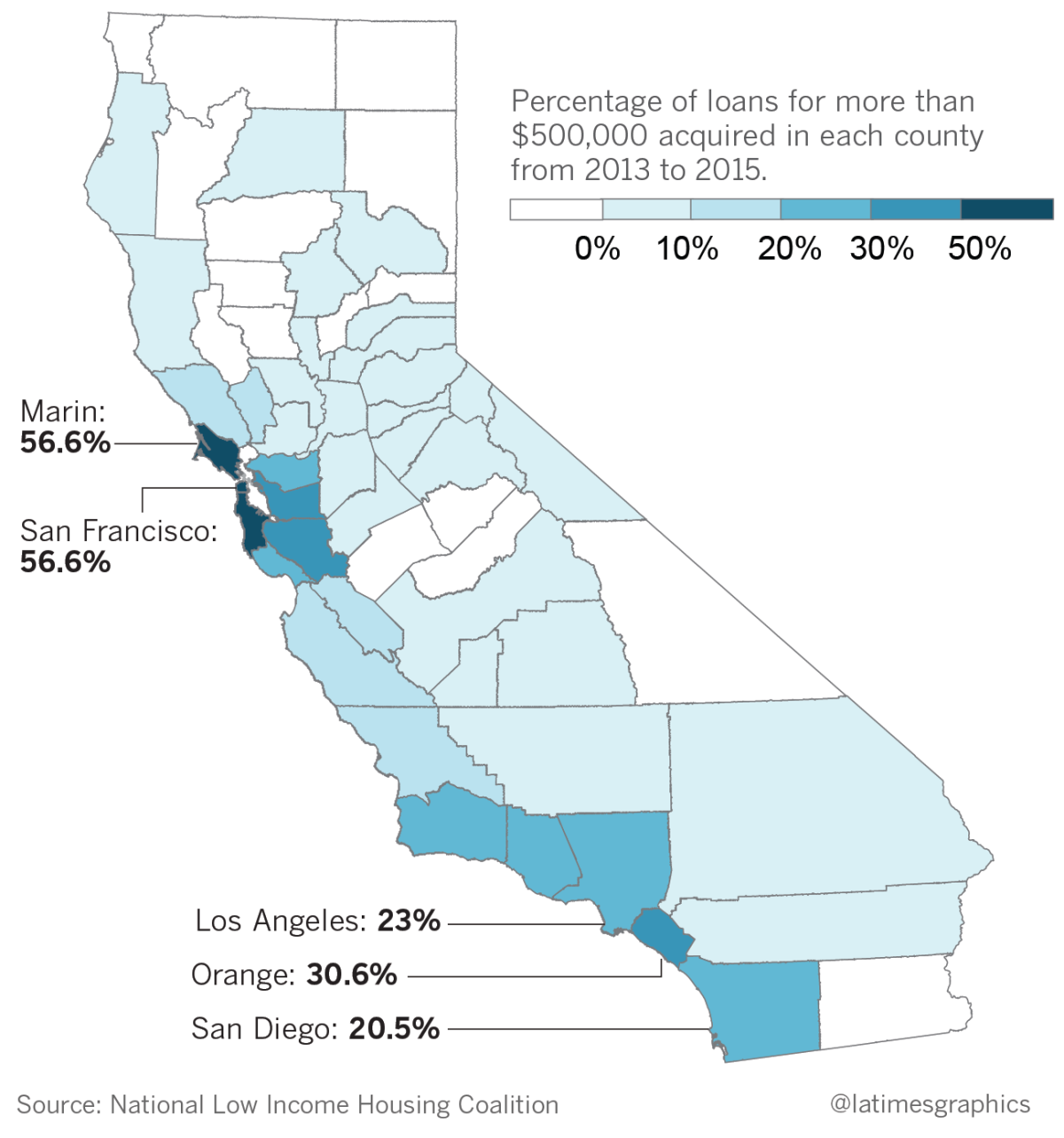

Mortgage interest deduction

The cap on mortgage interest deductions for future home loans drops to $500,000 — down from $1 million. The change, which would only apply to home purchases and mortgages made after Nov. 2 , is likely to deliver a significant blow to California homeowners. Mortgages throughout the state routinely exceed the proposed $500,000 threshold.

Retirement plans

Popular 401(k) retirement savings plans used by many Americans were untouched by the bill, despite some efforts to restrict those tax-deferred accounts in a effort to pay for cuts elsewhere.

Estate tax

And the bill includes a phase-out of the estate tax — a move that mostly benefits the rich and has long been a goal of Republicans. It would double the existing exemption to $11 million for individuals and $22 million for couples starting next year, and fully repeal the tax in 2024.

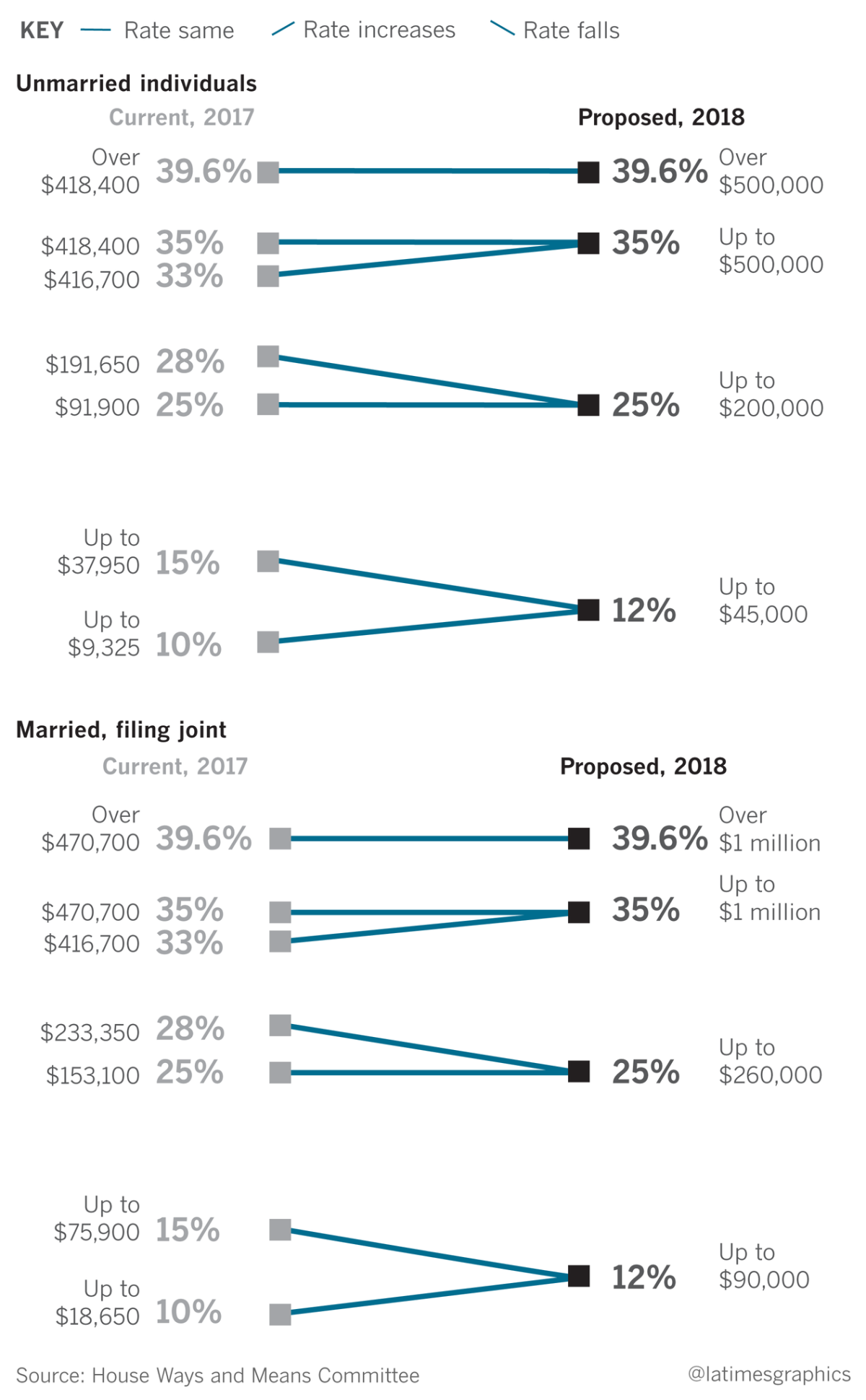

Tax brackets

The number of tax brackets is reduced from seven to four.

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.