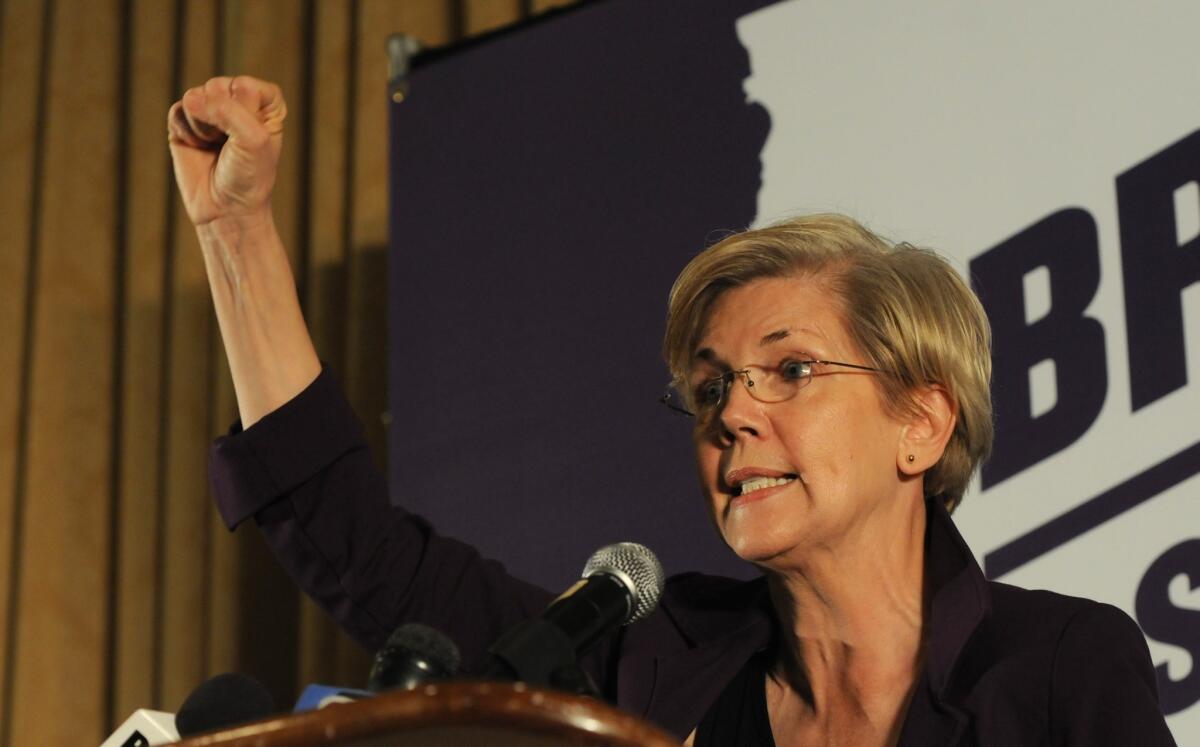

Elizabeth Warren outlines $20-trillion ‘Medicare for all’ plan at pivotal point in the campaign

Ending her months-long silence on how to pay for moving the entire nation into a government-run healthcare system, Elizabeth Warren on Friday laid out a detailed plan that relies on trillions of dollars in new taxes on the rich and corporations, big pay-ins from employers and aggressive cost cutting.

The proposal is a crucial step for Warren at a time when polls show her moving to the front of the pack in key states. With it, Warren will be able to claim that she is the first of the Democratic candidates to fully describe how to pay for a “Medicare for all” plan, which many of the party’s progressive activists ardently back. Her plan also allows her to say that she can fund the policy without raising taxes on the middle class — a key political goal.

Her chief rival on the party’s left, Sen. Bernie Sanders of Vermont, who has campaigned in favor of a government-run medical plan for years, has outlined options for financing, but has not committed to one. He has said middle-class taxes could go up under his plan.

Warren argues that America could do away with private insurance — entirely eliminating premiums, deductibles and co-payments — and move everyone into a single-payer system without sacrificing care and without hiking taxes on the middle class. The elimination of those out-of-pocket costs would save families trillions of dollars over a decade, according to her estimates, which were vouched for by prominent economists recruited by her campaign.

“When fully implemented, my approach to Medicare for All would mark one of the greatest federal expansions of middle class wealth in our history,” Warren wrote in a Medium post describing her plan. She said at campaign stop in Iowa that the single-payer system could be achieved “without raising taxes one cent on middle class families.”

Soaring deductibles and medical bills are pushing millions of American families to the breaking point, fueling an affordability crisis that is pulling in middle-class households with health insurance as well as the poor and uninsured.

Her plan offers Democrats the promise of a healthcare system without the vast inequities that mark the current one. It also illustrates how heavy a political lift would be required. The political fight to achieve it would risk eclipsing anything else a new, Democratic president might want to pursue in a four-year term.

A Medicare for all system would disrupt existing healthcare plans for the more than 156 million Americans who currently have insurance through their jobs. It would vastly increase the federal government’s role, expanding federal spending by roughly a third. And it would impose major new taxes on the wealthy and push down payments to doctors, hospitals, drug companies and the insurance industry, all of whom have repeatedly shown their ability to block proposals that could reduce their incomes.

The plan was immediately attacked by Warren’s more moderate Democratic rivals as financially burdensome, mathematically suspect and politically unrealistic.

Warren unveiled her plan at a key moment in the campaign: Polls over the last few weeks have shown her leading the Democratic race in key states that hold contests early in the nominating season. Surveys also show former Vice President Joe Biden fading in several of those states, although he continues to lead in nationwide polls.

The debate over how far to go in restructuring the healthcare system has consistently served as a key issue differentiating Warren and Sanders on the one side from more centrist rivals, including Biden, Mayor Pete Buttigieg of South Bend, Ind., and Sen. Amy Klobuchar of Minnesota.

Warren maintains that a single-payer, Medicare for all system could cover everyone in the U.S. and provide expanded benefits, including long-term care and vision and dental coverage, for roughly what the country is currently slated to spend on healthcare — about $52 trillion over a decade.

Covering more people with more benefits for the same cost would require holding down the amounts paid to doctors and hospitals, limiting doctors to the rates currently paid by Medicare and hospitals to slightly above current Medicare rates. Her proposal also includes measures to sharply reduce drug prices.

But even if overall costs did not increase, government spending would surge under the Warren plan, to make up for the money currently generated by premiums and out-of-pocket costs for families.

The tab to the federal government would be roughly $20.5 trillion over the next decade — about a one-third increase in the total federal budget.

Instead of income tax hikes, Warren would cover nearly half that cost by collecting $9.1 trillion in additional taxes from corporations and high-income families over the next 10 years.

The amount would eclipse the wealth tax Warren has earlier proposed to fund such things as student debt relief and free public college. Several liberal economists have already warned the wealth tax might generate only a fraction of the revenue she envisions.

Warren would cover much of the rest of the cost by requiring employers to continue paying, on average, what they currently pay to cover their workers under group insurance plans. Instead of paying an insurance company, however, they would pay the government. Their bill would be calculated based on their average spending on employee health insurance over the last few years.

Warren argues the cost would be less onerous than what those employers currently face, as they would be shielded from existing runaway healthcare price increases because costs would not rise faster than inflation under her plan. Many small businesses that currently don’t pay for healthcare for their workers would be exempt, and states would keep paying roughly what they already do to cover government workers and low-income residents on Medicaid.

“We can generate almost half of what we need to cover Medicare for All just by asking employers to pay slightly less than what they are projected to pay today,” Warren wrote.

Biden’s campaign aides said such fees are essentially a payroll tax that will be passed onto middle class workers and accused Warren of “double talk.”

“The mathematical gymnastics in this plan are all geared towards hiding a simple truth from voters: it’s impossible to pay for Medicare for All without middle class tax increases,” said a statement from deputy campaign manager Kate Bedingfield.

“To accomplish this sleight of hand, her proposal dramatically understates its cost, overstates its savings, inflates the revenue, and pretends that an employer payroll tax increase is something else.”

But the Biden protests come as a new poll shows Democratic voters in Iowa favoring the single-payer approach by a margin of roughly 3-to-1.

The poll by the New York Times and Sienna College had other bad news for Biden. It showed Warren as the Iowa front-runner. The former vice president was in a close three-way matchup for second place with Sanders and Buttigieg. And voters were just as confident in Warren or Sanders to defeat Donald Trump as they were in Biden.

Although Iowa Democrats say they like the idea of a single-payer plan, the new taxes and the limits on payments to doctors and hospitals in the Warren plan almost certainly will provide fresh lines of attack for her opponents.

Warren’s tax proposals include a substantial increase in her wealth tax, aimed largely at billionaires. The taxes on fortunes larger than $1 billion would soar to 6%, double what the candidate earlier proposed.

In addition to the wealth tax, Warren would hit the richest 1% of Americans with a new, annual capital gains tax. Her plan also calls for several trillion dollars of new taxes on financial firms and large corporations. They include rolling back the tax cuts signed into law by President Trump, but also go far beyond that.

Among the new taxes would be one on financial transactions, with levies collected when stocks and bonds are bought and sold. Large financial institutions would pay a new “systemic risk fee.”

Corporations would lose trillions of dollars of tax deductions they are currently eligible to claim, and firms that move their profits abroad would be targeted with substantial new levies.

To collect all of this money the senator is arguing for a significant expansion of the Internal Revenue Service.

“The wealthy and their allies in Washington have worked to slash the IRS budget, leaving it without the resources it needs,” Warren wrote. She argued that the “tax gap” in the U.S., the money that is currently owed the IRS but is going unpaid and uncollected, is substantially larger than it is in other wealthy nations, such as the United Kingdom.

Katie Hill took Steve Knight’s congressional seat in 2018. Then someone gave his former campaign operatives naked pictures of her.

As Warren has with her other plans, she presented this one with a stamp of approval from pedigreed experts in the field.

Donald Berwick, the head of Medicare and Medicaid under President Obama, was part of the team that signed off on the viability of Warren’s cost-cutting proposals.

Those plans include aggressive measures that would upend the healthcare industry. Warren suggests the nation’s 10-year tab for healthcare could be trimmed by $1.8 trillion simply by cutting out the complex, often incomprehensible, billing practices of insurance companies, which burden doctors and patients with bloated administrative costs.

The plan also relies on other big, politically tough policy shifts. Warren counts on Congress passing comprehensive immigration reform that would legalize the roughly 10.5 million undocumented residents of the U.S. — a move that would make those people taxpayers and thereby boost federal revenue. She would also pare down the military, cutting its budget by $800 billion over a decade.

Sanders has avoided potential attacks by staying deliberately vague on such details.

“You’re asking me to come up with an exact detailed plan of how every American — how much you’re going to pay more in taxes, how much I’m going to pay,” he said on CNBC earlier this week. “I don’t think I have to do that right now.”

Times staff writer Melanie Mason contributed to this report from Des Moines.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.