Opinion: Have Republicans forgotten that taxes are meant to fund the government?

To the editor: Your editorial on the tax bill is a scorecard on who wins and who loses, who gains a percentage point or two of savings on future taxes and how those savings will be recovered. (“The GOP’s big tax win is a loss for the rest of us,” editorial, Dec. 2)

Taxes, if you ask any American, are supposed to pay for the goods and services that government provides — roads, schools, health, defense and more. But the funds generated or saved in this tax bill are primarily designed to protect, punish or promote a targeted political group, not to raise revenue.

Real tax reform would look at the costs of government and then figure out how we can best meet those costs as fairly as possible with a tax regime that stops favoring one sector over another. A third political party built on such a goal might do well with an electorate that proved in 2016 that it is sick of the status quo.

Godfrey Harris, Los Angeles

..

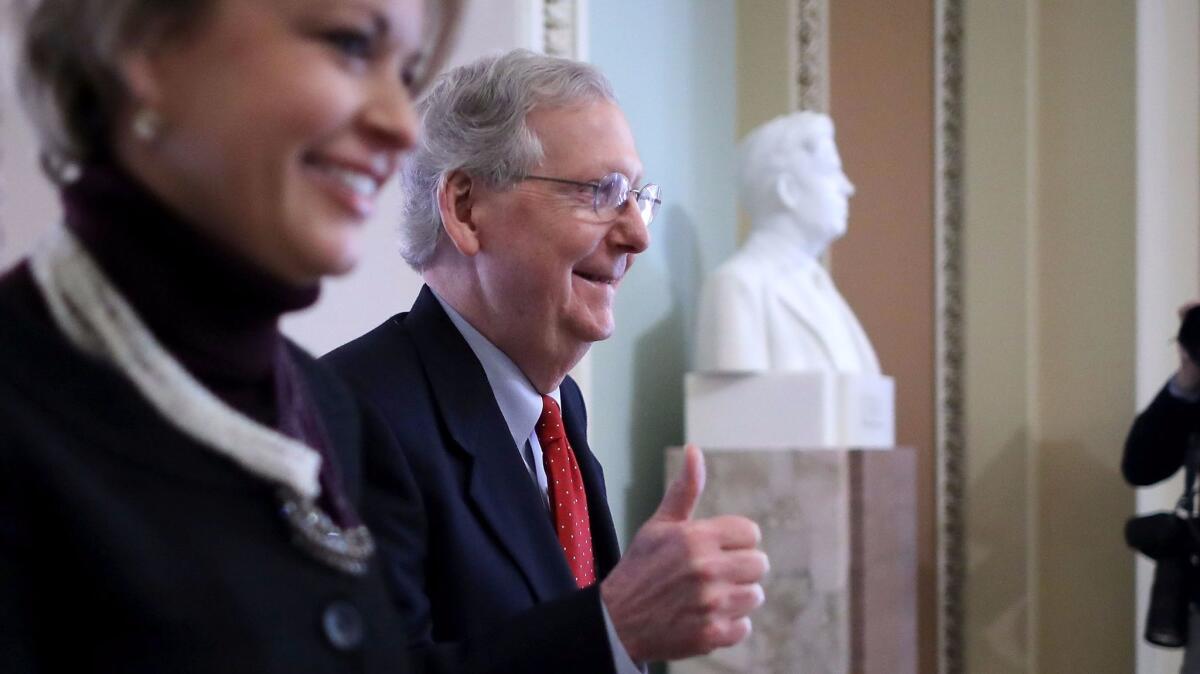

To the editor: The pictures of a jubilant Senate Majority Leader Mitch McConnell (R-Ky.) realizing he had the votes to pass his tax bill are worth a thousand words. Never has a public servant exuded such joy at his altruistic, noble actions to help the American people. It’s enough to melt your heart.

Not. McConnell’s face reflects giddy triumph and relief at finally managing to please his donors. At long last, after a year of tap dancing and jumping through hoops, he finally secured enough votes to keep the checks flowing in 2018. When he and his fellow Republicans are more likely thrown out in 2018, they will at least have paved the way to become lobbyists for those beholding donors.

The only things missing from the photos of the rich white men who sealed this destructive tax deal for the middle class are black T-shirts bearing the words, “Donor Lives Matter.”

Wendy Blais, North Hills

..

To the editor: The recently passed Senate tax reform bill favors the welfare of big corporations over young companies, the welfare of legacy fossil fuel corporations over entrepreneurial clean energy companies, the welfare of those lucky Americans with trust funds over the majority whose assets are earned, and the welfare of healthy families over those less so.

In an economy where consumer spending accounts more than two-thirds of the gross domestic product, how do the senators square their contention that their tax reform is needed to create jobs when this so-called reform imposes higher taxes on consumers by 2027? In an economy where 64% of net new private-sector jobs are created by small businesses (most of which are relatively young), how does favoring older, larger corporations yield higher employment?

The primary purpose of the Senate’s tax reform bill is clearly not the creation of more jobs or providing long-term relief to the middle class.

William McCarthy, Malibu

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.