Burger King, Warren Buffett under fire for Canadian inversion deal

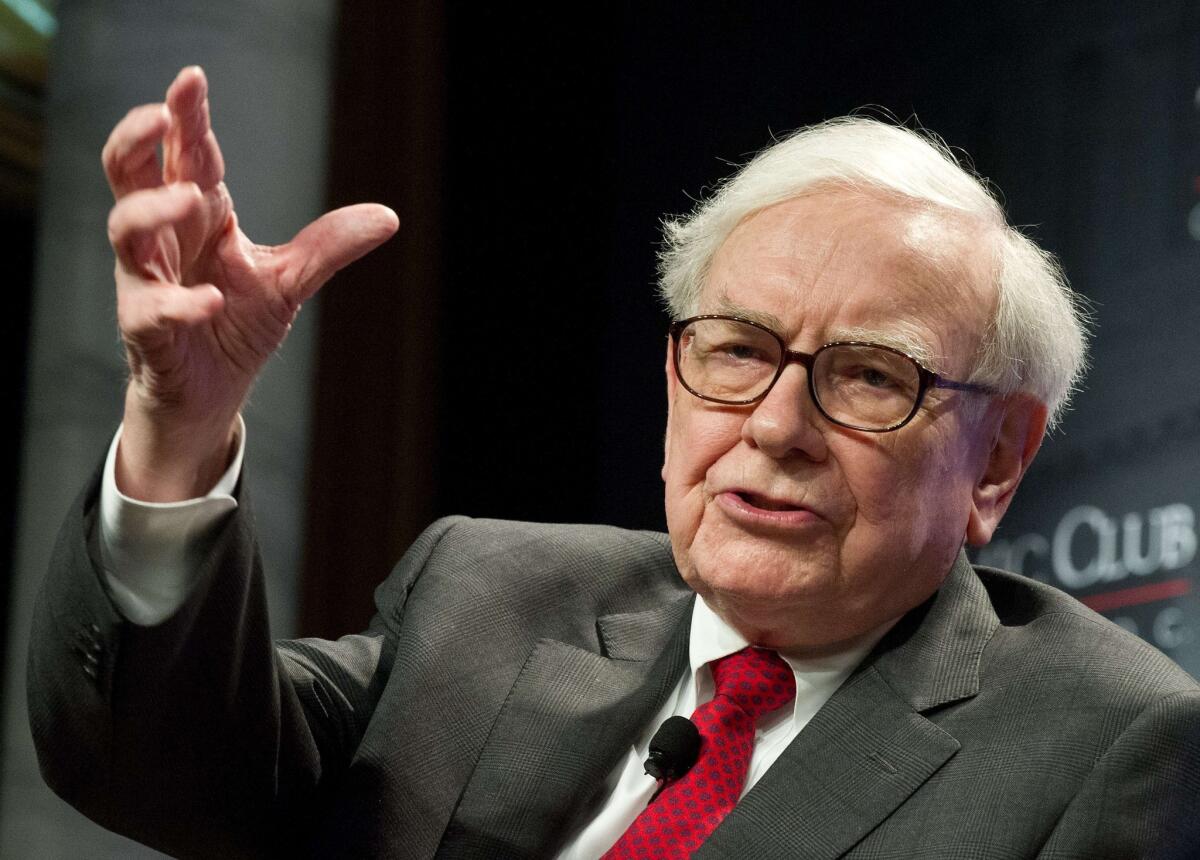

Burger King Worldwide Inc. and billionaire investor Warren Buffett faced sharp criticism over plans that would create a new Canadian company after buying Tim Hortons Inc. to take advantage of Canada’s lower corporate tax rates.

Burger King said Tuesday it would pay $11.4 billion to buy the Canadian doughnut-and-coffee chain -- with $3 billion in financing from Buffett’s Berkshire Hathaway Inc. -- and set up headquarters of the new company in Canada.

Sen. Sherrod Brown (D-Ohio) called for Americans to boycott Miami-based Burger King for the so-called inversion move to reduce its corporate taxes. And consumers posted negative comments on the company’s Facebook page.

“I’ve eaten my last whopper,” Oscar G. Echeverría wrote on Burger King’s Facebook page.

Laurel Hutch wrote: “Another American Company that doesn’t want to pay its fair share of taxes. Bye Bye Burger King ... BOYCOTT!!!”

Buffett, who has backed an Obama administration plan named after him to force millionaires to pay the same share of their income in taxes as middle-class families, also came under fire.

In announcing the $11.4-billion deal Tuesday to buy Tim Hortons, the companies said Berkshire Hathaway would receive preferred shares in the new firm for its $3-billion investment.

“‘Tax Me More’ Warren Buffett To Finance Burger King’s Tax Inversion Deal,” was a headine on the economics and political website Zero Hedge.

“It has to be twisting the White House in messaging and political knots,” said Chris Krueger, a Washington policy analyst with Guggenheim Securities.

“How can you hammer a deal for tax policies when the very person your signature tax policy [The Buffett Rule] is named after is involved -- and argues that it is not tax motivated?” Krueger said.

“The White House cannot paint this as a black-and-white issue, and Buffett’s involvement shows that it is more like 50 shades of grey,” Krueger said.

Burger King and Buffett defended the deal, which is one of the largest and highest-profile tax inversions so far.

in the maneuver, which breaks no laws, a U.S. company buys a foreign competitor in a lower-tax nation and shifts its headquarters to that country. The Obama administration and some congressional Democrats have been pushing to limit tax inversions.

“This is not a tax-driven deal,” said Alex Behring, who is Burger King’s executive chairman and will hold the same role for the new combined company.

The headquarters for the new firm will be in Canada, which will be its largest market and its “natural home,” he said.

The combined federal, state and local corporate tax rate in Canada is 26.3%, according to the Organisation for Economic Cooperation and Development. The combined U.S. corporate rate is 39.1%.

Burger King’s overall effective tax rate in 2013 was 27.5%, according to its annual report. Tim Hortons’ effective tax rate for the same year was 26.8%.

“We don’t expect there to be meaningful tax savings, nor do we expect there to be a meaningful change in our tax rate,” Burger King Chief Executive Daniel Schwartz told reporters on a conference call.

On its Facebook page, Burger King told customers, “We’re not moving, we’re just growing and finding ways to serve you better.”

Burger King and Tim Hortons will remain stand-alone brands, and Burger King’s headquarters will stay in Miami, company executives said.

Buffett said Tuesday that it made sense for the combined company’s headquarters to be in Canada.

“Tim Hortons earns more money than Burger King does,” he said told the Financial Times. “I just don’t know how the Canadians would feel about Tim Hortons moving to Florida. The main thing here is to make the Canadians happy.”

For breaking economic news, follow @JimPuzzanghera on Twitter