U.S. wants better debt relief for students defrauded by colleges

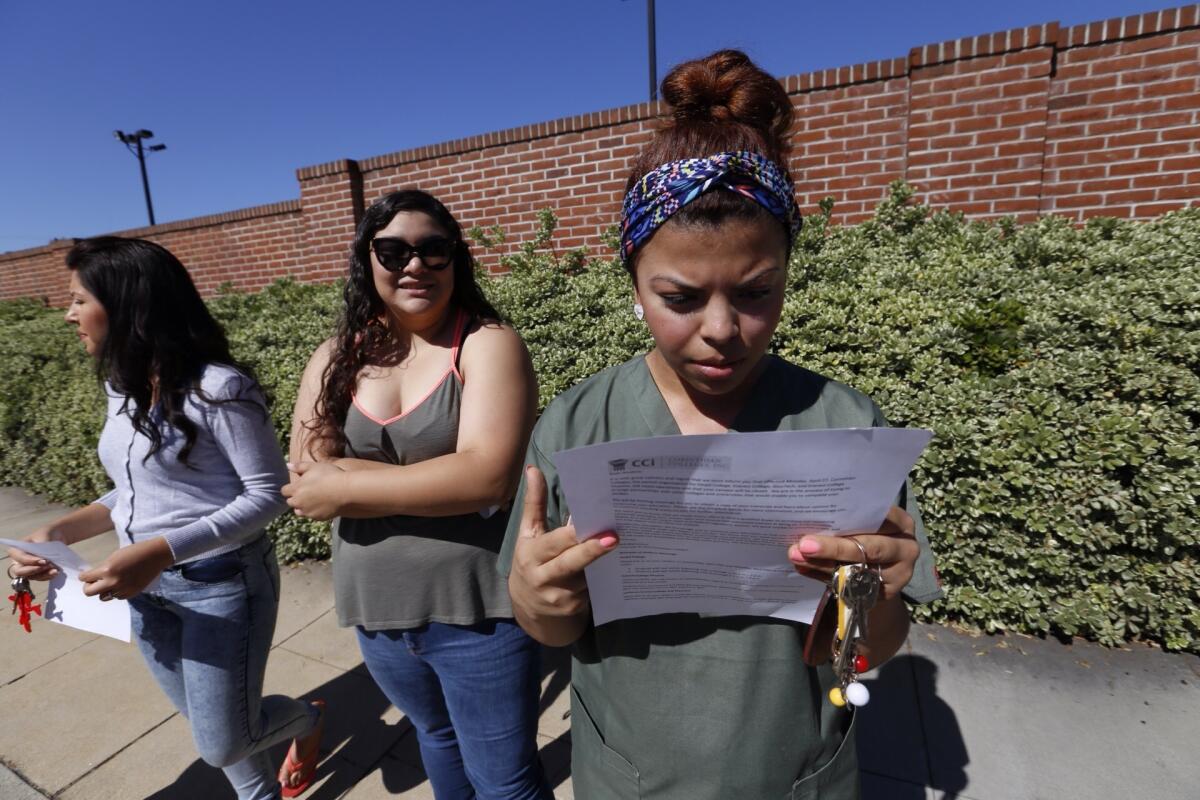

Ruby Maldanado, a medical assistant student, checks a note handed out to students who were turned away at the gate of Everest College in Alhambra, one of the Corinthian Colleges that closed April 27, 2015.

Following the collapse of Corinthian Colleges Inc. this spring, the U.S. Department of Education is crafting new regulations to help students seek debt relief and better hold colleges accountable for wrongdoing.

A final regulation is not expected until November 2016, and the department offered few specifics Wednesday. U.S. Under Secretary of Education Ted Mitchell said the rules will complement an initiative already underway that allows potentially hundreds of thousands of former Corinthian students to apply for federal student-loan forgiveness.

He said the new regulations are intended to be more proactive, holding problematic institutions accountable for wrongdoing before they go under — as was the case with Santa Ana-based Corinthian, which filed for bankruptcy in May.

“We want institutions to know, in no uncertain terms, that they are responsible for the malfeasance that they create,” Mitchell said.

Ever since Corinthian’s troubles came to light last summer — amid a federal investigation into inflated job-placement numbers — student activists, lawmakers and state attorneys general called on the Department of Education to help students shouldering massive debts.

Only students attending schools that abruptly close are automatically eligible for loan forgiveness. But in June, the Education Department announced additional debt-relief options for many former Corinthian students, allowing students to apply for loan forgiveness if they believed they were victims of fraud.

Federal law allows students to make those claims, but the provision had been used only a handful of times before Corinthian’s collapse. Mitchell said the new regulations aim to clarify that process for all federal borrowers.

“Borrowers deserve as clear a set of policies and regulations as possible to make it easier and more transparent,” he said.

In the meantime, former Corinthian students and others who believe they have been defrauded can still seek loan forgiveness under the department’s current process.

About 7,000 students attending Corinthian schools that shut down in April have applied for loan forgiveness, and nearly 3,300 other Corinthian students have signed forms claiming they were victims of fraud.

The department will hold public hearings on the proposed rules in Washington, D.C., and San Francisco next month.

Twitter: @c_kirkham