Tax bill simplifies filing for some but complicates it for others — and don’t count on that postcard

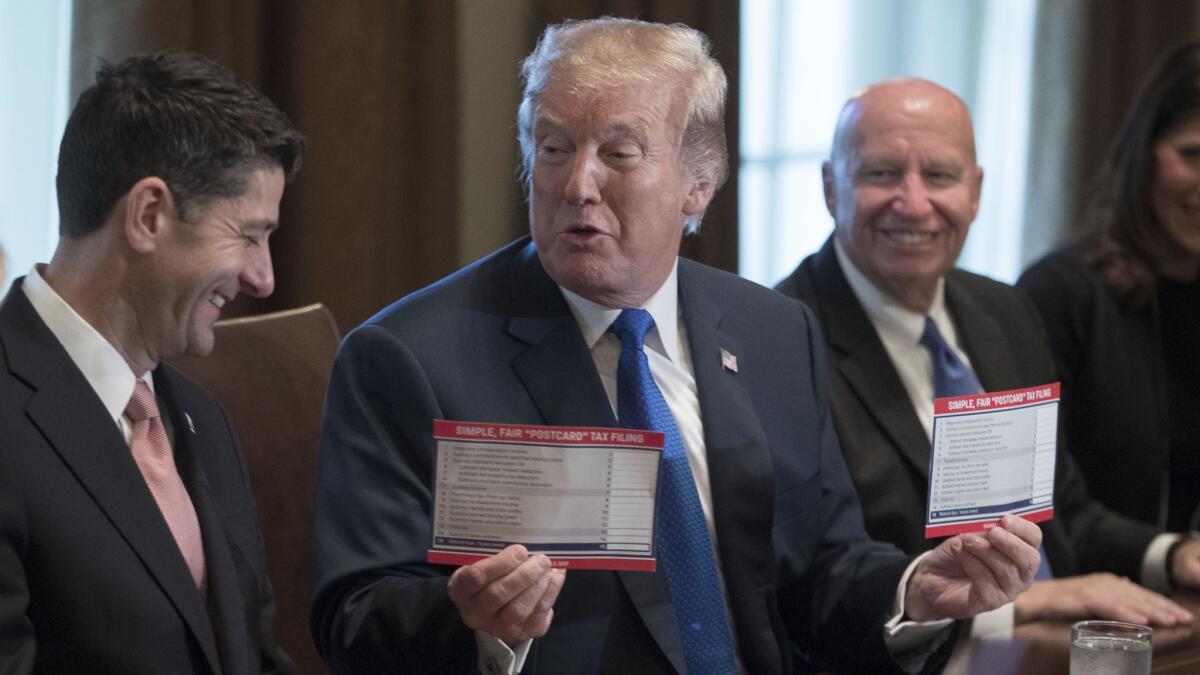

A priority of the Republicans’ tax overhaul was simplification, and they drove home the point this fall with an omnipresent prop: a red-white-and-blue postcard.

“We’re making things so simple that you can do your taxes on a form the size of a postcard,” House Speaker Paul Ryan (R-Wisc.) said last month, pulling one from his jacket pocket as he and Republican leaders unveiled their bill.

They gave a couple of the cards to President Trump at a White House meeting a few hours later and flashed them often during news conferences and TV interviews in the coming days.

But as the tax legislation worked its way through Congress and now heads to Trump’s desk, that postcard has largely disappeared — it was nowhere to be seen at Wednesday’s White House celebration — as have many of the changes that were designed to simplify the federal tax code.

Deductions that House Republicans planned to eliminate were added back into the bill. A plan to reduce the seven existing tax brackets to four was abandoned. The complicated alternative minimum tax for individuals, which the House bill proposed to axe, was kept in place.

And in the case of so-called pass-through businesses, which pay taxes through the individual code, the overhaul adds new complexities in how they classify their income.

“This is not about simplification,” Rep. Richard Neal (D-Mass.) said this week in urging his colleagues to vote down the nearly 11,000-page bill and accompanying report. “It was going to be on a postcard. You are going to need to carry a billboard around with you to understand what is in this actual bill.”

Experts said that the new tax code won’t be much different than the existing code.

“For some taxpayers it will be a little simpler, for some it will be more complex, but overall it will be familiar and folks won’t think of it as some drastic change,” said Joseph Rosenberg, a senior researcher at the nonpartisan Tax Policy Center. “On net, it’s not going to be any simpler.”

The biggest simplification is a nearly doubling of the standard deduction — to $12,000 from $6,350 for individuals, and to $24,000 from $12,700 for couples. That will sharply increase the number of Americans who do not need to itemize because the value of their total deductions won’t exceed the new standard deduction.

“Just doubling the standard deduction means 9 out of 10 people can — I wish I had it with me — 9 out of 10 people can file their taxes on a form like a postcard,” Ryan said last week, patting his pocket but no longer carrying one of the postcards.

The Tax Policy Center said those figures are roughly correct. They estimated that the number of people who itemize will drop to about 19 million from about 46 million after the bill’s changes take effect.

Not having to itemize would reduce the time and cost of filing taxes. A study by Youssef Benzarti, an assistant economics professor at UCLA, estimated that filing taxes costs Americans about $200 billion a year.

The figure has been rising since the 1980s in part “because of the increase in the number of forms filed by each taxpayer,” the study said.

But many people who won’t have to itemize still will have to calculate their deductions to determine if they exceed the new standard deduction, Rosenberg said.

“Just like under current law, you have to know what your itemized deductions are to know if you’re better off with the standard deduction,” he said.

And while no longer having to itemize deductions simplifies tax filing, the bill also eliminates some breaks that helped people reduce how much they send to Washington, said Edward Kleinbard, a USC professor and former chief of staff to Congress’ Joint Committee on Taxation.

“My experience is that taxpayers are willing to accept a good deal of complexity if doing so saves them money,” Kleinbard said.

He pointed to the deduction for state and local taxes, which the bill caps at $10,000 for couples filing jointly. There is no limit in existing law.

The average state and local deduction taken by the 6.1 million California residents who claimed it in 2015 was $18,438, according to the Tax Policy Center. That was the third-highest average of any state, behind New York and Connecticut.

“For them, it may be a simplification, but it’s not a happy one,” Kleinbard said.

The alternative minimum tax, which forces some upper-income earners to calculate their taxes twice to see if it applies, will remain in place, although it will apply to far fewer people.

The Tax Policy Center estimated that the higher exemption level in the bill for the alternative minimum tax will mean the number of filers who have to pay it will drop to about 200,000 from 5 million. So for many of the people who now pay it, the bill will simplify tax filing.

But just as with itemized deductions, some people who will not have to pay the alternative minimum tax still will have to go through the calculations to determine if it applies to them.

“From a simplification standpoint, you’d prefer no AMT to any AMT,” Rosenberg said.

Pass-through businesses — which include mom-and-pop operations and large partnerships such as law firms and hedge funds — will find tax filing more complicated because of new provisions designed to cut the tax rate on their income.

Under the bill, 20% of pass-through income can be deducted, while the rest is taxed at regular individual rates. The deduction is limited to the first $315,000 in income for couples filing jointly and phases out above that level.

The deduction for pass-through income could entice some people to reclassify their tax status to take advantage of it.

“Taxpayers are going to jump through a lot of hoops, some of them highly suspect as a tax law matter, to shoehorn their income into this new category,” Kleinbard said. “In a sense, it injects a tremendous amount of complexity.”

Some of the need for simplification has disappeared with tax preparation software and online calculators, he said.

But the broader question, Kleinbard said, is whether eliminating deductions, such as one the House bill initially planned to scrap for large individual medical expenses, is fair to taxpayers.

“The basic problem is you can’t be both simple and fair at the same time,” he said.

Twitter: @JimPuzzanghera