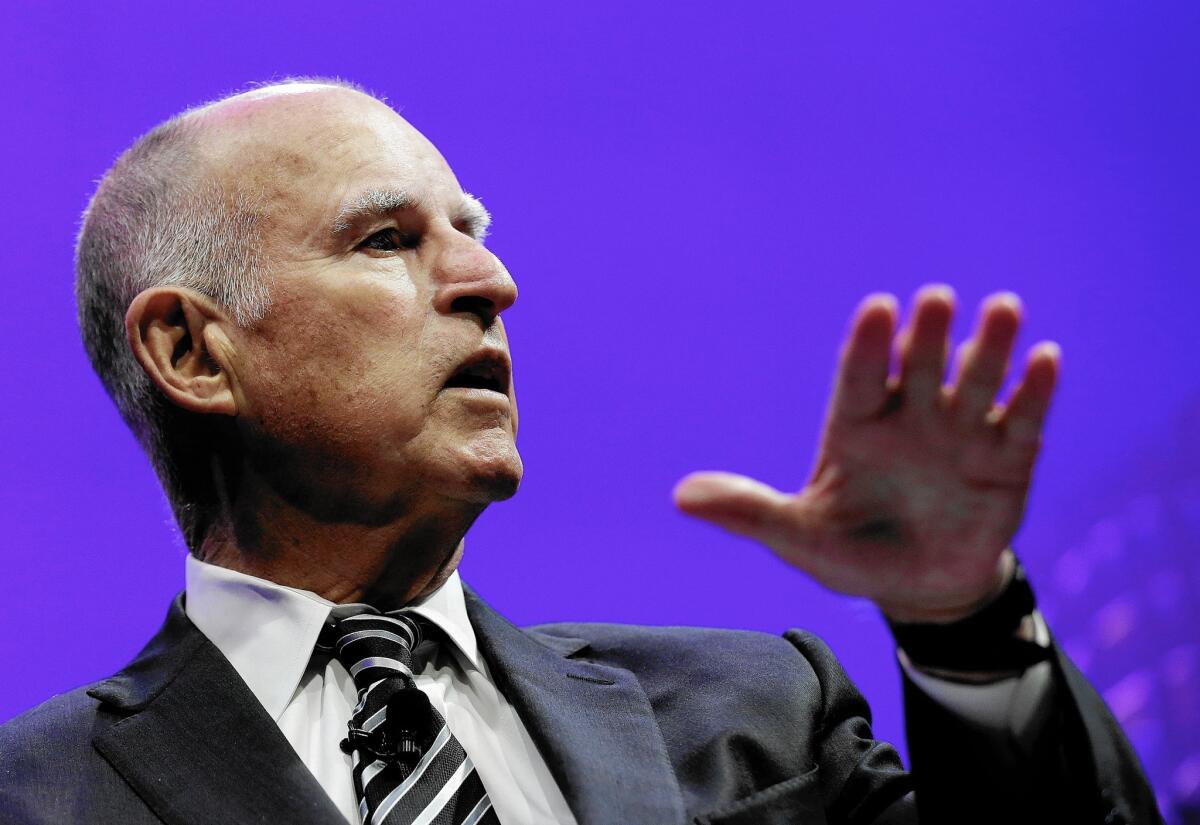

CalPERS pay-down plan isn’t fast enough for Gov. Jerry Brown

If there is one thing that Gov. Jerry Brown has made a calling card since returning to office in 2011, it’s a push toward paying down government debt.

And yet his reaction to Wednesday’s decision to do just that by directors of the California Public Employees’ Retirement System was an angry one.

“I am deeply disappointed that the CalPERS board reversed course,” Brown said in a written statement.

The nation’s largest pension fund voted to lower its estimate of future investment returns from 7.5% to 6.5% over 20 years. The move will increase payments by taxpayers, but CalPERS says it will more quickly pay down the $117-billion debt for pensions already owed to 1.7 million government workers and retirees.

Brown wanted it to happen even faster. His criticism hinted at a larger struggle, a political tug of war between Brown and public employee unions.

SIGN UP for the free Essential Politics newsletter >>

“The fight is interesting to watch between a Democratic governor and a Democratic constituency,” said Richard Costigan, a CalPERS director who pushed this week for a more aggressive policy that would have reduced the debt more quickly. “A Democratic governor wanted to take a more hard-line stance.”

For years, CalPERS critics have warned that the pension fund was using overly optimistic projections for its investment portfolio, projections that would leave taxpayers picking up an ever larger share of the obligations made to state and local government workers.

CalPERS directors partially relented on that front on Wednesday, agreeing to adjust the projections but on a more conservative course.

The decision will increase amounts paid to CalPERS for state government workers’ future retirement. As the employer, the state’s general fund already pays CalPERS $5 billion a year. And for a governor who preaches lower spending, it seems jarring to think Brown would actually push to increase the size of the state’s annual pension costs.

Jarring, that is, until one considers Brown’s real strategy: to help pay down the pension obligation now, when funds are available, rather than face the question in an economic downturn. It also would take revenues off the table for other budget fights in Sacramento in 2016.

That’s where the disagreement comes in with organized labor.

As CalPERS leaders voted to rejigger the mix of taxpayer money and Wall Street investment profits, the nonpartisan Legislative Analyst’s Office on Wednesday released a new projection showing billions in unexpected tax dollars are likely to materialize over the next few years.

Sources close to both CalPERS and the Brown administration said Thursday that the governor had been privately lobbying some of the pension fund directors for weeks to push for a faster, deeper cut in the long-term estimates of what will be funded by Wall Street investments. In other words, he wanted to set aside more tax revenues for paying pension obligations.

Doing so would strengthen his hand should he be asked to expand government programs. Or it could help stave off contract demands by state employee unions with whom he’s now negotiating. One of those unions, composed of scientists, protested on the streets of Sacramento on Thursday in support of a more generous contract than Brown is offering.

------------

FOR THE RECORD

Friday, Nov. 20, 4:09 p.m.: An earlier version of this post said that a union representing state-employed engineers and scientists were protesting Thursday. The protest involved only scientists.

------------

The governor, in so many of his actions over the last few years, has made it clear he wants to pay off as much debt as he can right now.

“We’re just kicking the can down the road,” said Richard Gillihan, the governor’s human resources director and a CalPERS board member. At a pension fund committee meeting Tuesday, Gillihan proposed that the expected investment return rate be lowered immediately to 6.5% — and not over two decades.

The majority of the CalPERS board comes from the ranks of public employee unions. For a while this week, it looked like they may have been beaten. The committee on Tuesday ultimately approved a middle-ground approach between Gillihan’s recommendation and what union representatives had endorsed.

But 24 hours later, the unions’ preferred approach was adopted. “You’ve done a lot of reforms,” Jai Sookprasert, a lobbyist for the California School Employees Assn., told the pension fund leaders. “Let’s give them a chance.”

The political positioning notwithstanding, taxpayers will still be relied on for more of the pension equation. But the larger tug of war in Sacramento goes on. Neither union members nor Brown, who at best has proved to be only their occasional ally, are likely to give up any time soon.

Times staff writer Melody Petersen contributed to this report.

ALSO:

Israeli spy Jonathan Pollard released from U.S. prison after 30 years

Syrians’ arrival at U.S. border crossing raises concern of a flood of asylum seekers

House votes to block Syrian refugees despite White House veto threat

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.