U.S. Investigates Oil Firms’ Deals in West Africa

Federal investigators have been looking into American oil companies’ real estate dealings in Equatorial Guinea to determine whether they have improperly benefited the country’s despotic ruler, according to sources familiar with the inquiries.

Separate inquiries by the FBI and Congress examined the purchase of land from Brig. Gen. Teodoro Obiang Nguema Mbasogo, Equatorial Guinea’s president, and leases made through a firm he is believed to control.

Investigators are trying to determine whether oil companies paid prices so far above the market rates that they violated the Foreign Corrupt Practices Act, which bars companies from bribing foreign government officials, sources told The Times.

Marathon Oil Corp. and ExxonMobil Corp. confirmed that company officials had met with Senate investigators, but would not provide details. Both firms said their dealings in Equatorial Guinea had been proper and lawful.

Interest in the land deals grew out of a money-laundering inquiry involving accounts held by Equatorial Guinea at Riggs Bank in Washington. The biggest account contained hundreds of millions of dollars in oil revenues deposited by American oil companies operating in the country.

Sources said that although the account nominally belonged to the state, Obiang in effect exercised control over it.

The inquiries, which are being led by a federal grand jury and the Senate Permanent Subcommittee on Investigations, have explored broader financial ties between the oil companies and Obiang, sources said.

Officials at the Senate committee and at the FBI, which is assisting in the grand jury inquiry, declined to comment.

ExxonMobil leases land in Equatorial Guinea’s capital, Malabo, where it has a compound for its workers.

Robert Davis, a spokesman for ExxonMobil, said the land was leased from a firm named Abayak.

A report submitted to the United Nations by an opposition group identifies Obiang as the owner of Abayak -- a holding company whose interests have included real estate, cement, construction and banking.

Obiang is also named as the “major shareholder” of Abayak in a federal complaint filed by Foley Hoag, a Washington law firm that is trying to collect fees for work on a telecommunications venture.

Davis said ExxonMobil considered its lease to be a private contract and would not disclose the terms.

“However, the land was leased at competitive market rates,” he said in an e-mail. He declined to answer questions about Abayak’s ownership.

No one answered telephone calls to Abayak’s main office in Equatorial Guinea. Officials at the country’s embassy in Washington declined to discuss the investigations or the ownership of Abayak.

Marathon Oil bought 625 acres of land from Obiang, company spokesman Paul Weeditz told The Times. He declined to disclose the price but said the amount was “appropriate for the land we purchased.”

Weeditz said Abayak had acted as Obiang’s agent on the land deal. “We believe President Obiang may have an interest in Abayak,” he said.

Oklahoma-based Devon Energy, which holds a stake in a major field in Equatorial Guinea, also met with the Senate investigators, spokesman Brian Engel said in an e-mail. He would not say whether Devon had done business with companies owned by government officials, citing “confidentiality obligations.”

Amerada Hess and ChevronTexaco, which also operate in Equatorial Guinea, declined to answer questions for this article. Sources familiar with the investigation have told The Times that the Senate has interviewed officials from both companies.

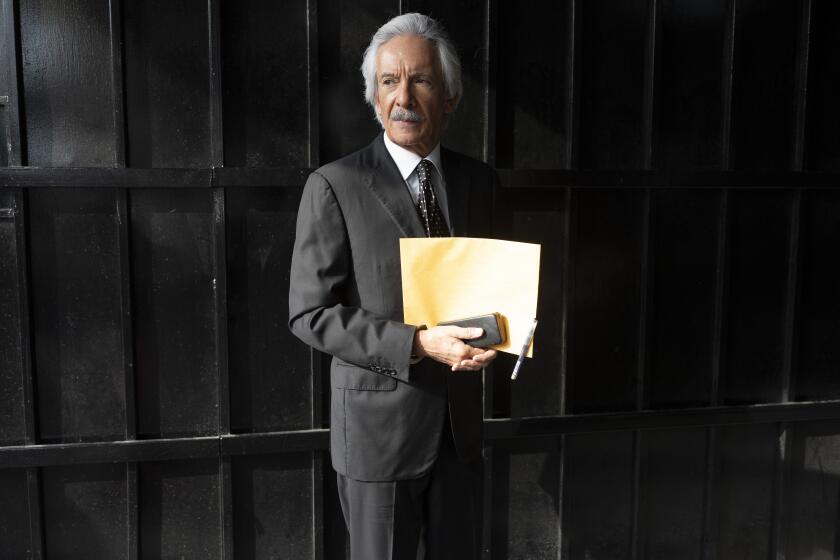

Obiang seized power in a 1979 coup, and his regime has been accused of torturing dissidents and suppressing civil liberties. The State Department’s most recent report on human rights in the country said that most of its wealth “appears to be concentrated in the hands of top government officials while the majority of the population remained poor.”

American oil companies have developed close political and financial ties to the Obiang regime since oil was discovered in Equatorial Guinea in the mid-1990s. Led by ExxonMobil, Amerada Hess and Marathon, U.S. companies now have invested at least $5 billion there.

Philippe Vasset of the Paris-based Africa Energy Intelligence said oil companies were Obiang’s most important backers. “Equatorial Guinea has no other resources or industries,” he said.

The companies’ business dealings have included using an employment agency owned by a former government minister who is also a relative of Obiang, according to a State Department report issued in 2000. The report said that the agency denied jobs to opposition sympathizers and “allegedly kept nearly two-thirds of employees’ wages.”

The department’s 2004 human rights report on Equatorial Guinea said that oil companies had taken steps to reduce government control of hiring, but that international labor organizations had said the measures had been largely ineffective.

In addition, Marathon spokesman Weeditz told The Times that the company currently pays $13,000 a month to help cover costs at Equatorial Guinea’s Washington embassy.

Sarah Wykes of Global Witness, a London-based good governance group that recently issued a report on Equatorial Guinea, said her organization had discussed ties between oil companies and Obiang with Senate investigators.

Wykes, who helped prepare the group’s report, said oil companies should “come clean” about their dealings with Obiang or “lay themselves open to accusations of being complicit with corruption and diversion of state revenues.”

Last week, the Office of the Comptroller of the Currency, which regulates American banks, fined Riggs $25 million over its handling of accounts linked to Equatorial Guinea and to Saudi Arabia.

In addition to Equatorial Guinea’s state oil account, Obiang had a personal account at the bank holding more than $10 million.

At least three other family members also had large holdings at Riggs, according to sources familiar with the investigations.

The comptroller said Riggs had ignored “suspicious activities” such as large transfers between a government account and the “personal account of a government official” and deposits of millions of dollars “into a private investment company owned by an official of the country.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.