Proposal Reignites Power Struggle

When an ambitious plan to build five nuclear power plants in Washington state fell to pieces in the 1980s, it caused the largest municipal bond default in U.S. history.

Lawmakers and electricity ratepayers showered criticism on Northwest utilities that were party to the debacle. Voters passed an initiative to rein in public spending on big power plants. No entity took more heat than the Washington Public Power Supply System, or WPPSS, which led the effort. To this day, the project suffers under the moniker “Whoops.”

But in the years since the scandal, the utility changed its name to Energy Northwest, weeded out those responsible and began the laborious process of rebuilding its public image. Now it has plans for a new power plant -- one that many agree employs promising technology but which has been carefully designed to avoid a public vote.

The proposed coal gasification plant would be the most ambitious project since the colossal failure decades ago, and some critics are already raising concerns about the viability of the technology, the potential environmental hazards and the public financing of the project.

For decades, the Pacific Northwest has relied on relatively cheap power from hydroelectric dams. In the late 1970s, WPPSS proposed building five nuclear plants to meet rising demand for electricity -- demand that never materialized.

The project collapsed in the 1980s amid massive cost overruns, leaving the concrete shells of four unfinished plants and $2.25 billion in worthless bonds. Bondholders eventually reached a settlement after years of court battles.

Today, the energy demand is gradually increasing as the region’s population grows and environmental pressure on dam operations mounts. Some argue that conservation and investment in renewable energy resources, such as the wind farms sprouting in eastern Washington, will meet the rising demand.

Energy Northwest supports the conservation efforts but does not believe they alone will meet demand, said Tom Krueger, the agency’s project manager. In addition, he said, the region won’t support hydropower expansion, a new nuclear plant in Washington isn’t an option, and natural gas has become inordinately expensive.

Instead, Energy Northwest is proposing what is called an integrated gasification combined cycle plant. The plant would generally use coal or petcoke, the waste product from oil refineries, which would be turned into a gas to be burned to generate power. The plant could also burn natural gas if the price declines.

Krueger compared the emissions from a plant using the technology to those of a natural gas plant.

“The question is not whether you can get energy in coal, but whether you can use it in an environmentally friendly way,” Krueger said.

The proposed plant would capture the carbon dioxide emissions for storage. In other parts of the country, emissions are injected into spent oil wells. Energy Northwest is taking part in a study into injecting the emissions into basalt deposits, which are common in the region.

“Of course it raises questions. Unless you examine that stuff, you never know,” said Ronald Hatfield, chairman of the Energy Northwest board of directors, who represents Pacific County Public Utility District No. 2.

Hatfield voted for the project. He does not know if his utility will sign a contract for power from the plant, but he does not believe the bad memories from WPPSS should impede its progress.

“I don’t know if they’ve forgotten, but it’s always been my attitude that because mistakes were made in the past doesn’t mean you don’t continue to try,” he said.

Energy Northwest is a joint agency, comprising 19 public utilities and municipalities. It operates Columbia Generating Station near Richland, the only WPPSS nuclear plant now operating, and a hydropower project, as well as wind, solar and biomass power projects.

The agency’s board of directors voted to push forward with the project in July, allowing Energy Northwest to pursue a plant site west of the Cascades and to continue to research the technology.

“To tie this to the WPPSS era is ludicrous,” said Bob Boyd, an Energy Northwest board member representing the Chelan County Public Utility District. Boyd voted against the proposal on behalf of his district, partly because he believed the energy the plant produced would be too expensive.

John Prescott, board member from Seattle City Light, also voted against the plan, citing his utility’s policy against additional carbon-based power generation.

“It just might be time for us to try to meet our needs through renewables and conservation, then look at what else,” Prescott said.

The Northwest Power and Conservation Council, which has planned the region’s power needs since 1980, takes a similar stance in favor of renewable energy and conservation to meet the region’s power needs for the next 10 years.

John Harrison, a council spokesman, said Energy Northwest might be a little ahead of schedule with plans to have the plant operating by 2012. But he said the council recognized the technology as its preferred new thermal power source beginning in 2015.

At least one analyst is raising concerns. Energy Northwest may not have pursued a major project since WPPSS, but some of its public utility members have, and they are paying higher rates for power, said Jim Lazar, an economist and private energy consultant.

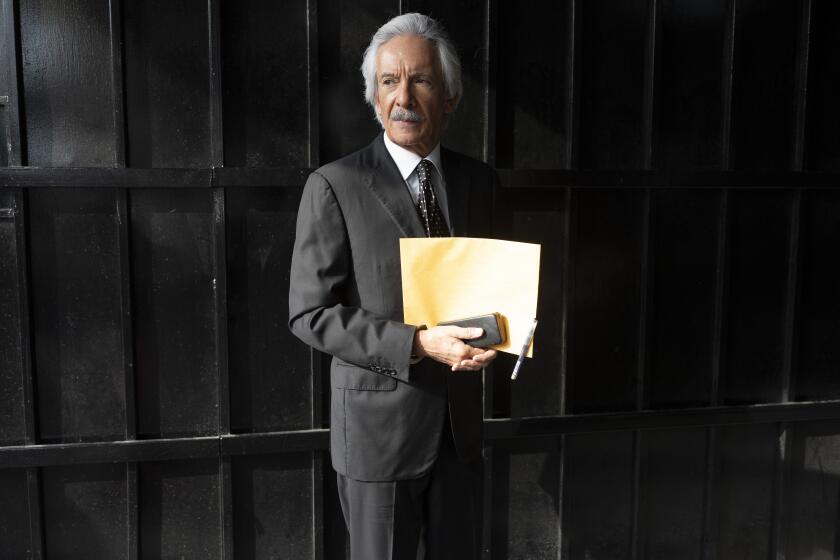

Lazar was research director for the Don’t Bankrupt Washington Committee, the group that successfully pushed a 1981 voter-approved initiative requiring voter approval for public financing of power plants that generate more than 350 megawatts.

“It’s promising technology, but it’s an organization with a poor track record, made up of organizations with poor track records,” Lazar said.

The cost of the 600-megawatt plant has been estimated at close to $1 billion. Public utilities would pay half the cost and get half the power, an arrangement that dodges the requirement for a public vote.

The rest of the power would be sold under private contracts, and the second half of the project would require separate financing.

The WPPSS hangover likely won’t impede the project’s advancement, said Alan Spen, managing director at Fitch Ratings, who has tracked Energy Northwest for more than 20 years.

“Overall, I’m sure there’s going to be a few old-timers who say, ‘I don’t think I want to buy this,’ ” Spen said. “But for the most part, I think most people are able to evaluate this on its own and get past the name.”

More to Read

Start your day right

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.