Renault and Nissan enter talks over proposed Fiat Chrysler merger

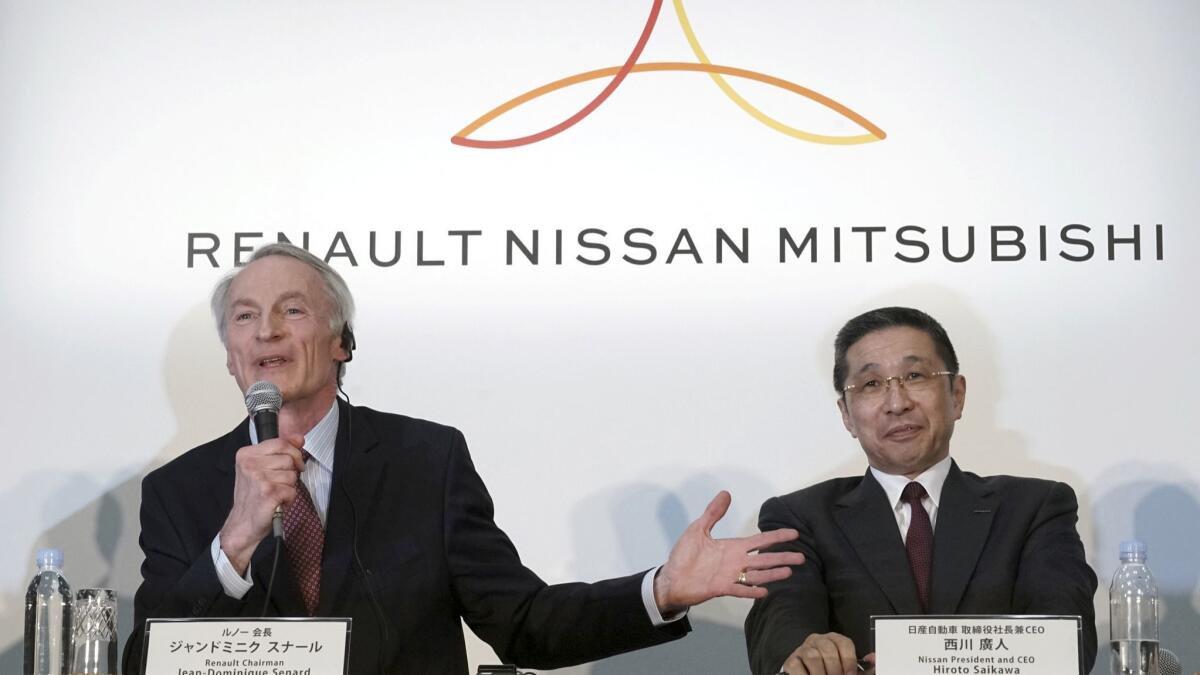

Renault Chairman Jean-Dominique Senard arrived in Tokyo with a crucial mission: to sell the proposed merger between Fiat Chrysler Automobiles and his company to longtime partner Nissan Motor Co.

There are signs he made some progress Wednesday at a meeting of the board overseeing the alliance of Nissan, Renault and Mitsubishi Motors Corp. Speaking to reporters after the gathering, Nissan Chief Executive Hiroto Saikawa said he sees potential opportunities for the alliance in Fiat Chrysler’s merger proposal, though he plans to study the matter further.

“In terms of the benefits for Nissan, we want to see specifically where they will come from,” Saikawa said. “Overall, we don’t consider this as a minus, but we want to watch carefully how things go.”

Under the terms of the Fiat proposal, Nissan will gain voting rights of 7.5% in the new entity, compared with no voting rights attached to its current cross-held shares in Renault. A merger would also dilute the French state’s control over Renault, and indirectly over Nissan, easing a concern the Japanese company has had for years.

Senard’s goal is to ensure that they all work well together. Although Nissan and Renault have been partners for two decades, the Japanese automaker isn’t in a position to block the deal. Nissan doesn’t own a controlling stake in the French company, and a merger wouldn’t breach their operating agreement.

Even so, Nissan is a crucial part of what would be a global carmaking confederation that would produce 15 million cars a year, the most in the world. Renault and Fiat both need Nissan to facilitate access to markets in China, Japan and the rest of Asia, as well as electric-car technology.

The three-way alliance issued a statement saying that they held an “open and transparent discussion” on the merger proposal. “The meeting also discussed and positively concluded several current operational alliance matters,” the partners said.

“Senard has to convince the board members of Nissan this is probably a better idea for Nissan,” said Koji Endo, an analyst at SBI Securities in Tokyo. “He will have to reassure not only Nissan but also the Japanese government that Nissan will remain as one independent company, because that’s their primary concern.”

Renault’s board is expected to give preliminary approval to Fiat’s proposal as soon as next week, according to people familiar with the matter. Though Fiat and Renault aren’t seeking a merger with Nissan for now, the companies plan to eventually invite Nissan and Mitsubishi Motors to join forces, they said.

“The benefits that would accrue from a combination of Groupe Renault and FCA, we believe, would also extend to the alliance partners Mitsubishi and Nissan,” Fiat Chrysler told its dealers and suppliers Monday. “We look forward to engaging with them on even greater, mutually beneficial opportunities.”

At stake is the companies’ ability to compete as the industry faces multiple challenges. With sales falling in the world’s biggest car markets, manufacturers are being pushed by regulators to electrify and reduce fleet emissions, forcing them to combine efforts and investments. They also need to spend heavily on self-driving technology or risk getting left behind by new, deep-pocketed competitors like Alphabet Inc.’s Waymo.

Although Renault owns a 43% stake in Nissan, the Japanese automaker is the bigger partner by sales and owns 15% of Renault, with no voting rights. Nissan sold 5.65 million cars last year, more than Renault’s 3.88 million units, but its profitability has been on the decline.

Hurt by slumping U.S. sales, aging vehicle models and an out-of-sync product cycle, the Japanese automaker issued an outlook for weak operating profit and cut its dividend for the first time in a decade.

The alliance was destabilized six months ago with the arrest of Carlos Ghosn, its architect and chairman, in connection with alleged financial crimes during his time as leader of the Japanese carmaker. Ghosn has denied all of the charges and is preparing for his trial, which will probably start next year.

Senard, who replaced Ghosn as chairman of Renault and the alliance, has sought to put the three automakers back on stable ground after his predecessor’s arrest. He worked this year with Nissan to craft a new governance structure to oversee the partnership, giving up key concessions over board seats to assuage concerns by the Yokohama-based company.

Although Senard had been prodding Saikawa to consider further consolidation under a holding company structure, that’s now on hold. Eventually, they plan to invite the Japanese automaker to deepen ties, people with knowledge of the matter said.

Saikawa, who had rebuffed any talk of merging, now appears to be shifting his message. Talks between the European car companies will bring more opportunities and be positive for the future, Nissan’s CEO said. “It’s better if the alliance’s reach expands,” he said.

Jie and Takahashi write for Bloomberg.