Mitt Romney vs. employer-provided healthcare insurance

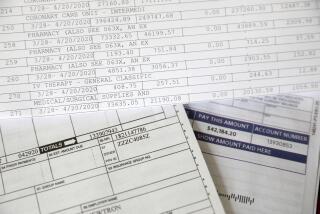

The Times’ Noam Levey stitched together the clues that Mitt Romney has given about his plans for redoing healthcare reform, concluding that the GOP presidential candidate’s strategy is “in crucial ways more revolutionary — and potentially more disruptive” than the 2010 Patient Protection and Affordable Care Act. That’s because Romney wants to shift from a system in which employers are the primary supplier of insurance to one in which individuals are responsible for their own coverage.

That would truly be a far-reaching change. But while Levey suggests that only conservatives like this approach, it’s actually an idea favored by many economists of all stripes -- in theory. Whether it’s workable depends on the degree to which the new system enables individuals to pool their risks.

Here’s the theory: One reason healthcare costs have risen so much faster than other expenses is because the people who pay the bills -- generally speaking, employers and insurers -- aren’t the ones demanding the care. If individuals were more sensitive to the cost of medical services, they would stay in better shape, seek more preventative care and be smarter shoppers for the treatments they can’t do without.

COMMENTARY AND ANALYSIS: Presidential Election 2012

Removing employers from the equation would be a partial answer to that problem. Granted, most workers with health benefits are painfully aware that costs are going up because their premiums and copays have been increasing. But because employers cover a portion of the rising cost, individual workers aren’t as motivated to change as they would be if they shouldered the full increase.

(I should note here that employees have been paying the full cost of employer-provided benefits; their employer’s share actually is part of the compensation paid in lieu of wages. The rise in employers’ healthcare costs has kept wages from rising as fast they would have otherwise. But that’s so abstract, most workers think of healthcare benefits as a freebie provided by their company, not something that comes at the expense of a higher salary.)

Another advantage to ending employer-provided insurance is that it would eliminate the portability problems in the current system. Your insurance would be tied to you, not to your job. You’d also be able to choose from among a full range of insurers and coverages rather than being stuck with the options picked by your boss.

On the other hand, the shift away from employer-provided insurance presents numerous challenges. The most obvious is that taxpayers heavily subsidize the cost of insurance when employers supply it, but not when people purchase it for themselves. Fixing that would require changing the tax law, assuming taxpayers wanted to keep providing subsidies for health insurance.

A more vexing problem is that when employees buy coverage as a group, they pool their risks and lower the average cost of a policy. The current system isn’t set up to do that for individual buyers, with the narrow exception of those classified as “high risk” customers because of preexisting conditions or dangerous professions.

Solving that problem requires a new mechanism to assure insurance companies that their customers will include a broad mix of young and old, hardy and vulnerable. One approach is contained in the 2010 healthcare law that Romney wants to repeal. It calls on states to create insurance buying marketplaces called “exchanges” where individuals buy policies, giving states the option of creating virtual risk pools and spreading the costs imposed by the entire group across insurers equitably.

A third issue is guarding against employers getting a windfall from the shift to individual policies. Sen. Ron Wyden (D-Ore.) and former Sen. Robert Bennett (R-Utah) proposed a way to do that in their ill-fated healthcare overhaul proposal in 2009. They would have required employers to increase workers’ wages in an amount equal to what they had been spending on health benefits, or else pay a tax penalty of the same size.

If these transitional issues are managed properly, the shift could yield a healthcare system that’s more sensitive to market forces and more affordable in the long run. That’s a big “if,” however. The potential downside is a system with more uninsured Americans. It’s also worth noting that such a shift wouldn’t do much for those who can’t afford insurance today, such as the working poor, unless the change is accompanied by new subsidies for individual purchasers -- perhaps in the form of refundable tax credits.

Romney hasn’t offered enough detail yet to see whether he addresses these issues, and if so, how well. Given the magnitude of the change he apparently favors, he should offer those details himself instead of letting his critics try to fill in the blanks.

ALSO:

Kinsley: Romney, born to succeed

How Romney could win over Latino voters

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.