Venues are catering to e-sports fans with beanbag chairs, energy drinks and food on sticks

In a rare move, the largest sports arena in Columbus, Ohio, relaxed a key policy for an event in April, allowing attendees to freely exit and reenter a game in progress.

Nationwide Arena simply couldn’t expect fans to stay seated for nine hours of action.

It’s among the accommodations event spaces across the country are making in bids to capitalize on the rise of arena-packing video-game contests, which they hope will attract a new generation of event-goers -- and with them increased ticket and concession sales.

For owners, operators and concessionaires of venues, e-sports are the biggest new mass-spectator events since raves, the Ultimate Fighting Championship and the X Games. An estimated 47 million North Americans will tune into e-sports this year, according to research firm Newzoo.

As venues -- and cities -- contend for the growing business, the same way they skirmish over concerts and conventions, they’re learning how to win over promoters and profit off gamers.

To start, fans attending a marathon day of matches aren’t as willing to be held captive -- forced to buy the arena’s food -- as those at a three-hour NHL game.

Staples Center plans to have more signage and ushers since many e-sports fans are first-time patrons. Concessions seller Delaware North expects to stock up on energy drinks such as Monster and Red Bull, preferred over beer among video game enthusiasts. And the Downtown Grand Hotel and Casino in Las Vegas, which hosts weekly amateur tournaments, has started serving more food on skewers.

“So their fingers don’t get sticky and the keyboards and joysticks don’t get sticky,” said hotel Chairman Seth Schorr.

The U.S. sees about one major e-sports arena event a month, topping out at about 10,000 guests each with weekend-long admission costing as much as $250. And optimism abounds at venues, including Brooklyn’s Barclays Center, Washington, D.C.’s Verizon Center and Las Vegas’ Mandalay Bay Events Center.

“We believe e-sports is here to stay,” said Delaware North Chief Marketing Officer Todd Merry, whose company owns Boston’s TD Garden. “Everyone’s still finding their way forward, but it’s the real deal.”

The nation’s newest arenas, including Sacramento’s Golden 1 Center and Las Vegas’ T-Mobile Arena, already are pitching themselves as the perfect high-tech homes for gadget-driven activities such as e-sports and drone racing.

E-sports benefit arenas in several ways. Venues get a new type of customer and exposure to millions more people who stream the competitions online.

“Getting that next generation accustomed to going to a live event is pretty important to our business,” Merry said.

E-sports replace disappearing events such as circuses, and their long length ought to guarantee strong ancillary revenue. For instance, the Nationwide Arena event generated about the same food and beverage sales per attendee for Delaware North as a Blue Jackets hockey game, with increases expected as the menu gets fine-tuned (Red Bull slushies?).

The arena events are mostly playoff matches that cap seasons hosted online or at small television studios. Top finishers collect up to millions of dollars in cash prizes -- enough to heighten the drama as fans hurtle dueling cheers toward a stage of seated players. Rung around them are giant screens that show what’s happening on the gamers’ monitors.

When the first arena events began about three years ago, contest organizers and arena managers came away surprised.

ESL, the leading e-sports events company, underestimated the costs of working with unionized venues, lacked understanding of equitable rental fees and didn’t realize venues would mandate the use of certain service providers.

Now, ESL gets better rates through revenue-sharing deals and more accurate predictions about staffing needs. The company generates profit from its event series, drawing near-equal revenue from tickets, sponsors and online streaming partners, said Bastian Veiser, product manager for the company’s Intel Extreme Masters event.

From the arena perspective, entertainment giant AEG urged Riot Games to move its “League of Legends” playoffs to Staples Center in 2013 after being amazed by the 2,000-plus turnout for the year-earlier version at a plaza across the street.

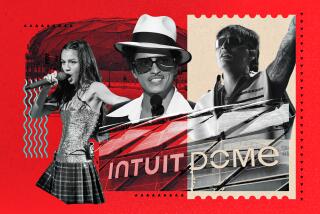

This October, AEG should be even more prepared as the event returns to the Los Angeles arena, following stops in Seoul and Berlin. Staples Center President Lee Zeidman pointed to plans for gamer-minded menu offerings inside and at nearby restaurants, possibly making the event more lucrative.

“You’re not coming for a single event in a single venue,” he said.

Fan complaints have brought experience improvements too. Bean bags became an alternative to uncomfortable floor seats. Stages got moved to create better viewing angles. And there’s talk of selling luxury suites packed with computers so fans can game during intermission.

Because more venues want to host e-sports events than there are competitions to go around, promoters could secure additional fan-friendly features. ESL, which is exploring a long-term partnership with AEG, recently moved its annual West Coast event to AEG-operated Oracle Arena in Oakland from the San Jose Sharks-run SAP Center. Now the company plans to push AEG for lower food pricing and permission to have food trucks and booths in the parking lot.

It’s not just the biggest venues that are considering e-sports. Small settings have advantages, for example allowing attendees to swarm the stage to take selfies and better connect with the teams.

Maintaining intimacy was among the reasons ELeague chose the 2,750-seat Cobb Energy Performing Arts Centre in Atlanta for its championship this month. The “Counter-Strike: Global Offensive” tournament wanted a larger, yet similar environment to the TV studio used for the regular season, said ELeague General Manager Christina Alejandre.

The Downtown Grand in Las Vegas, which doesn’t have space for thousands of event-goers, is banking on that thought. The casino recently replaced a high-limit blackjack area with an e-sports lounge. It holds small, thrice-weekly video-game contests and can accommodate occasional championships for up-and-coming games, Schorr said.

Between events and the rise of e-sports betting, there’s a “strong argument for casinos of almost all sizes and locations to investigate” e-sports, gambling industry analyst Chris Grove said in a report last month.

The venue business is attracting e-sports entrepreneurs too. E-sports teams aren’t typically tied to a particularly city, as in traditional sports, but some see an opportunity to change that.

Among them is Greensboro, N.C.-centered Team EnVyUs, which has about 40 players across eight video games. Team owner Mike Rufail wants to develop a venue in uptown Charlotte near other sports venues. With bleachers-style seating for 2,000 people, EnVyUs could use it for games, viewing parties, offices and retail.

The project could inject e-sports into the controversy over taxpayer financing of stadiums when Rufail asks the Charlotte City Council for an undetermined construction subsidy. James Mitchell, chairman of the council’s economic development committee, said he would endorse financial support if, as he suspects, Rufail’s project would raise Charlotte’s profile and increase its youth appeal.

Neither teams nor anyone else are likely to start working on 20,000-seat e-sports-centric arenas within the next year or two. But Dallas Mavericks owner and e-sports start-up investor Mark Cuban described such a possibility as “certainly something everyone thinks is on the horizon.”

Twitter: @peard33