Taxing tobacco

In case there was any lingering doubt, the Obama administration made clear Tuesday that it won’t be writing a big check to extricate California from its budget mess. It’s also unlikely, given the current political atmosphere, that the necessary supermajority of lawmakers will adopt a broad new tax. But small, targeted taxes can be part of a rational budget solution to help the state keep its safety net intact. Assembly Bill 89, by Democrat Tom Torlakson of Contra Costa County, offers one such rational revenue source by imposing a tax on tobacco products. The Legislature should pass it.

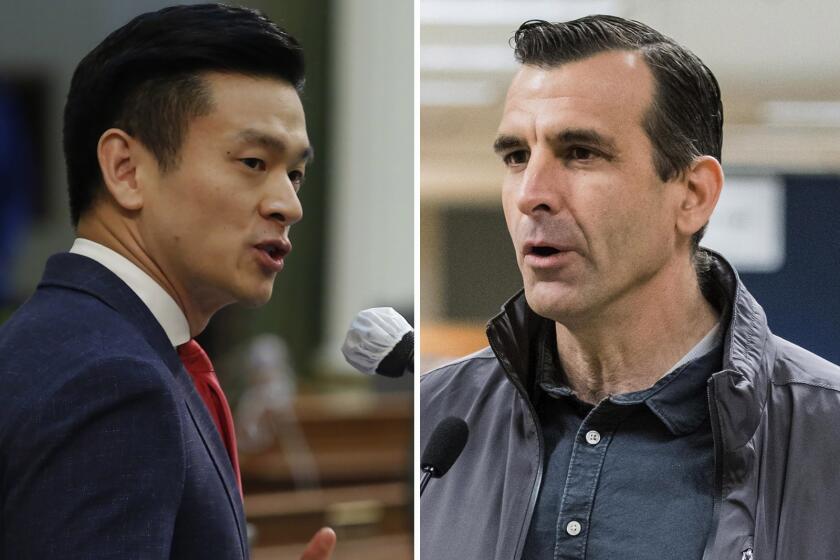

In a recession, new taxes are hard for taxpayers to absorb and can slow recovery by slowing consumption, but the economy also can be damaged by deep state cuts that eliminate basic services and drive thousands of Californians into more costly county safety net programs. Balance is the key. Lawmakers of any stripe should consider targeted taxes carefully and ask whether they’re an attempt to avoid responsible budgeting or part of a fair and constructive policy decision. AB 89 and its Senate counterpart, SB 600 by Democrat Alex Padilla of Los Angeles -- endorsed Tuesday by the L.A. County Board of Supervisors -- fall into the latter category.

At first glance, tobacco taxes may seem a bit too easy. Smokers are a convenient and unpopular class. But they’re more than a source of revenue; they’re a source of heavy costs to the state’s public health infrastructure. Making it harder for kids to buy cigarettes is a good thing and would be reason enough to raise tobacco taxes even in the best of budget years.

But the state also needs money, and if tobacco taxes discourage smoking, won’t they necessarily raise less money each year? Perhaps. That’s a good reason not to rely on them over the long term. But in the short term, a tax of $2.10 per pack of cigarettes (in addition to the current 87 cents) would generate almost $2 billion and obviate the need for the state to raid local government treasuries or eliminate cost-saving programs that provide health insurance to children.

There are alternatives, such as letting counties tax tobacco to pay for programs currently funded by the state. But such a move seems unlikely in the short term.

All Californians should pay for education and safety net services because those programs benefit more than just the direct recipients; they contribute to a state that is economically, as well as physically, healthy. But for the present, a broad tax is untenable, and crucial services are on the block. If the Legislature can save them with a tobacco tax and discourage smoking in the bargain, it should.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.