Want a tax break on that lap dance? No dice, court says

Payments for lap dances are not exempt from state taxes because they do not promote cultural or artistic performances in local communities, the New York State Court of Appeals ruled Tuesday.

In a 4-3 decision, the state’s highest court ruled that the cover charge collected by the Nite Moves strip club in Albany and the payments its lap dancers earned didn’t qualify for the state’s tax exemption for “dramatic or musical arts performances.”

If ice-skating shows with meticulously choreographed music and dance numbers aren’t exempt, then “a club presenting performances of women gyrating on a pole to music, however artistic or athletic their practiced moves are, was also not a qualifying performance,” wrote Judges Carmen Beauchamp Ciparick, Victoria Graffeo, Eugene Pigott Jr. and Theodore Jones Jr. in their affirming opinion.

The business owed more than $124,000 in taxes, according to a court filing. A majority of the club’s revenue came from the $15 it collected on every $25 private dance, with the other $10 going to the dancer. Nite Moves charged $10 for guests to enter the business.

The judges pointed out that other forms of entertainment, such as baseball games, carnivals, ice shows and animal acts, are not exempt from taxes in New York.

In a strongly worded dissent, Judge Robert S. Smith wrote that the “distinction between highbrow dance and lowbrow dance” raises “significant constitutional problems.”

“The people who paid these admission charges paid to see women dancing,” Smith wrote. “It does not matter if the dance was artistic or crude, boring or erotic. Under New York’s Tax Law, a dance is a dance.”

Personally, Smith said, he finds the entertainment distasteful. But he also would not want to see Hustler magazine taxed differently than the New Yorker.

“That sort of discrimination on basis of content would surely be unconstitutional,” he wrote. “It is not clear to me why the discrimination that the majority approves in this case stands on any firmer constitutional footing.”

ALSO:

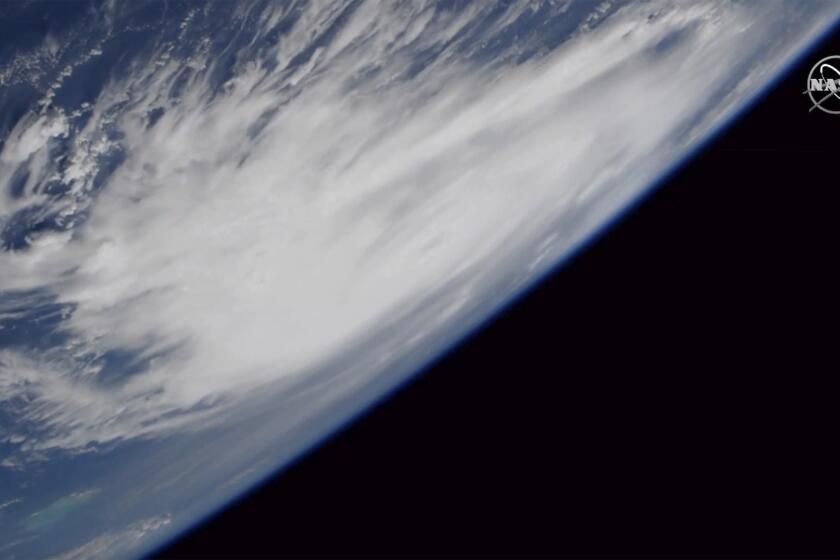

Frost on Mars? Curiosity uses its laser to probe mystery

Texas reviewing old arson convictions for suspect evidence

Taped beating: No charges against man struck by New York cops

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.