Viacom Chairman Reacts to Criticism on Eve of Paramount Auction

As the takeover battle for Paramount Communications Inc. approaches a final deadline, Viacom Inc. on Sunday responded to questions about purchases of its stock that have added controversy to its bid.

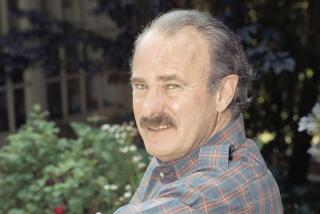

In a written statement, Viacom Chairman Sumner M. Redstone said purchases of Viacom stock by National Amusements Inc., which he owns, were “totally lawful and appropriate.”

He also described as “totally inaccurate” assumptions that he controls WMS Industries Inc., a maker of pinball and gaming machines in which he holds a 24.9% stake.

Critics have portrayed purchases of Viacom stock by Redstone and WMS as efforts to boost the stock and therefore Viacom’s half-stock, half-cash offer for Paramount, valued at the time in the range of $9.5 billion.

Viacom’s rival in the takeover battle is QVC Network Inc., a home shopping service.

Seeking to distance itself from the flap over stock purchases, Viacom said Sunday that it declined an earlier WMS offer to invest $50 million directly in the proposed Viacom-Paramount merger.

Shortly afterward, Viacom announced agreements with Blockbuster Entertainment Corp. and NYNEX for a total of $1.8 billion in merger financing.

Redstone’s statement came one day before the deadline for sealed bids in the multibillion-dollar battle for control of Paramount.

Both the QVC and Viacom offers are expected to be $10 billion to $11 billion, or $85 to $92 a share, arbitragers said.

Paramount’s stock ended Friday at $81.625, up 37 1/2 cents on the New York Stock Exchange.

The Wall Street Journal reported earlier this month that the Securities and Exchange Commission was looking into trading in Viacom shares, both before and after Viacom had reached a tentative agreement to buy Paramount.

In late November, a Delaware chancery court judge moved to slow down a friendly Viacom-Paramount union and ease the way for competing offers.

The decision led to today’s auction.

Viacom said Sunday that investments in Viacom by National Amusements were carried out with full public disclosure and that Redstone had no knowledge of purchases of Viacom stock by WMS.

QVC’s current bid of $90 per share cash for 51% of Paramount and securities for the rest is valued at about $10.05 billion, or $84.10 per share. Viacom’s bid of $85 per share in cash for 51% and securities for the rest is worth about $9.6 billion, or $80.33 per share.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.