Tesla factory racing to retool for new models

FREMONT, Calif. — Xavier, Wolverine, Iceman, Thunderbird and Cyclops were all working hard.

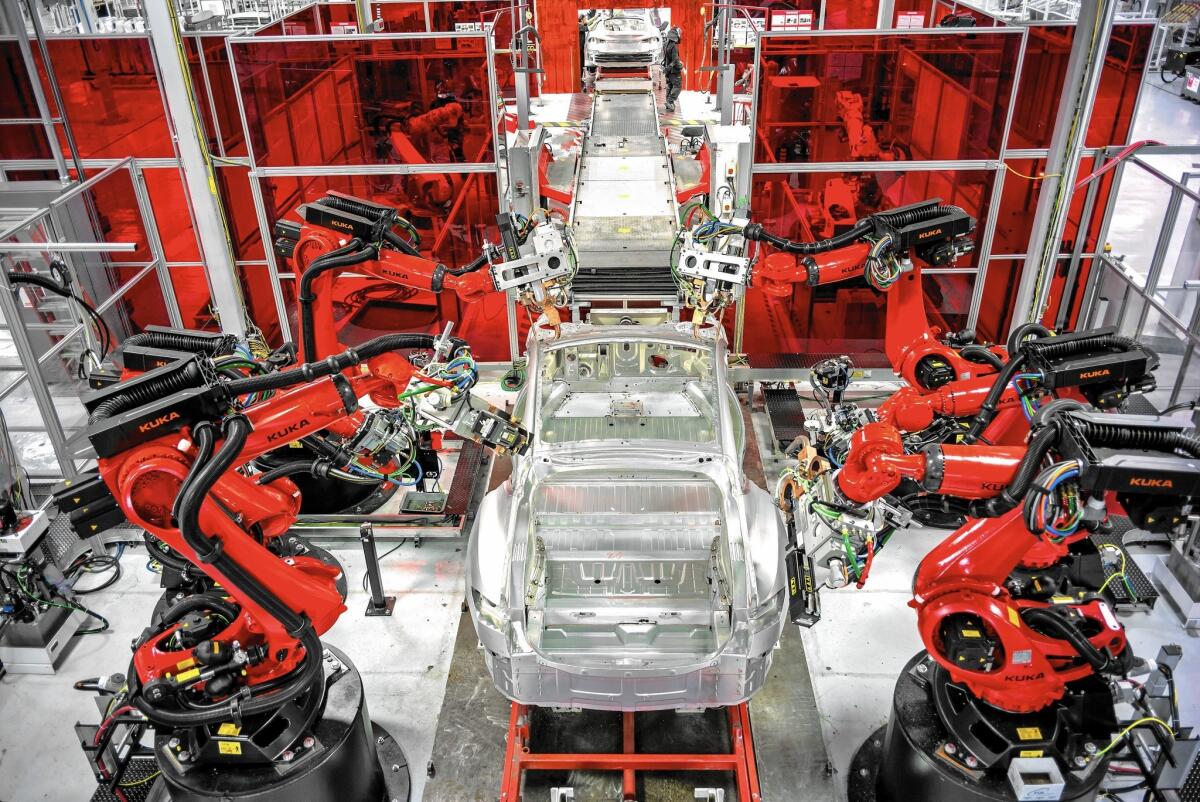

In balletic movements, the massive robots, among the world’s largest industrial machines, were silently building Tesla electric cars.

Named by Chief Executive Elon Musk after popular comic book characters, the robots are essential features of the 5.3-million-square-foot Tesla plant that every week turns out as many as 1,000 of the $85,000-plus Model S sedans.

Musk and his electric car company are going to need all the superhero robots they can find.

Having just reported a $107.6-million fourth-quarter loss that sent its stock tumbling, Tesla Motors Inc. intends to double vehicle production in the next year as it finally introduces its Model X sport utility vehicle — after about two years of delays.

Meanwhile, Tesla is racing to finish the design of its Model 3, the “affordable” Tesla, expected to sell in the $30,000 range after government subsidies. Musk’s company is chasing General Motors Co., which plans a 2017 release of its all-electric Bolt, with a similar price and 200-mile driving range between charges.

“Tesla is not going to be the only kid on the block anymore,” said Thilo Koslowski, vice president of automotive for Gartner Inc. “To date, they have been a highly desirable brand with a unique product. Maintaining that, going forward, will be tricky.”

Tesla has so far failed to build cars as quickly as customers want to buy them. The company has outstanding orders for 10,000 Model S sedans, and reservations for 20,000 of the Model X SUVs, according to filings.

Still, the Palo Alto-based automaker commands an almost cult-like devotion among owners and especially employees.

“We have to succeed,” said Adam Slusser, who runs factory tours at the Fremont facility. “If we fail to bring about this electric-car revolution, this chance may not come again in our entire lifetimes.”

Musk and his Model S have fans on Wall Street too. Tesla shares, even after their midweek tumble, are trading at about $200. That’s up from about $40 two years ago, though well off the peak of $286 in September.

Musk is “a Thomas Edison for our times,” said Cathie Wood, founder and chief investment officer for Ark Investment Management. “He is ushering in a very important period of time, when we are shifting away from internal combustion technology to battery technology.”

More skeptical analysts believe that this year will be crucial to Tesla’s long-term survival. To succeed, the company must deliver on the hype surrounding Model X — an all-electric, seven-passenger SUV with a price tag similar to Tesla’s only current car, the Model S. The sport sedan starts at more than $70,000 and typically sells for about $100,000.

“Tesla announced the Model S in 2008 and came out with it in 2012, and the car could do no wrong,” said Michael Harley, editor in chief of the auto sales search engine AutoWeb. “But the company hasn’t delivered anything innovative or exciting since.”

Tesla has lost its luster, he said, and could soon lose credibility.

At the Fremont factory, the massive machines — and an estimated 6,000 human workers — struggled in late 2014 to produce a high-performance version of the Model S, the P85D, while retooling the factory to churn out the upcoming Model X.

Tesla had promised to hit a 2014 production goal of 35,000 vehicles, and just managed to do it — working through the Thanksgiving, Christmas and New Year’s holidays. The company so exhausted its workforce, Musk told analysts this week, that he gave the entire factory a week off in January.

Musk has announced his intention to double production every year for the next several years. Last week he told analysts that the company expected to deliver about 55,000 Model S and Model X vehicles in 2015.

He said those numbers will continue to climb. Tesla will be able to make as many as 50,000 Model X SUVs in 2016, Musk said.

By the time the Model 3 is in production, he said, the factory should be able to produce 10,000 cars a week — a number some analysts doubt, given Tesla’s projected figure of 10,000 vehicles in the first quarter of 2015.

“How’s he going to do that?” asked Kelley Blue Book senior analyst Karl Brauer. “How’s he even going to get to 55,000 a year?”

Increasingly mindful of the delays, Musk told analysts that the first versions of the Model 3, at least, will not be an “adventurous” engineering exercise.

“We’re being quite conscientious about that,” he said. “We’re not going to go super-crazy with the initial design of the Model 3.”

In the most recent delay, Tesla underestimated how many buyers would want the new, faster Model S.

“It turns out — a lot!” the sometimes self-deprecating Musk said. “It’s difficult to forecast demand. I’d love to figure out how to be less stupid about this in the future.”

The factory was built in 1962 as a GM plant and later became a joint GM-Toyota operation that produced half a million Toyota Corollas, Matrixes, Geo Prisms and Pontiac Vibes a year. It has the capacity for a swing shift, if needed, and even 24-hour production.

But the 380-acre campus, which sits off Interstate 880 northeast of San Jose, just miles from the plant where Ford Motor Co. once produced Mustangs, has run out of parking places for workers, Musk said.

Most of the estimated 10,000 parts that go into a Tesla are manufactured on site. Some performance parts, such as the Brembo braking systems, are made elsewhere, as are the batteries — for now. They come from Panasonic Corp.’s factories in Japan, but in the future they will be made at Tesla’s $5-billion “gigafactory” under construction outside Sparks, Nev.

The Fremont factory shows an impressive attention to detail.

Each vehicle’s lush paint job, the result of multiple hand-sanded and hand-rubbed coats of paint, is done in an almost hospital-like environment. Workers must be tested before getting a paint shop gig to make sure that vapors from their hair and skin products don’t cause the painted surfaces to bubble and pit.

Tesla is spending what Musk called “staggering amounts of money” on ramping up for mass production.

Some upgrades have come at bargain prices. Tesla picked up a $50-million hydraulic press, which Tesla claims is the largest in the U.S., for only $4 million from a company going into bankruptcy.

The massive press, which will make parts for the S and X models, had to be disassembled for the month-long trip to Fremont. Then the factory roof had to be raised to accommodate its four stories below ground and three above.

It currently takes about five workdays to build a Model S. By comparison, it takes about 20 hours to build a Ford Fusion, and about the same amount of time to build a Toyota Camry, representatives for those companies said.

Despite the challenges ahead for Tesla, there’s a palpable atmosphere of enthusiasm and good humor inside the Fremont plant.

“We all have a vision of something much bigger than ourselves,” Slusser said. “That’s why this is such a different company.”

Electric tour trams — the company gives an estimated 35 guided factory tours a week — make photo opp stops for grinning fans who, perhaps having visited the gift shop on previous visits, already own Tesla T-shirts, caps and jackets. Looking to a future generation of Tesla buyers, the shop sells branded onesies and infant T-shirts.

Buyers can pick up their new Teslas from a customer delivery center here, which will ply them with free coffee and a factory tour before sending them away in their new electric cars.

While the auto world waits for the Model X, analysts said the delivery of the Model 3 will make or break the company.

“Model 3 is essential,” Koslowski said. “No car company can survive when their lowest-priced vehicle costs $70,000. Even Porsche and BMW offer vehicles at $50,000.”

ALSO:

Tesla’s Elon Musk talks about sex and retirement

Tesla Motors’ Elon Musk plans to build cars that fly and swim

Scientists kick a robot that’s so much like a dog you want them to stop