Will the Levies Hold? : Hawthorne Businessman’s Suit Seeks to Invalidate 9 City Taxes and Fees

Last fall’s decision by the California Supreme Court drastically limiting the taxing authority of cities will get its first local test in debt-racked Hawthorne, where a feisty local businessman recently filed a lawsuit challenging nine city levies.

The lawsuit, filed Feb. 13 in Los Angeles Superior Court, seeks a court order barring future collection of three taxes and six service fees. The suit alleges that the levies violate the tax control provisions of Proposition 62, which the high court ruled in September were constitutionally valid.

In a 5-2 decision, the justices ruled that a half-cent transportation tax passed in 1992 by 54% of voters in Santa Clara County was invalid because it violated the proposition’s prohibition against enactment of a special tax without approval by two-thirds of voters.

Authored by tax revolt patriarch Howard Jarvis and passed by voters in 1986, Proposition 62 also forbids cities and counties from enacting new taxes for general purposes without prior approval from 50% of voters.

According to the 24-page lawsuit against Hawthorne, no elections were held on the nine levies.

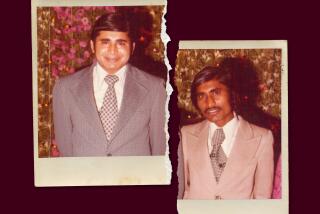

“These taxes are clearly illegal and improper,” said Hawthorne pool hall owner Jerry Jamgotchian, who filed the lawsuit. “The voters of California have said, ‘Hey listen, we need to have our taxes enacted by the people,’ and we’re trying to make it so they do.”

Losing the lawsuit would mean painful new blows to the aging, middle-class city that only recently erased its budgetary red ink by leasing its public water utility. The city came close to declaring bankruptcy at one point, and imposed the levies over the past six years to help erase a $10-million budget deficit.

Hawthorne City Atty. Glen Shishido, however, said all but three of the nine levies are service fees and are therefore beyond the reach of the ballot measure’s authority. The fees cover the licensing of residential rental units and businesses, and the cost of refuse pickup and recycling.

Shishido said that the remaining taxes--which boost utility rates by 10% and tack a sliding scale tax on the gross receipts of businesses--also are unaffected because they were approved before the high court’s ruling, which he said does not specifically invalidate taxes passed after 1986.

But Pasadena attorney Christopher Sutton, who prepared the lawsuit on Jamgotchian’s behalf, contends that at least four of the six service fees that the city enacted are really taxes because their revenues go to Hawthorne’s general fund.

City Manager Bud Cormier agreed that money collected through the residential rental and businesses fees is deposited in the city’s general fund, but he said those funds are legitimate fees because they are used to pay city licensing and regulation costs.

Among the defendants named in the suit are the city, the City Council and 10 city officials.

The lawsuit follows similar litigation filed in December against San Francisco by a gun shop owner who maintains that payroll and business taxes enacted in 1994 are illegal under Proposition 62.

Other legal challenges are expected to be launched statewide against similar municipal taxes.

In January, the Howard Jarvis Taxpayers Assn. gave nine governmental entities until Feb. 15 to take steps to put up for voter approval taxes enacted since 1986 or face litigation. None of the cities and counties targeted agreed, association attorney Jonathan Coupal said, and the first of the lawsuits is expected to be filed soon in Northern California. A second is expected to follow a short time later in Southern California. Coupal would not identify the cities, but said that since the January ultimatum, at least 11 additional municipalities statewide have been told to comply with the ballot measure or face legal consequences.

The lawsuit also marks at least the fifth time in six years that Jamgotchian, who owns part of the El Segundo Boulevard strip mall that his business inhabits, has legally tangled with the city.

He first went to court to fight for a city-denied liquor license and returned later to battle back attempts to limit business hours at his pool hall and even to determine if city residents and merchants are unwittingly footing the yearly franchise fee for the city’s sole trash hauler, H & C Disposal. Jamgotchian also has been cited for removing one of the company’s trash bins from his strip mall.

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.