Tech workers used to bank on riches from stock options. For Snap employees, it’s no certainty

The wave of house buying, start-up investing and increased extravagance expected from employees of Snap Inc. may be delayed. (August 1, 2017) (Sign up for our free video newsletter here http://bit.ly/2n6VKPR)

The wave of house buying, start-up investing and increased extravagance expected from employees of Snap Inc. may be delayed.

During most of July, shares of Los Angeles’ biggest tech company not only fetched less than their initial offering price of $17, but also were cheaper than the $15.36 investors paid for them in the company’s final private financing.

The price slide has dampened employees’ desire to sell shares that they earned as compensation, according to wealth managers and other advisors.

They expect confidence among employees that Snap is worth at least slightly more than current prices to prevail over anxiety in the coming weeks. That’s brought down the chance of an imminent surge of cash into Los Angeles when employee-shareholders become free to sell around $4 billion worth of holdings for the first time Aug. 14.

The amount workers sell might be enough to fund grand family vacations abroad, but not home purchases or risky bets on starting their own tech ventures. Westside real estate agents said that they haven’t seen a big uptick in demand from Snap employees.

“There’s not a line of people looking to utilize this window to sell,” said Jordan Kahn, chief investment officer for Los Angeles firm HCR Wealth Advisors. “There are a lot of people who think at $13 and change, below the offering price, that’s not the best time to sell.”

A preview of what to expect later this month came Monday as an estimated 400 million shares held by early Snap investors became newly tradable, according to analysts. The amount of shares exchanging hands increased threefold Monday compared with the average daily trading over the last 30 days, but it was far from a major flood. Lightspeed Venture Partners, one of the potential new sellers, declined to comment.

Snap shares closed Monday at $13.67, down 14 cents, or 1%.

Employees want to start paring their Snap ownership sooner rather than later, driven by fears that the stock market is due for a downturn after more than eight years of riding high, experts say. Wealth managers also are warning even the youngest employees that an IPO like Snap’s — the biggest in Southern California history — is probably a once-in-a-lifetime event.

“People are looking to protect themselves and are trying to go for doubles rather than triples and home runs,” said Jordan Taylor, who works with tech clients for Silverhawk Private Wealth. “Let’s try to make consistent strong decisions rather than swing for the fences every time.”

Further spooking workers is political turmoil unlike any most young tech shareholders have seen.

“People who have negative views toward the current president are concerned about what’s going to happen economically, so they want to be a little safer,” Taylor said. “How people are responding to markets is more political than ever.”

The unease is trickling down to workers at start-ups that might go public over the next year. For years, employees at such places would shell out to exercise as many stock options as possible before an IPO. Workers had little doubt they were getting a good deal because they felt shares would continue to rise in price. They would save on taxes and lock in big gains.

That’s not the case anymore, said Jack Meccia, who has advised workers at Blue Apron, Cloudera and other tech firms on tax issues. Companies are getting so pricey on the private market that the public stock markets are not immediately embracing them with an instant premium.

“Employees are wisely skeptical that an IPO means a higher share price,” said Meccia, a tax associate at financial planning firm Vestboard. “Writing a check to acquire those shares, you’re not going to automatically do that.”

Money managers say tech companies have recognized the concerns and are making adjustments. Dropbox and Uber reportedly have converted some of the stock they give employees into non-qualified stock options, which gives workers more time to find the cash to pay for their shares and the increasingly larger tax bills associated with them.

“This is definitely an issue at an elite level because of the huge valuations,” said Evan Schmidt, whose firm manages about $350 million in assets and has worked with Snap employees.

If anything, employees at companies such as Snap are considering more options about how to sell, where to invest and when to do it than peers at other firms in recent years, experts said.

Will

“It’s creating a certain amount of angst in newly public companies that wasn’t there a year ago,” Meccia said. “I’m seeing clients more eager to sell on a shorter time frame than even five months ago. It’s making them gung-ho about scheduling sell-offs in 2018.”

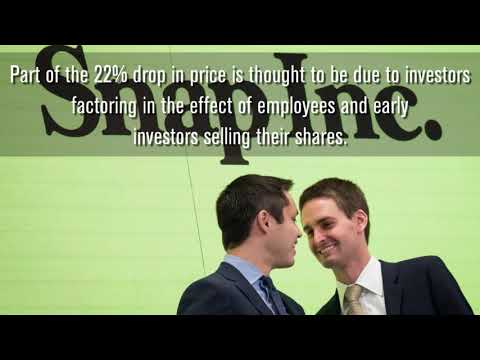

A sell-off at Snap may be more in bits and pieces because many of the employees believed to hold the most shares, including co-founders Evan Spiegel and Bobby Murphy and other top engineers, fall under additional federal trading restrictions.

Snap declined to comment for this article.

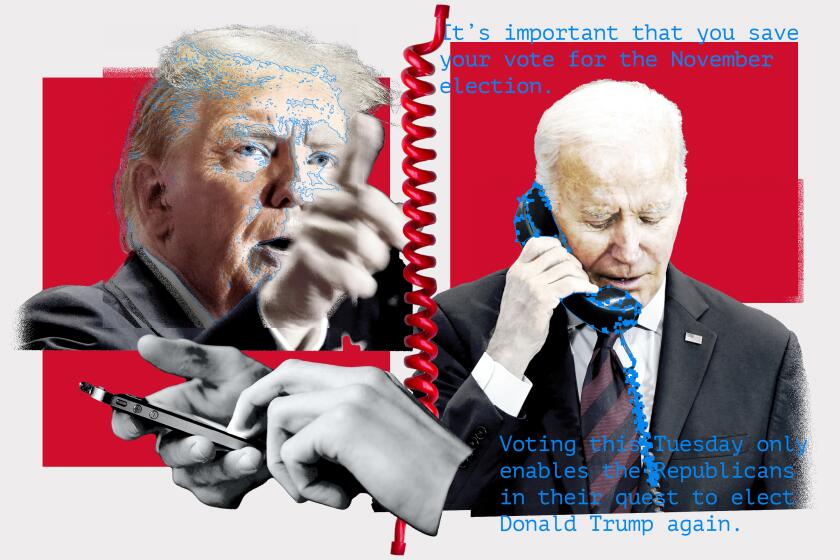

Financial analysts who follow Snap have said much of the 22% decline in Snap’s share price during the last month represents investors factoring in employees and early investors selling some shares. If the sell-off remains muted and Snap delivers strong second-quarter sales Aug. 10, the stock could bounce back up into the high teens. At that point, selling could become more attractive to employees.

Start-up advisor Richard Titus, who saw a friend go bankrupt after spending lavishly following an IPO, said he hopes the extra concerns weighing on people this year lead to smarter financial moves.

“The most sophisticated of people in these situations are doing things like pledging their shares early for cash to protect against depression in price,” he said.

During the dot-com boom around 2000, Titus sold the first of his millions of dollars worth of shares in Razorfish for $126 after an IPO. He got just 20 cents for his last shares years later.

“That’s a precipitous drop in value,” said the former vice president at Razorfish’s Los Angeles office. “I was very cautious along the way.”

Guidance Software agrees to acquisition

Los Angeles County could lose one of its longest-running publicly traded tech companies this year should OpenText’s $222-million acquisition of Pasadena firm Guidance Software close as expected this quarter.

OpenText, which develops document management software, agreed to pay $7.10 in cash per share for the maker of forensics and cybersecurity software. Guidance shares had traded for about $6.90 ahead of the deal announcement last week, and they closed Monday at $7.07.

Guidance’s best-known program, EnCase, is widely used in law enforcement to search the hard drives and memory of seized phones and computers.

Founded in 1997, the company has never had a profitable year since going public in 2006. And losses have increased, reaching nearly $21 million last year.

Sales growth has been uneven, and the company recently missed expectations for its most recent quarter. Financial analysts who study the company estimate it will post $111 million in sales this year, or about the same as last year.

In recent years, Guidance lost its founder and chief technology officer and its long-time chief executive. Shawn McCreight, the former CTO, continues to be its largest shareholder with about one-quarter ownership. McCreight, who last year settled an activist campaign to replace the company’s board of directors, declined to comment.

The company didn’t immediately provide more commentary on why it decided to sell beyond a statement that noted the deal “represents the best value reasonably attainable for our stockholders and will benefit our customers and employees.”

The law firm Levi & Korsinsky announced Monday it had opened an investigation into the fairness of the sale.

Vetted raises funding

Vetted, an app to summon a veterinarian to your home, raised $3.3 million in funding. The investment was led by Foundation Capital, which has invested in the pet space previously through pet-sitting app DogVacay. That service merged with Rover this year.

Amplify.LA also invested in Vetted. The start-up hopes to launch subscription and insurance services as it expands.

Elsewhere on the Web

- Whisper laid off 14 of its 71 employees as it relies on automated content curation tools and has begun bringing in just over $1 million a month in revenue, according to TechCrunch.

- Snap has replaced its general counsel and heads of human resources and facilities and security, according to Business Insider.

- Eversport, which streamed live events from college and niche sports around the world, sold its assets to Pluto.tv, according to Cablefax.

- Culver City yoga studio chain YogaWorks postponed a planned initial public offering last week, citing market conditions, according to ClubIndustry.com.

- WeWork plans to open a location in West Hollywood, according to L.A. Business Journal.

- The investment fund run by Laurene Powell Jobs, the widow of Steve Jobs, co-led a $40-million investment into virtual reality video production firm Within, according to Bloomberg.

In case you missed it

- Worried about election hacking, L.A. County officials are turning to hackers for help.

Coming up

SIGGRAPH, which bills itself as the world’s biggest conference focused on computer graphics and interactive technology, continues through Thursday at the Los Angeles Convention Center. The event is put on by the Assn. for Computing Machinery's Special Interest Group on Computer Graphics and Interactive Techniques. Many of this year’s top discussions are expected to focus on virtual reality.

Twitter: @peard33