ECB President Mario Draghi ‘very cautious’ on Eurozone revival

ST. PETERSBURG, Russia — Even as European Union leaders at the G-20 summit here crowed about a reviving Eurozone, the head of the European Central Bank said he didn’t share their optimism.

In somber remarks, ECB President Mario Draghi said he was “very, very cautious about the recovery.” Draghi, speaking at a monthly news conference in Frankfurt, damped the growing enthusiasm for the prospects of the advanced economies in the world, led by the United States.

A very strong report Thursday on the U.S. service sector fueled further confidence that the economy was picking up steam and that the August jobs report to be released Friday would turn out better than expected. Bond yields edged higher, and the dollar rose in value.

Yet the increased optimism on the side of developed nations, notwithstanding Draghi’s remarks, also pointed up the weakening momentum and risks for the emerging world — dangers that could intensify should over-confidence set in.

On the first day of the summit for leaders of the Group of 20 largest economies, a gathering that was largely overshadowed by the conflict in Syria, the biggest economic concern was the recent tumbling of currencies and stocks in emerging economies — and the threat of a financial crisis in the developing world.

Investors have been pulling back from emerging markets, shifting funds to advanced economies in anticipation of higher yields there driven by the improved outlook and the expectation that the Federal Reserve will begin reducing its massive stimulus program as soon as this month. Cutting the stimulus is expected to drive up interest rates, making U.S. bonds more attractive than ones in poorer countries.

Leaders of five major developing countries of the G-20 met separately Thursday ahead of the formal start of the summit. Brazil, Russia, India, China and South Africa — the so-called BRICS group — said afterward that they made further progress in setting up a pool of funds to counter the effects of large capital outflows.

The BRICS issued a joint statement Thursday stressing their concerns about the unintended harmful effects of policy actions by the Fed and other central banks in developed nations.

“The eventual normalization of monetary policies needs to be effectively and carefully calibrated and clearly communicated,” the statement read, a reference to an eventual withdrawal of extraordinary easing of money after the financial crisis that flooded global markets with cheap cash.

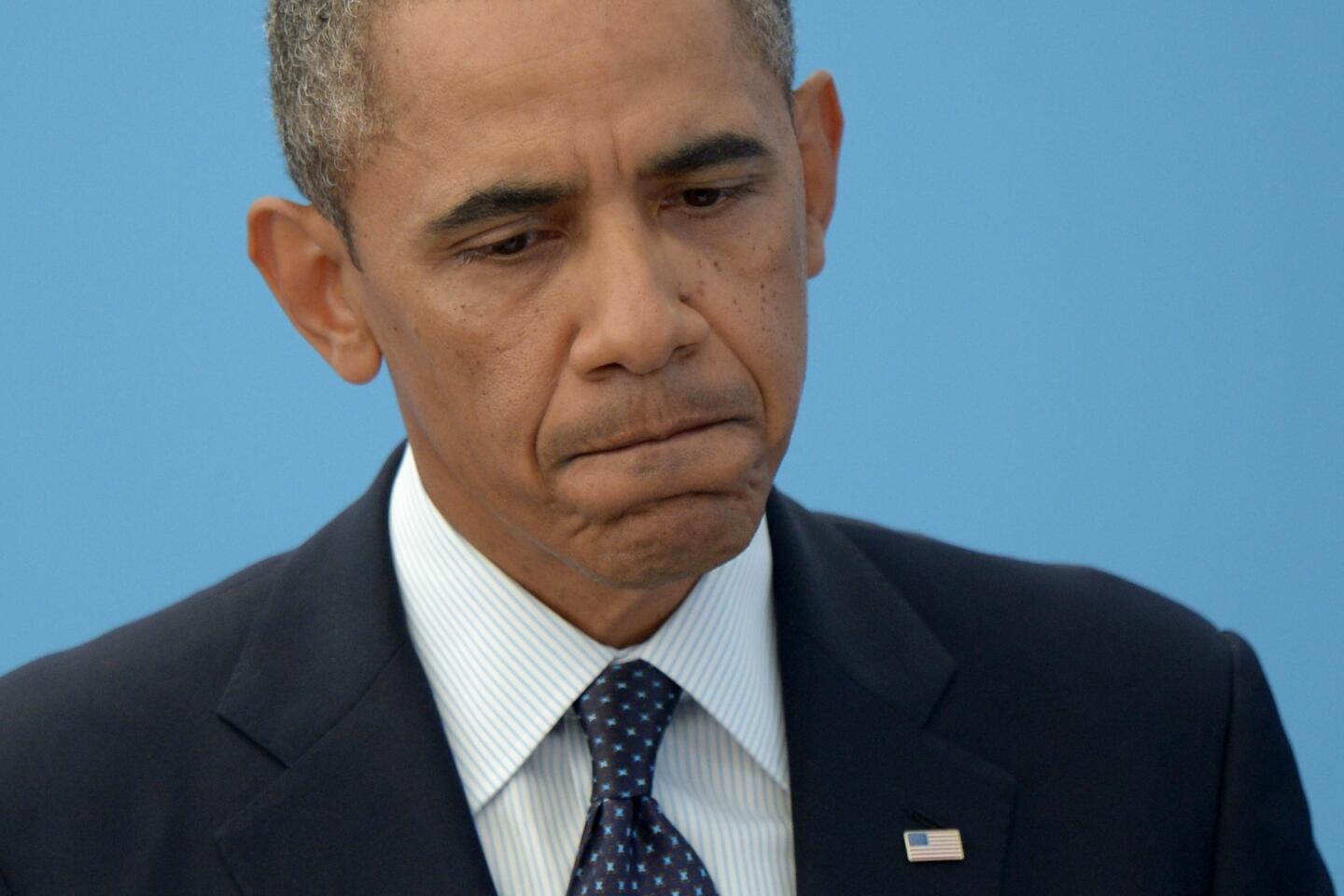

President Obama sought to reassure G-20 leaders that the U.S. was mindful of its policies’ effects on the rest of the world, and would withdraw stimulus gradually, according to Russia’s finance minister, Anton Siluanov, who spoke at a briefing after the first formal session of the summit.

The capital retreat from emerging economies has been highly uneven.

India has been hit particularly hard, while China, with its tight currency and capital controls, has felt little direct pain. And that has raised questions of how united and effectively the BRICS can press the leaders of the rich countries to adopt a strong statement on the issue.

“We are all on the same page,” insisted Sujatha Singh, India’s foreign secretary.

Nobody is expecting the G-20, a forum without a mechanism for enforcement, to make specific policy recommendations for central banks.

The Fed’s interest, after all, is the well-being of the U.S. economy, and it answers to Congress, not the G-20. And Fed Chairman Ben S. Bernanke has argued that in the end, policies that help make the U.S. economy stronger are good for the global economy as well.

Zhu Guangyao, China’s vice finance minister, spoke about the importance for the BRICS to cooperate but also said it was up to the individual nations to respond to the sell-off in their markets.

“Each country needs to deepen the reform of their economic structures,” he said.

He seemed to agree with a widely held view, especially in the developed world, that the financial volatility in emerging markets stemmed largely from homegrown structural problems in those countries, such as weak financial systems.

The G-20’s focus on the troubles of emerging economies contrasts sharply with its prior two annual summits, in France and Mexico, when lingering debt problems in Greece and in the Eurozone generally dominated the discussions.

With the situation in the euro area having quieted in the last year, European Union leaders arrived in St. Petersburg and began by highlighting how far they had come from a year ago.

“The European Union comes to this summit with a message of confidence,” said Jose Manuel Barroso, president of the European Commission.

“We in Europe are seeing a turning point,” he stated, adding quickly that “we should avoid any kind of complacency.”

Angela Merkel, Germany’s chancellor, agreed that the Eurozone had weathered many storms.

But there is much left to do, she told reporters before the opening of the summit. “Most of all,” she said, “there can be no letup on structural reforms.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.