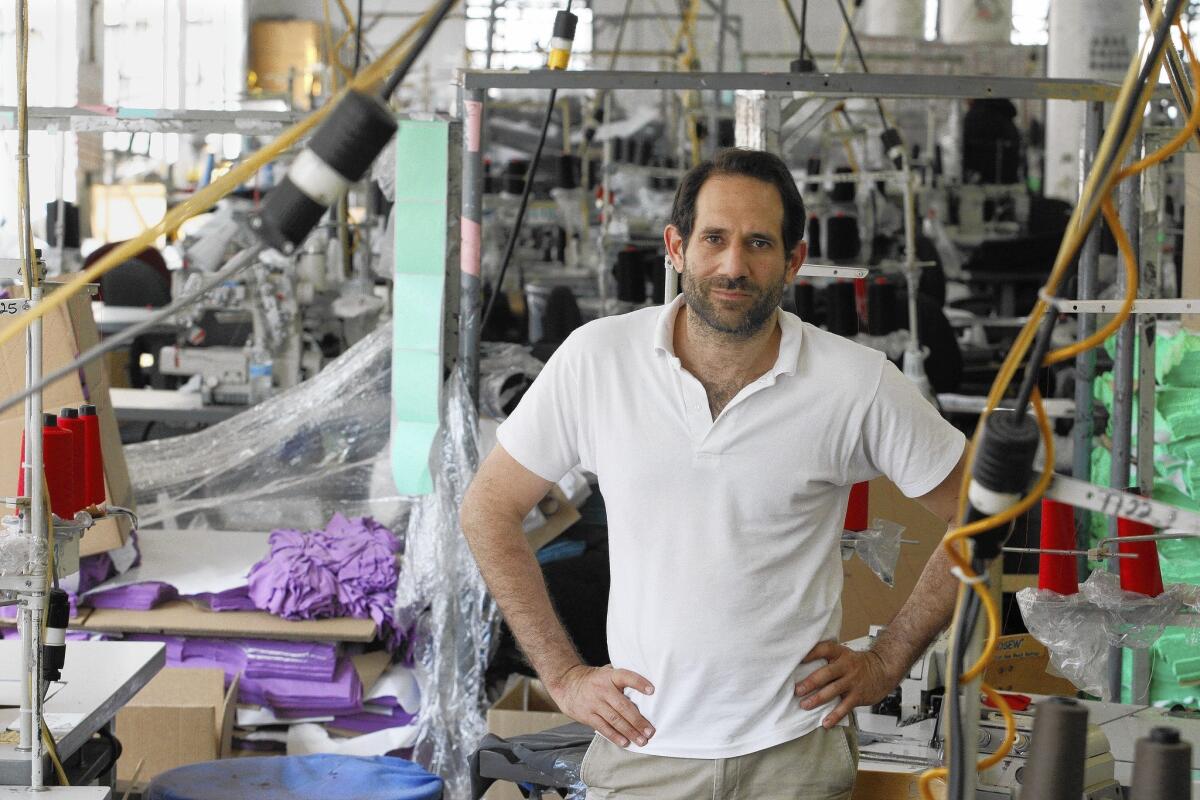

American Apparel, ousted founder trade power plays

The slugfest at American Apparel Inc. showed no signs of calming down as ousted Chief Executive Dov Charney increased his ownership stake and the retailer’s board maneuvered to block him from retaking control.

Charney revealed late Monday that he paid $19.6 million for 27.4 million shares of the Los Angeles company’s stock, according to a filing with the Securities and Exchange Commission. When added to his previous holdings, the new stock gives Charney a 43% share of the company he founded, up from 27%.

The filing indicates that the shares were acquired Friday. That means the buying spree would predate the shareholder rights plan that American Apparel announced Saturday. The one-year “poison pill” is designed to thwart Charney’s attempt to wield greater influence at the company that booted him June 18.

Also over the weekend, a special committee of the board tweaked American Apparel’s bylaws, the company revealed Monday in an SEC filing. The move came in response to Charney’s request last week for a stockholder meeting to expand the number of board members to 15 from seven — a request that the board rejected.

“They now have an out-and-out war going on with their former CEO and by far largest shareholder,” said Lloyd Greif, chief executive of investment banking firm Greif & Co. “If he is at 43%, he is within spitting distance of actual control.”

On Friday, Charney said he had reached a deal with New York investment firm Standard General to gain control of more American Apparel shares through a cooperative buying arrangement, according to a security filing. Under the agreement, Standard General would buy American Apparel stock and then would lend Charney the money to buy the stock from the investment firm at an annual interest rate of 10%.

Late Monday, Standard General reported to the SEC that on Thursday and Friday it purchased 27.4 million shares, which it sold to Charney. On Monday, it bought an additional 1.5 million shares, or less than 1% of the company’s shares.

Charney’s failure to gain more than 50% of the shares before the poison pill was implemented means that he still needs allies, said a person familiar with the corporate battle.

“The change in the bylaws and the poison pill do not prevent him from seeking control of the company. What it does is prevent him from trying to do it surreptitiously,” the person said. “The only way he could gain control now is through a proxy solicitation, which is very public and takes a long time.”

American Apparel said that its amended bylaws roughly doubled the time — from 60 to 90 days to 120 to 150 days — required to nominate directors and submit proposals at its annual shareholder meetings, stripped executives and stockholders of the right to call special meetings and emphasized that board directors can be removed only “for cause.”

Part of American Apparel’s poison pill plan kicks in if any person or group buys more than 15% of the company’s stock, or if an existing shareholder who already owns at least 15% of the retailer’s stock buys an additional 1% stake. If that happens, shareholders would be able to buy newly issued shares of the company’s stock.

Charney is the only shareholder who owns more than a 15% stake, according to company filings. The proliferation of new stock would dilute Charney’s holdings, complicating his efforts.

The board voted to replace Charney as chairman and terminate him as CEO pending an investigation “into alleged misconduct.” The vote resulted in Charney’s immediate suspension, but under his employment contract, termination requires a 30-day delay.

The company has been working hard to counter attempts by Charney to get back his job. His lawyer, Patricia Glaser, filed an arbitration petition last week alleging wrongful termination, breach of contract and retaliation, among other issues.

Aside from its difficulties with Charney, American Apparel is struggling to overcome many hurdles.

The retailer has lost nearly $270 million in the last four years and is more than $200 million in debt. The company has warned that firing Charney could trigger defaults on nearly $40 million in loans and force it into bankruptcy.

One lender, Lion Capital, which owns 12% of American Apparel’s stock, has demanded repayment on a $10-million loan this week, according to the New York Post. That could trigger another default on a $30-million loan with Capital One.

Allan Mayer, the retailer’s co-chairman, said that the company had sufficient capital to pay off the loan if Lion asks to be repaid right away.

Shares of American Apparel slid 6.8%, or 7 cents, to 90 cents on Monday.

Twitter: @ByShanLi

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.