U.S.-China trade talks in Beijing raise hopes that a deal may be reached

President Trump on Tuesday raised hopes for an end to the trade war with China, tweeting that talks between U.S. and Chinese officials were “going very well,” as negotiations entered a second day.

His tweet came as talks designed to hammer out the details of a hoped-for agreement continued late into the day, with time running out as a March 1 deadline nears.

The talks, planned for two days were then extended into a third day in a sign progress was being made.

Pressure for a deal has grown as billions of dollars in tariffs impact both the U.S. and Chinese economies — although China’s growth has been slowing for different reasons, including government moves to curb debt.

When they met over dinner last year at the Group of 20 summit in Buenos Aires, Trump and Chinese President Xi Jinping agreed to postpone tariff increases due to take effect Jan. 1 to allow negotiations. Trump on Sunday portrayed China as keen for a deal because of its slowing economy.

In a sign of China’s eagerness to reach a compromise, Beijing has offered several concessions in recent weeks, including temporarily cutting tariffs on U.S. cars, buying American soybeans and drafting a law banning Chinese firms from demanding intellectual property from foreign partners, a key complaint of American firms doing business in China. Late last month the Chinese customs authority announced it would allow the first imports of American rice, seen as a goodwill gesture in the lead-up to this week’s talks.

At the heart of the trade conflict are long-held American concerns that China has not opened its economy sufficiently to foreign competition or treated foreign companies fairly, despite its accession to the World Trade Organization in 2001. U.S. officials believe China has not lived up to past promises on key areas of conflict, including protection of intellectual property and China’s subsidies to state-owned firms.

China was under pressure in the Beijing talks to show U.S. officials that this time things would be different — as well as to agree on mechanisms to enforce the deal.

U.S. Commerce Secretary Wilbur Ross warned Monday in comments to CNBC the key issue in any deal would be enforcement, though he said there was a good chance of achieving a reasonable agreement.

Any deal would likely also see China increasing imports of soybeans and American liquefied natural gas.

The state intellectual property office of China announced Monday that it would step up moves to protect intellectual property in 2019 and would deepen international cooperation to catch offenders. China’s agriculture ministry Tuesday announced approval for imports of five U.S. genetically modified crops including canola, corn and soybean, in a further goodwill gesture.

Foreign Ministry spokesman Lu Kang said Tuesday that China’s position in the trade talks was open and clear to the United States.

“China’s position on resolving Sino-U.S. economic and trade frictions is also open and transparent,” he said. “We have sincerity and firm will on this issue. The U.S. is very clear about China’s position.” He ruled out any link between the trade talks in Beijing and a visit to the capital by North Korean leader Kim Jong Un, which began Tuesday.

Asked whether China might use the Kim visit as a bargaining chip in the trade talks, Lu said, “I don’t think China needs to send any messages across to the U.S. through playing tricks.”

Kim’s visit comes ahead of a possible second summit with Trump, but the U.S. president needs China’s help to secure denuclearization of the Korean peninsula by pressing Kim to move ahead on the issue.

As part of its effort to appease the Trump administration, China has also taken a softer approach to its Made In China 2025 strategy — its plan to emerge as a world leader in 10 high-tech fields by then. Officials and state media have avoided the term in recent months.

The Trump administration is also demanding China cut state subsidies to large state-owned companies; however, this is central to China’s economic and strategic approach.

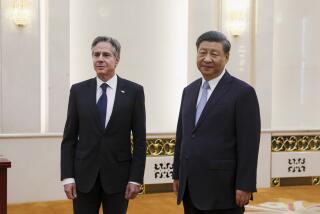

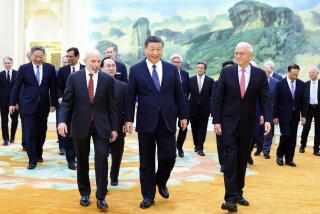

Vice President Liu He, Xi’s top economic advisor, showed up unexpectedly for the talks among dozens of other Chinese officials, leaked photos showed, a sign of the importance placed on the two-day meeting by the Chinese government. The presence of such a senior official was a surprise. The smaller U.S. delegation was led by Deputy U.S. Trade Representative Jeffrey Gerrish, and included agricultural and energy officials.

The trade war blew up last year with tit-for-tat tariffs on billions of dollars in Chinese and American goods, with Trump threatening new hikes if a deal was not reached by the deadline.

It comes amid mounting global rivalry between the U.S. and China, which has built military installations in the disputed South China Sea and has extended its global reach through the Belt and Road Initiative — a vast infrastructure program building railroads, ports, highways and other projects in dozens of nations, financed by Chinese loans.

Even if Xi does offer enough sweeteners to satisfy Trump, any deal would be unlikely to avert a period of protracted military and technological rivalry between the world’s two largest economies, likely to last decades, according to analysts.

“The trade dispute is just one component of a much broader shift in the U.S.-China relationship towards friction and contention. A possible trade deal by the March 1 deadline will do nothing to change the broader geopolitical dynamic, the intensifying technology competition or the increasing focus in the U.S. on People’s Republic of China influence [or] interference,” said China analyst Bill Bishop, author of the newsletter Sinocism.

But he backed Trump’s view that China wanted a deal.

“The Chinese do need to make a deal, both because the trade conflict is exacerbating underlying problems in their economy and also because I hear Xi is quite concerned about the possibility of U.S. decoupling from China, especially in technology,” he wrote in a recent analysis.

“However, the Chinese side cannot accede to all U.S. demands without making structural changes that could pose an existential challenge to the [Communist] party’s view of how the economic system needs to be structured, so whether or not there is ultimately a deal will come down to how much is enough from the Chinese side to get President Trump to say, ‘We have a deal.’”

One analyst, Robert D. Kaplan, senior fellow at the Center for a New American Security, said America and China are entering a new “cold war,” regardless of the outcome of the trade talks. He added it would last decades even if there was a trade deal, writing in an article in Foreign Policy:

“This is because the differences between the United States and China are stark and fundamental. They can barely be managed by negotiations and can never really be assuaged.”

An editorial in China’s state-owned Global Times said the trade war came about because of U.S. fears about China’s global rise and warned that Washington should not assume China would not strike back fiercely.

“The fundamental reason for the extensive and bitter trade war lies in China’s rise, which has shaken the U.S.-led global power structure,” the editorial said. “Even if the U.S. regards China as its No.1 competitor, it needs to plan more carefully how to safely pressure China rather than implement a trade war as if fighting a close encounter. The world needs more certainties in 2019 and so does the U.S.”

The U.S. enacted the National Defense Authorization Act in August, banning government agencies from using technology of Chinese firms Huawei and ZTE because of security concerns. The U.S. also pressed its allies including those in the “Five Eyes” intelligence-sharing alliance — Canada, Britain, Australia and New Zealand — to block Chinese firms such as Huawei and ZTE from sensitive 5G networks. So far, Australia, New Zealand and Japan have done so.

Reuters reported last month that the White House was considering an executive order banning American telecommunications companies from buying Chinese technology.

Twitter: @RobynDixon_LAT

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.