Time Warner investor day: Five things to watch

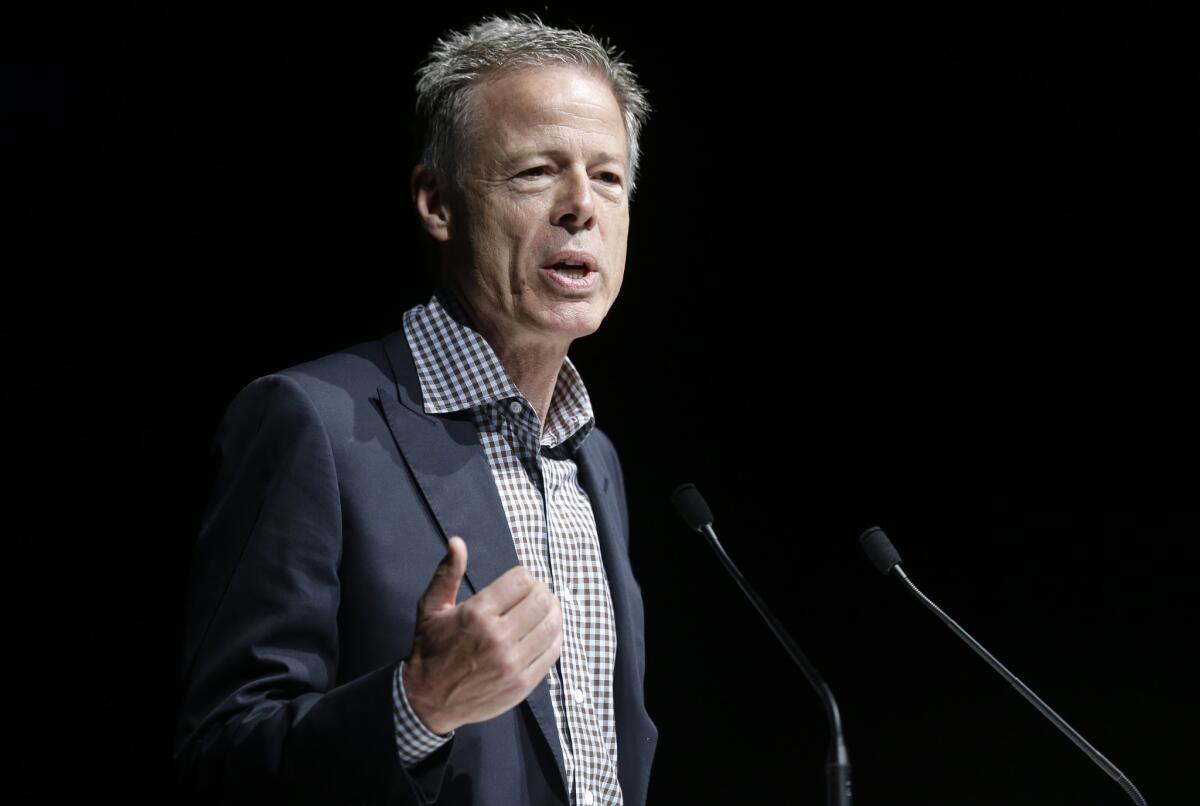

Time Warner Chief Executive Jeff Bewkes is poised to explain why bigger wouldn’t have been better.

Three months after refusing to entertain Rupert Murdoch’s 21st Century Fox’s takeover bid for his company, Bewkes is expected to outline his vision for a smaller, more cohesive Time Warner during an investor day in New York on Wednesday.

Although Fox withdrew its $80-billion offer in early August, Wall Street has been eager to learn more about Bewkes’ strategy to grow his company’s value beyond the $85-a-share that Murdoch had offered. Wednesday’s event is expected to draw more than 300 investors and analysts.

So far, investors have been supportive of Bewkes and have taken a wait-and-see attitude.

Amid huge sell-offs of other media stocks in recent weeks, Time Warner has largely maintained its value. The company’s shares closed Tuesday at $70.64 -- just about the same as before the Fox bid became public. (Once the Fox bid was disclosed, Time Warner shares briefly soared to more than $85 a share).

Investors would like to see a return to such lofty levels.

“In spite of having among the best media assets across the industry in HBO and Warner Brothers, Time Warner trades at a discount,” Barclays media analyst Kannan Venkateshwar wrote in a research report Tuesday.

“It will be important for management to outline a clear path to value creation,” Venkateshwar said.

Analysts and investors hope to learn about the company’s strategies for boosting value beyond making staff cuts or further share buybacks.

Programming costs have been accelerating, putting increased pressure on Time Warner’s bottom line.

Here are five things to watch for during Time Warner’s investor day:

1) Staff cuts. The company has telegraphed that it intends to make substantial cuts, and Turner Broadcasting -- which includes CNN, Cartoon Network, TBS, TNT and Tru TV -- already has initiated buyouts and layoffs. The Turner unit has announced that it intends to cut about 10% of its staff -- 1,475 positions.

Warner Bros., based in Burbank, also is expected to be hard-hit. Some have predicted as many as 1,000 people could lose their jobs at Hollywood’s largest film and TV studio -- but there haven’t been any firm details.

The studio, led by Kevin Tsujihara, is not expected to shed many from its movie and TV production units. Instead, Warner Bros. has said that it wants to build its content pipeline. However, other groups such as finance, marketing and home entertainment could be forced to make deep cuts.

2) HBO growth. Investors and analysts are particularly keen to hear how the company intends to grow HBO and whether the company will offer HBO as a stand-alone product. Bewkes, during a Goldman Sachs conference last month, hinted the company was mulling that option.

Currently, consumers must subscribe to a pay-TV package in order to receive HBO and its companion digital offering, HBO Go.

“Some investors believe HBO should simply offer a direct-to-consumer product at the same retail price as the current offering, say $16” a month, Bernstein & Co. media analyst Todd Juenger said last month. “We believe such an offering would be riddled with conflict and complication.”

Juenger concluded that HBO likely is angling to extract more favorable terms from pay-TV distributors, which would allow the company to keep a greater share of the subscriber fees.

HBO also is expected to stress international expansion. Currently, about a quarter of HBO’s revenue comes from international sales.

3) Warner Bros. movie slate. Time Warner is expected to share details about its upcoming movies and TV shows, and tout the company’s enhanced efforts to better leverage its successful franchises, including its Lego movie and DC Comics characters -- or perhaps efforts showcasing both those franchises.

Already this fall, Warner Bros.’ new Batman prequel TV series, “Gotham,” has scored improved ratings for Fox Broadcasting.

4) Focus on Kids. Turner Broadcasting on Tuesday announced a relaunch of one of its animation brands, Boomerang. The network, which currently reaches 250 million households globally through 13 international feeds, is expected to launch in the U.S. next year.

Boomerang will boast some exclusive original programs and classic characters, including Scooby-Doo and a few Looney Tunes favorites.

“This is one of the areas that the company has mentioned in the past as a potential area for growth,” Venkateshwar said, adding that Time Warner generates more than $1 billion a year from its international kids business.

“The opportunity on the kids front is to both increase carriage domestically and internationally of networks like Boomerang and to improve programming at Cartoon Network,” he said.

5) Bottom line. Analysts have speculated that the company might be targeting $200 million in annual cost savings, which would represent about 4% of the company’s administrative costs.

Some investors are not expecting big news out of Wednesday’s confab. Instead, more information might be gleaned during the question-and-answer session should investors ask pointed questions about CNN’s ratings or Warner Bros.’ growth strategy for China or digital distribution.

Follow me on Twitter: @MegJamesLAT

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whipp’s must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.