Writer seeks to publish books

Dear Karen: I’ve written a series of children’s books. How can I get them illustrated and published?

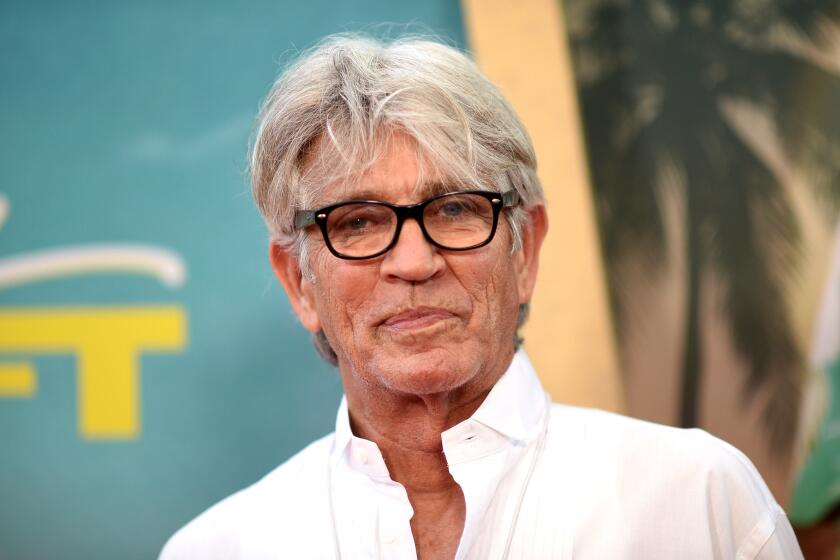

Answer: If you’re pursuing this as a commercial venture, you’ll want to attract a traditional publisher, either on your own or through an agent. “Your most important talent will become not writing but perseverance. It can take years to find an agent or publisher,” said Eric D. Goodman, a Baltimore children’s author who recently published “Flightless Goose” ( www.rungoose.com).

You won’t need an illustrator to submit your manuscript. Most publishers prefer to assign an artist to the manuscripts they accept.

If you want to see your books in print and aren’t concerned about generating revenue, consider self-publishing through a print-on-demand company such as Lulu Inc. ( www.lulu.com) or Booklocker.com Inc. (www.booklocker .com), Goodman said.

--

Find a niche for new beverage

Dear Karen: I’ve got a great idea for a drink and would like to start a company to produce and market it. How do I go about this?

Answer: Become a student of the beverage industry so you can determine which products and marketing work. Find a void in the market that your product can fill. Entrepreneurs must find specialty niches, as established brands dominate and constantly reinvent themselves.

For instance, Kara Goldin introduced Hint Essence Water as a family drink that hydrates without extra sweeteners. “Our message of living a healthy lifestyle has matched our audience,” she said. “People aren’t looking for another ‘me too’ drink.”

Try launching in a small market and test market among friends at work or school.

--

How to subdue credit card fees

Dear Karen: Increasing credit card fees are eating into my earnings. How do I reduce this expense?

Answer: Too many small-business owners aren’t aware of their credit card processing fees, and they’re paying too much because rate increases are opaque and confusing.

Rate increases and one-time fees are easily overlooked within paragraphs of dense legal language on merchant card statements, said Bob Carr, chairman of Heartland Payment Systems of Princeton, N.J. “The largest company in our industry just debited every merchant account $139.90 for a so-called security fee. If people called in and complained, they got their money back, but if they didn’t complain -- too bad,” Carr said.

You may have gotten an artificially low introductory rate that rapidly increased, or the reasonable interest rate you think you’re paying applies only to a narrow percentage of your transactions, Carr said.

If you’ve been charged exorbitantly, consider switching vendors. Most companies lock merchants into three-year contracts that may carry early-exit penalties of as much as $300, Carr said. If it’s not worth it to pay that fee, mark your calendar now for when your contract comes up for renewal and get a better deal next time.

Carr has established a website at www.merchantbillofrights.com that provides additional information on merchant credit processing.

More to Read

Sign up for our Book Club newsletter

Get the latest news, events and more from the Los Angeles Times Book Club, and help us get L.A. reading and talking.

You may occasionally receive promotional content from the Los Angeles Times.