Allergan urges shareholders to reject Valeant buyout offer

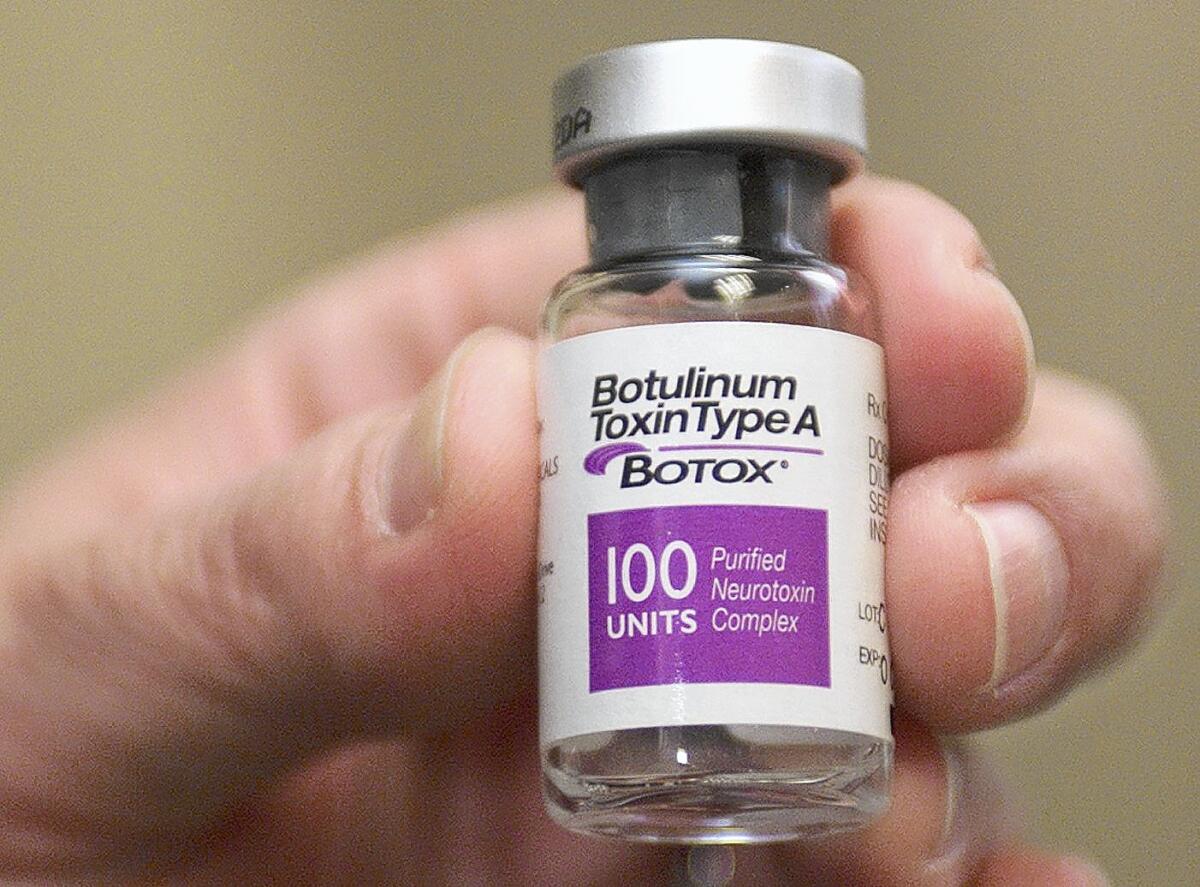

Allergan Inc., the Irvine company that makes Botox, is urging shareholders to reject a buyout offer from a Canadian pharmaceutical firm.

Valeant Pharmaceuticals International Inc. said last week that it will take its acquisition offer directly to Allergan shareholders after the Orange County company twice rejected its acquisition offers.

Under the deal, Allergan shareholders can exchange their stock for $72 in cash and 0.83 of a share of the Canadian firm. Based on Monday’s closing price, that would amount to $172.60 per Allergan share — about 5% higher than Allergan’s closing price Friday.

Allergan’s board has rejected two previous offers from Valeant, and it urged shareholders to do the same Monday.

David E.I. Pyott, Allergan’s chief executive and chairman, said in a news release that Valeant’s offer is “grossly inadequate, substantially undervalues Allergan and is not in the best interests of Allergan and its stockholders.”

“The board strongly recommends that Allergan stockholders reject Valeant’s exchange offer,” Pyott said, “and prevent Valeant from taking control of Allergan at a price that does not appropriately reflect the underlying value of Allergan’s assets, operations and prospects, including our industry-leading position and projected growth opportunities.”

A Valeant spokeswoman did not respond to a request for comment. The company’s CEO, J. Michael Pearson, has previously said the merger would be best for both companies and generate significant value for Allergan shareholders.

“We strongly believe that applying Valeant’s operating philosophy, strategy and financial discipline to a broader set of durable assets will continue to create substantial returns for shareholders over the short, intermediate, and long term,” Pearson said in a recent statement. “We are very committed to getting this deal done.”

Allergan shares fell 50 cents Monday to $164.82. Valeant’s stock dropped 72 cents to $121.21.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.