Buffett Maintains His Bet Against the Dollar

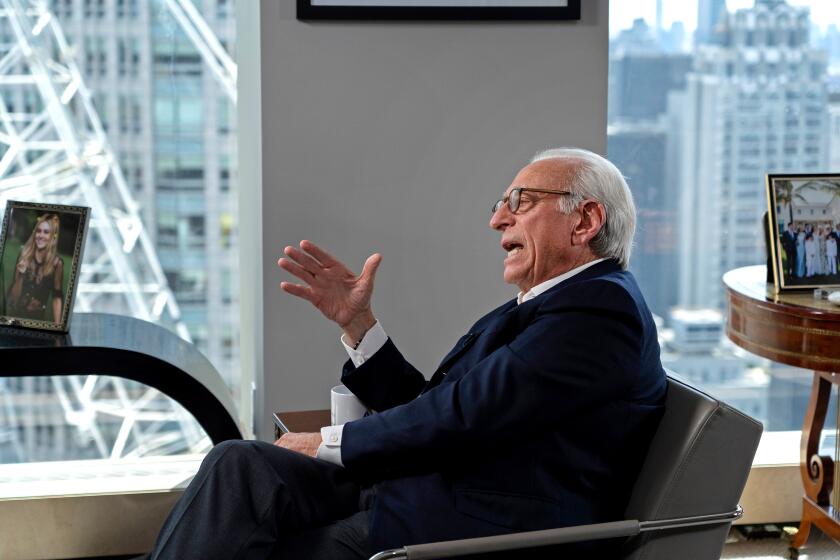

Warren E. Buffett, the billionaire chairman of Berkshire Hathaway Inc., is sticking to his bet against the U.S. dollar even as a rally in the currency produced more than $300 million in losses this year.

Buffett, who has amassed the world’s second-biggest fortune by investing in out-of-favor assets, said Monday that he expected the dollar would weaken over time because of the widening U.S. trade deficit. The dollar’s 9.5% surge against a basket of six major currencies this year hasn’t altered Berkshire’s wager, which began in 2002, he said.

“There’s no change in the underlying factors affecting currencies, in my view,” Buffett told reporters in Boise, Idaho, where he was attending a meeting of state utility commissioners. “The policies that we’re following are likely to lead to a weaker dollar over a long period of years. It’s not a forecast for next week, or next month or even next year.”

Berkshire’s bet stood at $21.8 billion of currency forward contracts as of March 31 and caused a $307-million first-quarter loss before taxes. The U.S. dollar index, which measures the dollar’s value against six currencies including the euro, yen and British pound, rose 4% in the first quarter and has gained 5.3% since then.

The dollar has rallied this year amid expectations that U.S. economic growth will outpace Europe and interest-rate increases will boost demand for U.S. debt and other dollar-based assets. The gains have pared some of the dollar’s three-year decline against the euro.

On Monday, the euro fell to $1.214, from $1.228 on Friday. The dollar has risen about 12% since it fell to a record $1.367 per euro on Dec. 30.

Shares of Berkshire rose $325 to $82,700.