Opinion: Tech billionaires follow the climate-change money

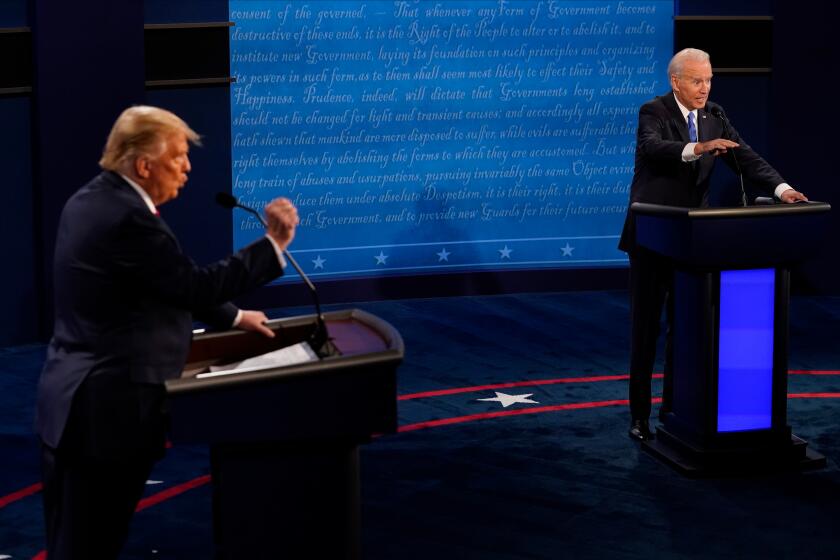

President Obama and Microsoft founder Bill Gates leave after attending the “Mission Innovation: Accelerating the Clean Energy Revolution” meeting at the United Nations Climate Change Conference in Le Bourget, north of Paris, on Monday.

One of the frequent complaints from Republicans about U.S. energy policy is that it’s more about subsidies than markets. In its zeal to promote renewable energy sources, these critics say, the Obama administration has poured money into rebates and credits for solar and wind power, among other clean energy sources, disguising the fact that they can’t compete with power produced by natural gas and other fossil fuels.

They have a point, although the gap between fossil and renewable power costs has narrowed considerably. There’s also a good argument that fossil fuels have benefited from huge subsidies over the years, so it makes sense to help renewable sources catch up -- particularly when it comes to the infrastructure needed to be competitive.

Regardless, two announcements Monday underscore the continuing importance of subsidies in the alternative-fuel industry. That’s because they demonstrate how tuned in private investors are to where governments are putting their money.

One of those announcements came from an international group that includes some of the most successful private-sector entrepreneurs, who said they’re committing a sizable chunk of their personal wealth to the clean-energy business. The group, which includes Microsoft co-founder Bill Gates and Facebook founder Mark Zuckerberg, is creating a multibillion-dollar fund for clean-energy investments, planning to help commercialize promising new technologies.

You could argue that this “Breakthrough Energy Coalition” is driven more by ideology than business judgment; Zuckerberg’s statement (on Facebook, of course) certainly reads that way. “Solving the clean energy problem is an essential part of building a better world,” intoned Zuckerberg, one of the world’s richest men. “We won’t be able to make meaningful progress on other challenges -- like educating or connecting the world -- without secure energy and a stable climate.”

But another likely factor is a savvy recognition of the opportunities that climate change creates. Even if you think it’s all a hoax, governments the world over are adopting policies that are making fossil fuels costlier to use while casting about for clean-energy alternatives. The announcement of the “Breakthrough Energy Coalition” was timed to coincide with the unveiling of “Mission Innovation,” a new effort by the United States and 19 other countries to increase funding for clean-energy research.

Mission Innovation will use public funds to finance the sort of basic research that can lead to scientific milestones but not necessarily specific products. The Breakthrough Energy Coalition’s goal, in turn, is to bring those new solutions to market. But because clean energy is not yet fully competitive with fossil fuels, the Breakthrough Energy Coalition says, it needs the help of specially motivated investors. Here’s how the coalition put it on its website:

“The private sector knows how to build companies, evaluate the potential for success, and take the risks that lead to taking innovative ideas and bringing them to the world. But in the current business environment, the risk-reward balance for early-stage investing in potentially transformative energy systems is unlikely to meet the market tests of traditional angel or VC investors – not until the underlying economics of the energy sector shift further towards clean energy,” the coalition states on its website (emphasis added).

“Experience indicates that even the most promising ideas face daunting commercialization challenges and a nearly impassable Valley of Death between promising concept and viable product, which neither government funding nor conventional private investment can bridge. This collective failure can be addressed, in part, by a dramatically scaled-up public research pipeline, linked to a different kind of private investor with a long term commitment to new technologies who is willing to put truly patient flexible risk capital to work.

“These investors will certainly be motivated partly by the possibility of making big returns over the long-term, but also by the criticality of an energy transition. Success will provide the economic proof points necessary for the mainstream market-driven clean energy economy required for our planetary future,” the coalition argues (again, emphasis added).

Think of it as a symbiosis between governments and investors who aren’t aiming just for a return, and certainly not for a short-term payoff. It won’t please free-market purists who object to governments warping how investors allocate capital. But these particular investors seem eager to tilt the playing field enough to make that sort of intervention no longer necessary.

Follow Healey’s intermittent Twitter feed: @jcahealey

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.