Market shrugs off trade concerns as tech, bank and industrial companies lead it to gains

Technology companies, banks and industrial companies all rose Thursday as investors continued to let go of some of their concerns about the trade dispute between the U.S. and China.

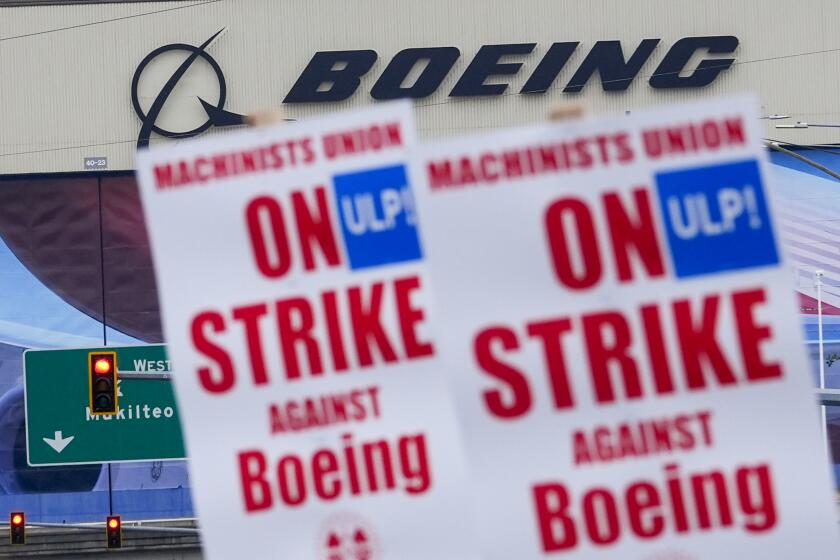

Big tech companies such as Apple and Microsoft, the market’s leaders over the last year, rose again. They have struggled recently as investors wondered whether the trade tensions would spiral into a bigger dispute that affects global economic growth and stock prices. Industrial companies such as Boeing and Caterpillar gained ground as well, with airlines climbing after Delta reported solid results in the first quarter. Bond prices dropped and interest rates rose, which helped banks.

The market has been jittery in March and April as investors worried about tariffs and other barriers to trade. Investors may have been pleased to hear that, according to a group of legislators, President Trump asked members of his administration to explore the possibility of the U.S. rejoining trade talks with 11 Pacific nations. Those countries formalized a deal last month after Trump rejected an earlier agreement that involved the U.S. called the Trans-Pacific Partnership.

The S&P 500 index gained 21.80 points, or 0.8%, to 2,663.99. The Dow Jones industrial average added 293.60 points, or 1.2%, to 24,483.05. The Nasdaq composite climbed 71.22 points, or 1%, to 7,140.25. The Russell 2000 index of smaller-company stocks advanced 10.52 points, or 0.7%, to 1,557.33.

The S&P 500, a benchmark that is used by many index funds, has fallen for three of the last four weeks as the trade situation dominated Wall Street’s attention. But the S&P is up 2.3% so far this week as investors felt new proposals by Chinese President Xi Jinping could help avert a trade war.

Xi said his government will reduce tariffs on imported cars, improve intellectual property protection and open China’s financial markets. On Thursday China’s government denied that Xi was trying to resolve the dispute and said negotiations with the U.S. aren’t possible right now, but investors sent stocks higher anyway.

Apple rose 1% to $174.14, and Microsoft picked up 1.9% to $93.58. Technology companies have made big gains since the start of 2017 but have stumbled in recent weeks. Investors sold the stocks as they worried that the U.S.-China trade dispute might slow the global economy and make the high prices of those stocks harder to justify.

Bond prices fell, causing the yield on the 10-year Treasury note to rise to 2.83% from 2.79%. That helped banks because higher yields mean they can make more money from mortgages and other types of loans. Big dividend stocks such as utilities and household goods companies fell, as investors see them as an alternative to bonds and they are less interested in buying them when yields rise.

Companies are starting to report their first-quarter results. Investment firm BlackRock gained 1.5% to $533.01 after it surpassed Wall Street’s expectations at the start of the year.

Home goods retailer Bed, Bath & Beyond plunged after it gave a weak forecast for the fiscal year. The company also said it expects its earnings to decline next year, and its stock fell 20% to $17.21. Online rival Amazon.com gained 1.5% to $1,448.50.

Oil prices continued to trade at three-year highs. Benchmark U.S. crude rose 0.4% to $67.07 a barrel in New York. Brent crude, used to price international oils, shed 0.1% to $72.02 a barrel in London.

Precious metals prices tumbled. Gold dropped 1.3% to $1,341.90 an ounce and silver fell 1.8% to $16.47 an ounce. Copper lost 1.7% to $3.06 a pound.

Wholesale gasoline lost 0.6% to $2.05 a gallon. Heating oil dipped 0.4% to $2.08 a gallon. Natural gas rose 0.4% to $2.69 per 1,000 cubic feet.

Bristol-Myers Squibb fell and Pfizer rose after an analyst for Citi Investment Research said a deal between the two drugmakers isn’t likely to happen. Analyst Andrew Baum said he met with Pfizer’s top executives Wednesday and that they have “no interest” in Bristol-Myers or other major deals right now. Bristol-Myers lost 2.2% to $58.84, giving it a market value of $96 billion. Pfizer rose 1.5% to $36.32.

Drugmaker Mallinckrodt dropped after a former employee filed a whistleblower lawsuit against the company. Rasvinder Dhaliwal said Mallinckrodt asked her to mislead an insurance company so it would cover Acthar gel, a drug that brings in more than one-third of Mallinckrodt’s revenue and said an executive acknowledged the company misled payers about what Acthar is made of.

The lawsuit says she had numerous other concerns about potentially illegal or improper behavior, but the company retaliated against her for bringing them up and ultimately fired her last month.

Mallinckrodt said it “vehemently disagrees with the allegations” and will defend itself in court. Its stock fell 6.8% to $13.89.

The dollar rose to 107.23 yen from 106.95 yen. The euro fell to $1.2329 from $1.2362.

The DAX in Germany rose 1% and France’s CAC 40 added 0.6%. The FTSE 100 in Britain rose less than 0.1%. Japan’s benchmark Nikkei 225 stock index dipped 0.1%, while the Kospi in South Korea ended 0.1% lower. Hong Kong’s Hang Seng fell 0.2%.

UPDATES:

1:55 p.m.: This article was updated with closing market data.

7:20 a.m.: This article was updated with revised market data.

This article was originally published at 7:05 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.