U.S. Charges Stewart With Lying, Securities Fraud and Obstruction

NEW YORK -- In a case that prosecutors said was not about picking on a celebrity but about lying, a federal grand jury Wednesday indicted lifestyles entrepreneur Martha Stewart and her former stockbroker on charges of conspiracy, obstruction of justice and making false statements to investigators.

Arraigned Wednesday afternoon in a packed courtroom in lower Manhattan, Stewart and former Merrill Lynch broker Peter Bacanovic pleaded not guilty to all charges in the nine-count indictment.

Later in the day, Stewart stepped down as chairwoman and chief executive of the company she founded and controlled, New York-based Martha Stewart Living Omnimedia Inc. The company said she would stay on in the role of “founder and chief creative officer” and remain on the board of directors.

Notably, the 41-page indictment doesn’t charge Stewart and Bacanovic with insider trading. That charge is contained in a separate civil suit filed by the Securities and Exchange Commission, which accuses the pair of using inside information to dodge losses in her stock holdings of biotech company ImClone Systems Inc., formerly headed by Stewart’s friend and high-society companion Samuel D. Waksal.

Instead, the criminal indictment focuses on an alleged coverup and sheds light on new details in the case.

Stewart is accused, among other things, of altering an incriminating phone record after learning of the federal probe. Bacanovic’s charges include falsifying a worksheet to support a phony story about Stewart’s stock trading.

Besides the conspiracy, obstruction and lying charges, the indictment accuses Stewart of securities fraud in connection with false statements she allegedly issued to protect her own company’s stock after the federal probe became public. Bacanovic also is charged with perjury.

If convicted on all charges, Stewart could face a maximum penalty of 30 years in prison and $2 million in fines.

At Wednesday’s arraignment, Stewart rose to her feet and enunciated clearly when U.S. District Judge Miriam Goldman Cedarbaum asked for her plea.

“Not guilty,” Stewart said.

Asked whether she meant to enter that plea to all charges, Stewart replied: “I do indeed.”

Bacanovic answered the same way.

Cedarbaum released both defendants on their own recognizance and directed them to return for a June 19 status conference. She ordered Bacanovic to surrender his passport and remain in the continental United States. She said Stewart could travel abroad, but only upon giving the court 72 hours’ notice.

The indictment was no surprise. Stewart’s company had announced Tuesday that it was expected.

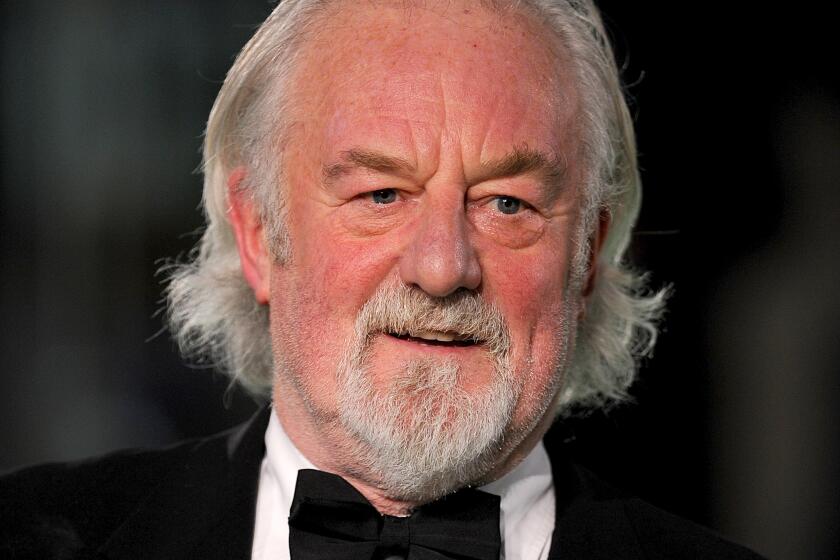

Still, it was a grim turn of events for one of America’s best-known businesswomen, who built a $295-million media empire on homespun cooking and decorating tips.

In its civil suit, the SEC seeks to permanently bar Stewart, 61, from serving as an officer or director of a public company.

Stewart’s lawyers, Robert G. Morvillo and John J. Tigue, questioned why Stewart was targeted.

“Is it for publicity purposes because Martha Stewart is a celebrity?” they asked. “Is it because she is a woman who has successfully competed in a man’s business world by virtue of her talent, hard work and demanding standards?”

U.S. Atty. James B. Comey gave his reply during a news conference to announce the indictment.

“This criminal case is about lying, lying to the FBI, SEC and investors,” Comey said, adding: “Martha Stewart is not being prosecuted because of who she is but because of what she did.”

The criminal charges stem from Stewart’s December 2001 sale of 3,928 shares of ImClone stock. The $228,000 stock sale came just a day ahead of an adverse ruling from the Food and Drug Administration on ImClone’s promising cancer drug, Erbitux. The stock plunged 18% on the news.

Had Stewart waited until after the FDA decision was public, her sale price would have been at least $45,000 less, according to the indictment. The SEC wants her to repay that alleged ill-gotten gain.

The indictment and SEC complaint allege that Bacanovic, at the time Stewart’s stockbroker as well as Waksal’s, sought to notify Stewart after he learned that Waksal and his family members were trying to sell large amounts of ImClone stock ahead of the FDA announcement.

Unable to reach Stewart directly, Bacanovic allegedly asked his assistant, Douglas Faneuil, to notify her of the Waksal sales. Faneuil pleaded guilty last year to a misdemeanor charge of accepting gifts to keep quiet about Stewart’s stock sale. He is expected to be a key witness for the prosecution.

Stewart and Bacanovic have maintained that she had a standing order to sell her ImClone stock if the price fell below $60 a share, but the indictment says they concocted that story after learning of the federal investigation.

According to the indictment, Stewart accessed her office telephone log and altered an incriminating message from Bacanovic, changing it from “Peter Bacanovic thinks ImClone is going to start trading downward” to “Peter Bacanovic re: ImClone.” Stewart later directed her assistant to restore the original wording.

Bacanovic is accused of adding the notation “@ 60” next to a worksheet entry mentioning ImClone to support the story about Stewart’s sell order.

Both defendants are charged with making other false statements to mislead investigators.

The Stewart case has provided a glimpse into the high-gloss social circle in which she moves. A key phone call in the chain of events that led to Wednesday’s indictment was made by Stewart when her private jet made a stopover on the way to a Christmas vacation at a swanky Mexican resort.

Stewart met Waksal through her daughter, Alexis, who once dated the former biotech executive despite an 18-year age difference. Stewart later designed the kitchen in his Manhattan loft.

Waksal, who pleaded guilty in October to insider trading and other charges, awaits sentencing next week.

Morvillo, Stewart’s lead criminal lawyer, is a highly regarded white-collar defense attorney with Southern California ties. For example, he represented Tom Spiegel, former head of Columbia Savings in Beverly Hills, against the Office of Thrift Supervision after Columbia’s huge portfolio of junk bonds collapsed. He also was a key outside advisor to Merrill Lynch in settlement negotiations after the Orange County bankruptcy in 1994.

More recently, Morvillo represented teenage actor Robert Iler, a regular on HBO’s popular “The Sopranos,” in a case involving an alleged mugging of some other teens in New York.

Martha Stewart Living Omnimedia said late Wednesday that Sharon Patrick, the company’s president and chief operating officer, would succeed Stewart as chief executive. Jeffrey Ubben, managing partner of ValueAct Capital Partners, a major investor in the company, was named chairman.

Times staff writer E. Scott Reckard in Orange County contributed to this report.